Virgin Islands Financial Statement Form - Individual

Description

How to fill out Financial Statement Form - Individual?

You can invest hours online attempting to locate the authentic document template that complies with the state and federal requirements you may need.

US Legal Forms offers a vast collection of valid forms that are assessed by specialists.

You can indeed obtain or create the Virgin Islands Financial Statement Form - Individual from my service.

If available, use the Review option to examine the document template as well.

- If you already have a US Legal Forms account, you can Log In and then click the Download button.

- Subsequently, you can complete, modify, print, or sign the Virgin Islands Financial Statement Form - Individual.

- Each valid document template you acquire is your own forever.

- To obtain another copy of the acquired form, visit the My documents section and click the appropriate option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions outlined below.

- First, ensure that you have selected the appropriate document template for the state/city of your choice.

- Review the form details to confirm you have chosen the correct form.

Form popularity

FAQ

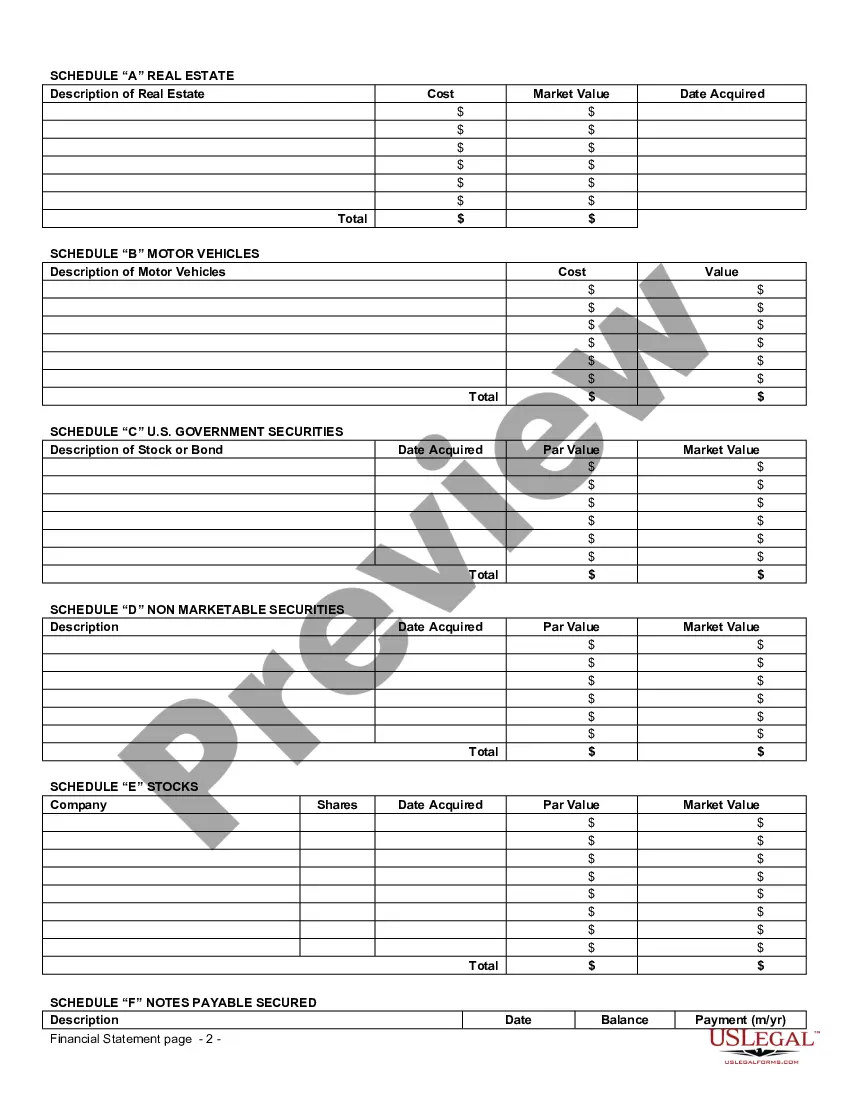

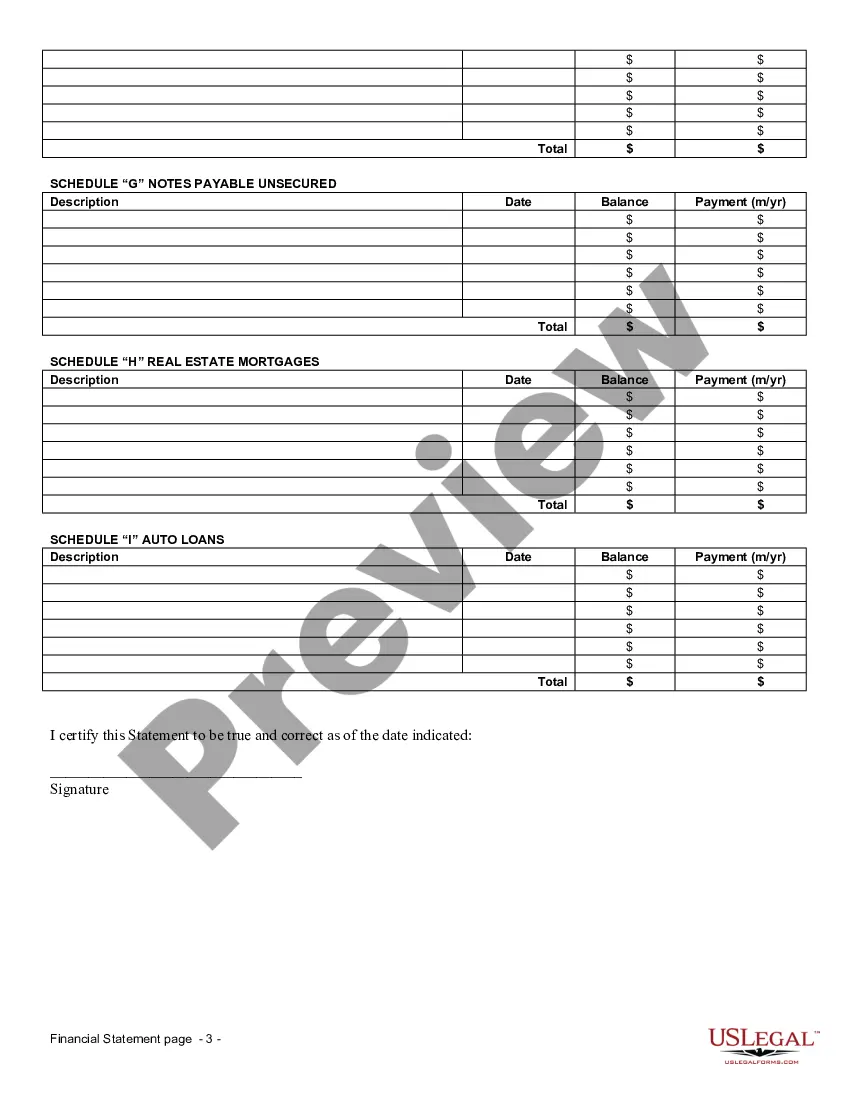

To fill out a financial statement, you should begin by identifying your financial position, which includes your assets and liabilities. Organizing all required information in a clear format simplifies this task. The Virgin Islands Financial Statement Form - Individual offers a well-structured layout that aids in accurately completing your financial statement.

To fill out a balance statement, you need to outline your assets, liabilities, and owner's equity. Start by listing what you own, such as properties and accounts, and then detail all financial obligations. Using the Virgin Islands Financial Statement Form - Individual will make this process simpler, helping to ensure that nothing is overlooked.

Filling out an individual financial statement requires you to list your assets, liabilities, and income sources. Begin by gathering all relevant financial documents, such as bank statements and tax returns. When using the Virgin Islands Financial Statement Form - Individual, you will have a structured guide to help you input all necessary data accurately and efficiently.

