Guam Amended and Restated Principal Underwriting Agreement regarding Issuance of variable annuity contracts and life insurance

Description

How to fill out Amended And Restated Principal Underwriting Agreement Regarding Issuance Of Variable Annuity Contracts And Life Insurance?

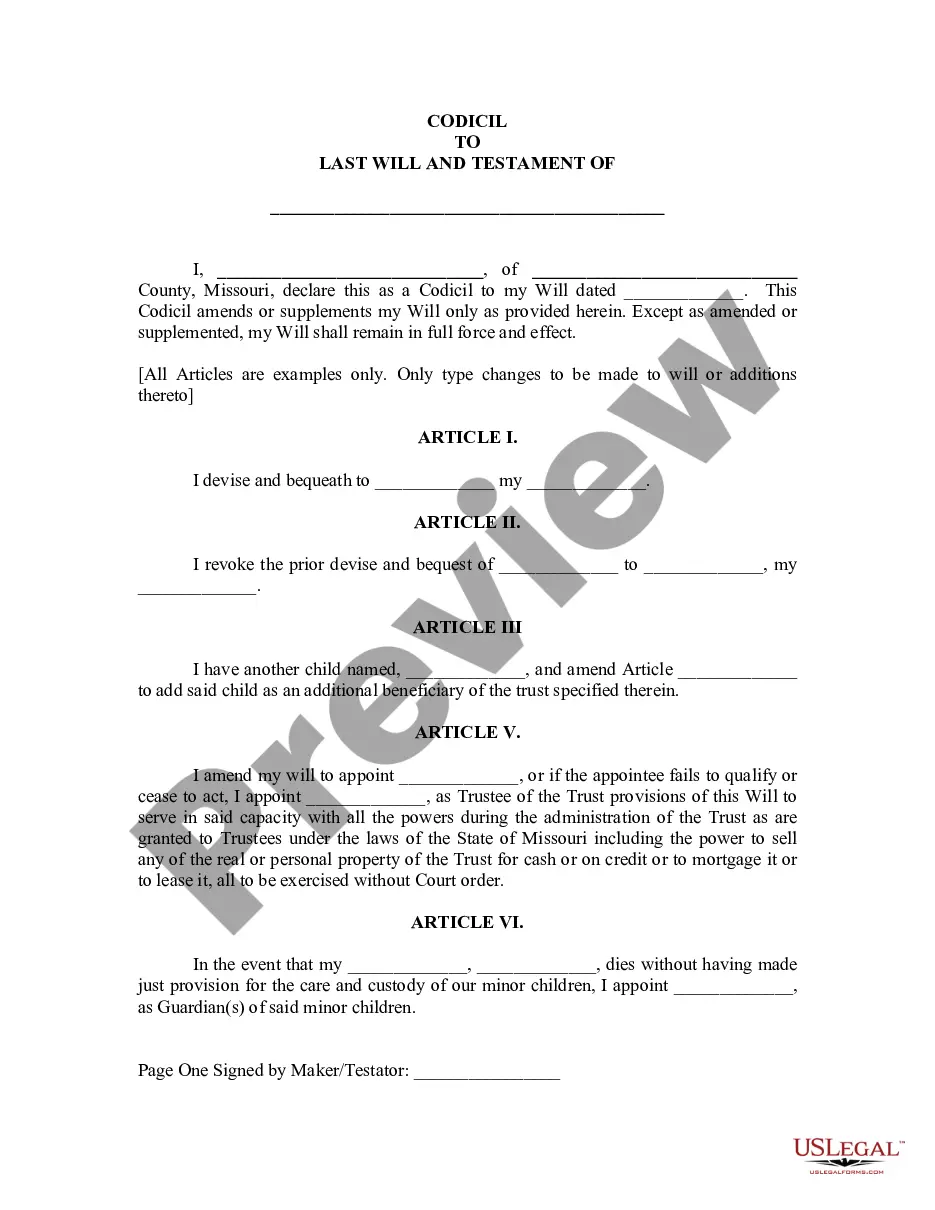

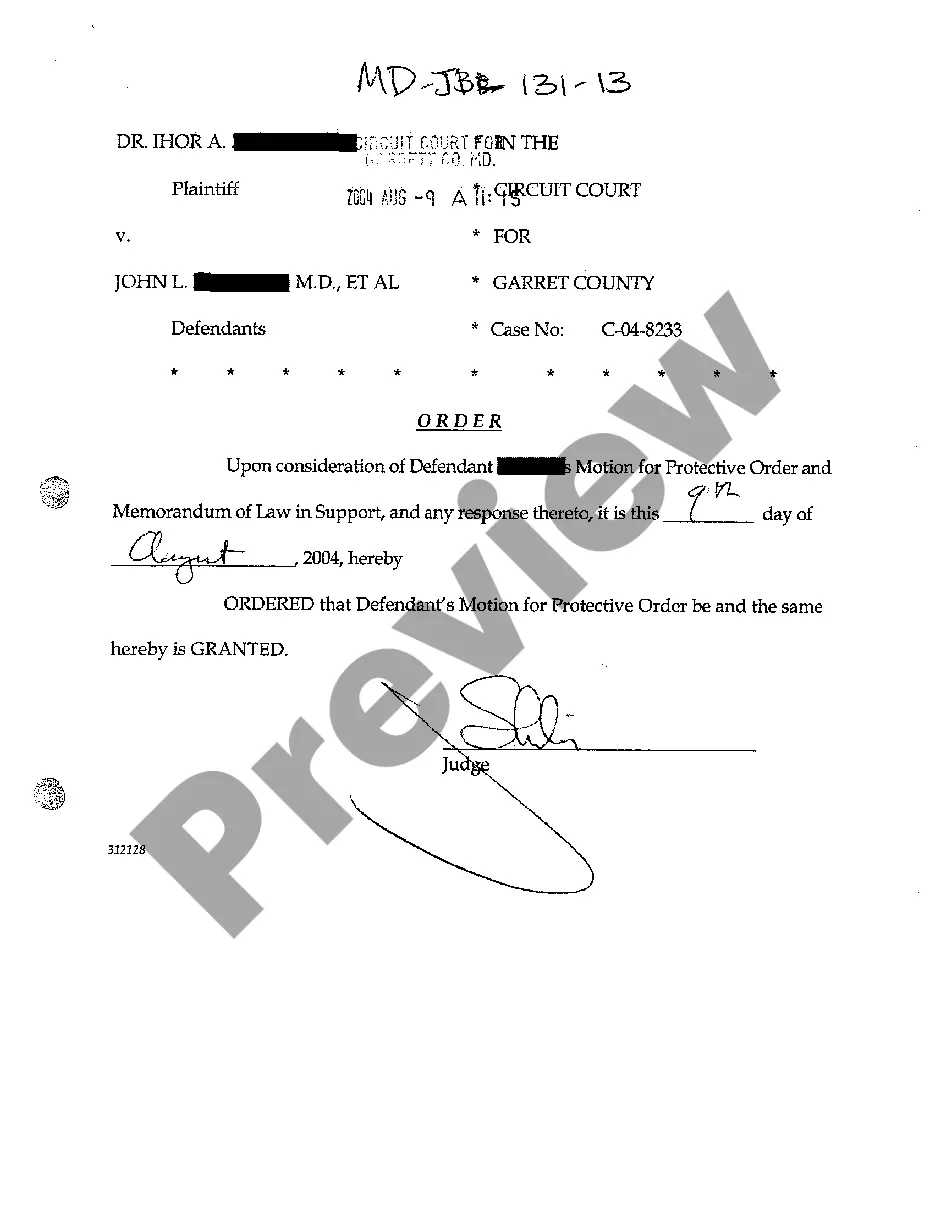

You can commit time on the web looking for the legitimate file format that fits the federal and state demands you will need. US Legal Forms gives a huge number of legitimate kinds that are examined by pros. It is possible to acquire or print out the Guam Amended and Restated Principal Underwriting Agreement regarding Issuance of variable annuity contracts and life insurance from your support.

If you already possess a US Legal Forms profile, you are able to log in and click the Download key. Afterward, you are able to comprehensive, modify, print out, or indication the Guam Amended and Restated Principal Underwriting Agreement regarding Issuance of variable annuity contracts and life insurance. Each and every legitimate file format you get is yours forever. To obtain yet another copy of any purchased kind, check out the My Forms tab and click the corresponding key.

If you use the US Legal Forms site initially, keep to the straightforward instructions listed below:

- Initially, make sure that you have chosen the proper file format for your region/area of your choosing. Read the kind description to make sure you have chosen the correct kind. If readily available, use the Preview key to check with the file format as well.

- In order to get yet another variation in the kind, use the Search industry to obtain the format that fits your needs and demands.

- After you have discovered the format you want, click on Acquire now to continue.

- Find the prices plan you want, type in your references, and sign up for a free account on US Legal Forms.

- Comprehensive the purchase. You should use your Visa or Mastercard or PayPal profile to pay for the legitimate kind.

- Find the format in the file and acquire it to the gadget.

- Make alterations to the file if necessary. You can comprehensive, modify and indication and print out Guam Amended and Restated Principal Underwriting Agreement regarding Issuance of variable annuity contracts and life insurance.

