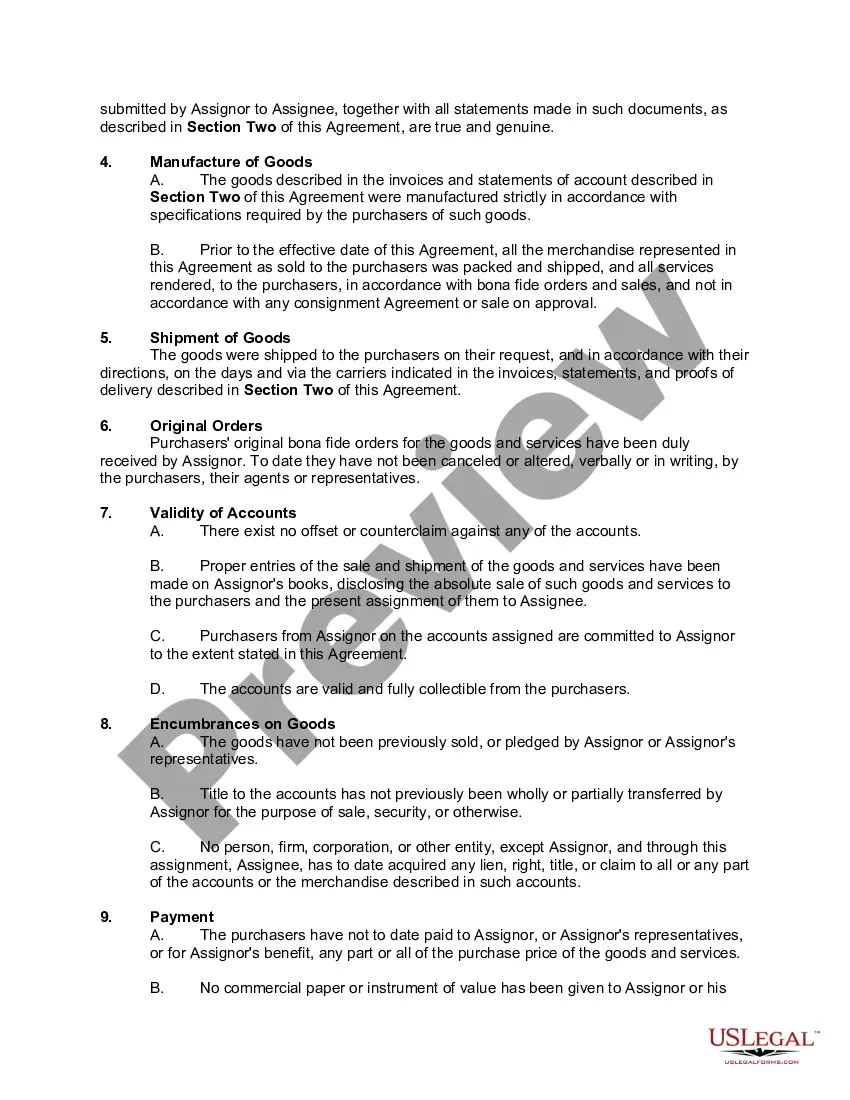

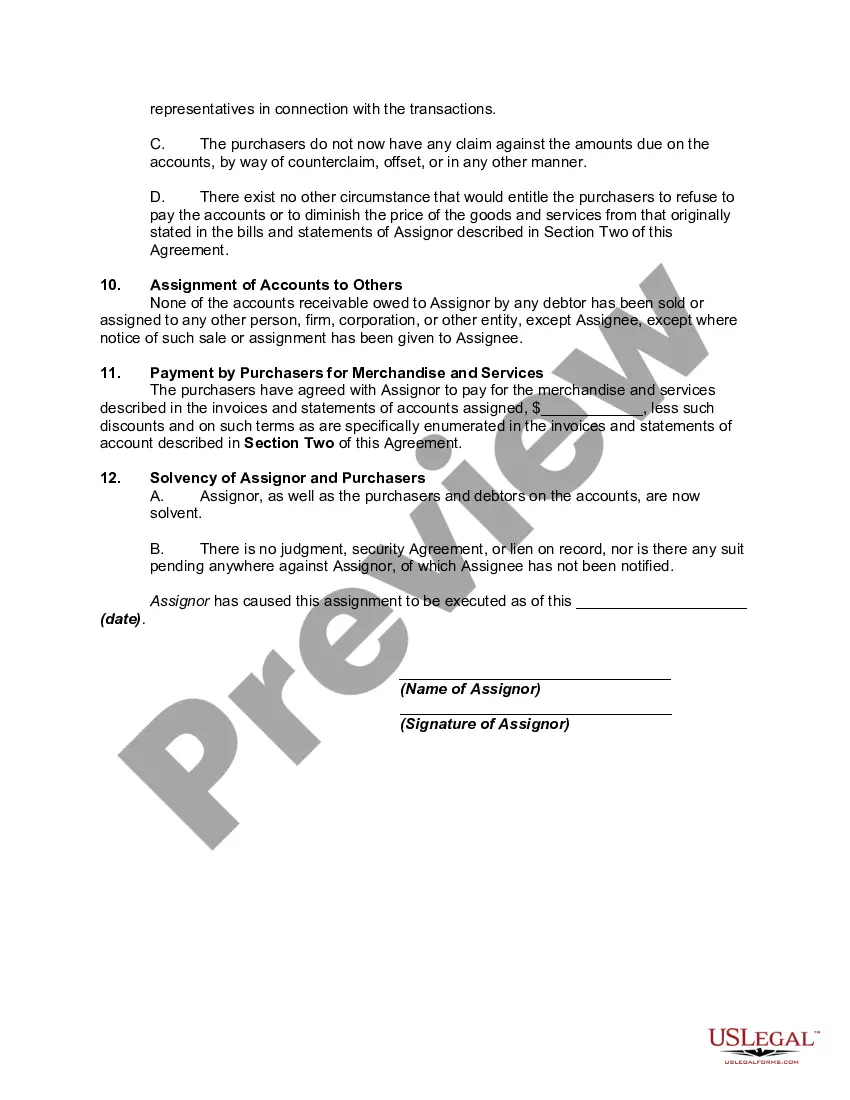

Virgin Islands Assignment of Accounts Receivable

Description

How to fill out Assignment Of Accounts Receivable?

You might spend a number of hours online searching for the valid document format that meets the state and federal requirements you need.

US Legal Forms offers a multitude of valid forms that are evaluated by experts.

It is easy to download or print the Virgin Islands Assignment of Accounts Receivable from your service.

If available, utilize the Preview button to review the document format as well. If you wish to find another version of the form, use the Search field to locate the format that meets your needs and requirements. Once you have identified the format you require, click Acquire now to proceed. Select the pricing plan you desire, enter your credentials, and sign up for an account on US Legal Forms. Complete the transaction. You can use your Visa or Mastercard or PayPal account to pay for the valid form. Choose the format of the document and download it to your device. Make modifications to your document if needed. You can complete, edit, sign, and print the Virgin Islands Assignment of Accounts Receivable. Obtain and print a multitude of document templates using the US Legal Forms website, which offers the largest selection of valid forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you possess a US Legal Forms account, you can sign in and click on the Acquire button.

- After that, you can complete, modify, print, or sign the Virgin Islands Assignment of Accounts Receivable.

- Every valid document format you purchase is yours permanently.

- To obtain another copy of the purchased form, go to the My documents tab and click on the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document format for the area/city of your choice.

- Review the form description to confirm you have selected the correct form.

Form popularity

FAQ

The Virgin Islands has a unique tax status that is different from the mainland US. While residents are US citizens, the tax guidelines are governed by local laws, which means that the Virgin Islands Assignment of Accounts Receivable may have varying implications for taxation. It's important for individuals and businesses to consult tax professionals familiar with both US and Virgin Islands tax codes. US Legal Forms can assist you with the necessary forms and information to navigate this complex area.

Title 33 Section 2362 of the Virgin Islands Code pertains to the regulation of assignments regarding accounts receivable. This section outlines the legal requirements and procedures for assigning such receivables, ensuring that all parties involved adhere to local laws. Understanding this statute is crucial for anyone looking to engage in financial transactions that involve the Virgin Islands Assignment of Accounts Receivable. For detailed information and forms related to these transactions, US Legal Forms provides comprehensive support.

