This due diligence checklist lists liability issues for future directors and officers in a company regarding business transactions.

Guam Checklist for Potential Director and Officer Liability Issues

Description

How to fill out Checklist For Potential Director And Officer Liability Issues?

Are you in a situation where you need files for both business or personal purposes almost every day? There are numerous legitimate document templates accessible online, but locating ones you can rely on isn't easy.

US Legal Forms offers a vast collection of form templates, including the Guam Checklist for Potential Director and Officer Liability Issues, which can be customized to meet federal and state regulations.

If you are already familiar with the US Legal Forms website and have an account, just Log In. After that, you can download the Guam Checklist for Potential Director and Officer Liability Issues template.

Select a convenient document format and download your copy.

Access all the document templates you’ve purchased in the My documents list. You can obtain an additional copy of the Guam Checklist for Potential Director and Officer Liability Issues at any time, if necessary. Just click the relevant form to download or print the document template.

- If you don’t have an account and want to use US Legal Forms, follow these steps.

- Locate the form you need and ensure it corresponds to the correct region/state.

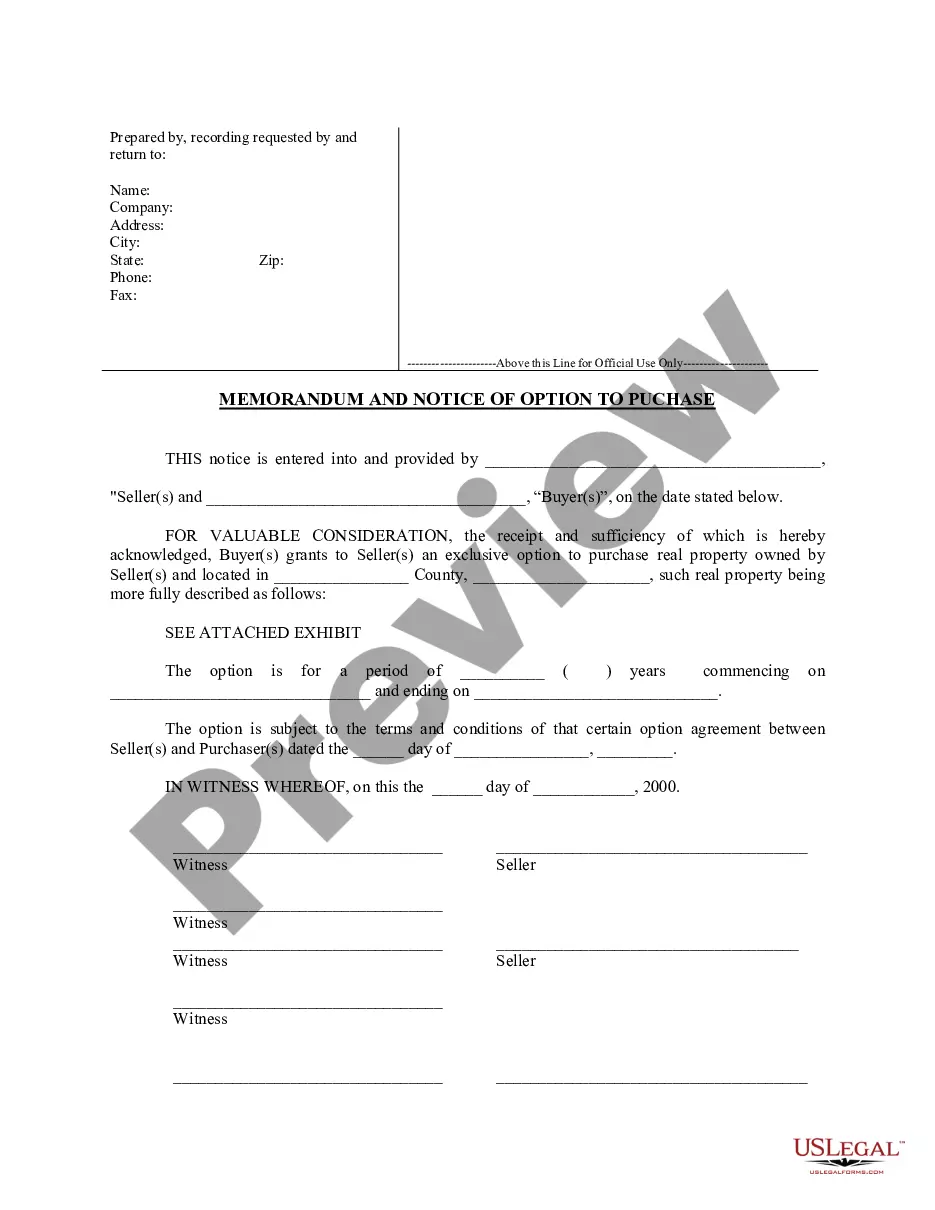

- Utilize the Review button to evaluate the form.

- Check the description to make sure you’ve selected the correct form.

- If the form isn’t what you’re looking for, use the Lookup section to find the form that suits your needs.

- Once you find the appropriate form, click Purchase now.

- Choose the pricing plan you prefer, provide the necessary information to create your account, and pay for the transaction using your PayPal or credit card.

Form popularity

FAQ

D&O insurance will not provide coverage for what many would consider the worst acts of the directors or officers; dishonesty, fraud, criminal or malicious acts committed deliberately. Insurance is created to transfer risk and not to cover the intentional acts of the insured.

Management liability, also known as directors and officers' insurance, includes extra coverage for the individual directors or officers of a business for their official company actions. Long story short, it's coverage for your managers. That's the big difference between it and professional liability.

Directors and officers (D&O) liability insurance protects the personal assets of corporate directors and officers, and their spouses, in the event they are personally sued by employees, vendors, competitors, investors, customers, or other parties, for actual or alleged wrongful acts in managing a company.

Board members can generally be held personally liable for breach of fiduciary duties, particularly in cases involving egregious neglect of the Board member's oversight responsibilities or the receipt of a personal benefit from the organization's assets or resources (sometimes referred to as private inurement).

Limited liability protects shareholders, directors, officers and employees against personal liability for actions taken in the name of the corporation and corporate debts. Ordinarily, an officer of the corporation, whether also a shareholder, director or employee, cannot be held personally liable.

Directors & Officers (D&O) Liability insurance is designed to protect the people who serve as directors or officers of a company from personal losses if they are sued by the organization's employees, vendors, customers or other parties.

While D&O insurance can cover clients who lost money due to the director's or officer's actions, the individual on the board is not providing a professional or specialized service, thus they would not be covered under professional liability insurance. Many businesses choose to carry both of these insurance policies.

In almost every D&O policy, there must be some finding or ruling that the insured actually engaged in the prohibited conduct before the exclusion will apply; an allegation that the director or officer engaged in the bad acts listed in the exclusion (e.g. fraud or illegal personal profit) is not enough for the exclusion

Typically, a corporate officer isn't held personally liable, as long as his or her actions fall within the scope of their position and the parameters of the law. An officer of a corporation may serve on the board of directors or fulfill a managerial role.