Virgin Islands Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause

Description

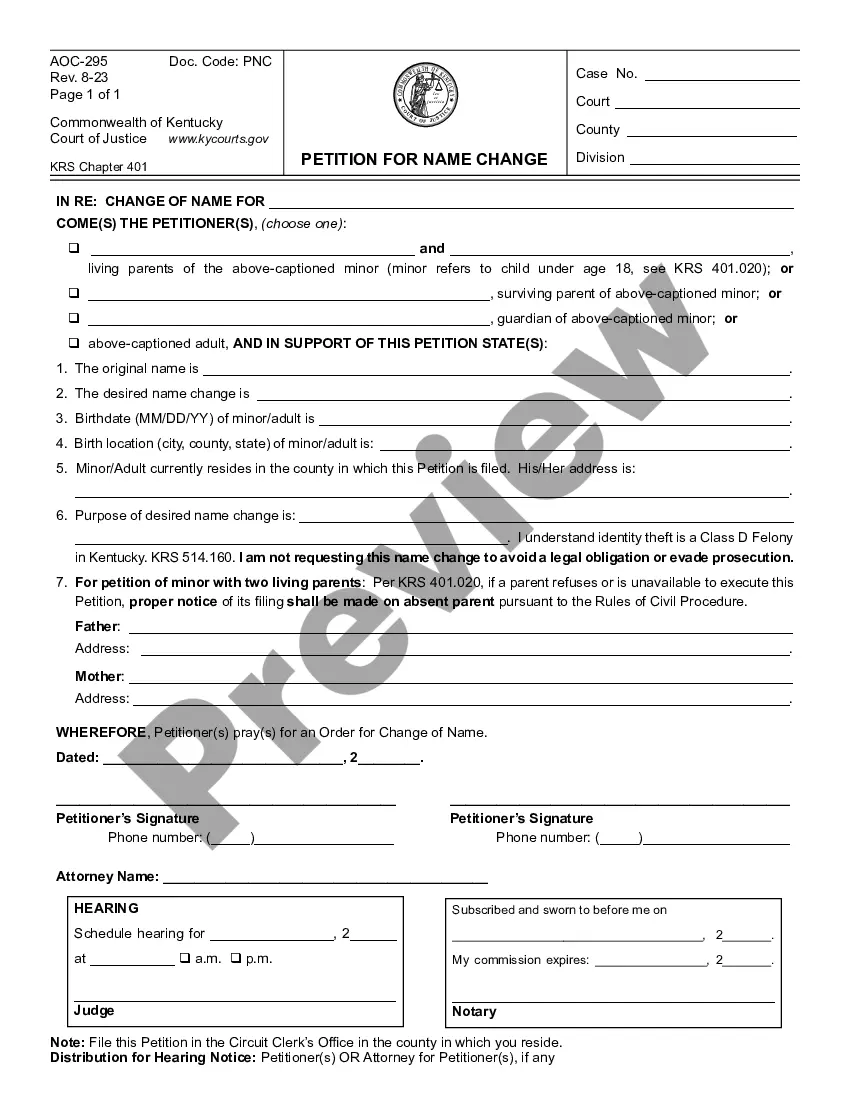

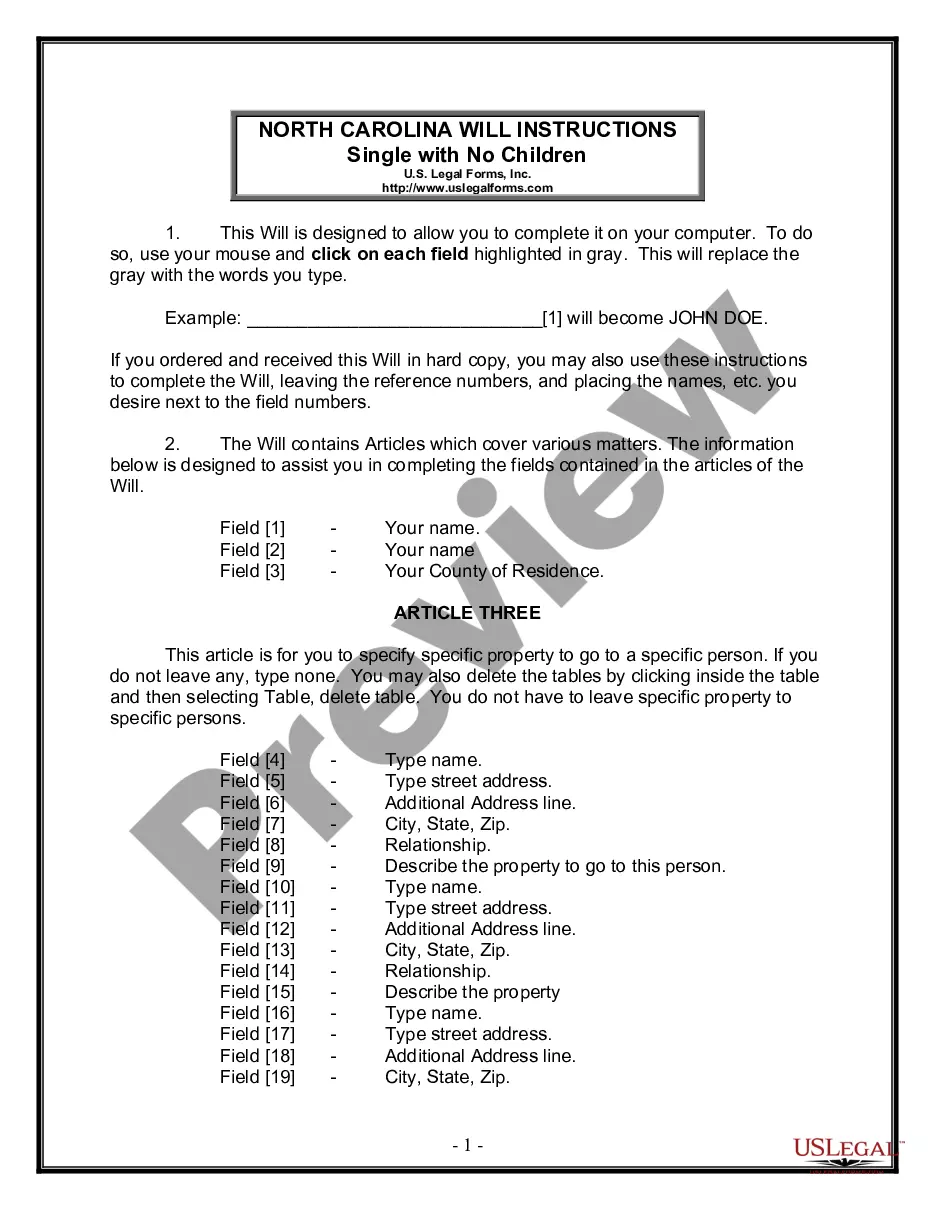

How to fill out Contract With Consultant As Self-Employed Independent Contractor With Limitation Of Liability Clause?

US Legal Forms - one of the largest compendiums of legal templates in the United States - offers an extensive variety of legal document formats you can download or print.

By utilizing the website, you can access thousands of templates for business and personal purposes, organized by categories, states, or keywords.

You can obtain the latest forms such as the Virgin Islands Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause in just a matter of minutes.

If the form does not meet your requirements, use the Search box at the top of the screen to find one that does.

Once satisfied with the form, confirm your selection by clicking the Get now button. Then, choose your preferred payment plan and provide your credentials to register for an account.

- If you hold a monthly subscription, Log In and download the Virgin Islands Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause from the US Legal Forms collection.

- The Download button will appear on each document you view.

- You can access all previously downloaded forms in the My documents section of your account.

- For first-time users of US Legal Forms, here are simple steps to assist you in getting started.

- Ensure you have selected the correct form for your city/state.

- Click the Review button to inspect the content of the form.

