Virginia Assignment and Conveyance of Net Profits Interest

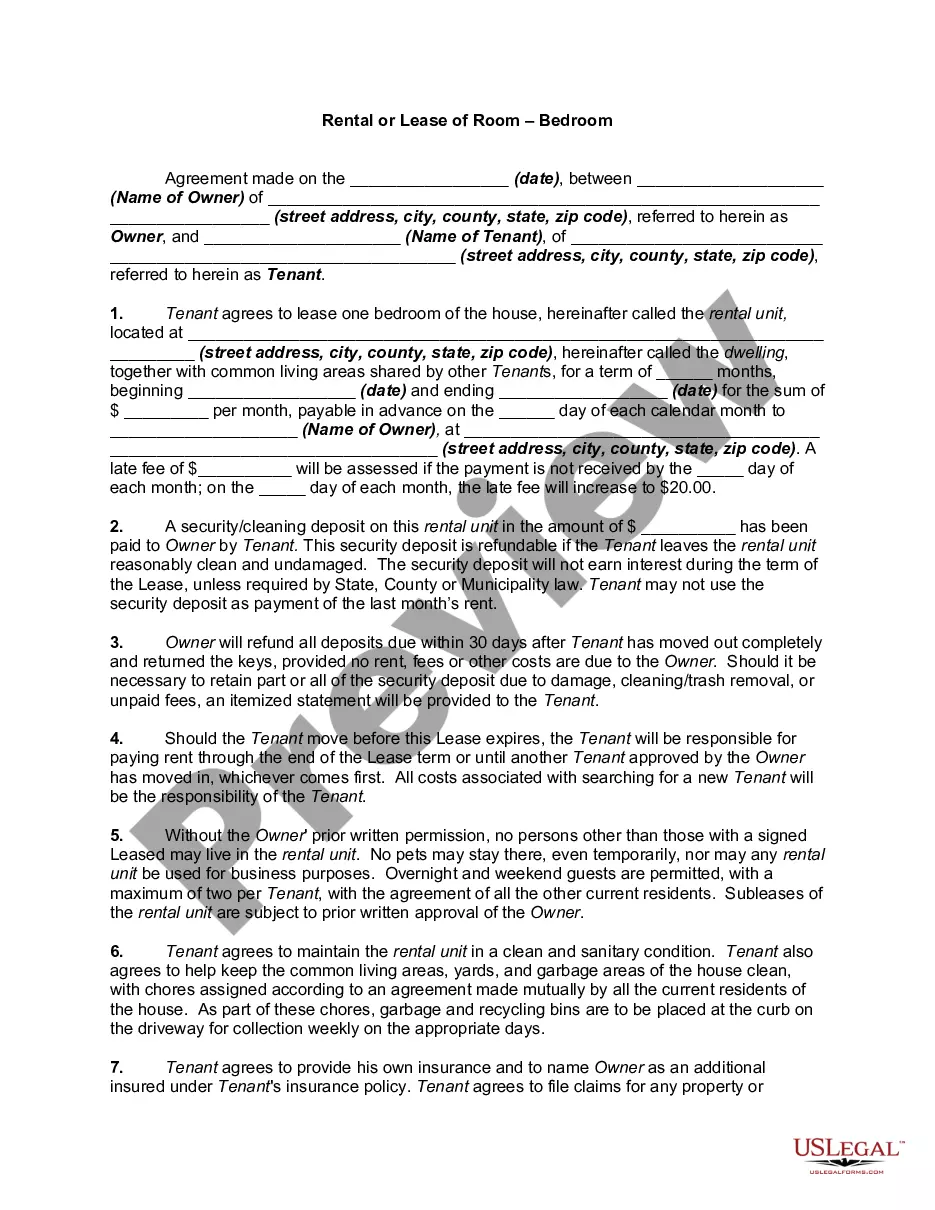

Description

How to fill out Assignment And Conveyance Of Net Profits Interest?

It is possible to commit hrs online searching for the authorized file web template which fits the federal and state requirements you need. US Legal Forms supplies thousands of authorized kinds that are examined by experts. It is possible to down load or print the Virginia Assignment and Conveyance of Net Profits Interest from your support.

If you have a US Legal Forms account, you can log in and then click the Obtain switch. Afterward, you can comprehensive, revise, print, or sign the Virginia Assignment and Conveyance of Net Profits Interest. Each authorized file web template you buy is your own property permanently. To acquire one more copy for any purchased form, visit the My Forms tab and then click the corresponding switch.

