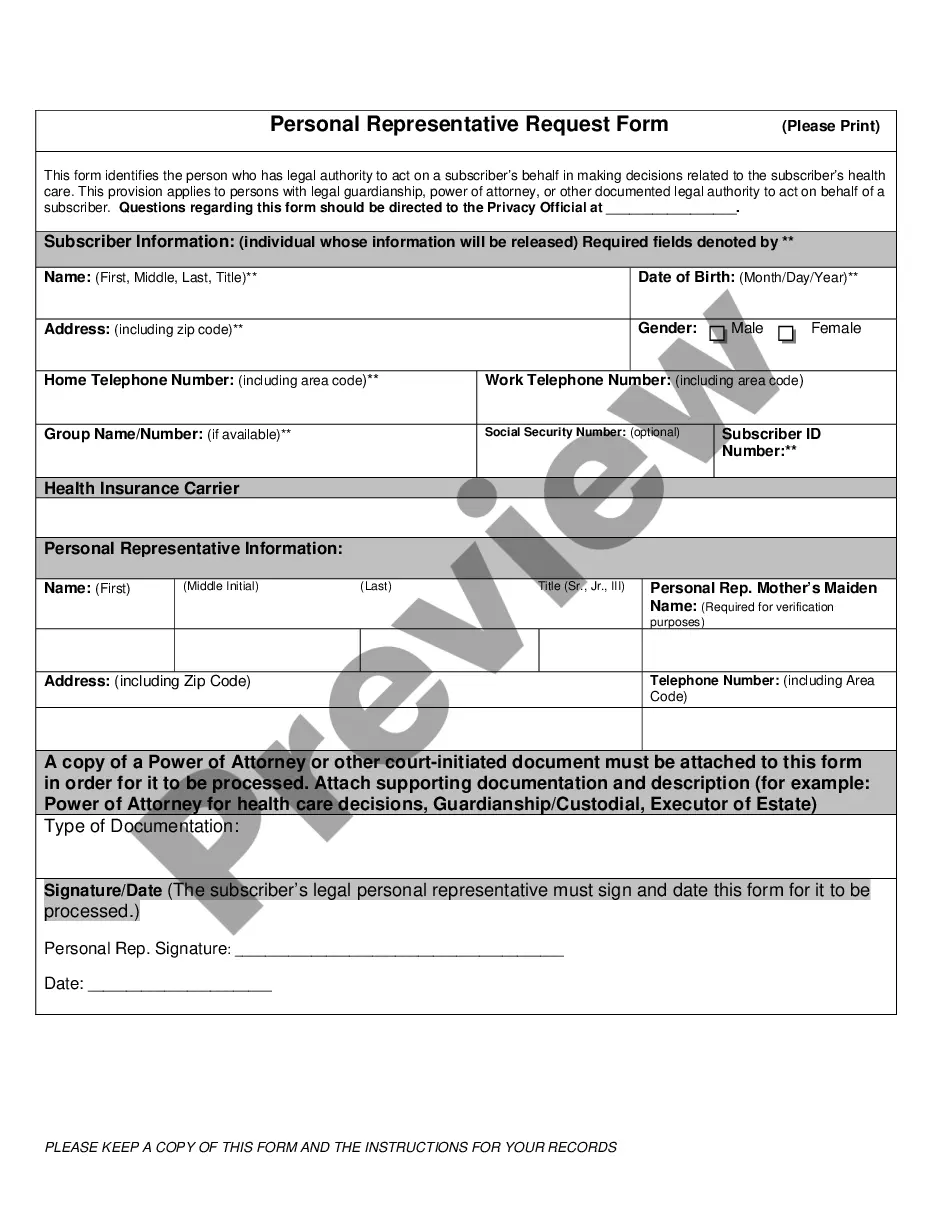

Wisconsin Personal Representative Request Form

Description

How to fill out Personal Representative Request Form?

Finding the correct legal document format can be a challenge.

Of course, there are many templates available online, but how do you obtain the legal form you need.

