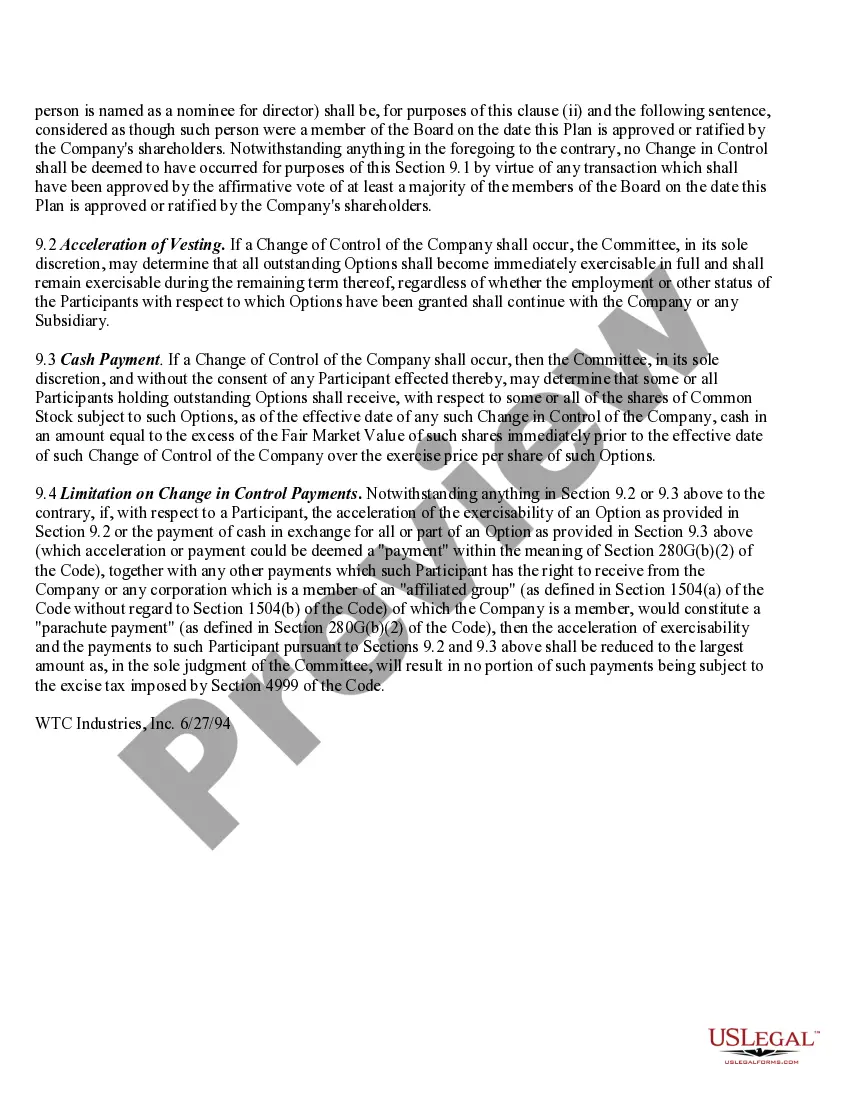

Virginia Change of Control of WTC Industries, Inc.

Description

How to fill out Change Of Control Of WTC Industries, Inc.?

If you want to full, obtain, or printing legitimate record layouts, use US Legal Forms, the biggest collection of legitimate forms, that can be found on the Internet. Take advantage of the site`s simple and convenient look for to obtain the papers you require. Numerous layouts for enterprise and individual functions are sorted by categories and states, or key phrases. Use US Legal Forms to obtain the Virginia Change of Control of WTC Industries, Inc. in just a few clicks.

In case you are presently a US Legal Forms consumer, log in in your accounts and then click the Obtain switch to get the Virginia Change of Control of WTC Industries, Inc.. You can also access forms you formerly acquired within the My Forms tab of the accounts.

If you work with US Legal Forms for the first time, refer to the instructions beneath:

- Step 1. Ensure you have chosen the shape for your proper town/land.

- Step 2. Take advantage of the Review method to examine the form`s content material. Do not forget about to see the explanation.

- Step 3. In case you are not happy using the form, utilize the Look for field at the top of the display screen to locate other types of your legitimate form web template.

- Step 4. After you have identified the shape you require, go through the Buy now switch. Select the rates strategy you like and add your credentials to sign up for an accounts.

- Step 5. Approach the purchase. You should use your Мisa or Ьastercard or PayPal accounts to finish the purchase.

- Step 6. Find the structure of your legitimate form and obtain it on the product.

- Step 7. Complete, change and printing or indication the Virginia Change of Control of WTC Industries, Inc..

Each legitimate record web template you acquire is the one you have forever. You may have acces to every form you acquired with your acccount. Click on the My Forms segment and choose a form to printing or obtain once again.

Be competitive and obtain, and printing the Virginia Change of Control of WTC Industries, Inc. with US Legal Forms. There are millions of expert and condition-particular forms you can use for your personal enterprise or individual demands.

Form popularity

FAQ

Nonresidents of Virginia must file a Form 763. (A person is considered a nonresident of Virginia if they lived in Virginia for less than 183 days in a calendar year). An instruction booklet with return mailing address is also available on the website. Part-Year Residents of Virginia file a Form 760PY.

760 - Individual Resident Income Tax Return. 760PY - Part Year Resident Individual Income Tax Return. 763 - Nonresident Individual Income Tax return.

All applications must be submitted to the Department of Taxation, Tax Credit Unit, P.O. Box 715, Richmond, VA 23218-0715 90 days prior to the due date of your return. A letter will be sent to certify the credit.

Returns may be filed through the Federal/State e-File program, or certain Virginia PTEs may qualify to electronically file a Form 502EZ using the eForms system on the Department's website. If the PTE is unable to file and pay electronically by the effective date, the PTE may request a waiver.

Due by . Mail to the Department of Taxation, P.O. Box 1498, Richmond, Virginia 23218-1498. Both spouses must complete a separate Form 763-S when both filers have Virginia income tax withheld. I, the undersigned, do declare under penalties provided by law that this is a true, correct and complete return.

Nonresidents File Form 763 Usually, when one spouse is a resident and the other spouse is a nonresident, each spouse whose income is at or above the filing threshold, must file separately. The resident spouse must file on Form 760. The nonresident spouse must file Form 763.

? Used to report additions to or to claim subtractions from federal taxable income and to claim withholding reported to a corporation by a pass-through entity on Virginia Schedule VK-1.

File Form 760PY to report the income attributable to your period of Virginia residency. File Form 763, the nonresident return, to report the Virginia source income received as a nonresident. Nonresidents File Form 763.