As most commonly used in legal settings, an audit is an examination of financial records and documents and other evidence by a trained accountant. Audits are conducted of records of a business or governmental entity, with the aim of ensuring proper accounting practices, recommendations for improvements, and a balancing of the books. An audit performed by employees is called "internal audit," and one done by an independent (outside) accountant is an "independent audit." Auditors may refuse to sign the audit to guarantee its accuracy if only limited records are produced.

Virgin Islands Report of Independent Accountants after Audit of Financial Statements

Description

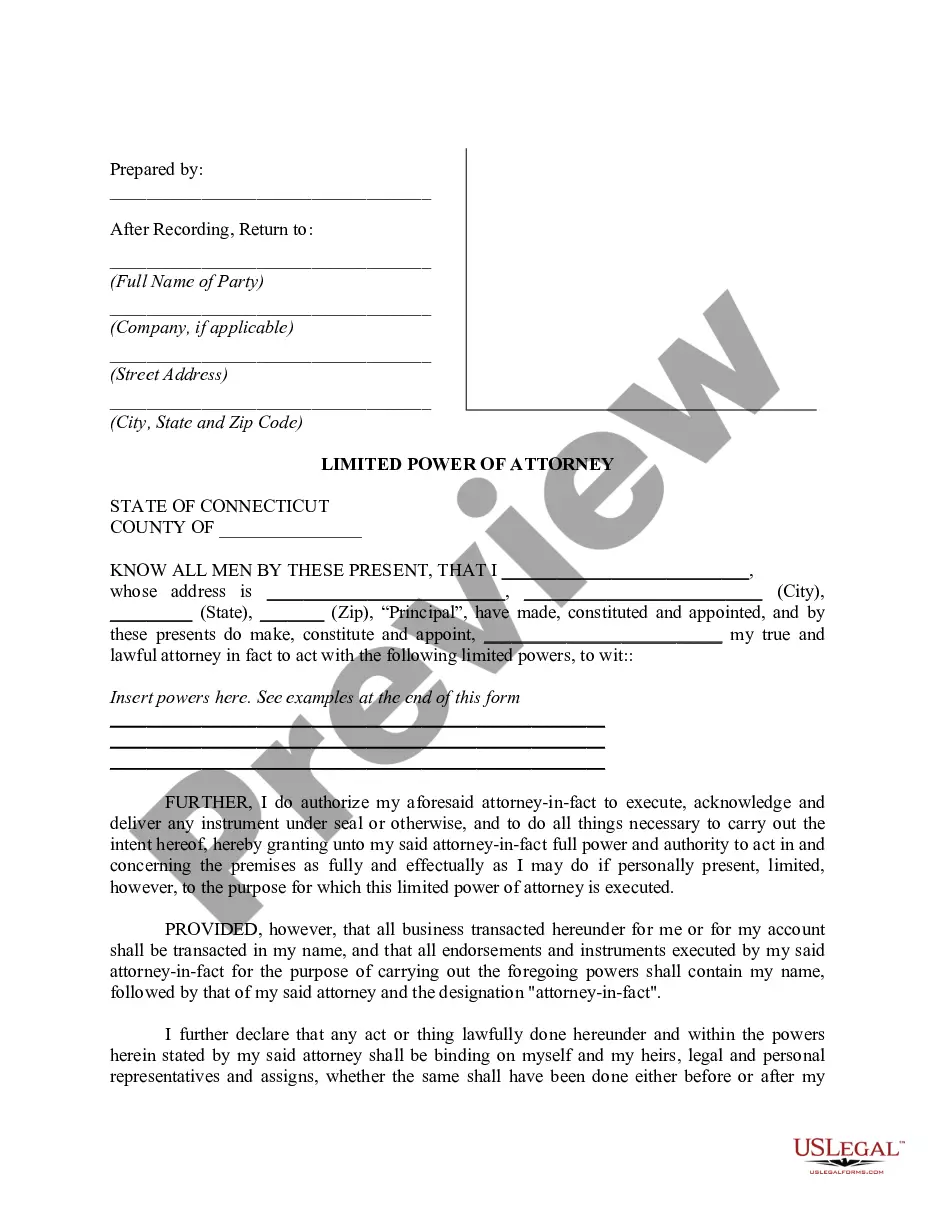

How to fill out Report Of Independent Accountants After Audit Of Financial Statements?