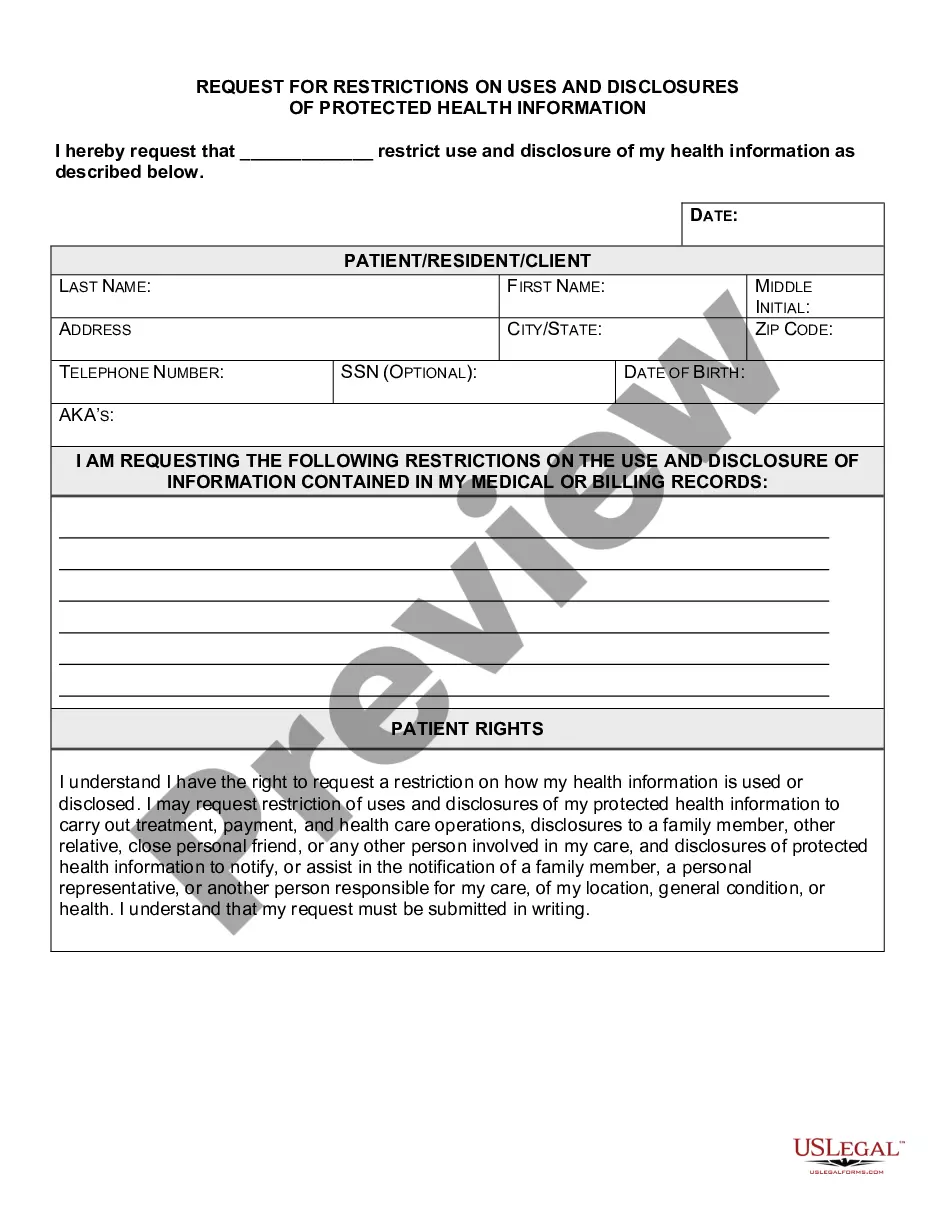

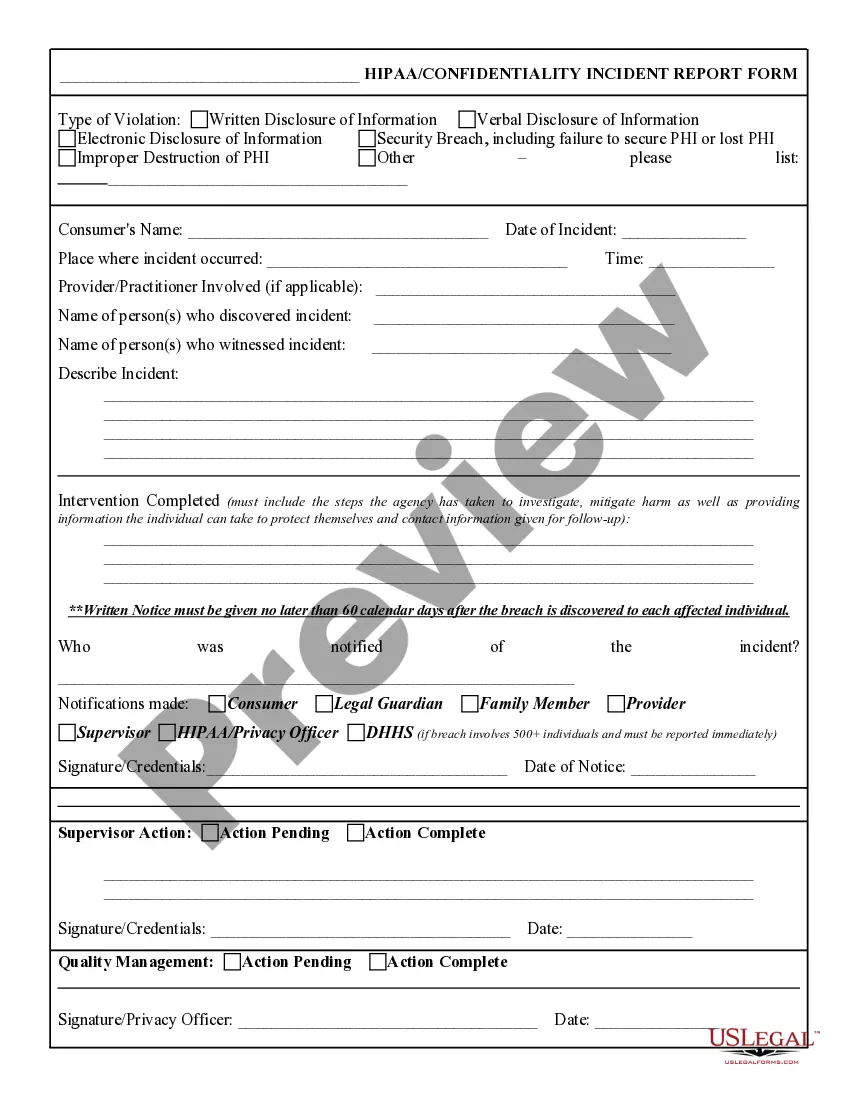

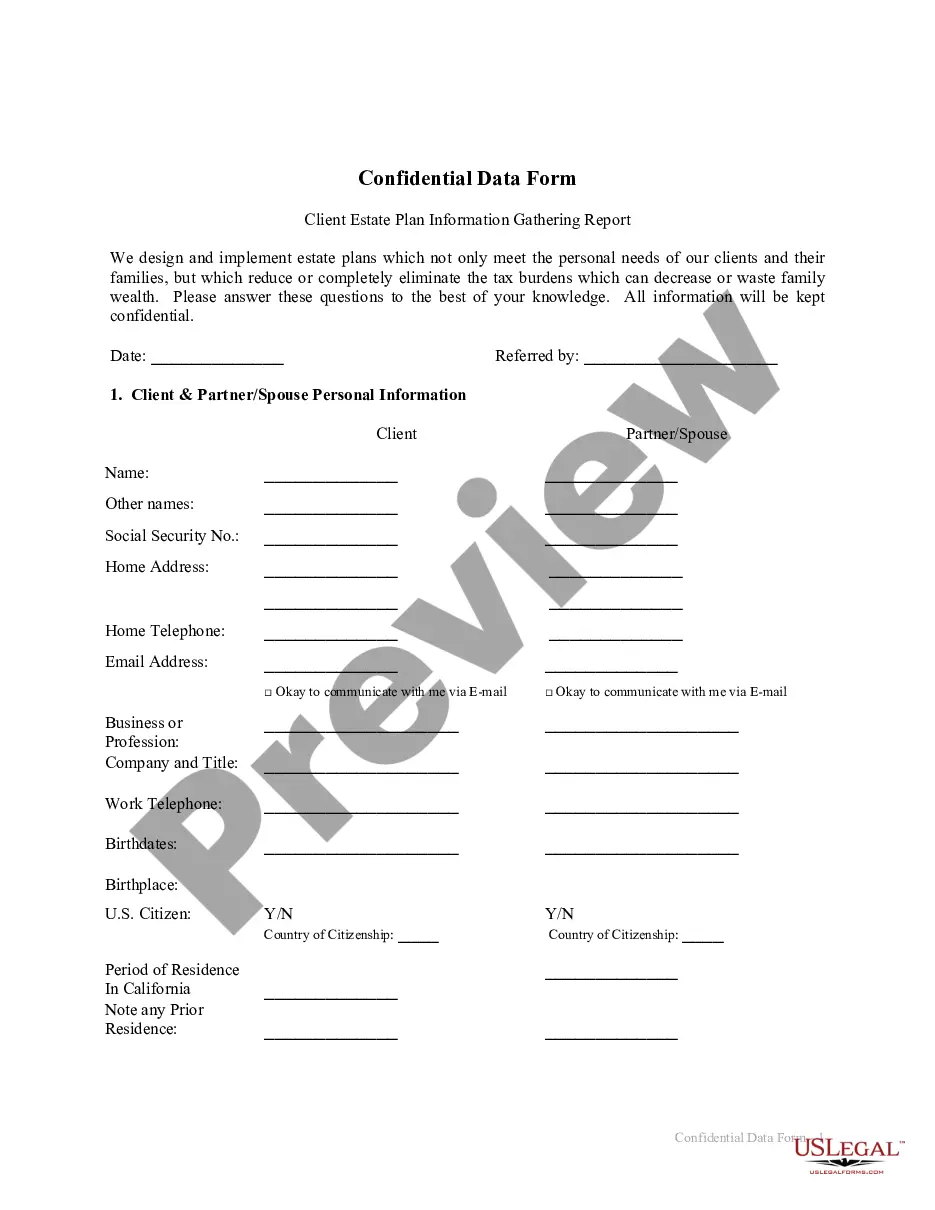

