"Capital Consortium Due Diligence Checklist" is a American Lawyer Media form. This form is a checklist that was created by the Mortgage Bankers Association of America, the National Association of Realtors, and the National Realty Committee, for The Capital Consortium.

California Capital Consortium Due Diligence Checklist

Description

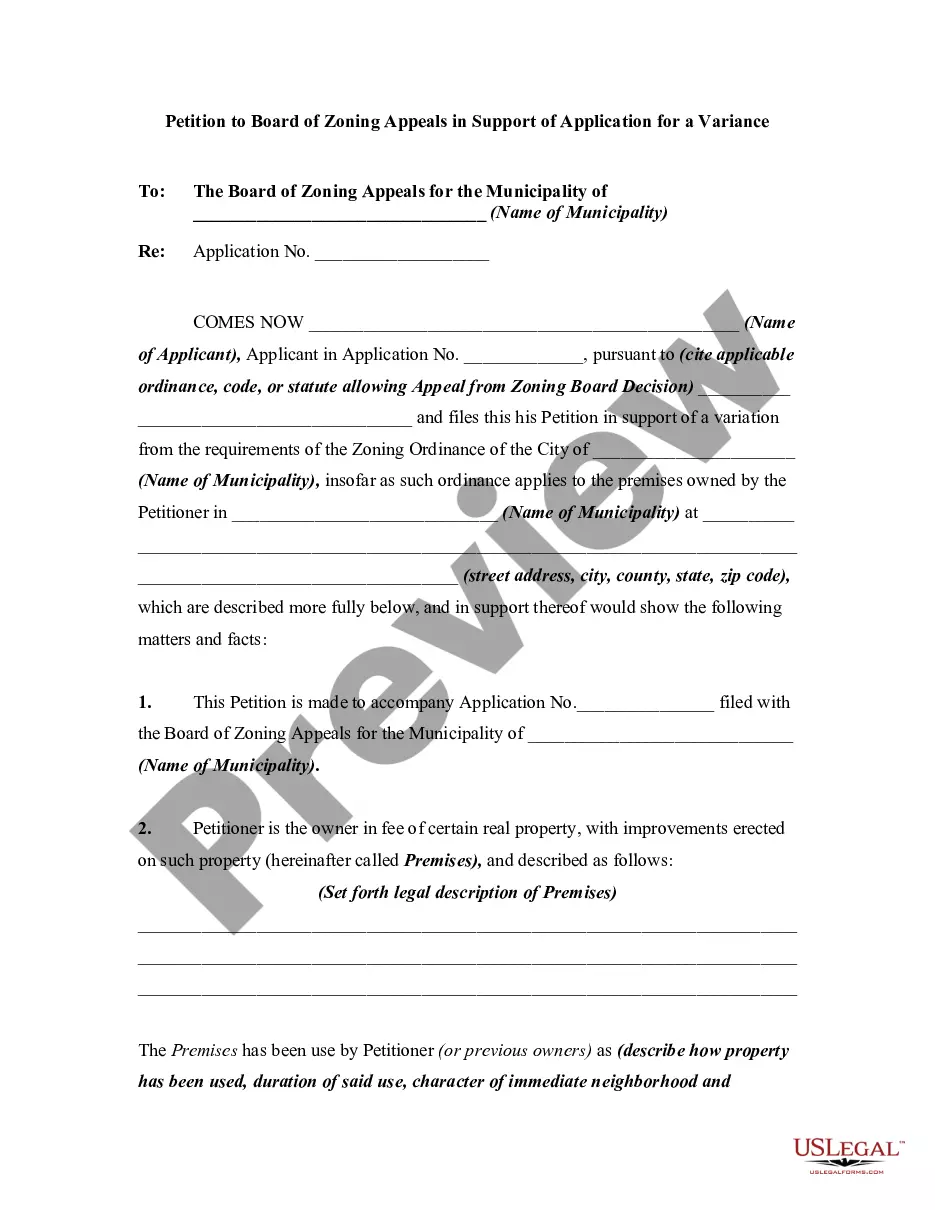

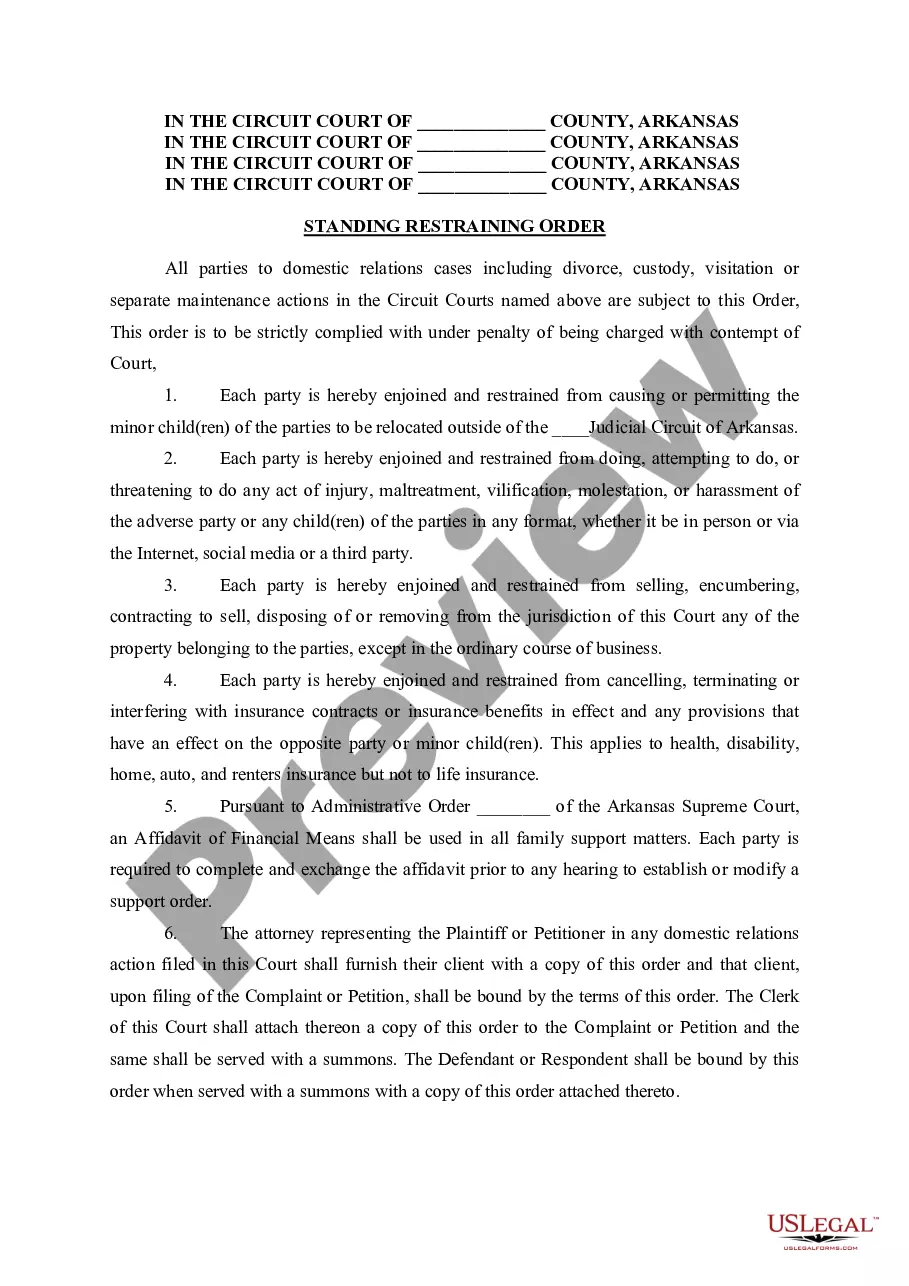

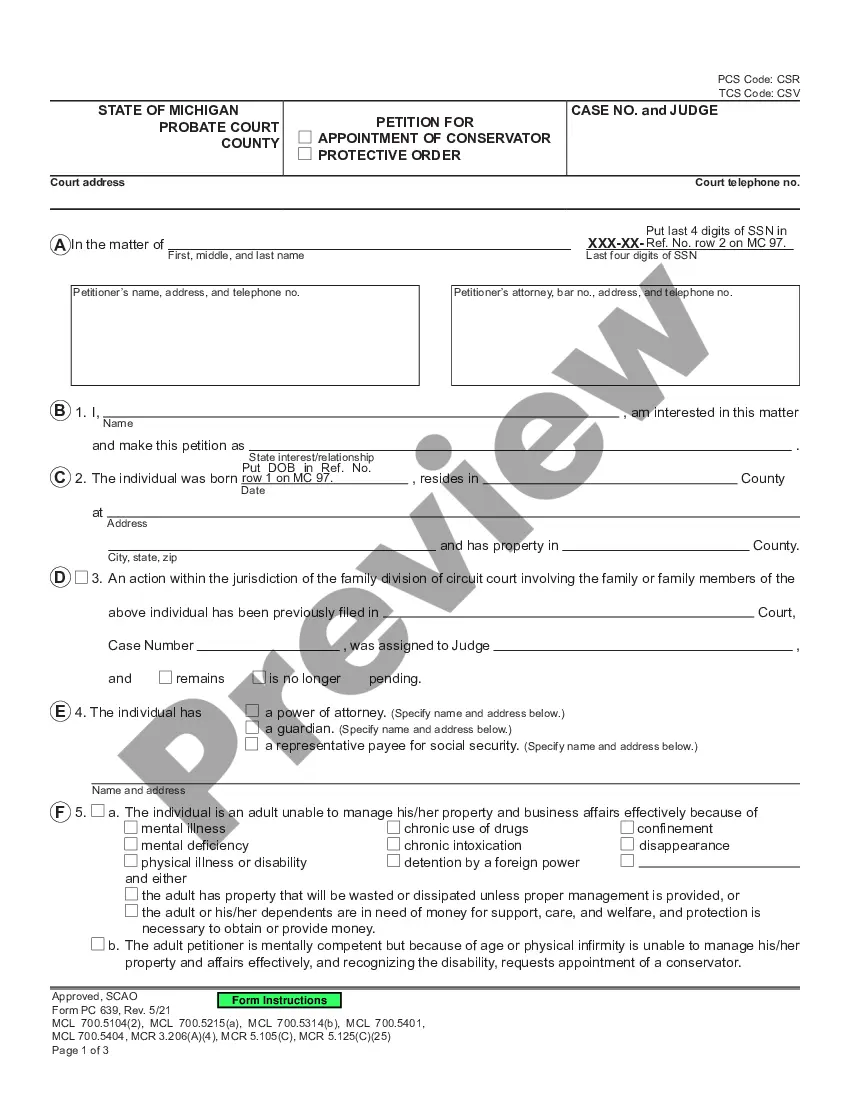

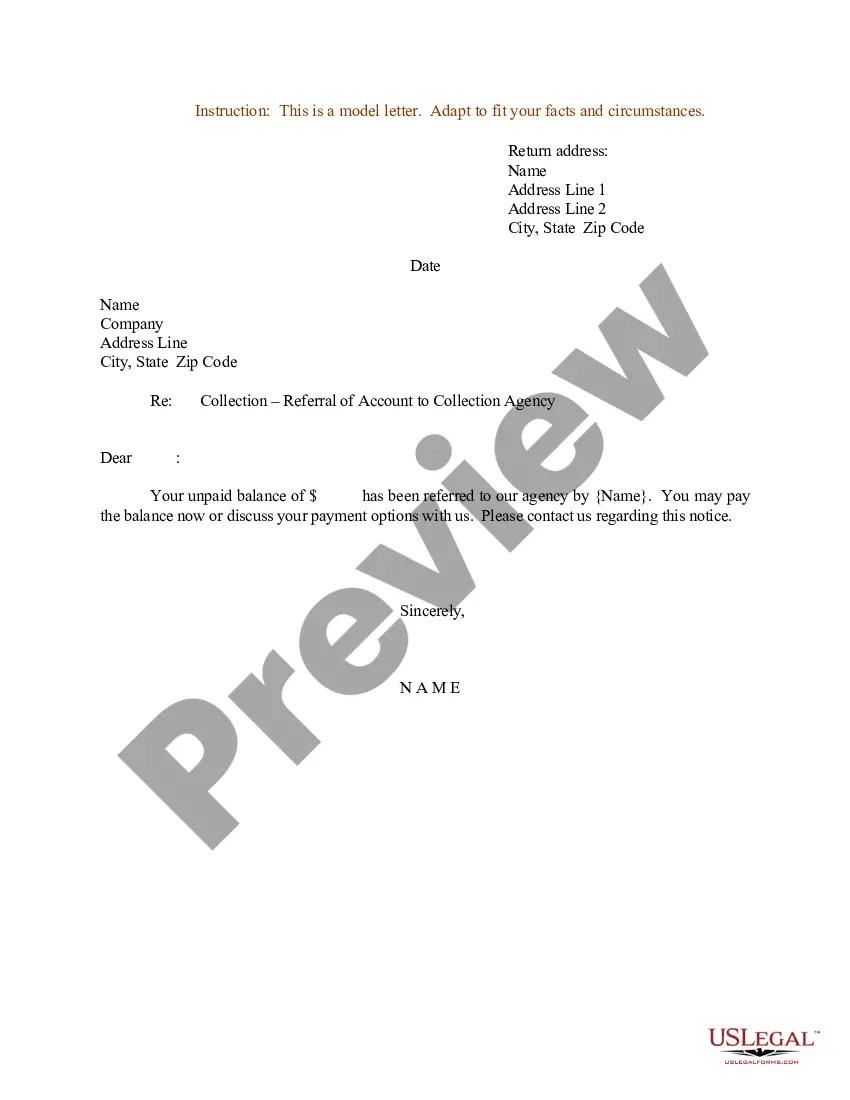

How to fill out Capital Consortium Due Diligence Checklist?

Finding the right authorized record format can be quite a struggle. Naturally, there are a variety of templates available on the Internet, but how will you discover the authorized form you require? Take advantage of the US Legal Forms site. The service gives 1000s of templates, like the California Capital Consortium Due Diligence Checklist, that can be used for company and personal requirements. All of the forms are checked out by specialists and meet up with federal and state needs.