US Legal Forms - one of the largest collections of legal documents in the USA - provides a vast array of legal form templates available for download or printing.

By utilizing the website, you can access thousands of forms for business and personal use, organized by categories, states, or keywords.

You'll find the most recent versions of forms such as the Virgin Islands Report of Independent Accountants after Audit of Financial Statements in a matter of seconds.

Check the form description to confirm you've selected the right document.

If the form does not meet your needs, use the Search feature at the top of the screen to find one that does.

- If you already possess a subscription, Log In and download the Virgin Islands Report of Independent Accountants after Audit of Financial Statements from the US Legal Forms library.

- The Download option will appear on every form you view.

- You can access all previously downloaded forms in the My documents section of your account.

- If you are new to US Legal Forms, here are simple steps to help you get started.

- Ensure you have chosen the appropriate form for your locality.

- Click the Review option to inspect the form's details.

Form popularity

FAQ

Typically, a company should prepare at least three years of audited financial statements before going public. This provides investors with a comprehensive overview of the company's financial history and performance. It is crucial to have this information documented, such as in the Virgin Islands Report of Independent Accountants after Audit of Financial Statements, to build investor confidence.

You can check audited financial statements by visiting the company's website or relevant regulatory agency's site where filings are published. These statements, including the Virgin Islands Report of Independent Accountants after Audit of Financial Statements, are available for review by the public. Utilizing platforms like USLegalForms can make the process smoother by guiding you on where to locate these documents efficiently.

The report of the independent auditors is a formal opinion provided after reviewing a company's financial statements. This report assesses whether the statements present a true and fair view of the company's financial position. As part of the Virgin Islands Report of Independent Accountants after Audit of Financial Statements, this document helps stakeholders understand the integrity of the financial information presented.

Yes, audited financial statements are generally considered public documents. Companies are obliged to disclose their audited financials to ensure accountability and provide transparency to founders and investors. This includes the Virgin Islands Report of Independent Accountants after Audit of Financial Statements, allowing users to access necessary financial data.

You can find the independent auditor's report on the company's official website, usually within the investor relations section. Additionally, many reports are filed with regulatory bodies, such as the SEC, making them accessible online. This includes the Virgin Islands Report of Independent Accountants after Audit of Financial Statements, which provides valuable insights into the company’s financial health.

Yes, audited financial statements typically qualify as public information. Companies that undergo an audit are often required to make their financial statements available to stakeholders, including shareholders and potential investors. This promotes transparency and trust, allowing users to review the Virgin Islands Report of Independent Accountants after Audit of Financial Statements.

Only licensed and qualified professionals, typically independent CPAs or audit firms, can legally audit financial statements. These individuals are trained to identify discrepancies and verify compliance with accounting standards. The integrity and reliability of the audit process are paramount, so choosing a reliable partner is essential. Ultimately, a well-conducted audit ensures a more informative Virgin Islands Report of Independent Accountants after Audit of Financial Statements, supporting business decisions.

An accountant can perform an audit, but they must meet specific licensing and certification requirements to do so effectively. Not all accountants have the credentials necessary to provide an independent audit opinion. For a report to be regarded as credible, it is crucial that the accountant holds a CPA designation. This expertise ensures that the Virgin Islands Report of Independent Accountants after Audit of Financial Statements meets all regulatory standards and expectations.

The responsibility for auditing financial statements generally falls on independent CPAs or audit firms. These professionals possess the necessary skills and qualifications to evaluate financial records thoroughly. Their goal is to ensure that these documents comply with applicable standards and regulations. In the Virgin Islands Report of Independent Accountants after Audit of Financial Statements, their conclusions provide essential insights for investors and stakeholders.

An independent CPA becomes associated with the financial statements when they conduct an audit of those documents. This involvement demonstrates the CPA's professional opinion regarding the accuracy and fairness of the financial reporting. The report generated is vital as it contributes to the Virgin Islands Report of Independent Accountants after Audit of Financial Statements. Therefore, having a qualified CPA associated with your financial statements enhances credibility and trust among stakeholders.