Virginia FLSA Exempt / Nonexempt Compliance Form

Description

How to fill out FLSA Exempt / Nonexempt Compliance Form?

Have you visited a place where you require documents for possibly commercial or personal purposes almost every day.

There are numerous authentic document templates accessible online, but finding versions you can trust is not simple.

US Legal Forms offers thousands of form templates, such as the Virginia FLSA Exempt / Nonexempt Compliance Form, designed to comply with federal and state requirements.

Once you locate the correct form, click on Acquire now.

Select the pricing plan you desire, complete the necessary information to create your account, and make the purchase using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Virginia FLSA Exempt / Nonexempt Compliance Form template.

- In case you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and confirm it is for the correct city/state.

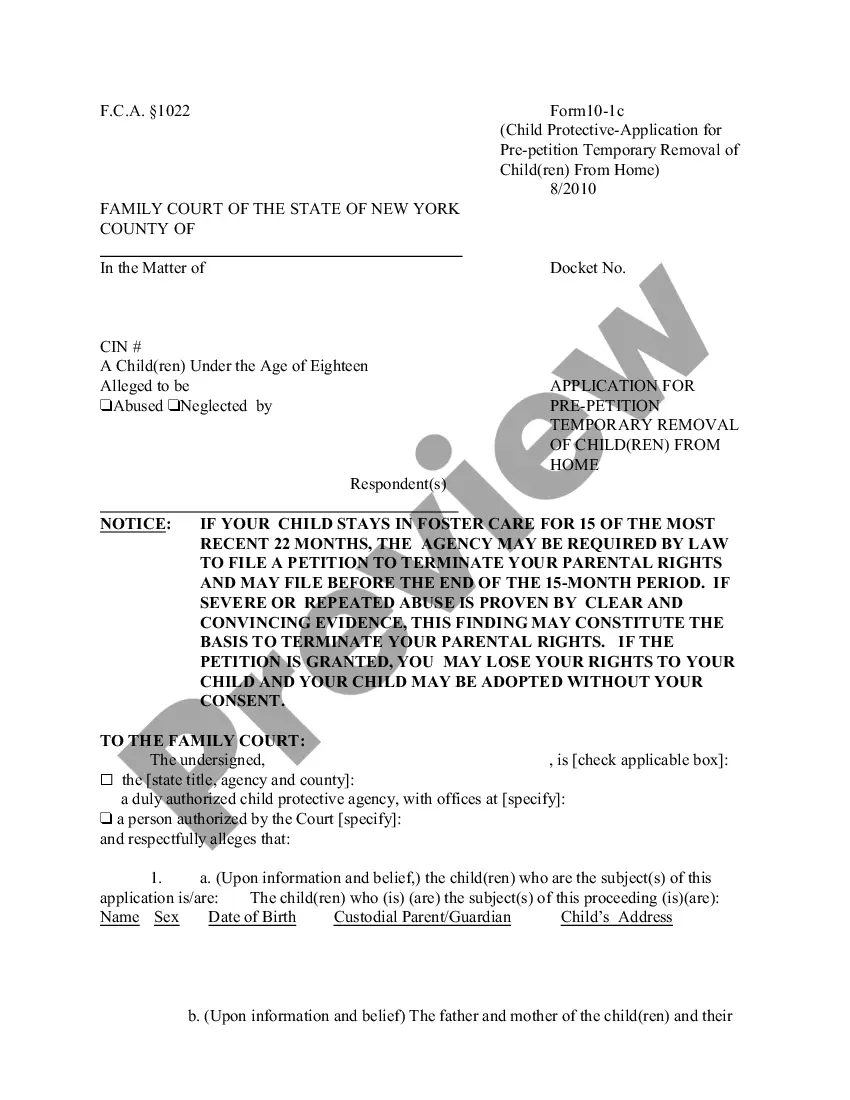

- Utilize the Preview button to examine the form.

- Read the description to ensure you have selected the correct form.

- If the form does not meet your requirements, use the Search field to find the form that suits your needs.

Form popularity

FAQ

Transitioning from non-exempt to exempt status requires a careful review of employee duties and compensation. Employers must ensure that the job meets the criteria outlined by the FLSA regarding responsibilities and salary levels. It’s important to document this change formally, and using the Virginia FLSA Exempt / Nonexempt Compliance Form can help streamline this process effectively.

With few exceptions, to be exempt an employee must (a) be paid at least $23,600 per year ($455 per week), and (b) be paid on a salary basis, and also (c) perform exempt job duties. These requirements are outlined in the FLSA Regulations (promulgated by the U.S. Department of Labor).

Executive, administrative, professional and outside sales employees: (as defined in Department of Labor regulations) and who are paid on a salary basis are exempt from both the minimum wage and overtime provisions of the FLSA.

An employee who, based on salary and duties performed, is not exempt from the minimum wage and overtime provisions of the Fair Labor Standards Act and must be compensated at a rate of one and one-half times his/her regular rate of pay for hours worked in excess of 40 in a workweek.

An employee who is not subject to the minimum wage and overtime requirements of the Fair Labor Standards Act based on salary and duties performed.

Under the Virginia law, a salaried employee's regular rate of pay is one-fortieth of all wages paid for a particular workweek, regardless of how many hours they worked. Under the FLSA, you calculate a salaried employee's regular rate of pay by dividing the salary by all hours worked.

Standards Act (FLSA) However, Section 13(a)(1) of the FLSA provides an exemption from both minimum wage and overtime pay for employees employed as bona fide executive, administrative, professional and outside sales employees.

Maximum hours an exempt employee can be required to work The law does not provide a maximum number of hours that an exempt worker can be required to work during a week. This means that an employer could require an exempt employee to work well beyond 40 hours a week without overtime compensation.

Nonexempt: An individual who is not exempt from the overtime provisions of the FLSA and is therefore entitled to overtime pay for all hours worked beyond 40 in a workweek (as well as any state overtime provisions). Nonexempt employees may be paid on a salary, hourly or other basis.

The Overtime Act eliminates this defense, providing instead that all salaried (nonexempt) employees are entitled to one and one-half times their regular rate for any hours worked over 40.