Virginia Agreement to Reimburse for Insurance Premium

Description

How to fill out Agreement To Reimburse For Insurance Premium?

US Legal Forms - one of the largest repositories of legal documents in the United States - offers a vast selection of legal document templates that you can download or create.

By using the website, you can access thousands of forms for both business and personal purposes, organized by categories, states, or keywords. You can find the latest forms, such as the Virginia Agreement to Reimburse for Insurance Premium, in a matter of seconds.

If you are already registered, Log In and download the Virginia Agreement to Reimburse for Insurance Premium from the US Legal Forms library. The Download button will appear on each form you view. You can access all previously downloaded forms in the My documents section of your account.

Process the payment. Use your credit card or PayPal account to complete the transaction.

Select the format and download the form to your device. Make adjustments. Complete, modify, print, and sign the downloaded Virginia Agreement to Reimburse for Insurance Premium.

Every document you add to your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply visit the My documents section and click on the form you need.

Access the Virginia Agreement to Reimburse for Insurance Premium with US Legal Forms, the most extensive library of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- If you intend to use US Legal Forms for the first time, here are some simple instructions to help you begin.

- Make sure you have selected the correct form for your city/state.

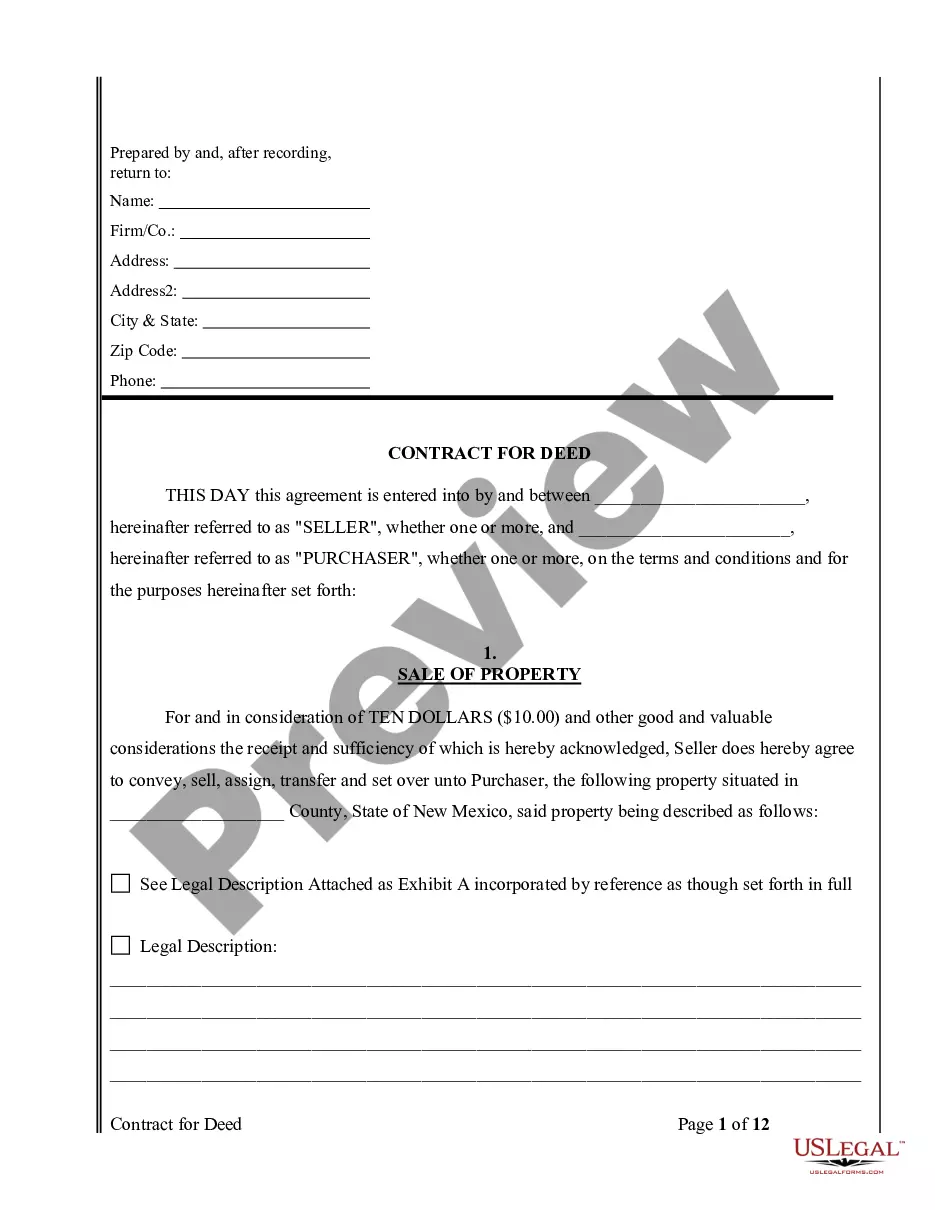

- Click the Preview button to review the contents of the form.

- Check the form information to confirm that you have chosen the appropriate document.

- If the form does not meet your needs, utilize the Search bar at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your selection by clicking the Get now button.

- Then, choose your preferred pricing plan and provide your credentials to sign up for an account.

Form popularity

FAQ

Med Pay: No. Virginia law prohibits inclusion of bodily injury subrogation clauses in auto insurance policies.

Virginia does not allow subrogation as to medical payments benefits. That exclusion likewise applies to health insurance benefits. The pertinent Code sections are § 38.2-2209 for Med Pay coverage and A§ 38.2-3405 for health insurance coverage.

You can reduce your auto insurance premium by increasing the deductible component, which is what you pay when you make a claim. But, pay only as much as you can afford. If you pay too much, the purpose of insurance is defeated.

The eight officially anti-subrogation states are:Arizona.Connecticut.Kansas.Missouri.New Jersey.New York.North Carolina.Virginia.

Subrogation is the principle by which an insurer, having paid a claim, then stands in the place of an insured, and exercises the insured's right of recovery in the insured's name against any third parties responsible for the loss.

The doctrine of subrogation provides that if an insurer pays a loss to its insured due to the wrongful act of another, the insurer is subrogated to the rights of the insured and may prosecute a suit against the wrongdoer for recovery of its outlay.

MedPay policies can be stacked in the same way as UM/UIM coverage. MedPay is no-fault medical coverage, meaning you can receive immediate coverage for your medical bills after a car accident. MedPay is optional in Virginia, but if multiple cars in your household have these policies, it can be helpful after a crash.

Virginia applies something called the Anti-Subrogation Rule. Under that Rule, a negligent party doesn't get the benefit of you having health insurance. So, when you pursue your accident claim, you will claim for the ENTIRE medical bill, plus pain, suffering, inconvenience, lost wages and any other claim applicable.

If you paid your premium in advance and cancel your policy before the end of the term, the insurance company must refund the remaining balance in most cases. Most auto insurers will prorate your refund based on the number of days your current policy was in effect.

No. You do not have to purchase Med Pay coverage in Virginia. The law requires only that you carry liability coverage for bodily injuries and property damage, as well as uninsured motorist coverage.