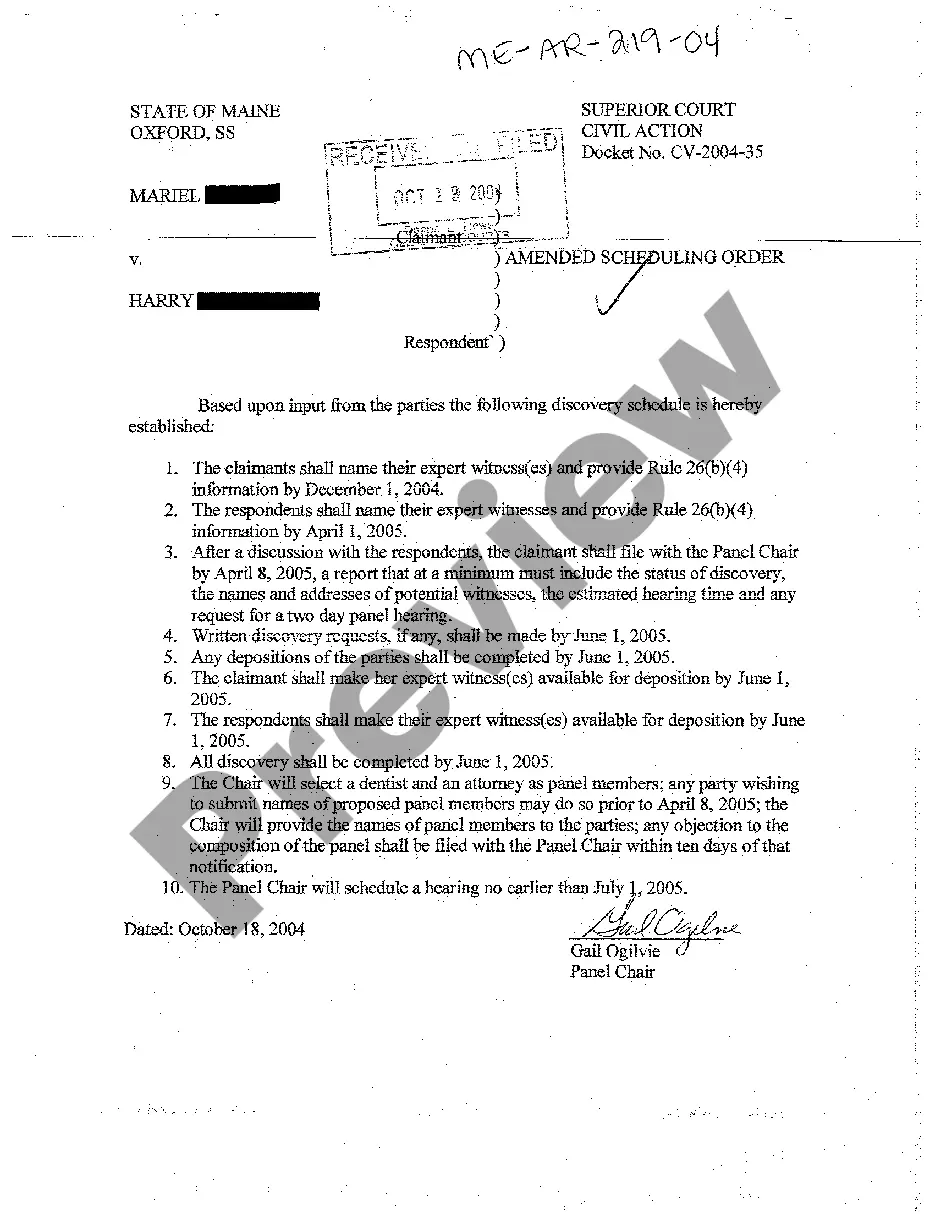

Virginia Demand for Payment of Account by Business to Debtor

Description

How to fill out Demand For Payment Of Account By Business To Debtor?

You can spend countless hours online searching for the legal document template that meets the state and federal requirements you need.

US Legal Forms provides thousands of legal documents that have been reviewed by experts.

You can easily download or print the Virginia Demand for Payment of Account by Business to Debtor from our service.

If available, utilize the Preview option to review the document template as well.

- If you already have a US Legal Forms account, you may Log In and select the Acquire option.

- Next, you can complete, modify, print, or sign the Virginia Demand for Payment of Account by Business to Debtor.

- Every legal document template you obtain is yours permanently.

- To get another copy of any downloaded form, navigate to the My documents tab and click the relevant option.

- If you are visiting the US Legal Forms site for the first time, follow the simple instructions below.

- Firstly, make sure you have chosen the correct document template for the area/city of your choice.

- Review the form details to ensure you have selected the proper form.

Form popularity

FAQ

The time limit is sometimes called the limitation period. For most debts, the time limit is 6 years since you last wrote to them or made a payment. The time limit is longer for mortgage debts.

Unpaid credit card debt is not forgiven after 7 years, however. You could still be sued for unpaid credit card debt after 7 years, and you may or may not be able to use the age of the debt as a winning defense, depending on the state's statute of limitations. In most states, it's between 3 and 10 years.

No execution shall be issued and no action brought on a judgment, including a judgment in favor of the Commonwealth and a judgment rendered in another state or country, after 20 years from the date of such judgment or domestication of such judgment, unless the period is extended as provided in this section.

The time limit is sometimes called the limitation period. For most debts, the time limit is 6 years since you last wrote to them or made a payment. The time limit is longer for mortgage debts.

This finite period of time is known as the statute of limitations. In Virginia, the applicable statute of limitations for credit card debts, mortgage debts, and medical debts is five years.

If you don't pay on time, your credit can be suspended, which means you cannot use your credit card. If you bought an item such as a washing machine on an HP agreement and are in default on the payments, your creditors can ask you to return the item. They can then sell this at a fair market price to offset your debt.

Under the new Virginia law that became effective January 1, 2022, judgments entered in a Virginia circuit court after July 1, 2021, have a 10-year limitations period and may only be extended up to two additional 10-year periods, for a maximum limitations period of 30 years.

In Virginia, there is a statute of limitations, also known as the length of time debt collectors have to recover the unpaid debt. In a written contract, debt collectors generally have a five-year period to try and collect or take legal action. However, a three-year period applies for oral contracts.

Under state laws, if you are sued about a debt, and the debt is too old, you may have a defense to the lawsuit. These state laws are called "statutes of limitation." Most statutes of limitations fall in the three-to-six year range, although in some jurisdictions they may extend for longer depending on the type of debt.

In Virginia, there is a statute of limitations, also known as the length of time debt collectors have to recover the unpaid debt. In a written contract, debt collectors generally have a five-year period to try and collect or take legal action. However, a three-year period applies for oral contracts.