Virginia Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status

Description

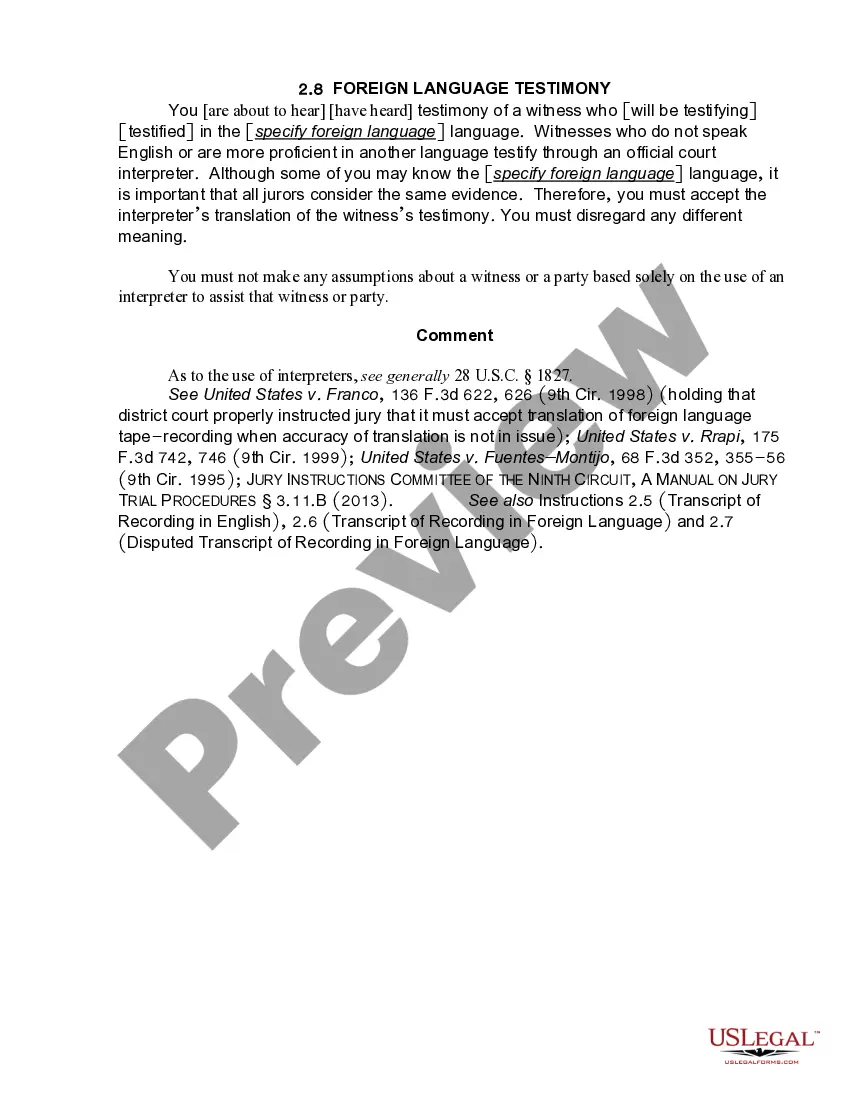

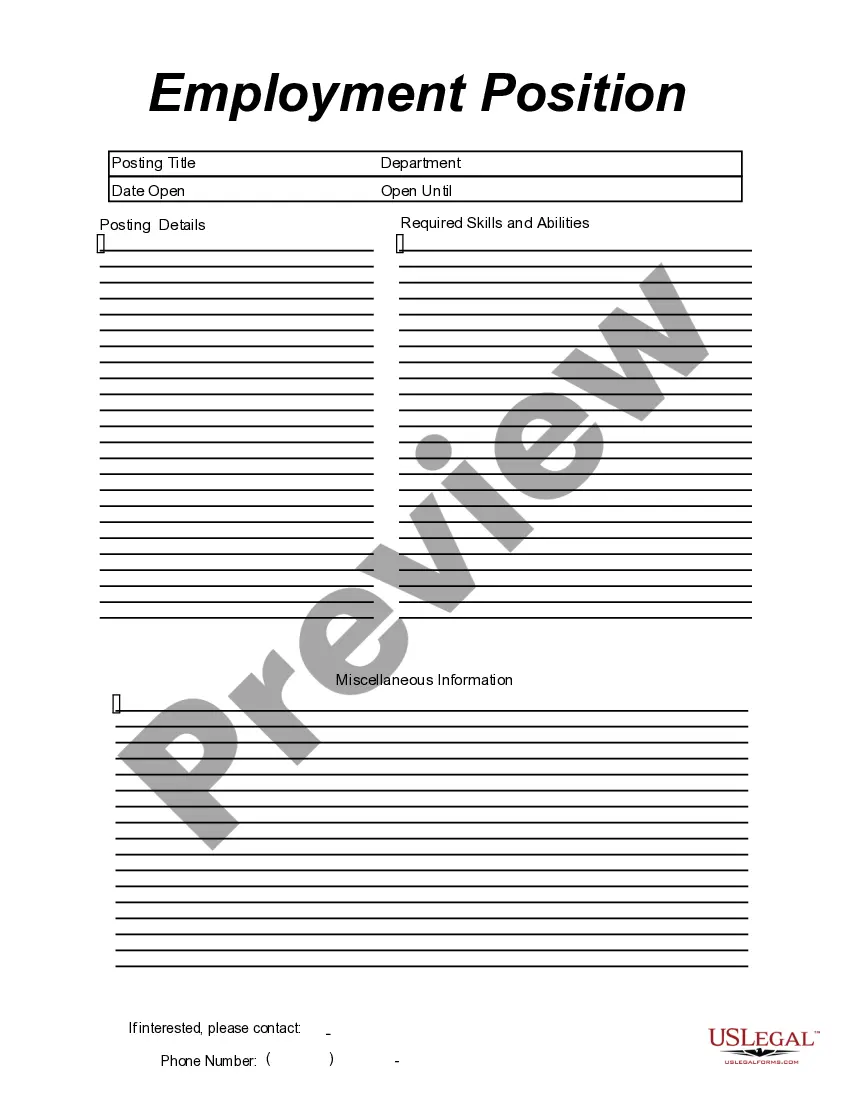

How to fill out Charitable Trust With Creation Contingent Upon Qualification For Tax Exempt Status?

If you wish to finalize, download, or print authorized document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Make use of the site’s user-friendly search feature to locate the documents you require.

Numerous templates for business and personal purposes are organized by categories and states, or keywords.

Step 5. Complete the purchase. You can use your Visa or Mastercard or PayPal account to finalize the transaction.

Step 6. Select the format of the legal form and download it to your device. Step 7. Fill out, modify, print, or sign the Virginia Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status.

- Utilize US Legal Forms to acquire the Virginia Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status in just a few clicks.

- If you are an existing US Legal Forms client, Log In to your account and click the Download button to obtain the Virginia Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status.

- You can also access forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Confirm you have selected the form for the correct city/state.

- Step 2. Utilize the Preview feature to review the form’s contents. Be sure to read the description.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other versions of the legal form template.

- Step 4. After finding the form you need, click on the Buy now button. Choose your preferred pricing plan and enter your details to register for an account.

Form popularity

FAQ

Nonprofits in Virginia typically use Form 102, also known as the Articles of Incorporation. This form outlines the basic structure and purpose of your organization. When establishing your Virginia Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status, ensuring the correct forms are completed accurately is crucial for compliance.