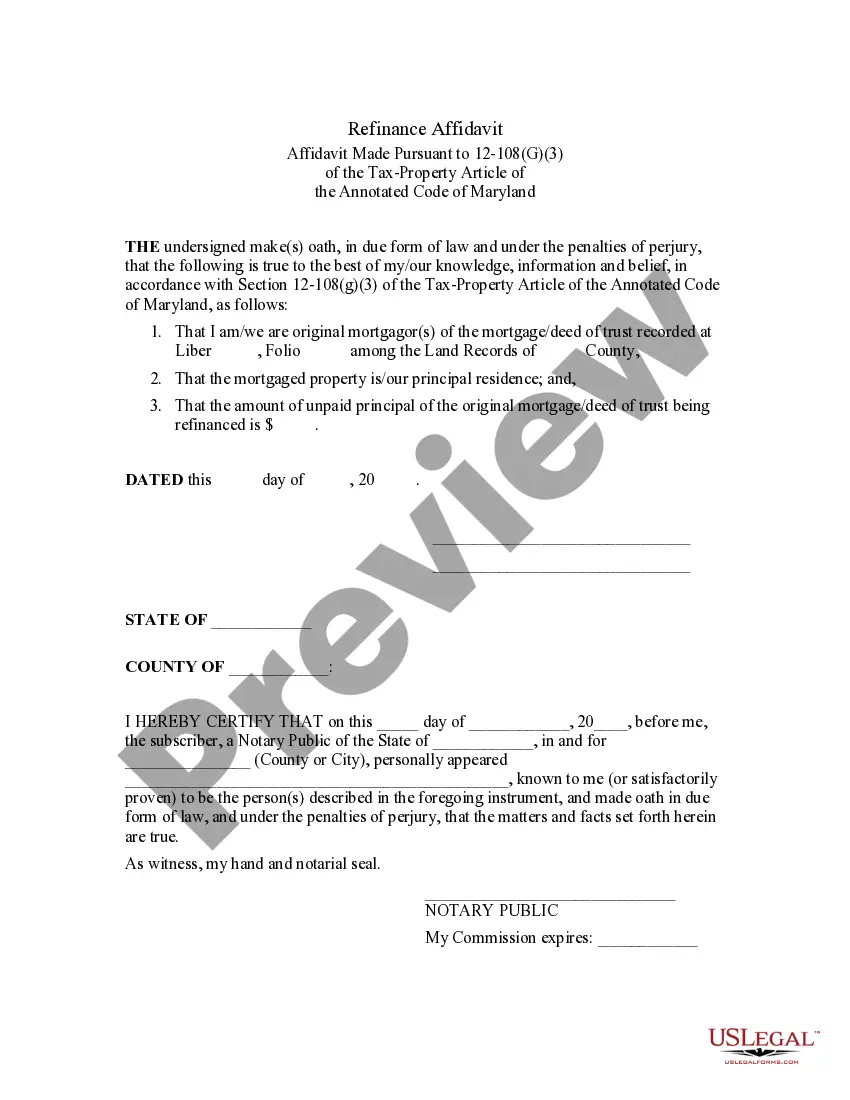

Utilize the US Legal Forms website. The service offers thousands of templates, including the Wisconsin Personal Representative Request Form, suitable for both business and personal purposes.

