An option is a contract to purchase the right for a certain time, by election, to purchase property at a stated price. An option may be a right to purchase property or require another to perform upon agreed-upon terms. By purchasing an option, a person is paying for the opportunity to elect or "exercise" the right for the property to be purchased or the performance of the other party to be required. "Exercise" of an option normally requires notice and payment of the contract price. The option will state when it must be exercised, and if not exercised within that time, it expires. If the option is not exercised, the amount paid for the option is not refundable.

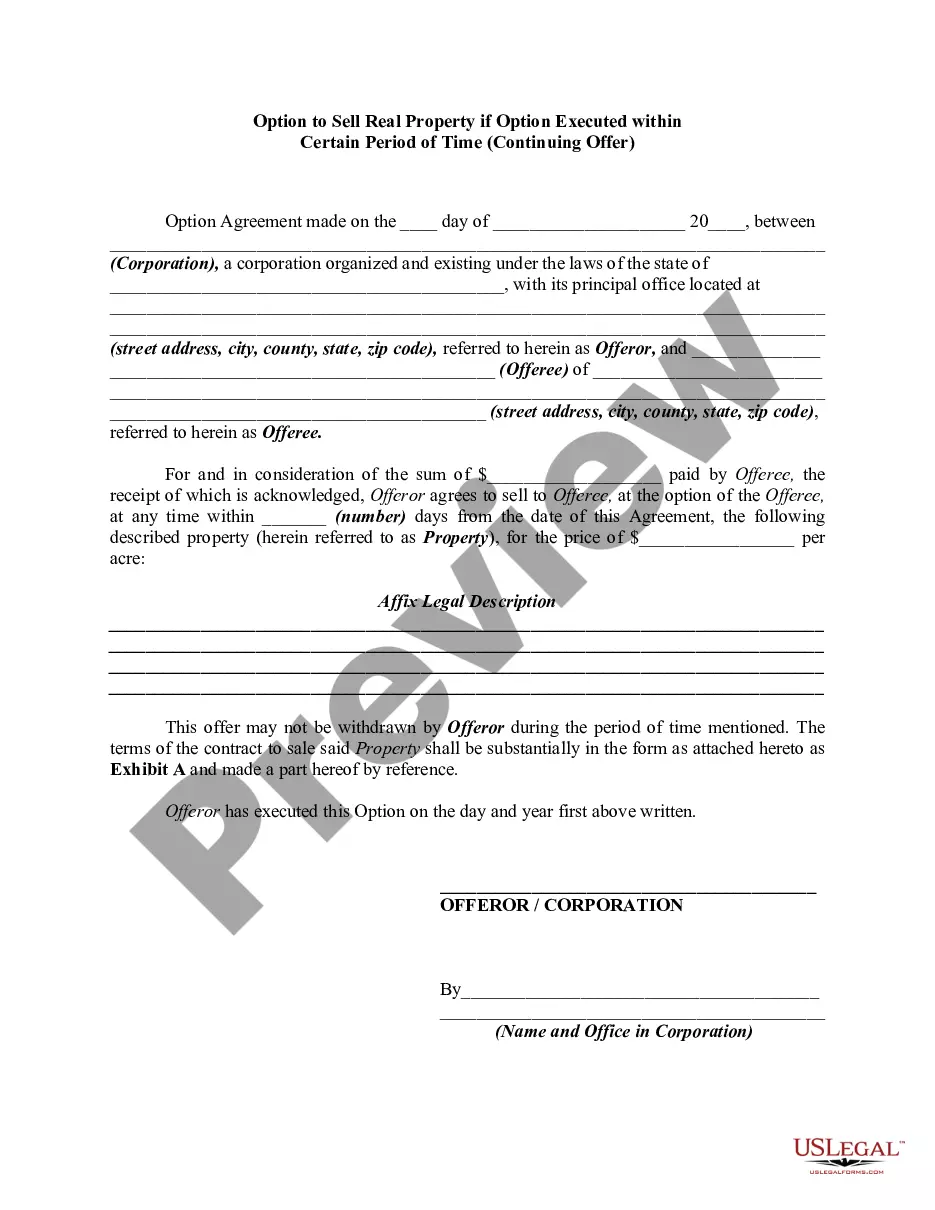

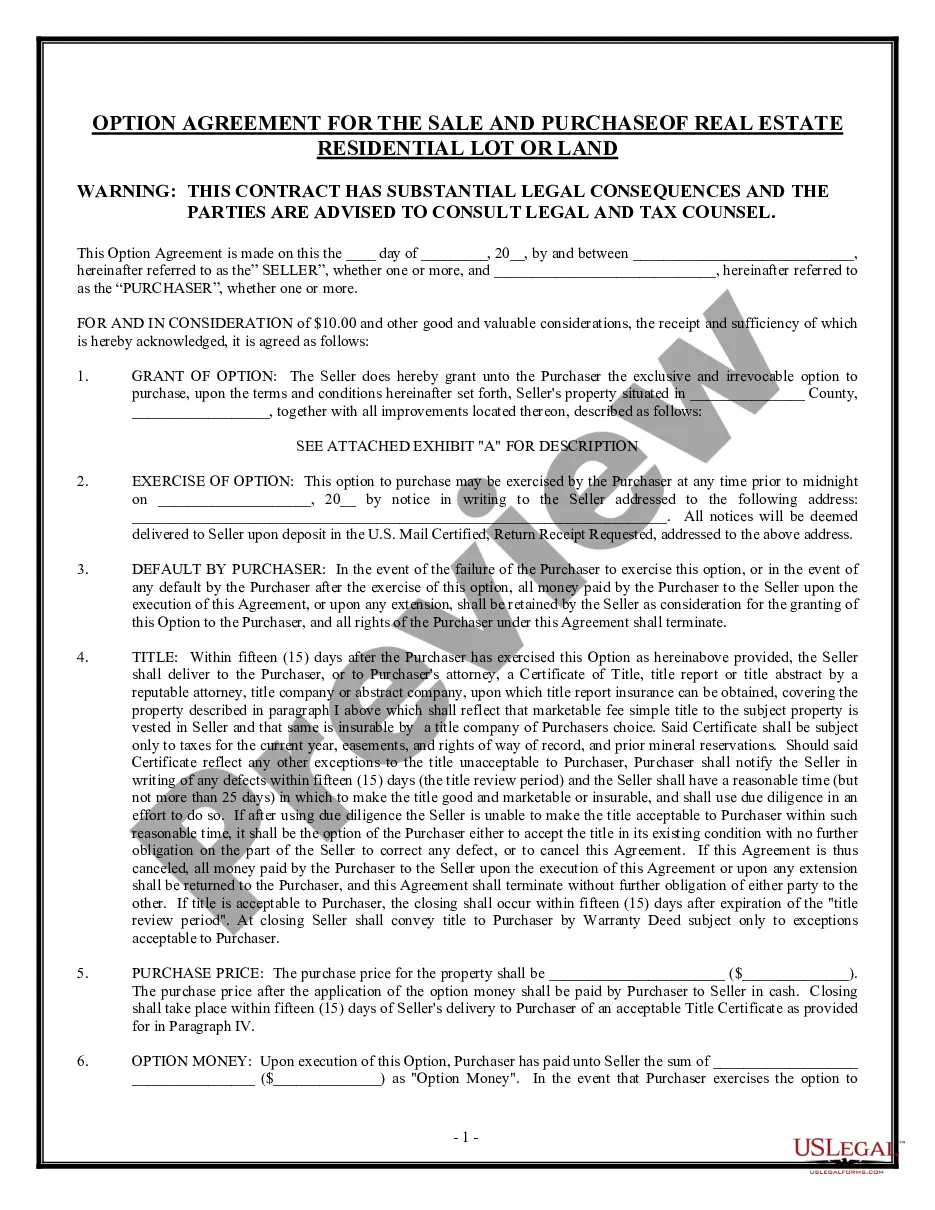

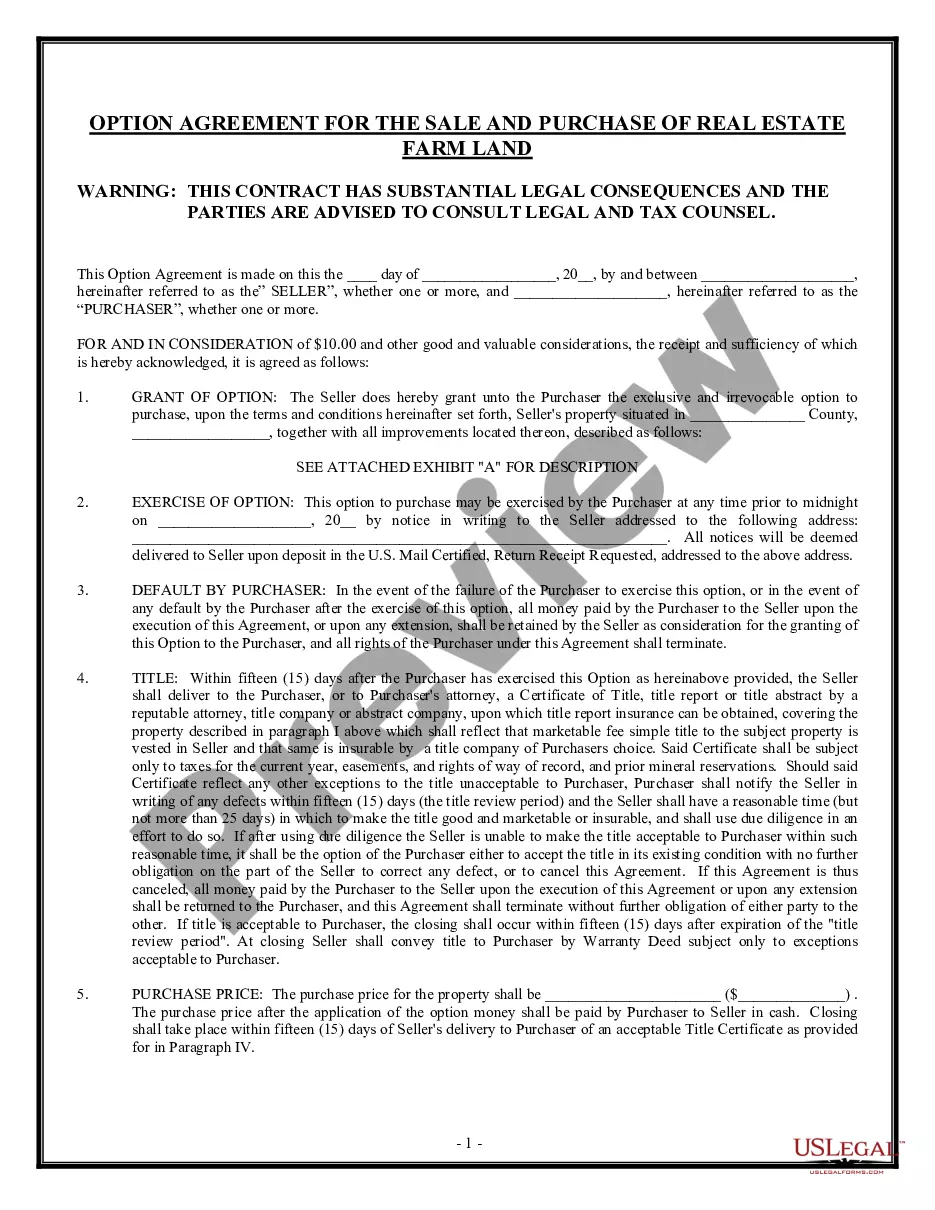

Virgin Islands Option to Sell Real Property if Option Executed within Certain Period of Time - Continuing Offer

Description

How to fill out Option To Sell Real Property If Option Executed Within Certain Period Of Time - Continuing Offer?

Are you presently in a scenario where you require documents for either business or specific tasks almost at all times.

There are numerous legal document templates accessible online, yet locating ones you can trust is not easy.

US Legal Forms offers thousands of form templates, including the Virgin Islands Option to Sell Real Property if Option Executed within Certain Period of Time - Continuing Offer, which are designed to meet state and federal requirements.

Choose a convenient file format and download your copy.