In Virginia, churches can apply for tax-exempt status using Form ST-13. This form is necessary for those establishing a Virginia Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status, as it demonstrates compliance with state tax regulations and allows the church to operate without incurring sales tax.

For the purposes of PSLF, eligible not-for-profit organizations include a organizations that are tax exempt under section 501(c)(3) of the Internal Revenue Code (IRC), or other not-for-profit organizations that provide a qualifying service.

Background. The Virginia General Assembly enacted legislation allowing Loudoun County to provide an exemption from real property taxes on the principal dwelling and up to three acres for residents who are at least 65 years of age or permanently and totally disabled.

In Virginia, certain items may be exempt from the sales tax to all consumers, not just tax-exempt purchasers. Several exceptions to the state sales tax are certain types of protective clothing, certain assistive medical devices, any learning institute's textbooks, and any software and data center equipment.

The IRS groups the 501(c)(9), 501(c)(4), and 501(c)(17) together when the latter two are employees' associations.

Organizations organized and operated exclusively for religious, charitable, scientific, testing for public safety, literary, educational, or other specified purposes and that meet certain other requirements are tax exempt under Internal Revenue Code Section 501(c)(3).

Exemption Requirements - 501(c)(3) Organizations To be tax-exempt under section 501(c)(3) of the Internal Revenue Code, an organization must be organized and operated exclusively for exempt purposes set forth in section 501(c)(3), and none of its earnings may inure to any private shareholder or individual.

Virginia provides an exemption from its sales and use tax to nonprofit organization who meet certain exemption criteria, the first of which is being exempt from federal income taxation under Section 501(c)(3), 501(c )(4) or (501)(c)(19).

In order to be exempt from the Virginia retail sales and use tax, an organization must apply to Virginia Tax and meet all the exemption criteria set forth in Code of Virginia § 58.1-609.11. See Retail Sales and Use Tax Exemptions for Nonprofit Organizations for additional information.