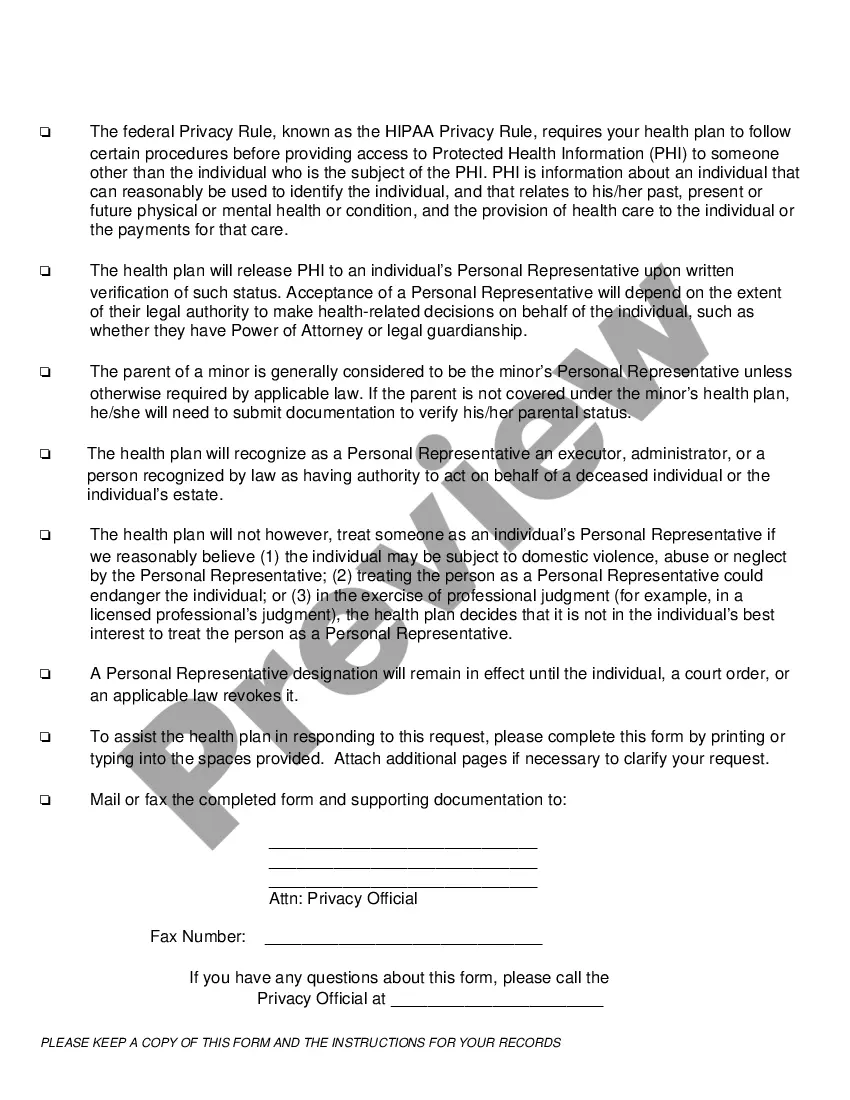

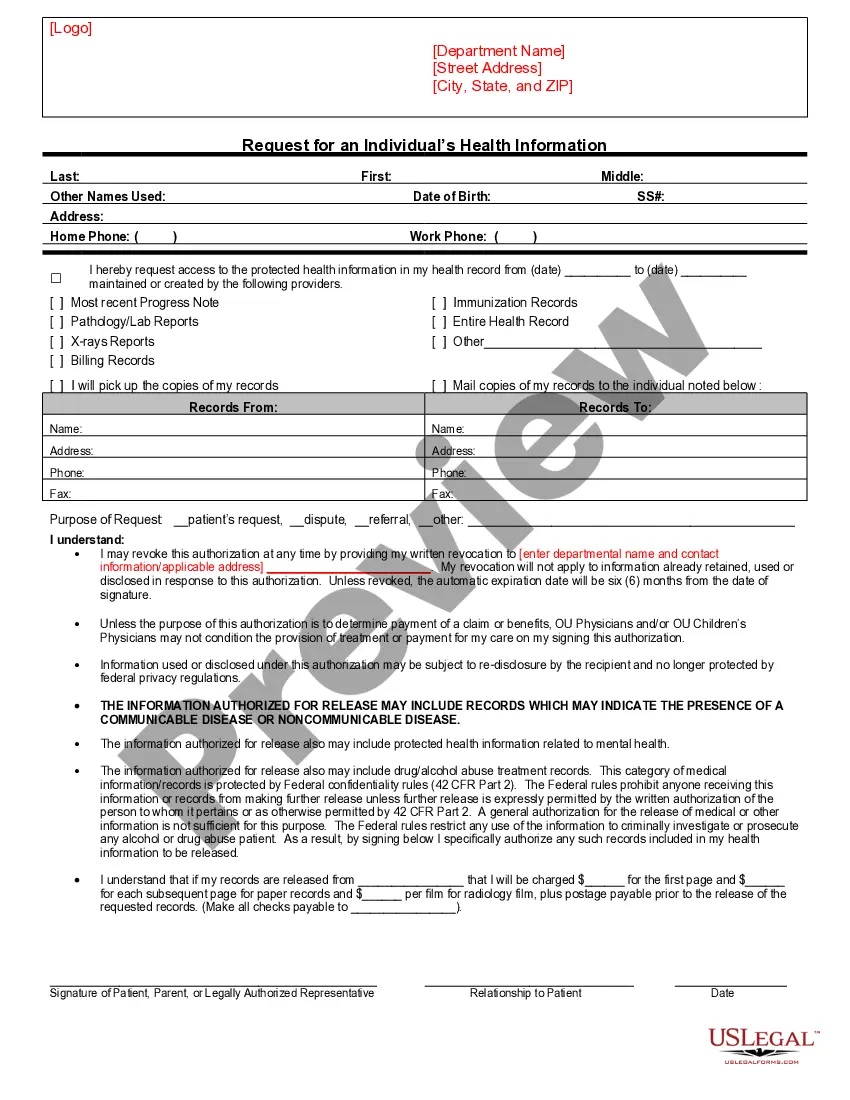

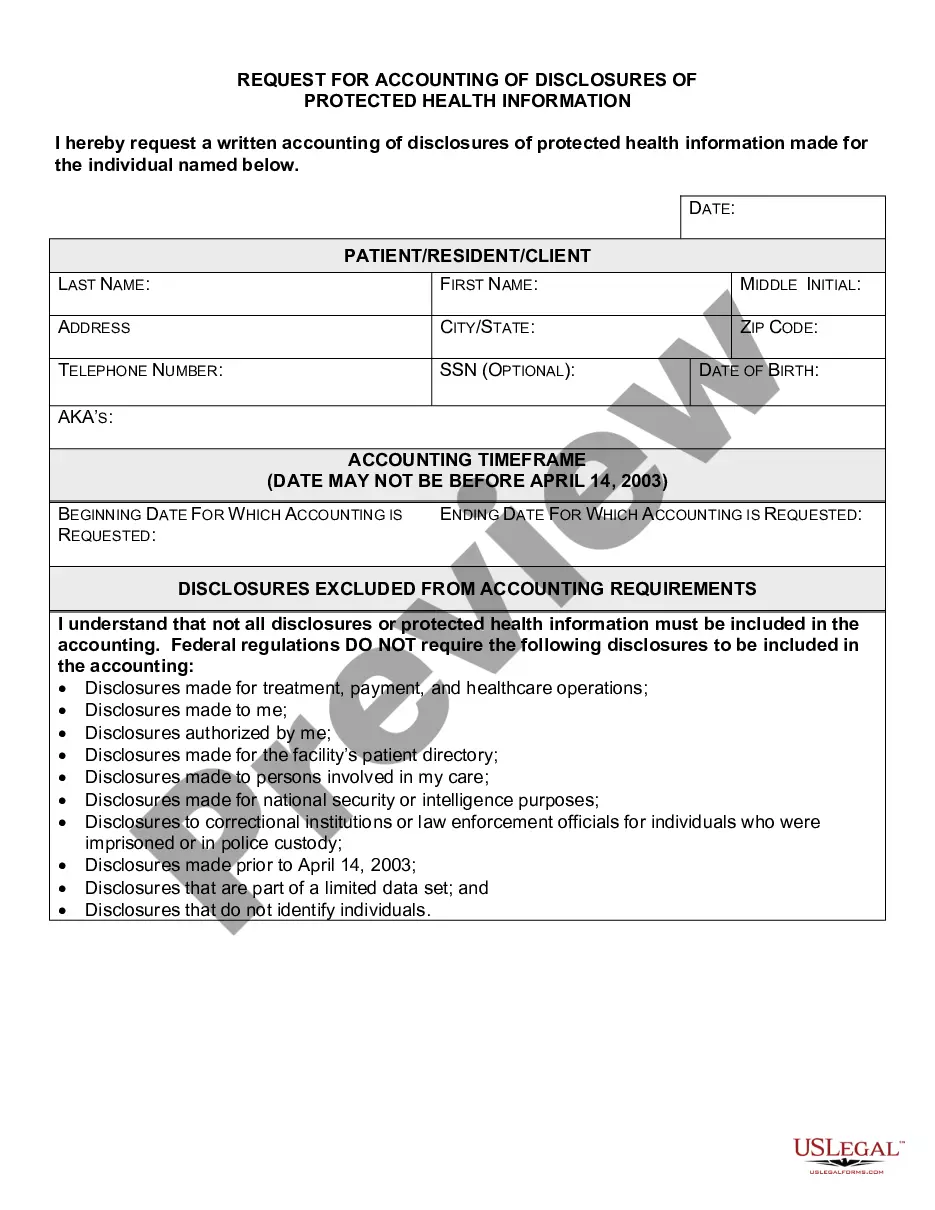

You can review the form using the Review option and read the form description to confirm it is the right one for you.

- All forms are reviewed by professionals and adhere to state and federal requirements.

- If you are already registered, Log Into your account and click the Download button to retrieve the Wisconsin Personal Representative Request Form.

- Use your account to access the legal documents you have purchased previously.

- Visit the My documents tab in your account to download an additional copy of the document you need.

- If you are a first-time user of US Legal Forms, here are simple steps you can follow.

- First, ensure you have selected the correct form for your locality/state.

Form popularity

FAQ

In Wisconsin, you can make a living trust to avoid probate for virtually any asset you own -- real estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

