Virginia Auctioneer Services Contract - Self-Employed Independent Contractor

Description

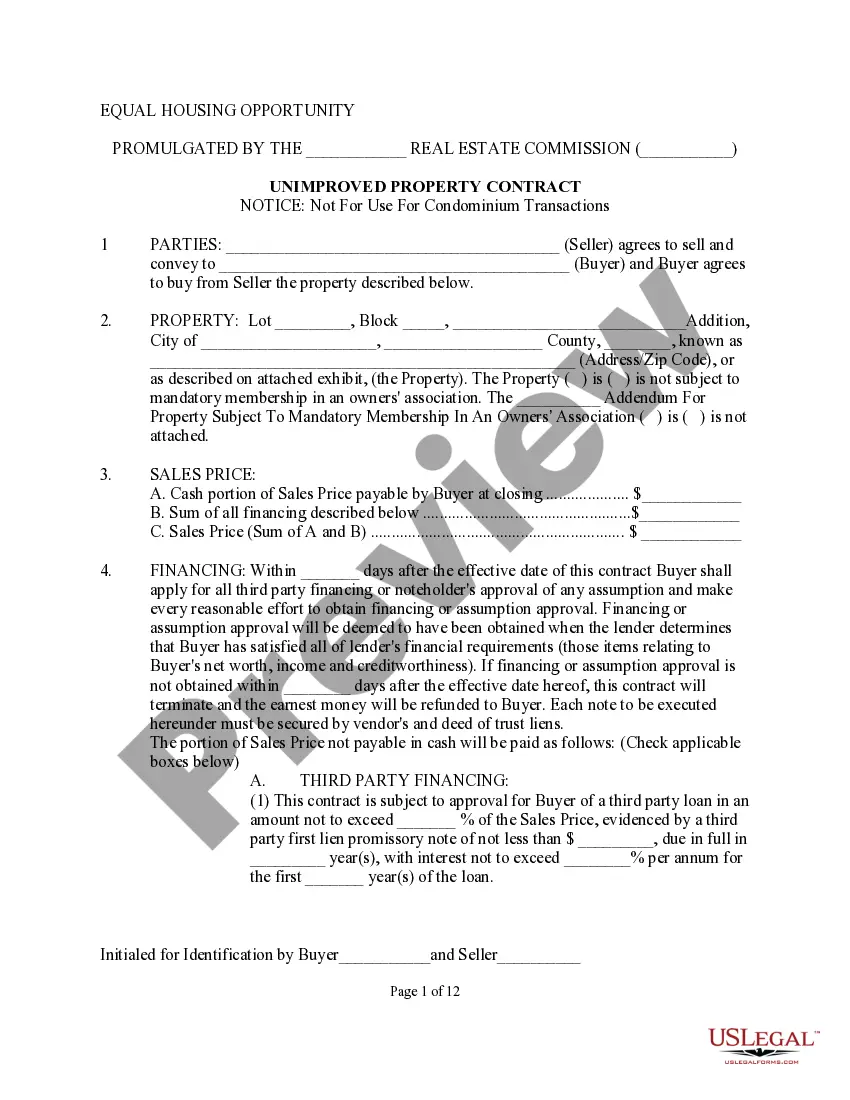

How to fill out Auctioneer Services Contract - Self-Employed Independent Contractor?

Are you in a location where you frequently need to provide paperwork for both business or personal activities.

There are numerous legal document templates available online, but finding reliable versions can be challenging.

US Legal Forms offers thousands of document templates, such as the Virginia Auctioneer Services Contract - Self-Employed Independent Contractor, designed to comply with state and federal regulations.

Once you find the right template, click Buy now.

Select your desired pricing plan, fill out the necessary information to process your payment, and complete your order using either PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Virginia Auctioneer Services Contract - Self-Employed Independent Contractor template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the document you need and ensure it is for the correct state/area.

- Utilize the Review button to assess the document.

- Read the description to ensure you have selected the appropriate template.

- If the template is not what you are searching for, use the Lookup field to find the document that fits your needs.

Form popularity

FAQ

To write a self-employed contract, start by outlining the services you will offer and your expectations for payment. Include terms related to the duration of the contract and any conditions for termination. A well-structured agreement based on the Virginia Auctioneer Services Contract - Self-Employed Independent Contractor will help protect your interests and clarify your role as a self-employed individual.

Filling out an independent contractor agreement requires you to include essential details like the contractor's name, service descriptions, and payment terms. It is advisable to specify the duration and scope of work to prevent misunderstandings. Consider using platforms like US Legal Forms, which provide templates for a Virginia Auctioneer Services Contract - Self-Employed Independent Contractor to simplify the process.

The new independent contractor law in Virginia focuses on making it easier for self-employed individuals to navigate their rights and obligations. This includes clarifications on tax responsibilities and the criteria for classification as an independent contractor. Understanding these updates is crucial for those entering into a Virginia Auctioneer Services Contract - Self-Employed Independent Contractor, as compliance can impact your business operations.

An independent contractor can serve as an agent if they have authority to act on behalf of another party. However, this depends on the specific arrangements outlined in the Virginia Auctioneer Services Contract - Self-Employed Independent Contractor. It is important to define the roles clearly to maintain proper legal boundaries and responsibilities.

Writing an independent contractor agreement involves outlining the scope of work, payment details, and the duration of the contract. Clearly state the responsibilities of both parties, including any specific terms related to the Virginia Auctioneer Services Contract - Self-Employed Independent Contractor. Always have both parties review and sign the agreement to ensure clarity and avoid future disputes.

To fill out an independent contractor form, start by providing your personal information, including your name and address. Next, include details about the contracted services, payment terms, and any relevant timelines. Ensure that you read the entire form carefully to understand your rights and obligations, especially regarding the Virginia Auctioneer Services Contract - Self-Employed Independent Contractor.

Yes, an independent contractor can be considered an agent if they are authorized to act on behalf of a principal in specific transactions. This relationship allows them to negotiate and engage in contracts, such as a Virginia Auctioneer Services Contract - Self-Employed Independent Contractor. Understanding this distinction can help you navigate your rights and responsibilities effectively.

To create an independent contractor contract, begin by outlining the scope of work, payment terms, and duration of the agreement. Include details about responsibilities, rights, and any confidentiality clauses. Utilizing a platform like uslegalforms allows you to efficiently draft a Virginia Auctioneer Services Contract - Self-Employed Independent Contractor that meets legal standards and protects your interests.

An agent can be anyone authorized to act on behalf of another person or entity. In the world of auctioneering, agents represent sellers or buyers to facilitate sales, negotiate terms, and finalize contracts. An independent contractor can serve as an agent, especially when executing a Virginia Auctioneer Services Contract - Self-Employed Independent Contractor, enhancing their role in the auction process.

Independent contractors belong to the category of self-employed individuals. They operate outside traditional employment structures, allowing them to offer specialized services like auctioneering. Through a Virginia Auctioneer Services Contract - Self-Employed Independent Contractor, they define their working parameters and relationship with clients, enhancing clarity and professionalism.