Virginia Employee Payroll Records Checklist

Description

How to fill out Employee Payroll Records Checklist?

Are you currently in the position where you frequently require documents for either business or personal activities almost every day.

There are numerous legal document templates accessible online, but finding versions you can trust is not easy.

US Legal Forms offers a vast array of form templates, including the Virginia Employee Payroll Records Checklist, designed to meet federal and state requirements.

Once you find the correct form, simply click Get now.

Choose the pricing plan you want, complete the necessary information to create your account, and pay for your order using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Virginia Employee Payroll Records Checklist template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct city/region.

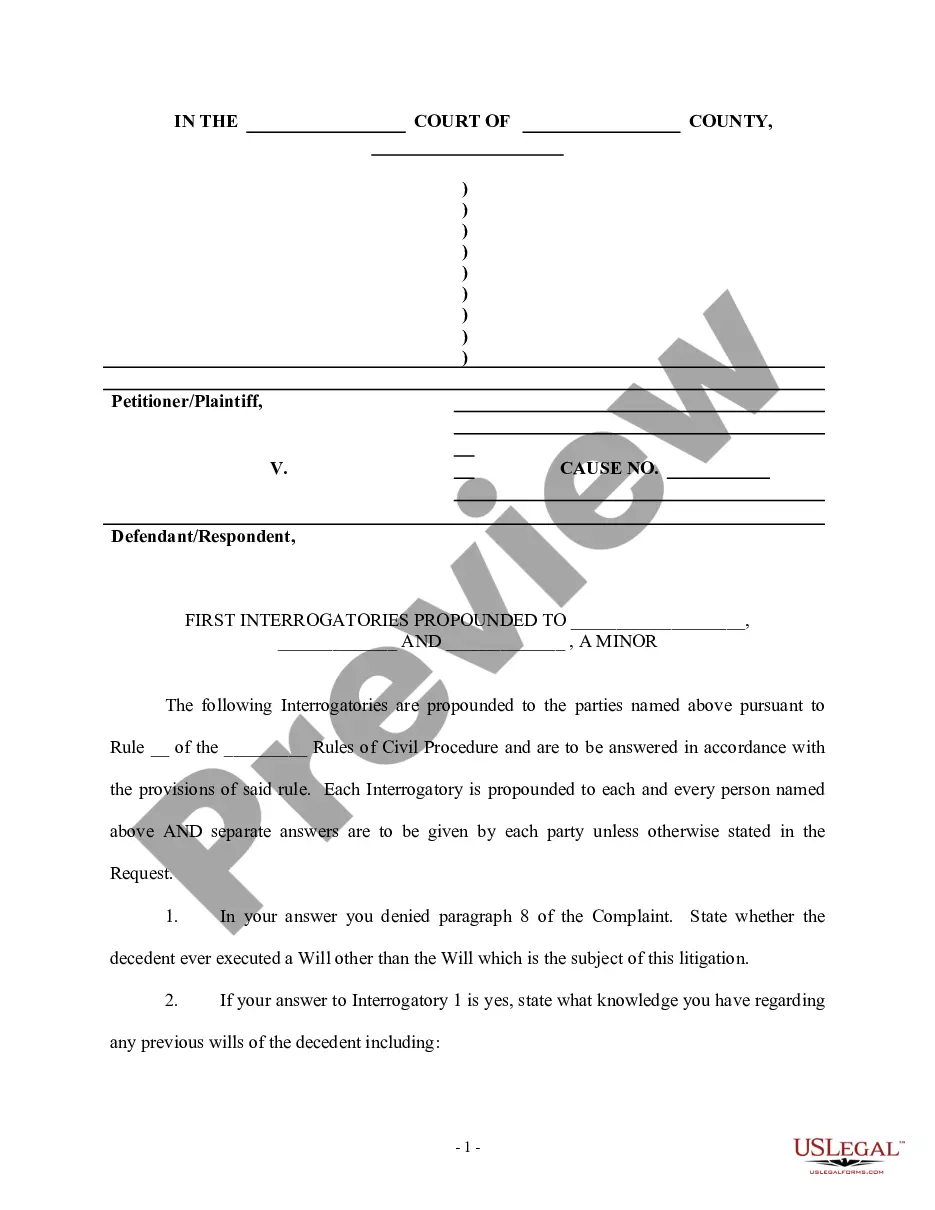

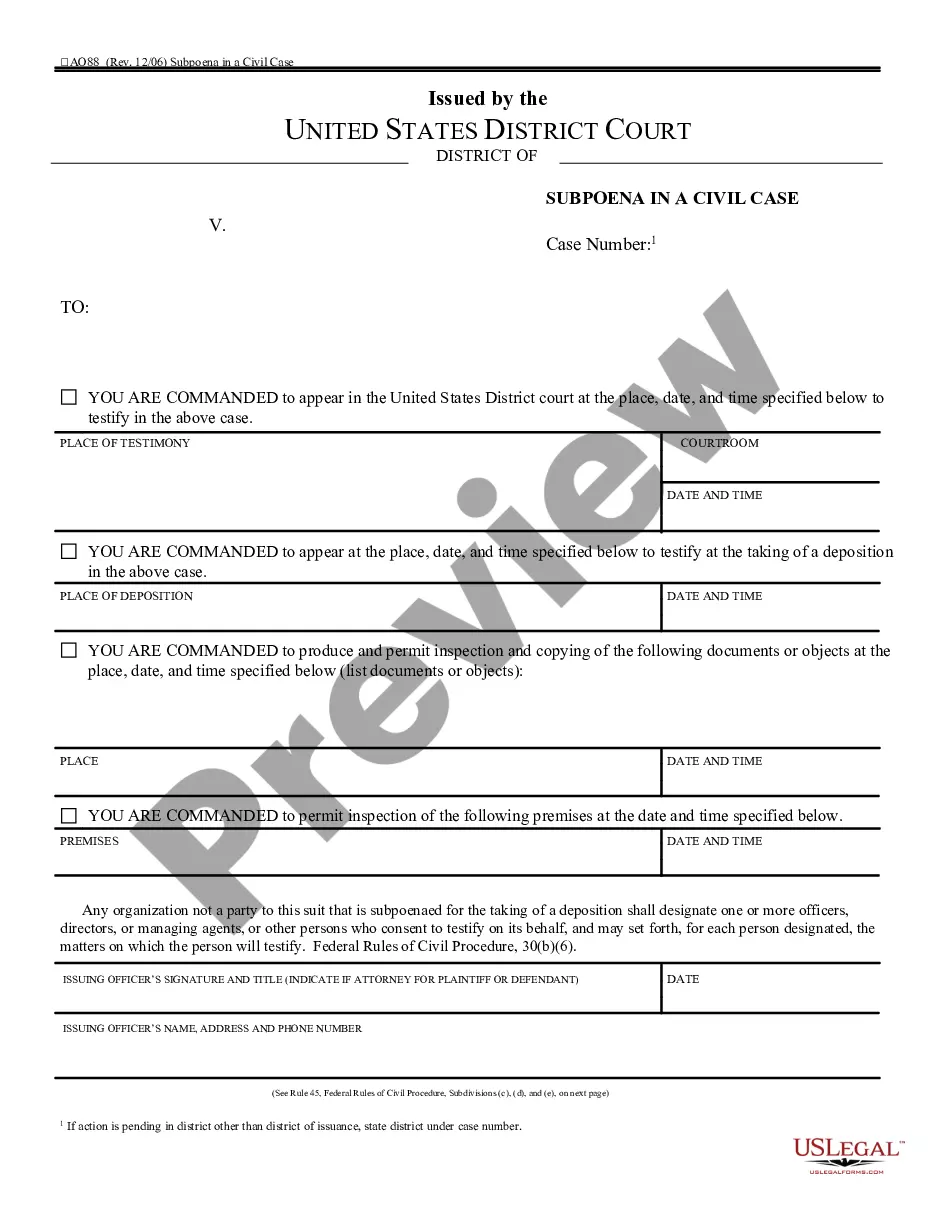

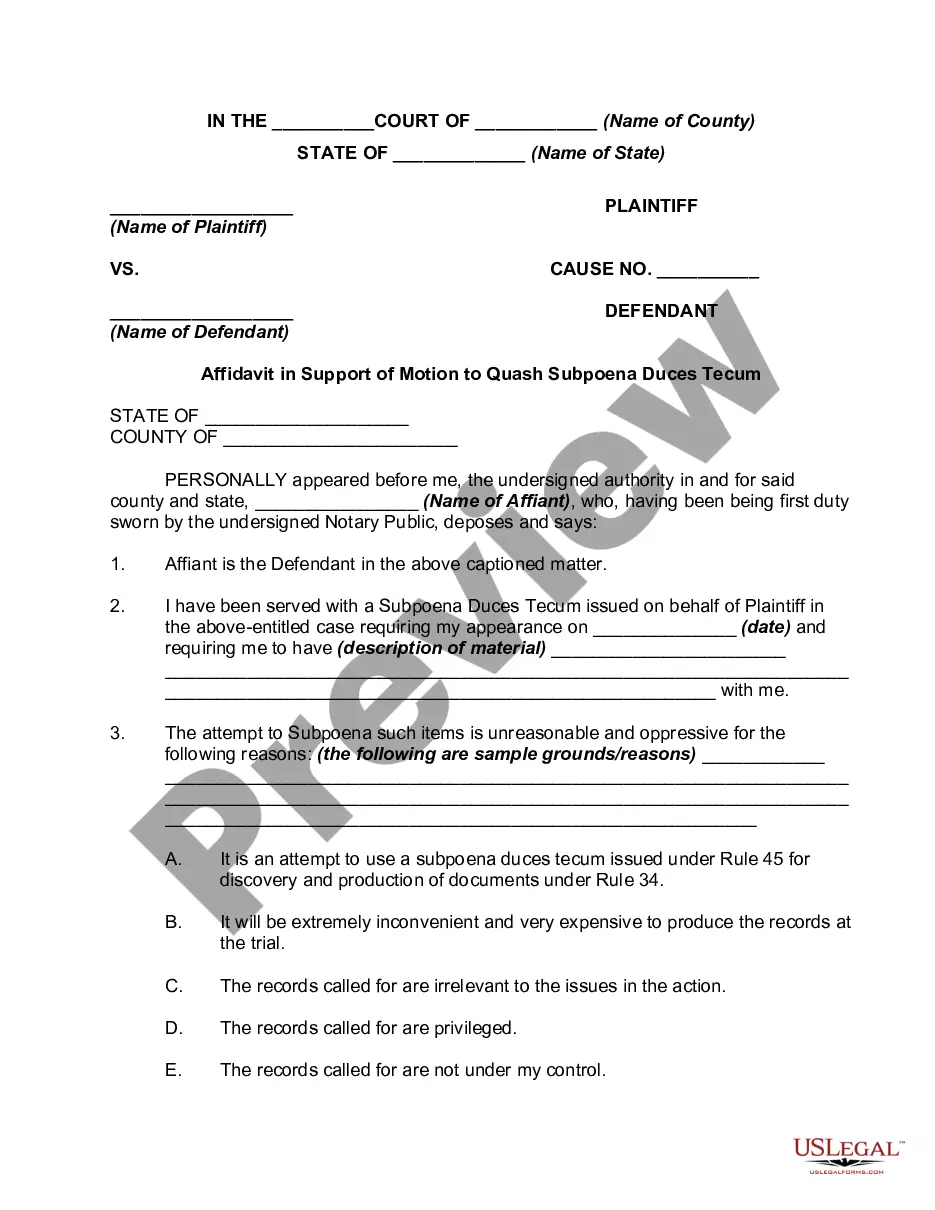

- Use the Review button to view the form.

- Read the description to confirm that you have selected the right document.

- If the form is not what you are looking for, use the Search field to find the form that suits your needs.

Form popularity

FAQ

Virginia law 8.01-413 relates to the ability of employees to request and obtain copies of documents used for record keeping. This law supports employees in obtaining necessary information about their employment history. Understanding this law can help you assert your rights effectively. The Virginia Employee Payroll Records Checklist can assist you in ensuring that you gather all relevant documentation.