Form popularity

FAQ

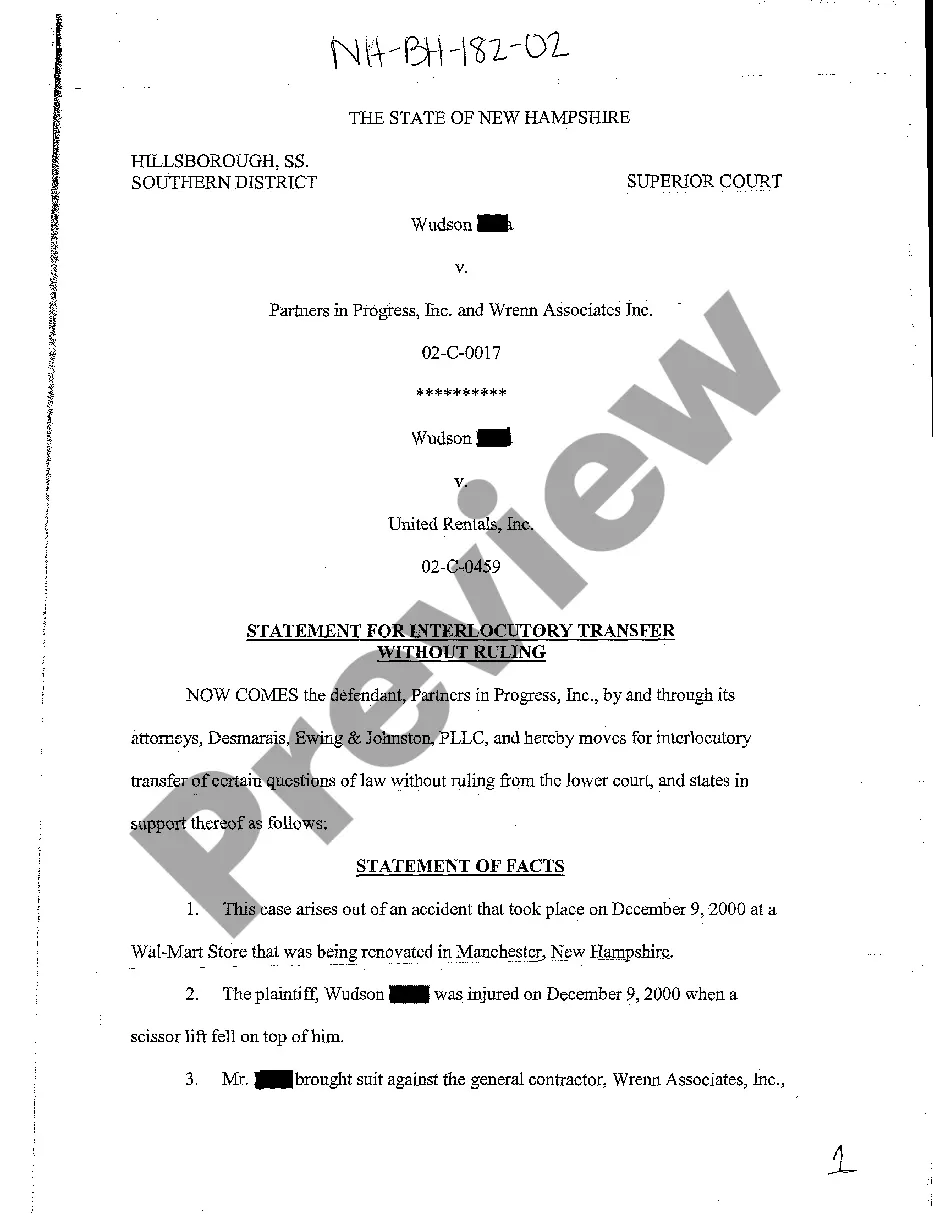

An example of a contractor could be a construction company hired to build a new office. They work independently, bringing their own resources and expertise to the project. Having a proper agreement in place, such as the Virgin Islands Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause, ensures that both parties are protected throughout the duration of the contract.

The technology industry frequently employs independent contractors, especially in fields like software development and digital marketing. These roles often require specific expertise that companies may not have in-house. Utilizing a Virgin Islands Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause can help streamline the hiring process.

To write an independent contractor agreement, start with a title and date. Clearly define the scope of work, payment terms, and any special clauses, like the Virgin Islands Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause that limits liability. Ensure both parties sign the document for legal protection.

An example of an independent contractor is a marketing consultant hired to develop strategies for a company. These contractors work independently, providing specialized skills on a temporary basis. They often utilize agreements like the Virgin Islands Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause to formalize their business relationship.

An independent form of work can be anything from graphic design to writing consulting reports. These projects often allow individuals to set their schedules and work locations. When establishing such work through a Virgin Islands Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause, it offers a structured approach to client engagements.

Filling out a contract agreement requires attention to detail. Start by clearly outlining the roles and responsibilities of both parties. Include specifics such as payment terms, deadlines, and clauses, like the Virgin Islands Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause to protect your interests.

An independent contractor is often referred to as a freelancer or a consultant. These terms emphasize their self-employed status and flexibility in choosing projects. When working under a Virgin Islands Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause, the relationship becomes clear and defines responsibilities.

While both freelancers and independent consultants work for themselves, the primary difference lies in their service offerings. Freelancers typically take on short-term or project-based work, whereas independent consultants often provide specialized expertise over a longer duration. Emphasizing these aspects in a Virgin Islands Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause can help define roles and expectations clearly for both parties.

employed individual is someone who works for themselves instead of working for an employer. This can include freelancers, independent contractors, or business owners. The Virgin Islands Contract with Consultant as SelfEmployed Independent Contractor with Limitation of Liability Clause is particularly important for selfemployed individuals, as it clarifies who is responsible for various aspects of their service agreements.

An independent consultant is unquestionably self-employed. Such professionals provide specialized services outside of a corporate structure, enabling them to manage their workload and clients. The Virgin Islands Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause further safeguards their status and sets outlines for their responsibilities.