Locate all the document templates you have purchased in the My documents menu. You can obtain an additional copy of Virgin Islands Option to Sell Real Property if Option Executed within Certain Period of Time - Continuing Offer at any time, if necessary. Just click the required form to download or print the document template. Utilize US Legal Forms, the most comprehensive selection of legal forms, to save time and avoid errors. The service offers professionally created legal document templates that you can use for a variety of purposes. Create your account on US Legal Forms and begin simplifying your life.

- If you are already acquainted with the US Legal Forms website and have your account, simply Log In.

- Then, you can download the Virgin Islands Option to Sell Real Property if Option Executed within Certain Period of Time - Continuing Offer template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for your correct locality/region.

- Use the Review button to examine the form.

- Read the description to ensure that you have selected the appropriate form.

- If the form is not what you are looking for, use the Search field to find the form that suits your needs and specifications.

- If you find the correct form, click Buy now.

- Select the pricing plan you prefer, fill out the required details to create your account, and make the purchase using your PayPal or credit card.

Form popularity

FAQ

A Section 121 Exclusion is an Internal Revenue Service rule that allows you to exclude from taxable income a gain of up to $250,000 from the sale of your principal residence. A couple filing a joint return gets to exclude up to $500,000.

SELLING MULTIPLE PROPERTIES IN AN SECTION 1031 If several sales are grouped in the same exchange, the identification rules permit listing only three (3) properties of unlimited value OR more than three (3) properties whose combined values do not exceed 200% of the value of properties being sold.

If a property has been acquired through a 1031 Exchange and is later converted into a primary residence, it is necessary to hold the property for no less than five years or the sale will be fully taxable.