Employment verification laws in Virginia dictate that employers may share certain information about employees, such as dates of employment and job titles. However, specific details, like salaries and performance reviews, often require employee consent to disclose. Knowing your rights regarding employment verification can protect your personal information. To navigate this process, consider using the Virginia Employee Payroll Records Checklist.

Virginia law requires employers to maintain certain employment records, including payroll data and timekeeping records. These records must be available for employees to review upon request. Understanding these legal requirements is vital for both employers and employees to ensure compliance. The Virginia Employee Payroll Records Checklist can help you keep track of these essential documents.

Yes, in Virginia, you have the right to request your employee file even after termination. This includes all records related to your employment, such as performance evaluations and payroll data. Accessing your employee file can provide valuable insights and assist you in your future job searches. To streamline this process, refer to the Virginia Employee Payroll Records Checklist.

The 40.1-27.4 law in Virginia allows employees to request copies of their payroll records. This law ensures that you have access to information regarding your earnings and deductions. Having a clear understanding of your payroll records is essential for managing your finances. Utilize the Virginia Employee Payroll Records Checklist to help you organize and retrieve this important information effectively.

Keep all records for at least three years after the due date of the returns or the date the tax was paid, whichever is later.

The documents commonly need for payroll recordkeeping include but are not limited to:Employee personal information.Employment information.Timesheets.Pay information.Tax documents.Deduction information.Paid and unpaid leave records.Direct deposit information.More items...

Generally, here are the documents you should include in each employee's payroll record:General information. Employee name. Address.Tax withholding forms. Form W-4. State W-4 form.Time and attendance records. Time cards.Payroll records. Pay rate.Termination/separation documents, if applicable. Final paycheck information.

The employee payroll file is the repository for everything that has to do with an employee's paycheck. The main reason to create a payroll file is to limit access to the rest of the confidential information that is located in the personnel file.

Seven Types of Records an Employer Should Keep Under Fair Work LegislationGeneral Records.Wages & Pay Records.Payslip Records.Hours of Work Records.Leave Records.Superannuation Records.Termination Records.Recordkeeping with Cloud Payroll.