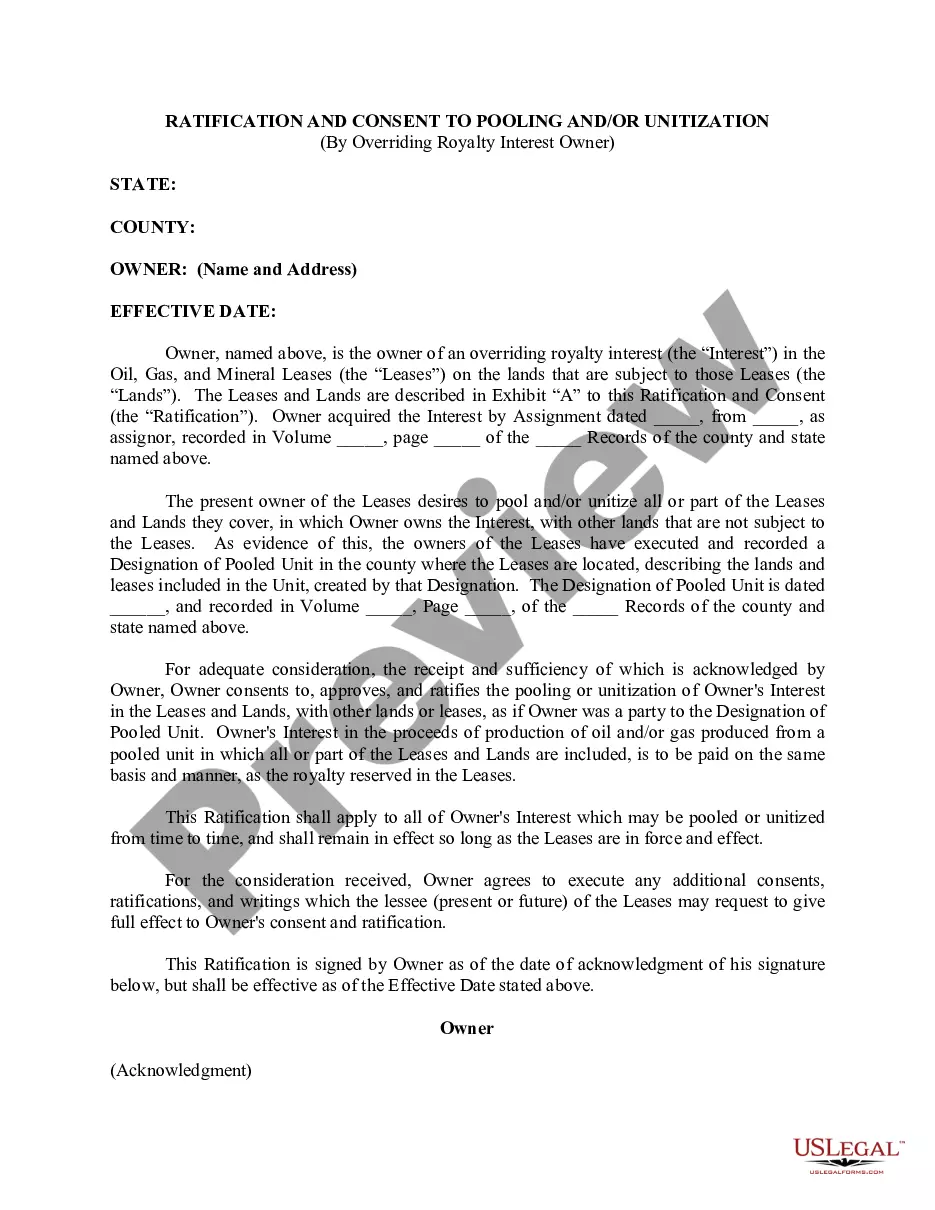

Virginia Assignment of Overriding Royalty Interest (Non-Producing, Single Lease, Reserves Right to Pool)

Description

How to fill out Assignment Of Overriding Royalty Interest (Non-Producing, Single Lease, Reserves Right To Pool)?

If you have to total, down load, or produce authorized record themes, use US Legal Forms, the largest selection of authorized varieties, that can be found online. Make use of the site`s simple and hassle-free search to obtain the papers you require. Numerous themes for business and personal functions are categorized by categories and suggests, or search phrases. Use US Legal Forms to obtain the Virginia Assignment of Overriding Royalty Interest (Non-Producing, Single Lease, Reserves Right to Pool) in a handful of click throughs.

When you are previously a US Legal Forms consumer, log in to your bank account and click the Down load button to have the Virginia Assignment of Overriding Royalty Interest (Non-Producing, Single Lease, Reserves Right to Pool). Also you can gain access to varieties you previously saved within the My Forms tab of your own bank account.

Should you use US Legal Forms initially, refer to the instructions listed below:

- Step 1. Ensure you have selected the shape to the proper area/nation.

- Step 2. Make use of the Review option to look through the form`s content. Never forget to read through the explanation.

- Step 3. When you are unhappy with all the develop, utilize the Search field at the top of the display screen to locate other variations from the authorized develop template.

- Step 4. Upon having discovered the shape you require, click on the Acquire now button. Opt for the costs prepare you like and add your qualifications to register for the bank account.

- Step 5. Process the deal. You should use your charge card or PayPal bank account to accomplish the deal.

- Step 6. Pick the file format from the authorized develop and down load it on the gadget.

- Step 7. Full, revise and produce or sign the Virginia Assignment of Overriding Royalty Interest (Non-Producing, Single Lease, Reserves Right to Pool).

Every authorized record template you get is yours permanently. You may have acces to each and every develop you saved within your acccount. Click the My Forms section and decide on a develop to produce or down load yet again.

Contend and down load, and produce the Virginia Assignment of Overriding Royalty Interest (Non-Producing, Single Lease, Reserves Right to Pool) with US Legal Forms. There are many expert and status-particular varieties you can use for your business or personal requirements.

Form popularity

FAQ

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.

The owner of a royalty interest receives a portion of the income generated from oil and gas production. Unlike an ORRI, a royalty-interest owner does not have the right to execute leases or collect bonus payments. The RI owner does not bear any operating costs or expenses related to the well.

ORRIs are created out of the working interest in a property and do not affect mineral owners. An overriding royalty interest (ORRI) is often kept or assigned to a geologist, landman, brokerage, or any entity that was able to reserve an interest in the properties.

Overriding Royalty Interest Conveyance means an assignment, in form and substance acceptable to Lender, pursuant to which Borrower grants in favor of Lender an overriding royalty interest equal to six and one-fourth percent (6.25%) of Hydrocarbons produced, saved and sold or used off the premises of the relevant Lease, ...

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.

Calculating Overriding Royalty Interest An ORRI is a straight percentage. For example, a 2% override would appear on the royalty statement as 0.02 interest in the proceeds from the sale of the leased hydrocarbons.

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.