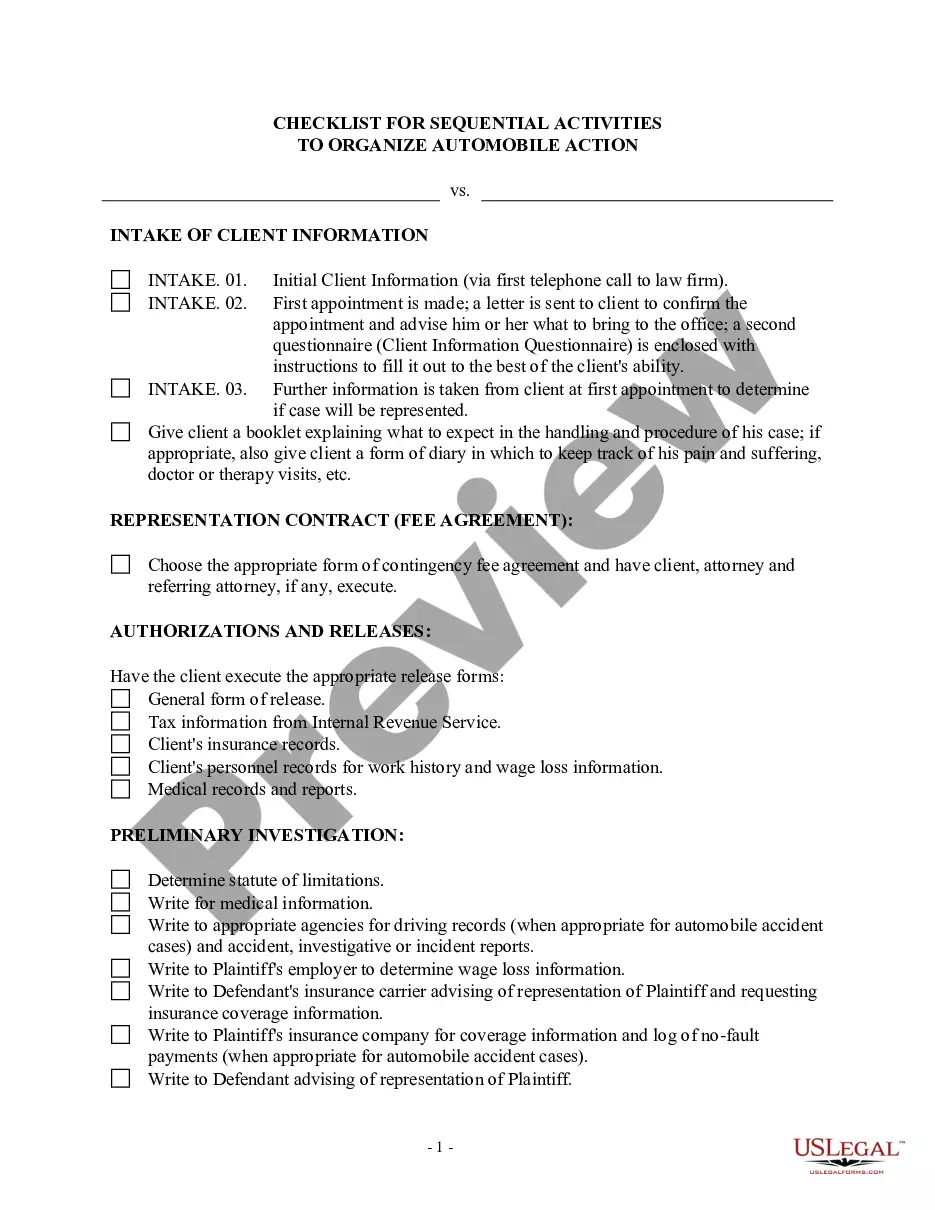

Should you use the US Legal Forms website initially, stick to the basic guidelines below:

- Very first, be sure that you have chosen the proper file web template to the state/area of your choice. Look at the form information to make sure you have picked the appropriate form. If accessible, take advantage of the Preview switch to search throughout the file web template as well.

- In order to locate one more variation of the form, take advantage of the Lookup area to discover the web template that suits you and requirements.

- When you have located the web template you would like, just click Get now to move forward.

- Select the costs plan you would like, type in your credentials, and register for an account on US Legal Forms.

- Complete the financial transaction. You can utilize your credit card or PayPal account to cover the authorized form.

- Select the formatting of the file and down load it in your system.

- Make alterations in your file if needed. It is possible to comprehensive, revise and sign and print Virginia Assignment and Conveyance of Net Profits Interest.

Obtain and print thousands of file layouts making use of the US Legal Forms site, which offers the most important assortment of authorized kinds. Use professional and status-specific layouts to tackle your company or individual requirements.

Form popularity

FAQ

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.

An overriding royalty interest (ORRI) is similar to a royalty interest in that it is also a portion of the proceeds from the sale of production. However, it is not retained under the terms of the oil and gas lease. An ORRI is granted, assigned and created under the terms of a separate document.

If there is insufficient profit, that is, the net profit is less than the amount of interest on capital, interest on capital will not be given, but the profit among the partners of the business firm will be distributed in their capital ratio.

Example 1: Profits interest ? Let's say that the company is worth $1,000,000 and has $50,000 in annual profits. A worker with a 10% interest grant doesn't have any interest in the company's current market value, but they do have a 10% interest in annual profits, which equates to $5,000.

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.

A profits interest is an equity-like form of compensation that limited liability companies (LLCs) can offer to employees and other service providers. The value of a profits interest is based on the growing value of the LLC, which allows employees (or ?partners?) to benefit from the LLC's appreciation in value.

A net profits interest is an agreement that provides a payout of an operation's net profits to the parties of the agreement.

Profits interests are a unique solution to ownership and incentive planning available under current US tax law. Properly designed, profits interests convey an ownership share of future profits and equity upside without a capital stake in the past.

Essentially, NPRI is the royalty severed from minerals just as minerals are severed from the surface interest. Unlike mineral owners, non-participating royalties do not have executive rights in lease negotiations, leasing incentives, or rental payments. They just receive the actual production proceeds.

ORRIs are created out of the working interest in a property and do not affect mineral owners. An overriding royalty interest (ORRI) is often kept or assigned to a geologist, landman, brokerage, or any entity that was able to reserve an interest in the properties.