Virginia Self-Employed Independent Contractor Construction Worker Contract

Description

How to fill out Self-Employed Independent Contractor Construction Worker Contract?

You can spend hours online looking for the legal document template that meets the federal and state requirements you need.

US Legal Forms provides a vast array of legal forms that are reviewed by experts.

You can easily obtain or create the Virginia Self-Employed Independent Contractor Construction Worker Contract from our service.

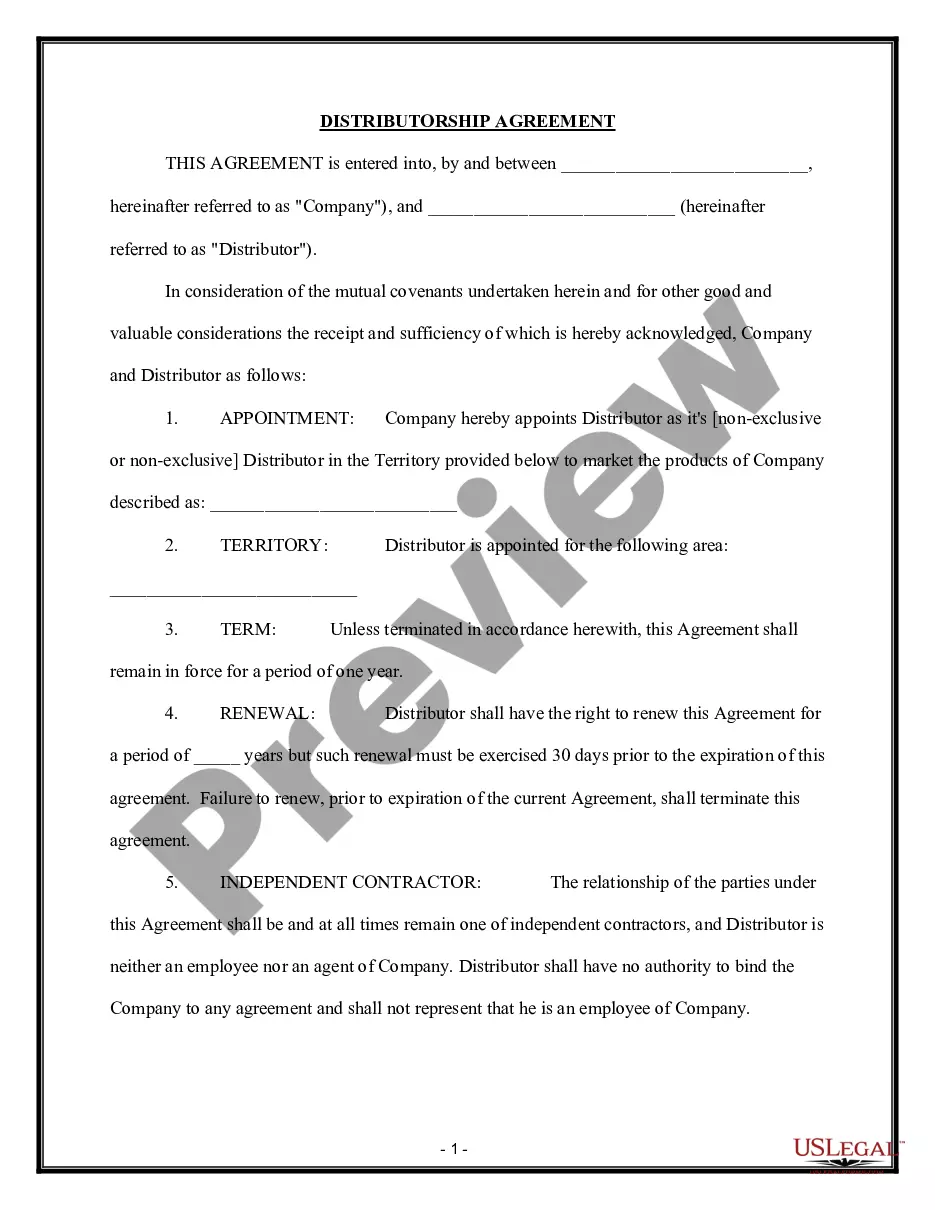

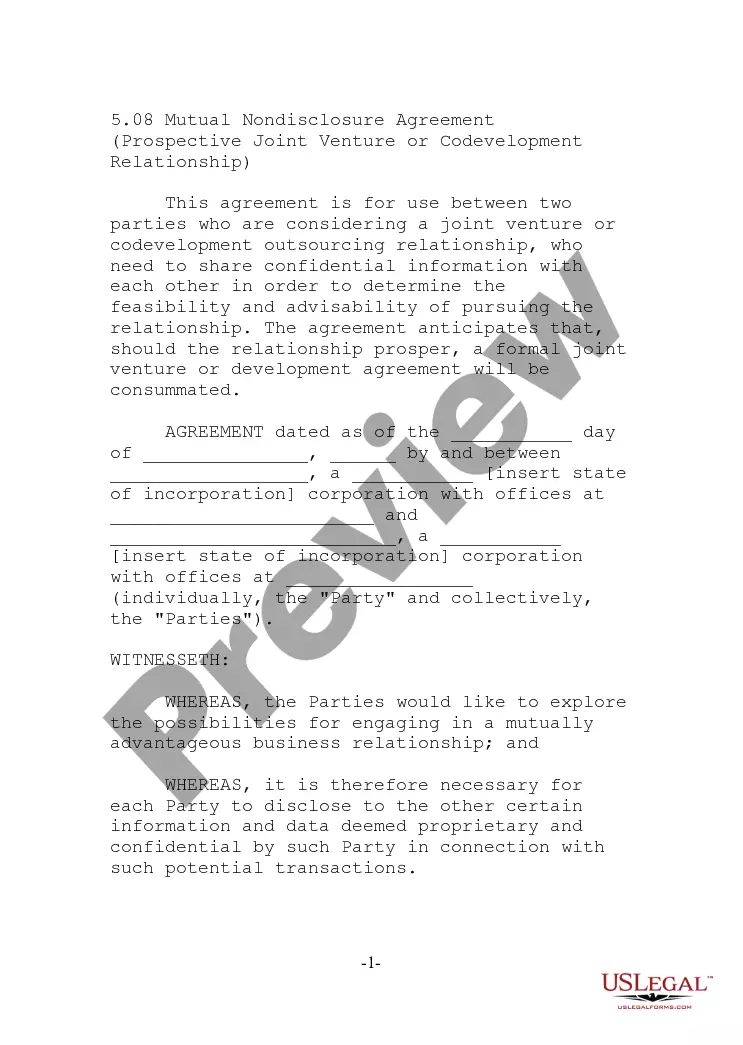

If available, use the Review option to browse the document template as well.

- If you already possess a US Legal Forms account, you may Log In and choose the Acquire option.

- Then, you can complete, modify, create, or sign the Virginia Self-Employed Independent Contractor Construction Worker Contract.

- Every legal document template you acquire is yours permanently.

- To obtain an additional copy of the acquired form, go to the My documents tab and select the appropriate option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your preferred region/city.

- Review the form description to confirm you have chosen the right form.

Form popularity

FAQ

The terms self-employed and independent contractor are often interchangeable, but 'independent contractor' specifies your business relationship with a client. Using 'independent contractor' may clarify your role in contractual agreements, such as a Virginia Self-Employed Independent Contractor Construction Worker Contract. Ultimately, choose the term that best fits your situation and communication with clients.

To create an independent contractor contract, start by defining the scope of work and payment terms clearly. You should also include confidentiality agreements and any relevant timelines. For your Virginia Self-Employed Independent Contractor Construction Worker Contract, it might be beneficial to use templates from platforms like uslegalforms, which simplify the process.

Independent contractors need their income records, business expenses, and a completed Schedule C form for their tax filings. Additionally, keeping track of any 1099 forms and ensuring you have all necessary receipts will help you accurately report your earnings and expenses. Utilizing tools like those offered by uslegalforms can help streamline this process for your Virginia Self-Employed Independent Contractor Construction Worker Contract.