Creating a financial statement for a small business involves compiling various financial data into a clear format. Start with your income, expenses, and any investments. The Virgin Islands Financial Statement Form - Individual can guide you through this process, ensuring you include all necessary information for a complete overview of your business's performance.

Yes, BVI companies are required to prepare financial statements. This requirement ensures transparency and accountability. For shareholders and regulatory bodies, these statements serve as critical insights into the company's financial health. Utilizing the Virgin Islands Financial Statement Form - Individual can streamline this process effectively.

The IRS form for a single person is also typically Form 1040, which caters to various filing statuses, including single individuals. This form allows for complete reporting of income and applicable deductions. Utilizing resources like the Virgin Islands Financial Statement Form - Individual can greatly assist in understanding how to fill out your tax return as a single filer.

The primary tax form for individual income is Form 1040. This form is where individuals report their income, claim deductions, and calculate their tax liability. Exploring the Virgin Islands Financial Statement Form - Individual can help ensure you have all the necessary information to complete your filing accurately.

Form 8689 is required for individuals who qualify as bona fide residents of the U.S. Virgin Islands and are claiming a refund of over-withheld tax. If you meet certain eligibility criteria, it is essential to file this form accurately. For a comprehensive understanding, look into the Virgin Islands Financial Statement Form - Individual to ensure you comply with the filing requirements.

A 1099 is a form used to report various types of income other than wages, while Form 1040 is the standard individual income tax return. Specifically, a 1099 is issued to report income such as freelance earnings or interest payments. Understanding these two forms is important for accurate reporting, and the Virgin Islands Financial Statement Form - Individual can help clarify where to report such income.

The 1040EZ form has been replaced by the redesigned Form 1040, which simplifies the tax filing process while accommodating various income situations. The new structure allows individuals to report income, claim deductions, and follow guidelines more easily. For individuals needing assistance, exploring the Virgin Islands Financial Statement Form - Individual can provide clarity.