Virgin Islands Accounts Receivable - Assignment

Description

How to fill out Accounts Receivable - Assignment?

Have you ever been in a situation where you require documents for both business or personal purposes almost every day.

There are numerous legitimate document templates available online, but finding versions you can trust is not straightforward.

US Legal Forms offers a vast array of template forms, such as the Virgin Islands Accounts Receivable - Assignment, which are designed to meet federal and state requirements.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Virgin Islands Accounts Receivable - Assignment template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct city/state.

- Utilize the Preview button to review the form.

- Read the description to confirm that you have selected the correct form.

- If the form is not what you are looking for, use the Search field to find the form that meets your needs and requirements.

- Once you find the appropriate form, click Purchase now.

- Select the payment plan you want, complete the necessary information to create your account, and pay for the order using your PayPal or credit card.

- Choose a suitable file format and download your copy.

- Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Virgin Islands Accounts Receivable - Assignment at any time, if needed. Just click the desired form to download or print the document template.

- Utilize US Legal Forms, the most extensive selection of legitimate forms, to save time and avoid mistakes. The service provides professionally crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start making your life a little easier.

Form popularity

FAQ

Living in the U.S. Virgin Islands offers several tax benefits, including exemptions on certain income types and lower overall tax rates. These advantages can significantly enhance financial well-being. For those managing Virgin Islands Accounts Receivable - Assignment, leveraging these tax benefits is essential for maximizing profit.

Yes, individuals born in the U.S. Virgin Islands are U.S. citizens. This citizenship grants them the same rights and responsibilities as those born in the mainland. As you navigate Virgin Islands Accounts Receivable - Assignment, understanding citizenship can play a role in legal and tax matters.

Taxes in the U.S. Virgin Islands function similarly to those in the mainland U.S., with residents subject to income taxes. However, tax rates may differ, often being lower. For businesses involved in Virgin Islands Accounts Receivable - Assignment, knowing these tax structures can optimize financial planning.

The U.S. Virgin Islands is often considered a tax haven due to its favorable tax laws. Businesses and individuals may benefit from lower tax rates compared to the mainland U.S. If you are exploring Virgin Islands Accounts Receivable - Assignment, understanding the tax implications can enhance your financial strategies.

Form 8689 is used to report income earned in U.S. territories, including the Virgin Islands. This form helps taxpayers calculate their tax liability on income generated in these areas. For those managing Virgin Islands Accounts Receivable - Assignment, understanding Form 8689 is crucial for accurate reporting.

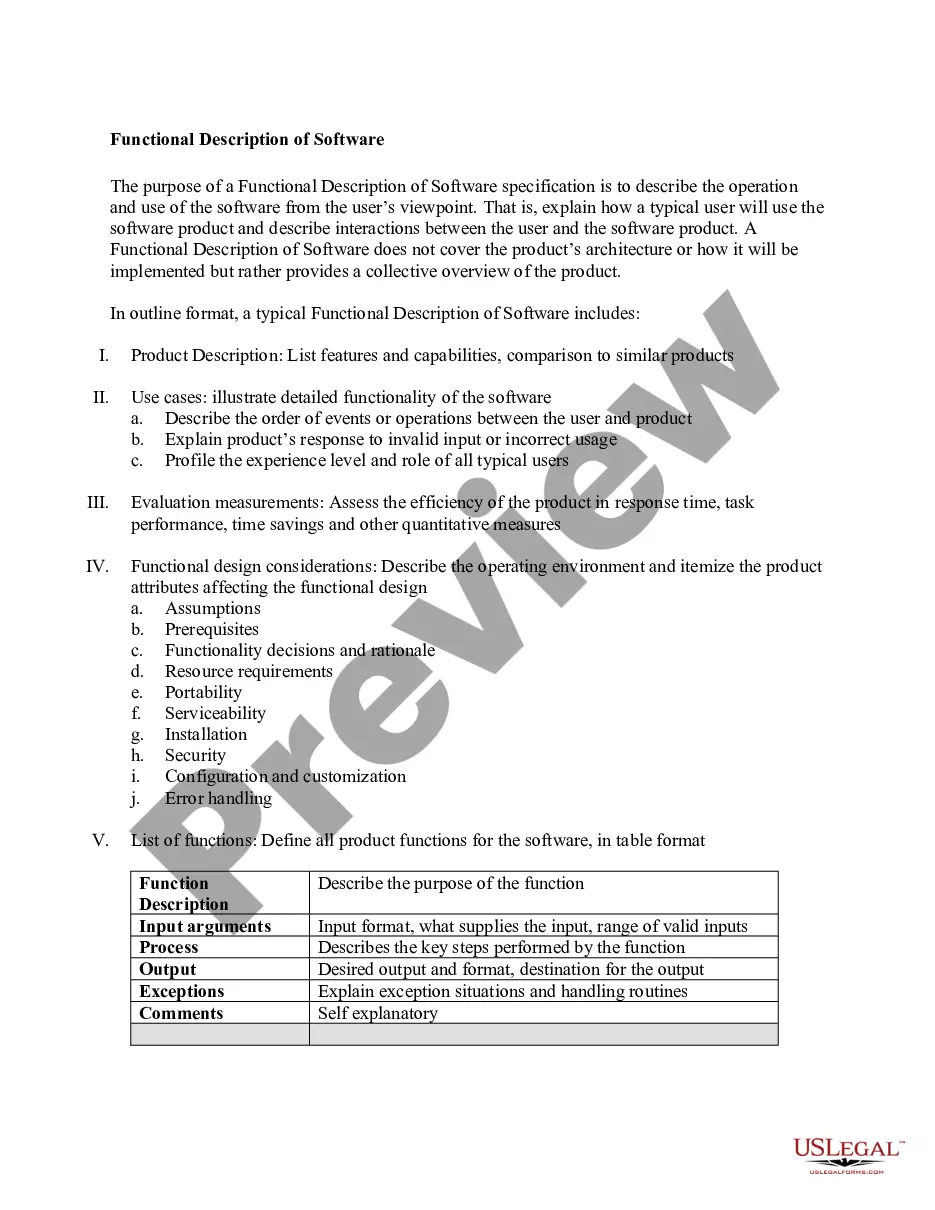

A factoring agreement can be used to transfer an account receivable referenced in the underlying sale contract, whilst assignment can also apply to accounts receivable resulting from loan agreements, business co-operation agreements, and the like.

In the accounts receivable assignment process, a company assigns receivables to a lending institution to borrow money. The borrower pays interest plus additional fees. The borrowing company retains ownership of the accounts receivable and collects payment from its customers.

Accounts Receivable are amounts due from customers from the sale of services or merchandise on credit. They are usually due in 30 ? 60 days. They are classified on the Balance Sheet as current assets.

Example of the Assignment of Accounts Receivable ABC Corp. approaches XYZ Bank to obtain financing using its accounts receivable as collateral. XYZ Bank agrees to provide a loan of 85% of the total accounts receivable value, which amounts to $170,000 (85% of $200,000).

Assignment of receivables would mean sale of the lease rentals, not the asset. In that case, the leased asset still remains the property of the assignor ? that is, the assignor has retained the residual interest in the asset. However, it would be different if the lessor sells the asset that has been leased out.