Virginia Long Term Incentive Compensation Plan of A.M. Castle and Co.

Description

How to fill out Long Term Incentive Compensation Plan Of A.M. Castle And Co.?

Are you within a placement that you will need paperwork for possibly business or personal reasons virtually every day time? There are plenty of lawful record layouts available online, but getting kinds you can depend on is not simple. US Legal Forms provides a huge number of type layouts, like the Virginia Long Term Incentive Compensation Plan of A.M. Castle and Co., that happen to be created to meet state and federal needs.

If you are previously knowledgeable about US Legal Forms internet site and get an account, merely log in. After that, it is possible to acquire the Virginia Long Term Incentive Compensation Plan of A.M. Castle and Co. format.

Unless you provide an profile and wish to begin using US Legal Forms, follow these steps:

- Obtain the type you need and make sure it is to the correct metropolis/county.

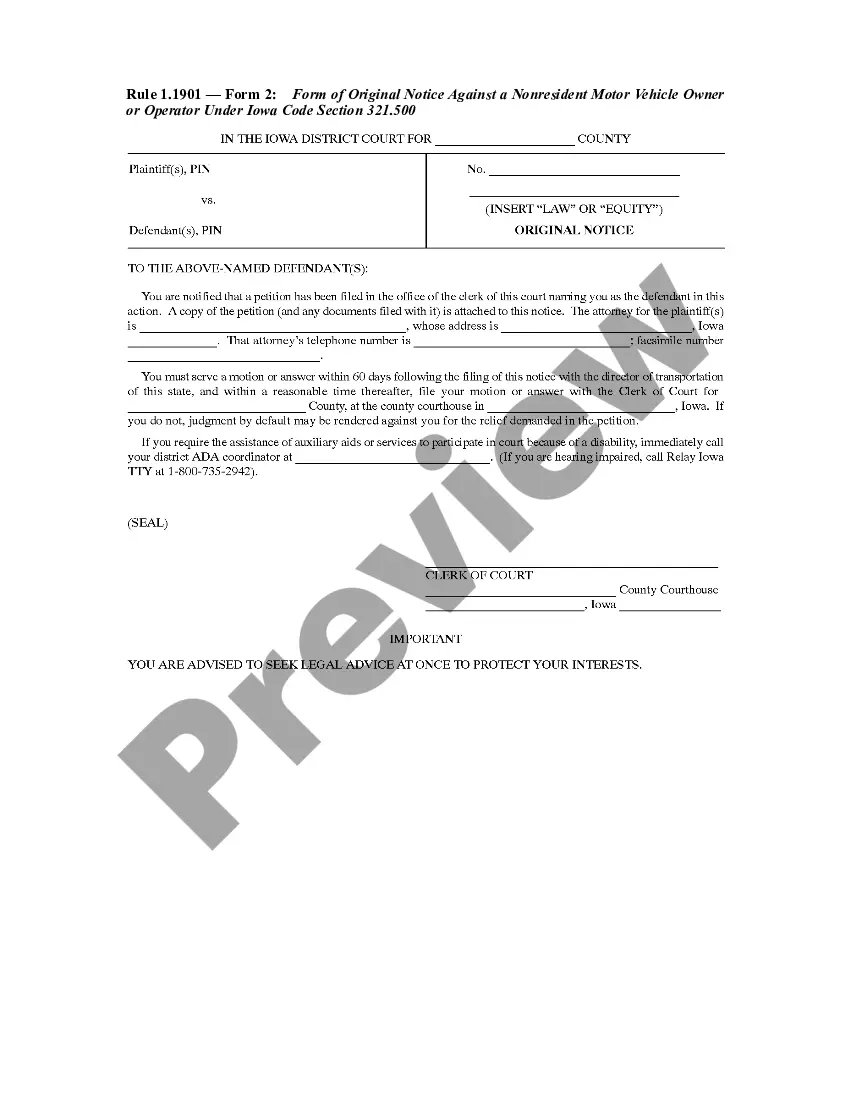

- Take advantage of the Preview option to review the form.

- Look at the information to ensure that you have chosen the appropriate type.

- In case the type is not what you are looking for, take advantage of the Look for field to find the type that fits your needs and needs.

- Whenever you obtain the correct type, click on Get now.

- Pick the prices plan you want, fill in the required information and facts to generate your money, and buy your order making use of your PayPal or credit card.

- Decide on a handy paper structure and acquire your copy.

Locate each of the record layouts you might have bought in the My Forms menu. You may get a further copy of Virginia Long Term Incentive Compensation Plan of A.M. Castle and Co. at any time, if possible. Just select the essential type to acquire or print the record format.

Use US Legal Forms, one of the most comprehensive assortment of lawful varieties, to conserve efforts and prevent mistakes. The service provides appropriately made lawful record layouts which can be used for a variety of reasons. Create an account on US Legal Forms and begin producing your way of life a little easier.

Form popularity

FAQ

Long-Term Incentives (LTIs) are a form of variable compensation that is earned in the present but whose payment is deferred and spread over time. This can be cash compensation but often is in the form of stock or stock options.

Every employer has their own qualifications as to how an employee becomes eligible for the LTIP. Generally all employees are eligible to receive the benefits after three to five years as long as they meet the performance goals specified by the company.

Some examples of short-term incentives include: Annual cash bonuses. Overtime pay. Holiday, weekend and shift work.

Long-term incentives, or LTI as they're often called, are a valuable part of a total compensation package both for delivering rewards and focusing employees on desired future outcomes and objectives.

Understanding Long-Term Incentive Plan (LTIP) Long-term incentives are earned based on the achievement of goals over a longer period of time. The goals may be based on stock price or business performance. It's important to take a holistic approach to compensation ? if it's short- or long-term, cash vs.

Short-Term Incentive Plan. The objective of an STIP is to reward key employees for their individual contribution for achieving the company's short-term business strategies and goals set by the compensation committee to increase the company's profitability.

LTI compensation is Long Term Incentive compensation, a form of variable compensation that an employee earns in the present but which payment comes later and is normally spread out over time.

These plans are discussed below: Premium Bonus Plan. Under premium bonus plans, the time taken to complete a job is fixed based on a careful time analysis. ... Profit-Sharing and Co-ownership. ... Group Incentives. ... Indirect Incentive Plans.

Usually, employees receive them if they meet specific criteria, such as completing a project on time and within budget. For example, a manager agrees to give everyone working on a certain marketing account a $500 bonus if they can complete all deliverables and get client approval by the end of the week.

Short-term incentives, also known as STI, are one of the crucial parts of the total rewards package delivered to an employee. For HR professionals who design total rewards packages, finding the right balance between STI, long-term incentives (LTI), and salary is important when attracting and retaining the best talent.