Probate is used to distribute a decedent's assets not only to beneficiaries but also to creditors and taxing authorities. Any Wisconsin estate that exceeds $50,000 in value must go through the probate process unless the property is subject to certain exemptions.

If a person dies leaving no will, the Wisconsin probate court follows the state's rules for Intestate Succession with the deceased's spouse and children receiving priority as inheritors. If there is no spouse or children, the deceased's parents, siblings, or other descendants may claim rights to the estate.

Simplified Probate Procedures You can use the simplified small estate process in Wisconsin if the value of the estate, less mortgages and encumbrances, is $50,000 or less and the deceased person is survived by a spouse or minor children.

How Long do you Have to File Probate After Death in Wisconsin? In general, Wisconsin state law requires that an estate be closed within 18 months of the person's death. However, several Wisconsin counties have recently adopted statutes requiring that probate be completed within 12 months of death.

State law requires that an estate be closed within 18 months. However, several counties have adopted a benchmark for completing probate within 12 months. For either period, a court may grant a Petition for Extension.

While the process varies from state to state, the executor must petition the probate court in the county in which the decedent lived. The application includes a sworn statement that the person has been named as the executor in the will, as well as an estimate of the estate's property and debts.

While the process varies from state to state, the executor must petition the probate court in the county in which the decedent lived. The application includes a sworn statement that the person has been named as the executor in the will, as well as an estimate of the estate's property and debts.

What is a Letter of Testamentary? A Letter of Testamentary is a document granted to the Executor of an estate by the probate court. This document gives the Executor the authority he or she will need to formally act on behalf of the decedent.