Virginia Journalist - Reporter Agreement - Self-Employed Independent Contractor

Description

How to fill out Journalist - Reporter Agreement - Self-Employed Independent Contractor?

Have you ever been in a situation where you need documentation for either professional or personal purposes almost every day? There are numerous legitimate document templates available online, but locating those you can rely on isn't simple. US Legal Forms provides a vast array of form templates, such as the Virginia Journalist - Reporter Agreement - Self-Employed Independent Contractor, designed to comply with state and federal regulations.

If you are already familiar with the US Legal Forms website and possess an account, simply Log In. After that, you can download the Virginia Journalist - Reporter Agreement - Self-Employed Independent Contractor template.

If you do not have an account and wish to start using US Legal Forms, follow these steps: Find the form you need and ensure it is for the correct state/county. Use the Review button to examine the document. Read the details to confirm that you have selected the correct form. If the form isn't what you're searching for, utilize the Search section to locate the document that meets your needs and specifications. Once you find the appropriate document, click Get now. Choose the pricing plan you prefer, complete the required information to create your account, and purchase an order using your PayPal or credit card. Select a convenient document format and download your copy. Access all the document templates you have purchased in the My documents menu. You can obtain an additional copy of the Virginia Journalist - Reporter Agreement - Self-Employed Independent Contractor whenever necessary. Just choose the desired form to download or print the document template.

- Employ US Legal Forms, the most extensive collection of legitimate forms, to save time and prevent errors.

- The service offers professionally crafted legal document templates that can be utilized for various purposes.

- Create an account on US Legal Forms and start simplifying your life.

- Avoid making any alterations or removing any HTML tags.

- Only synonymize plain text that is outside of the HTML tags.

Form popularity

FAQ

In Virginia, the amount of work you can undertake without a contractor license depends on the specific type of work and local regulations. For independent contractors like journalists, there may be limits on certain projects that require licensure. To navigate these requirements effectively, consider utilizing resources from uslegalforms, which can provide clarity on what is permissible under the Virginia Journalist - Reporter Agreement - Self-Employed Independent Contractor.

The new federal rule on independent contractors focuses on ensuring fair classification of workers. This rule impacts the Virginia Journalist - Reporter Agreement - Self-Employed Independent Contractor by establishing clearer criteria for determining whether a worker is an independent contractor or an employee. Understanding this rule is crucial for journalists to maintain their status and avoid misclassification.

Yes, in many cases, an independent contractor, including those under the Virginia Journalist - Reporter Agreement - Self-Employed Independent Contractor, may need a business license. The requirement can vary based on the type of services provided and the locality. It's advisable to consult local regulations or platforms like uslegalforms for guidance on obtaining the necessary licenses.

Starting July 1st, 2025, Virginia will implement new regulations affecting independent contractors, including journalists. These changes aim to clarify the rights and responsibilities of self-employed individuals, particularly in the context of the Virginia Journalist - Reporter Agreement - Self-Employed Independent Contractor. It's essential for reporters to stay informed about these updates to ensure compliance and protect their interests.

To provide proof of employment as an independent contractor, gather documents that demonstrate your work history and agreements with clients. This may include signed contracts, payment records, or invoices showing your work as a Virginia journalist. Additionally, a well-structured Virginia Journalist - Reporter Agreement - Self-Employed Independent Contractor can serve as official proof, outlining your role and the services you provide. Utilizing platforms like USLegalForms can help you create and maintain these important documents.

The new independent contractor law in Virginia, which was enacted to clarify the classification of workers, focuses on ensuring that individuals working as independent contractors genuinely operate their own businesses. This law affects how companies engage independent contractors, including Virginia journalists. It is crucial to stay informed about these changes, as they impact the structure of agreements like the Virginia Journalist - Reporter Agreement - Self-Employed Independent Contractor.

