Virginia Bill of Sale of Personal Property - Reservation of Life Estate in Seller

Description

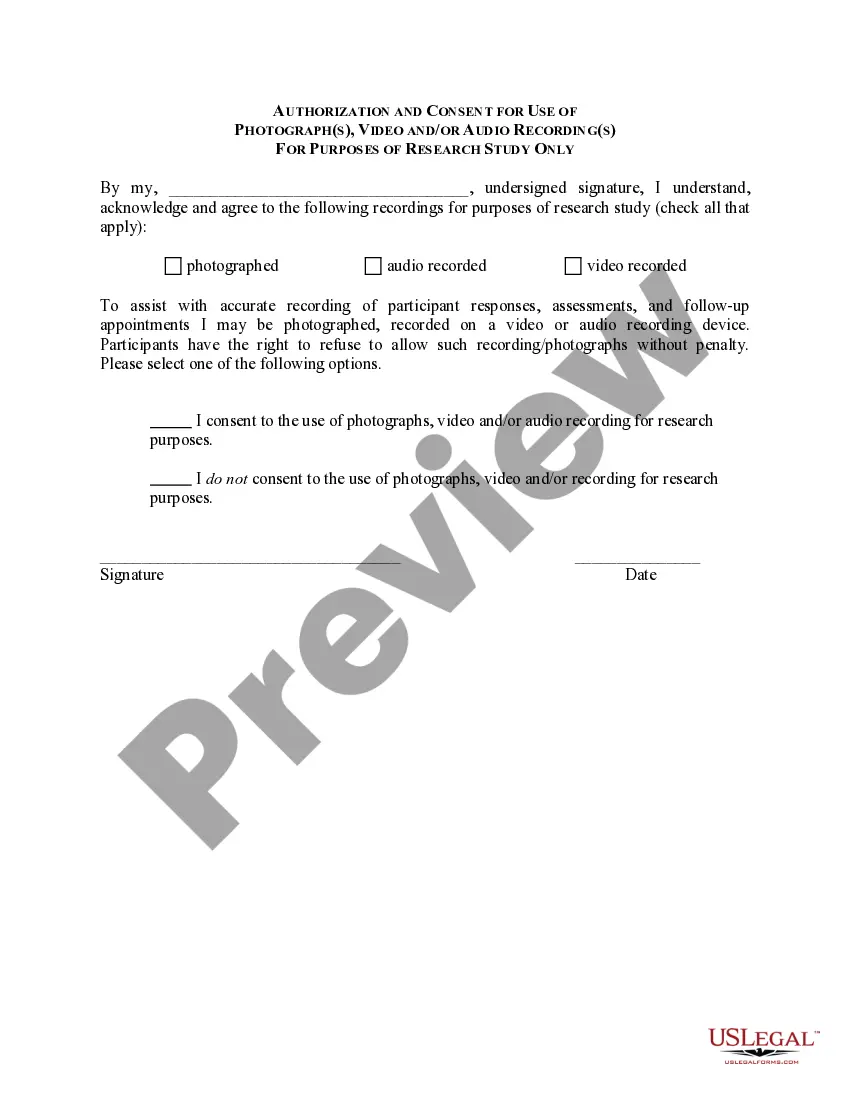

How to fill out Bill Of Sale Of Personal Property - Reservation Of Life Estate In Seller?

You can spend time online searching for the appropriate legal document template that meets the state and federal requirements you need.

US Legal Forms offers a vast selection of legal forms that are reviewed by professionals.

You can easily download or print the Virginia Bill of Sale of Personal Property - Reservation of Life Estate in Seller from our service.

If available, use the Preview option to view the document template as well.

- If you already have a US Legal Forms account, you can Log In and click the Download button.

- Then, you can complete, modify, print, or sign the Virginia Bill of Sale of Personal Property - Reservation of Life Estate in Seller.

- Every legal document template you acquire is permanently yours.

- To obtain another copy of any form you have purchased, visit the My documents section and click the corresponding option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, make sure you have selected the correct document format for your region/city of preference.

- Read the form description to ensure you have chosen the right one.

Form popularity

FAQ

To transfer property after the death of a parent in Virginia, you typically need to establish the authority of the estate representative through probate. If the property is included in a trust, it can be transferred without going through probate. A Virginia Bill of Sale of Personal Property - Reservation of Life Estate in Seller can be useful in documenting the transfer of ownership while retaining certain rights associated with the property. Consider using the USLegalForms platform to obtain the necessary documentation and ensure proper legal compliance.

How Does a Life Estate Work? The life tenant is responsible for maintaining the property during their lifetime. They can improve upon it, but they can't encumber it by using it as collateral for a loan or mortgage, and they can't sell it.

A life estate is a form of joint ownership that allows one person to remain in a house until his or her death- when it passes to the other owner. Life estates can be used to avoid probate and to give a house to children without giving up the ability to live in it.

A life estate is a freehold estate where ownership is limited to the duration of some person's lifetime, either the person holding the life estate the life tenant or some other designated person.

Key Takeaways. A life estate is a type of joint property ownership. Under a life estate, the owners have the right to use the property for life. Typically, the life estate process is adopted to streamline inheritance while avoiding probate.

A life estate deed is a special deed form that allows a property owner to use the property during life and transfer the property automatically at death. Life estate deeds are designed to transfer the property at death without losing the ability to use the property during life.

An interest in land that lasts only for the life of the holder. Thus, the holder of a life estate cannot leave the land to anyone in their will, because their interest in the land does not survive the person.

Since the heirs own the real estate when the decedent dies, all the heirs must join in selling the property, including signing the real estate contract, deed of sale and other documents incidental to a sales transaction.

Virginia law gives the life estate grantor the right to sell the property at any time. The life tenant (grantee) may not sell the property or force the grantor to move out of the property. Life estates are also safe from creditors and collection attempts.

Benefits of a Life EstateThe right to live in the home until death;Maintaining a $250,000 capital gains exclusion provided you resided in the home two (2) of the last five (5) years;The right to keep a portion of the sale proceeds of the house if it is later sold;The right to rental income;More items...?12-Jun-2012