Yes, independent contractors file their taxes as self-employed individuals. You will report your income and expenses on Schedule C of your tax return. This process is crucial for understanding your financial obligations and leveraging benefits that might apply to your Virginia Self-Employed Independent Contractor Construction Worker Contract.

Yes, an independent contractor is classified as self-employed. This means you run your own business and have control over your work, as defined by your Virginia Self-Employed Independent Contractor Construction Worker Contract. Understanding this classification helps you to manage your taxes and benefits effectively.

Yes, if you receive a 1099 form, you are typically considered self-employed. The 1099 form indicates that you earned income as an independent contractor, which means you work for yourself. It is important to understand how this affects your taxes and your business structure, especially if you are operating under a Virginia Self-Employed Independent Contractor Construction Worker Contract.

To write a contract for a 1099 employee, begin with clear identification of the contractor along with the services they will provide. Include payment rates, deadlines, and terms of termination. For those using a Virginia Self-Employed Independent Contractor Construction Worker Contract, ensure that all elements reflect the unique requirements of the construction industry for compliance and protection.

Writing an independent contractor agreement starts with outlining the key components such as the names of the parties and the project's scope. Include payment terms, timeframes, and other specific clauses pertaining to your Virginia Self-Employed Independent Contractor Construction Worker Contract. Finally, always have both parties review the agreement thoroughly before signing to ensure clarity and consensus.

An independent contractor typically needs to complete a W-9 form to provide their taxpayer information. Additionally, they may require contracts specific to their work, such as a Virginia Self-Employed Independent Contractor Construction Worker Contract. It’s essential to keep accurate records of all documentation for tax purposes and project management.

Filling out an independent contractor form involves providing necessary personal information, including your name, address, and contact details. You should also include the type of work you will perform, payment details, and any relevant tax identification numbers. For those utilizing the Virginia Self-Employed Independent Contractor Construction Worker Contract, ensure you specify the project details to avoid any ambiguities.