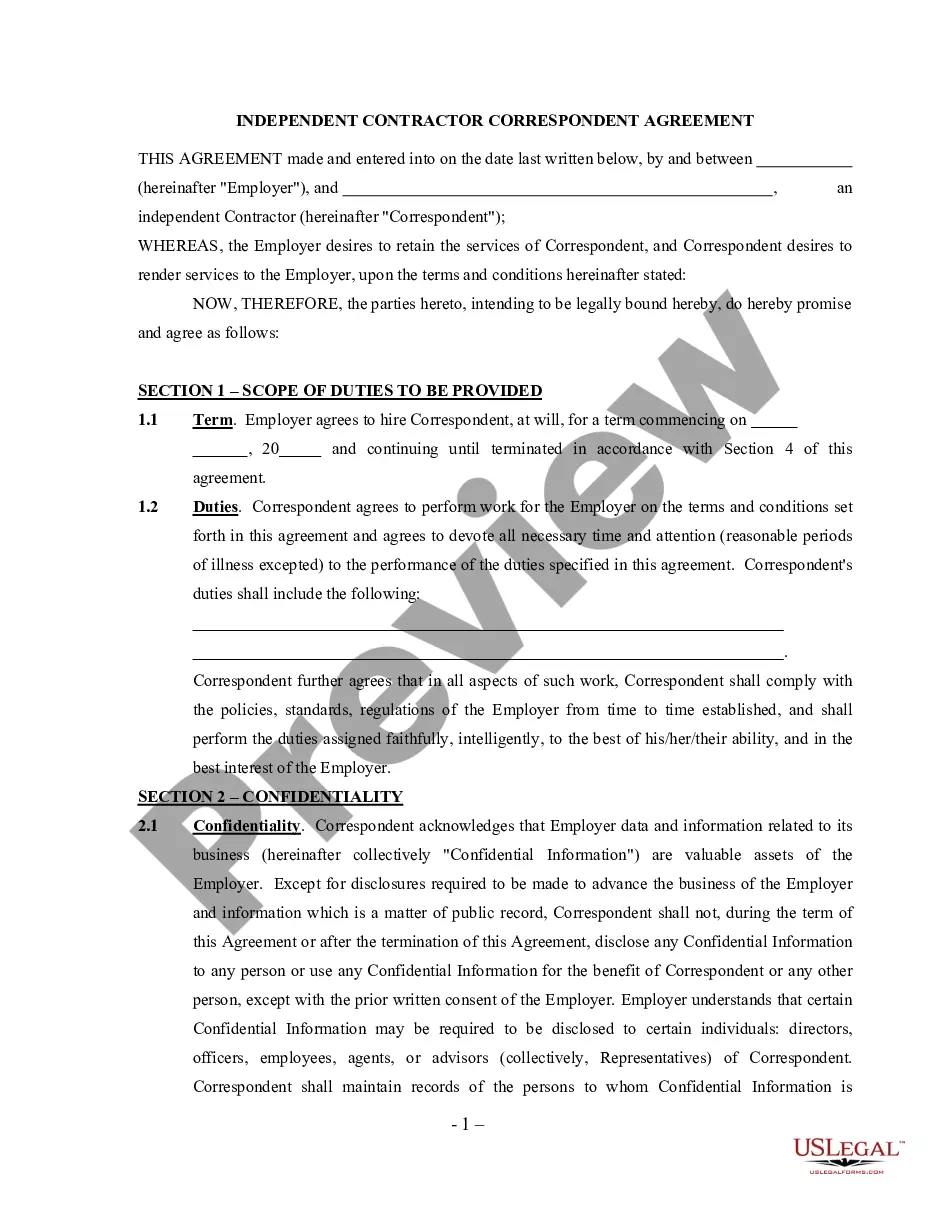

To create an independent contractor agreement, start by clearly defining the roles and responsibilities of both parties. Include essential elements such as payment terms, project scope, and deadlines. You can also specify the duration of the agreement and any confidentiality clauses. Using a template from USLegalForms can streamline this process, ensuring that your Virginia Journalist - Reporter Agreement - Self-Employed Independent Contractor is both comprehensive and legally sound.

Writing an independent contractor agreement involves outlining the project specifics and the expectations of both you and the hiring entity. Start with a clear introduction of the parties involved, followed by detailed descriptions of the work, payment terms, and duration of the contract. For Virginia journalists, incorporating elements from the Virginia Journalist - Reporter Agreement - Self-Employed Independent Contractor ensures legal clarity. You can also benefit from uslegalforms, which offers templates that help you draft a comprehensive agreement effortlessly.

Filling out an independent contractor agreement requires you to clearly define the roles and responsibilities of both parties. Include essential elements like payment terms, project timelines, and any confidentiality clauses. As a Virginia journalist, you should reference the Virginia Journalist - Reporter Agreement - Self-Employed Independent Contractor to ensure compliance with state laws. Utilizing uslegalforms can simplify this process with easy-to-follow templates tailored for your needs.

To fill out an independent contractor form, start by gathering the necessary information, such as your contact details, tax identification number, and the scope of work. Next, clarify the terms of your engagement, including payment rates and deadlines. If you are a Virginia journalist, ensure the form aligns with the Virginia Journalist - Reporter Agreement - Self-Employed Independent Contractor guidelines. For convenience, consider using platforms like uslegalforms to access pre-designed templates.