If you are previously listed, log in to your account and then click the Download switch to find the California Capital Consortium Due Diligence Checklist. Utilize your account to look from the authorized forms you might have bought earlier. Visit the My Forms tab of the account and get yet another copy from the record you require.

If you are a fresh consumer of US Legal Forms, listed below are easy directions so that you can follow:

- Very first, make certain you have chosen the right form for your metropolis/region. You may examine the form making use of the Preview switch and study the form information to make sure it will be the right one for you.

- If the form is not going to meet up with your preferences, use the Seach discipline to discover the appropriate form.

- Once you are sure that the form is acceptable, go through the Acquire now switch to find the form.

- Select the rates prepare you would like and enter the needed information and facts. Create your account and pay money for an order with your PayPal account or bank card.

- Opt for the submit formatting and down load the authorized record format to your device.

- Full, modify and printing and signal the obtained California Capital Consortium Due Diligence Checklist.

US Legal Forms will be the biggest library of authorized forms for which you can discover numerous record templates. Take advantage of the company to down load appropriately-manufactured paperwork that follow condition needs.

Form popularity

FAQ

Due diligence is an investigation, audit, or review performed to confirm facts or details of a matter under consideration. In the financial world, due diligence requires an examination of financial records before entering into a proposed transaction with another party.

The Due Diligence Report includes a format and sample of information used in business transactions such as a merger or acquisition, partnership, investment, etc. The report requires research carried out prior to a financial transaction to assess commercial and legal risks, as well as opportunities.

The process of due diligence ensures that potential acquirers gain an accurate and complete understanding of a company. It helps evaluate a company's strengths, weaknesses, risks, and opportunities. The creation of a due diligence checklist provides the detailed roadmap required to guide such an extensive analysis.

What Should Be in a Due Diligence Report Checklist? Information on the finances of the company. ... Information about the company's employees. ... Information on the assets of the company. ... Information on partners, suppliers, and customers. ... Legal information about the company.

A legal due diligence report typically includes the following information: Company structure and governance. ... Contracts and agreements. ... Litigation history. ... Intellectual Property. ... Compliance documents. ... Real estate and land use. ... Data privacy and security. ... Taxation.

Due diligence typically involves a large number of documents that must be exchanged and carefully examined. This often requires coordination of a team of reviewing attorneys, good organizational skills and planning a well-defined scope to the due diligence exercise.

Due Diligence Checklist Template A due diligence checklist can be used as a guide in conducting an analysis on a company with potential for investment. Use this due diligence checklist to determine profitability and risk during the decision-making process before a merger or acquisition.

A due diligence check involves careful investigation of the economic, legal, fiscal and financial circumstances of a business or individual. This covers aspects such as sales figures, shareholder structure and possible links with forms of economic crime such as corruption and tax evasion.