South Dakota Registration Rights Agreement between ObjectSoft Corp. and Investors regarding sale and purchase of 6% Series G convertible preferred stocks

Description

How to fill out Registration Rights Agreement Between ObjectSoft Corp. And Investors Regarding Sale And Purchase Of 6% Series G Convertible Preferred Stocks?

US Legal Forms - one of several largest libraries of legitimate varieties in the States - delivers an array of legitimate papers web templates it is possible to acquire or produce. Utilizing the web site, you can get a huge number of varieties for organization and person functions, sorted by groups, suggests, or keywords and phrases.You will discover the most up-to-date types of varieties just like the South Dakota Registration Rights Agreement between ObjectSoft Corp. and Investors regarding sale and purchase of 6% Series G convertible preferred stocks in seconds.

If you currently have a subscription, log in and acquire South Dakota Registration Rights Agreement between ObjectSoft Corp. and Investors regarding sale and purchase of 6% Series G convertible preferred stocks from the US Legal Forms catalogue. The Down load key will appear on each and every develop you see. You have accessibility to all earlier saved varieties in the My Forms tab of your own profile.

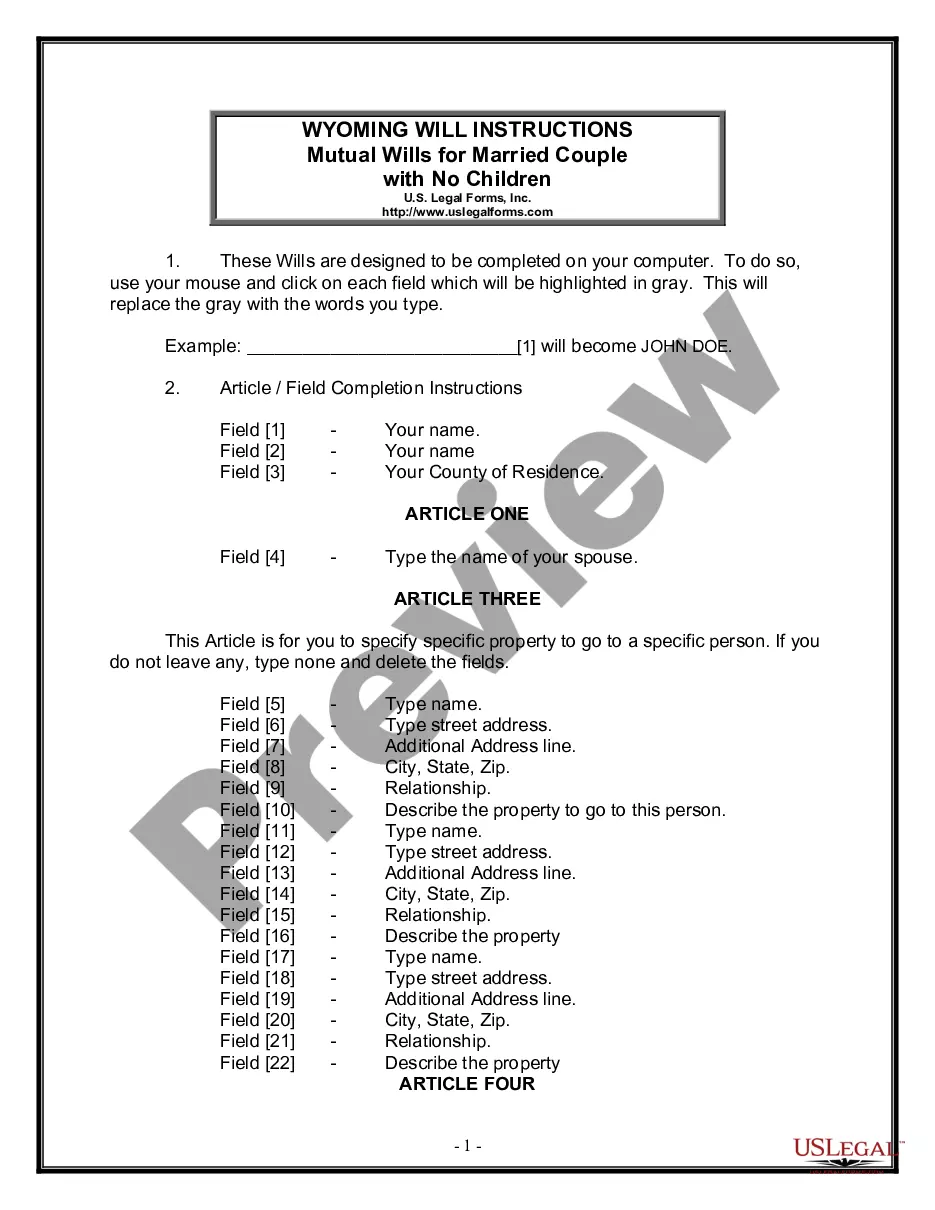

In order to use US Legal Forms initially, here are straightforward recommendations to help you get began:

- Make sure you have chosen the best develop for your personal area/area. Go through the Review key to check the form`s content material. Read the develop information to actually have chosen the proper develop.

- In the event the develop does not satisfy your specifications, use the Look for industry near the top of the display screen to discover the one which does.

- Should you be happy with the shape, confirm your selection by clicking the Acquire now key. Then, opt for the costs prepare you want and provide your qualifications to register for the profile.

- Process the purchase. Use your credit card or PayPal profile to finish the purchase.

- Choose the file format and acquire the shape on the system.

- Make modifications. Fill out, edit and produce and indication the saved South Dakota Registration Rights Agreement between ObjectSoft Corp. and Investors regarding sale and purchase of 6% Series G convertible preferred stocks.

Each and every design you added to your bank account does not have an expiration date and is yours eternally. So, if you would like acquire or produce one more backup, just go to the My Forms section and click in the develop you require.

Gain access to the South Dakota Registration Rights Agreement between ObjectSoft Corp. and Investors regarding sale and purchase of 6% Series G convertible preferred stocks with US Legal Forms, by far the most considerable catalogue of legitimate papers web templates. Use a huge number of skilled and status-particular web templates that fulfill your business or person requirements and specifications.