This due diligence checklist lists liability issues for future directors and officers in a company regarding business transactions.

Wyoming Checklist for Potential Director and Officer Liability Issues

Description

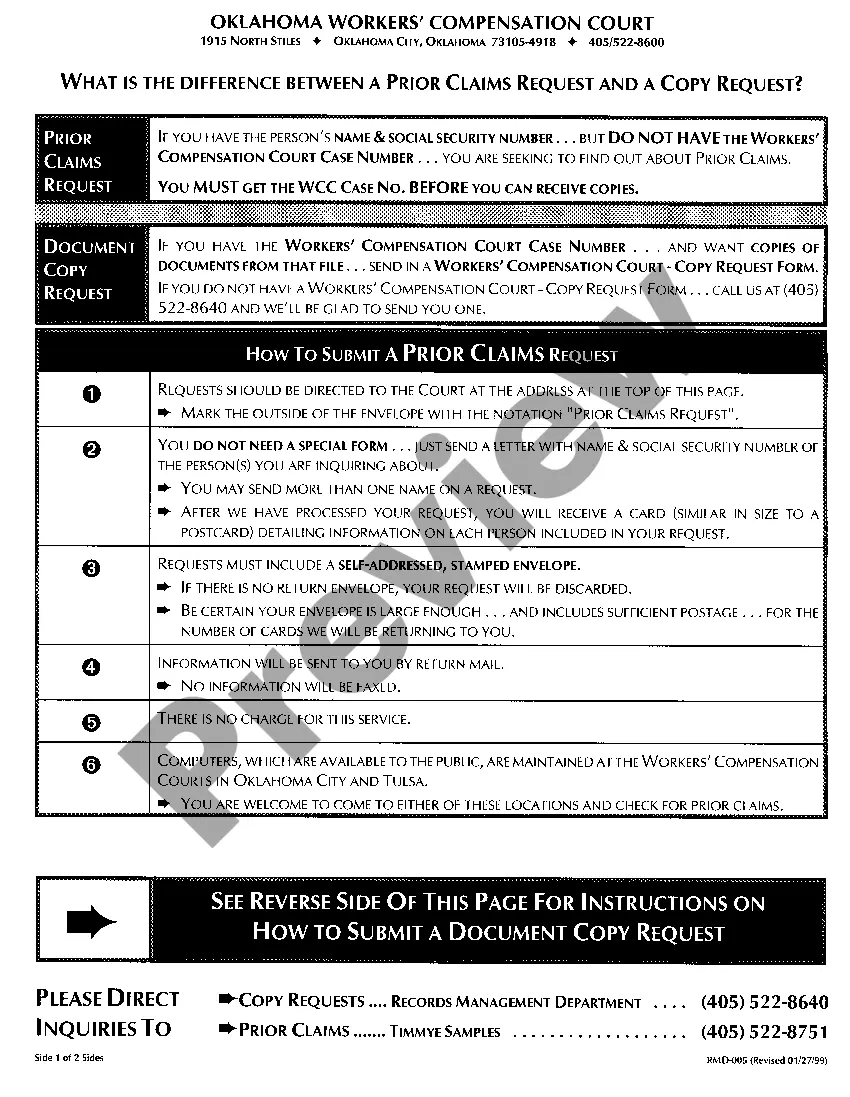

How to fill out Checklist For Potential Director And Officer Liability Issues?

Are you in a scenario where you require documents for both business or personal purposes nearly every day.

There are numerous authentic document templates accessible online, but finding reliable ones is challenging.

US Legal Forms offers a wide variety of form templates, including the Wyoming Checklist for Potential Director and Officer Liability Issues, designed to meet state and federal regulations.

Once you locate the appropriate form, click on Buy now.

Choose the pricing plan you want, fill out the necessary information to create your account, and complete the purchase with your PayPal or Visa or Mastercard.

- If you are already acquainted with the US Legal Forms site and have an account, simply sign in.

- After that, you can download the Wyoming Checklist for Potential Director and Officer Liability Issues template.

- If you do not possess an account and wish to start using US Legal Forms, follow these instructions.

- Select the form you need and ensure it is suitable for the correct city/state.

- Use the Review button to evaluate the document.

- Check the details to confirm you have chosen the right form.

- If the form does not meet your search requirements, utilize the Research field to find the form that suits your needs.

Form popularity

FAQ

Limited liability protects shareholders, directors, officers and employees against personal liability for actions taken in the name of the corporation and corporate debts. Ordinarily, an officer of the corporation, whether also a shareholder, director or employee, cannot be held personally liable.

Consequently, in certain circumstances, a director may be personally liable if, for example, they gained a personal benefit or increased their control of the company as a result of the oppressive or unfairly prejudicial conduct. Statutory provisions may also impose personal liability on a director.

A corporation is an incorporated entity designed to limit the liability of its owners (called shareholders). Generally, shareholders are not personally liable for the debts of the corporation. Creditors can only collect on their debts by going after the assets of the corporation.

With rare exceptions, members of a nonprofit board are protected against personal liability due to the following: An incorporated entity is responsible for its debts. In the vast majority of circumstances, judgments imposed on a nonprofit by a court of law have to be paid by the organization, not individual directors.

A director may be held personally liable in the following cases:Unlawful Act, Gross Negligence or Bad Faith and Conflict of Interest.Liability for Watered StockContractual Stipulation.Disloyalty.Filing False Statement.Access to Information by a Director, Especially Non-executive Director.Board Committees.More items...

Personal Liability of Officers and DirectorsBreach their duty of care to the corporation. Breach their duty of loyalty to the corporation. Misappropriate a corporate asset for personal use or use by another business. Commingle personal and business assets.

Typically, a corporate officer isn't held personally liable, as long as his or her actions fall within the scope of their position and the parameters of the law. An officer of a corporation may serve on the board of directors or fulfill a managerial role.

Board members can generally be held personally liable for breach of fiduciary duties, particularly in cases involving egregious neglect of the Board member's oversight responsibilities or the receipt of a personal benefit from the organization's assets or resources (sometimes referred to as private inurement).

A director can be held personally liable if they act in the management of the company while disqualified, or acting on the instructions of someone else who is disqualified.

Board members can generally be held personally liable for breach of fiduciary duties, particularly in cases involving egregious neglect of the Board member's oversight responsibilities or the receipt of a personal benefit from the organization's assets or resources (sometimes referred to as private inurement).