Download and print out a huge number of file web templates using the US Legal Forms site, that offers the largest collection of legitimate kinds. Use skilled and status-specific web templates to tackle your small business or individual needs.

Form popularity

FAQ

Deferred variable annuities are hybrid investments containing securities and insurance features. Their sales are regulated both by FINRA and the Securities and Exchange Commission (SEC).

The reviewing and approval process must be done within seven days after the application has been submitted to the office of the supervisory jurisdiction. On the same note, registered representatives must inform their clients of vital information concerning deferred variable annuities.

Variable Contracts of an Insurance Company. This Rule shall apply exclusively (and in lieu of Rule 2341 ) to the activities of members in connection with variable contracts, to the extent such activities are subject to regulation under the federal securities laws.

While all annuities are regulated by state insurance commissioners, variable annuities and RILAs are securities and therefore are also regulated by the SEC and FINRA. Annuities are often products investors consider when they plan for retirement.

1035 Exchanges The Internal Revenue Service allows you to exchange an insurance policy that you own for a new life insurance policy insuring the same person without paying tax on the investment gains earned on the original contract. This can be a substantial benefit.

If an insurance agent offers products that are considered securities?such as variable annuity contracts or variable life insurance policies?the agent must also be licensed as a registered financial professional and comply with FINRA rules.

05 Rule 2821 requires that the member or person associated with a member consider whether the customer has had another deferred variable annuity exchange within the preceding 36 months.

FINRA Rule 2330 (Members' Responsibilities Regarding Deferred Variable Annuities) establishes sales practice standards regarding recommended purchases and exchanges of deferred variable annuities, including requiring a reasonable belief that the customer has been informed of the various features of annuities (such as ...