This 180 day period is the maximum time that the funds can be retained in the escrow account that the qualified intermediary has established for the exchange.

The Internal Revenue Code Section 1031 is very clear about the process investors must undergo to defer recognition of capital gains (and, therefore, to defer paying taxes on those capital gains). Specifically, you have 45 days from the date you relinquish your asset to find a like-kind replacement.

More In Forms and Instructions One purpose of the form is to report net earnings from self-employment (SE) to the United States and, if necessary, pay SE tax on that income. The Social Security Administration (SSA) uses this information to figure your benefits under the social security program.

In general, to qualify for the Section 121 exclusion, you must meet both the ownership test and the use test. You're eligible for the exclusion if you have owned and used your home as your main home for a period aggregating at least two years out of the five years prior to its date of sale.

IRC section 121 allows a taxpayer to exclude up to $250,000 ($500,000 for certain taxpayers who file a joint return) of the gain from the sale (or exchange) of property owned and used as a principal residence for at least two of the five years before the sale.

Purpose of Form Use Form 8898 to notify the IRS that you became or ceased to be a bona fide resident of a U.S. possession in accordance with section 937(c). See Bona Fide Residence, later.

If your worldwide gross income is $75,000 or more, you must file Form 8898 for the tax year in which you became or ceased to be a bona fide resident of the U.S. possession. For married individuals, the $75,000 filing threshold applies to each spouse separately.