Virginia Nonexempt Employee Time Report

Description

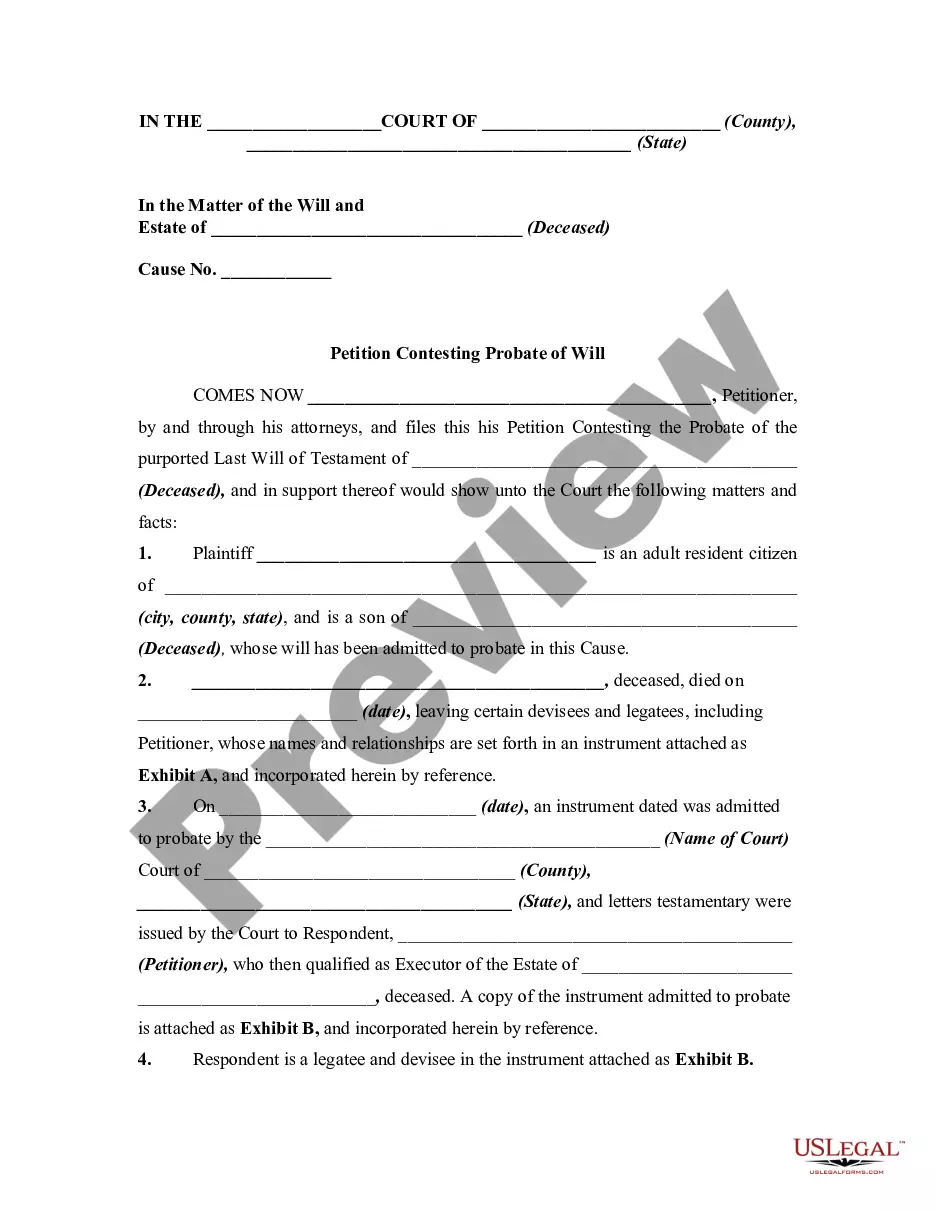

How to fill out Nonexempt Employee Time Report?

US Legal Forms - one of the largest repositories of legal documents in the United States - offers a broad range of legal document templates that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of documents such as the Virginia Nonexempt Employee Time Report in just seconds.

If you already have an account, Log In and download the Virginia Nonexempt Employee Time Report from the US Legal Forms library. The Get button will appear on every form you view. You can access all previously purchased forms from the My documents section of your account.

Select the pricing plan you prefer and provide your information to register for an account.

Complete the transaction. Use your credit card or PayPal account to finalize the payment. Choose the format and download the document to your device. Edit the form as needed, complete it, print, and sign the downloaded Virginia Nonexempt Employee Time Report.

Every template added to your account has no expiration date and is yours permanently. If you need to download or print another copy, just go to the My documents section and click on the form you require.

Access the Virginia Nonexempt Employee Time Report with US Legal Forms, the most extensive library of legal document templates. Utilize a plethora of professional and state-specific templates that fulfill your business or personal requirements.

- If you want to utilize US Legal Forms for the first time, here are simple instructions to help you get started:

- Ensure you have selected the appropriate form for your city/county.

- Click on the

- Review the form's summary to confirm that you have chosen the correct document.

- If the form does not meet your requirements, use the

- If you are satisfied with the form, confirm your choice by clicking the

Form popularity

FAQ

Instead, employers in Virginia had to follow the federal Fair Labor Standards Act (FLSA) regarding wage and hour requirements for employees. As a brief recap, the FLSA protects employees by establishing: Minimum wage requirements.

Exempt employees are mostly paid on a salary basis and not per hour. Unlike non-exempt employees, employers may decide whether to pay exempt employees for any extra work outside the official 40 working hours per week. As a business owner, this allows you flexibility in your payment and employee benefits policies.

An employee who, based on salary and duties performed, is not exempt from the minimum wage and overtime provisions of the Fair Labor Standards Act and must be compensated at a rate of one and one-half times his/her regular rate of pay for hours worked in excess of 40 in a workweek.

Under the Virginia law, a salaried employee's regular rate of pay is one-fortieth of all wages paid for a particular workweek, regardless of how many hours they worked. Under the FLSA, you calculate a salaried employee's regular rate of pay by dividing the salary by all hours worked.

For an employee to be considered exempt, their specific job duties and salary must meet all the requirements set by the U.S. Department of Labor. A typical exempt employee is one who performs supervisory or executive duties and is paid on a salary basis not less than $455 per week.

Nonexempt: An individual who is not exempt from the overtime provisions of the FLSA and is therefore entitled to overtime pay for all hours worked beyond 40 in a workweek (as well as any state overtime provisions). Nonexempt employees may be paid on a salary, hourly or other basis.

Non-exempt status indicates a Veteran is not exempt from paying the funding fee. Contact RLC indicates a system-generated determination is not available, or any loan may need to be submitted to VA as prior approval.

Wages and breaks There are no Virginia laws governing overtime, according to the Virginia Department of Labor and Industry. However, the Fair Labor Standards Act, which almost always applies, requires that non-exempt employees be paid 1.5 times their regular rate of pay for all hours worked over 40 in a workweek.

The FLSA sets the maximum amount of comp time that may be accumulated: nonexempt employees who work in "a public safety activity, emergency response activity, or seasonal activity" may accumulate up to a maximum of 480 hours of comp time, while other employees are limited to 240 hours.

A. Yes, you are entitled to one hour of reporting time pay. Under the law, if an employee is required to report to work a second time in any one workday and is furnished less than two hours of work on the second reporting, he or she must be paid for two hours at his or her regular rate of pay.