Yes, U.S. laws generally apply to U.S. territories, including the U.S. Virgin Islands. This means that businesses need to follow federal laws, as well as local regulations that may vary from state to state. Understanding the implications of Virgin Islands Assignment of Accounts Receivable within this framework is crucial for compliance. For more information, check out uslegalforms, which can provide valuable resources.

The U.S. Virgin Islands are governed by the federal government of the United States, along with a local government. This relationship influences many aspects of life on the islands, including legal frameworks like Virgin Islands Assignment of Accounts Receivable. Residents and businesses should understand how this governance affects their rights and responsibilities. Engaging a legal professional can be helpful in navigating these regulations.

U.S. laws do apply to the U.S. Virgin Islands, among other U.S. territories. This includes laws governing business practices such as Virgin Islands Assignment of Accounts Receivable. It’s important to understand both federal and territorial laws as they shape how businesses operate. For compliance, consider utilizing resources from platforms like uslegalforms.

Yes, U.S. citizens must go through customs when they enter the U.S. Virgin Islands. While the islands are part of the U.S., customs regulations apply to ensure compliance with both federal and local law. This process allows for the clear movement of goods and services, including those related to Virgin Islands Assignment of Accounts Receivable. Staying informed will make your travel experience smoother.

Yes, U.S. laws generally apply to the U.S. Virgin Islands. This means that legal principles, including those related to Virgin Islands Assignment of Accounts Receivable, are guided by federal laws and local statutes. However, certain local regulations can also affect how laws are implemented. Always consult with a local attorney for specific applications.

The country code for the Virgin Islands is 'VI', which designates this beautiful territory in the Caribbean. Understanding this code is important for various business operations, including those related to the Virgin Islands Assignment of Accounts Receivable. When interacting with international partners, knowing this code can streamline communication and transactions.

Yes, the US Virgin Islands do have an income tax system, but it operates differently than that of the mainland U.S. Many individuals and businesses engaging in the Virgin Islands Assignment of Accounts Receivable can benefit from lower tax rates. It is important to consult with tax professionals to fully understand your obligations and find ways to optimize your tax position.

In the Virgin Islands, there is no income tax on certain business earnings, making it a financially attractive destination. This environment supports businesses, particularly those involved in the Virgin Islands Assignment of Accounts Receivable. By leveraging this tax structure, you can maximize your financial opportunities while living or working in the territory.