Virginia Agreement Acquiring Share of Retiring Law Partner

Description

How to fill out Agreement Acquiring Share Of Retiring Law Partner?

Have you ever found yourself in a situation where you require documents for both business or particular purposes almost every day.

There are numerous legal document templates accessible online, yet finding ones you can trust is challenging.

US Legal Forms offers thousands of document templates, including the Virginia Agreement to Acquire Share of Retiring Law Partner, designed to comply with state and federal requirements.

When you find the appropriate document, click Get now.

Choose a convenient file format and download your copy. Access all the document templates you’ve purchased in the My documents menu. You can download another copy of the Virginia Agreement to Acquire Share of Retiring Law Partner at any time. Just select the specific template for download or to print.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Afterwards, you can download the Virginia Agreement to Acquire Share of Retiring Law Partner template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Locate the template you need and ensure it corresponds to the correct state/region.

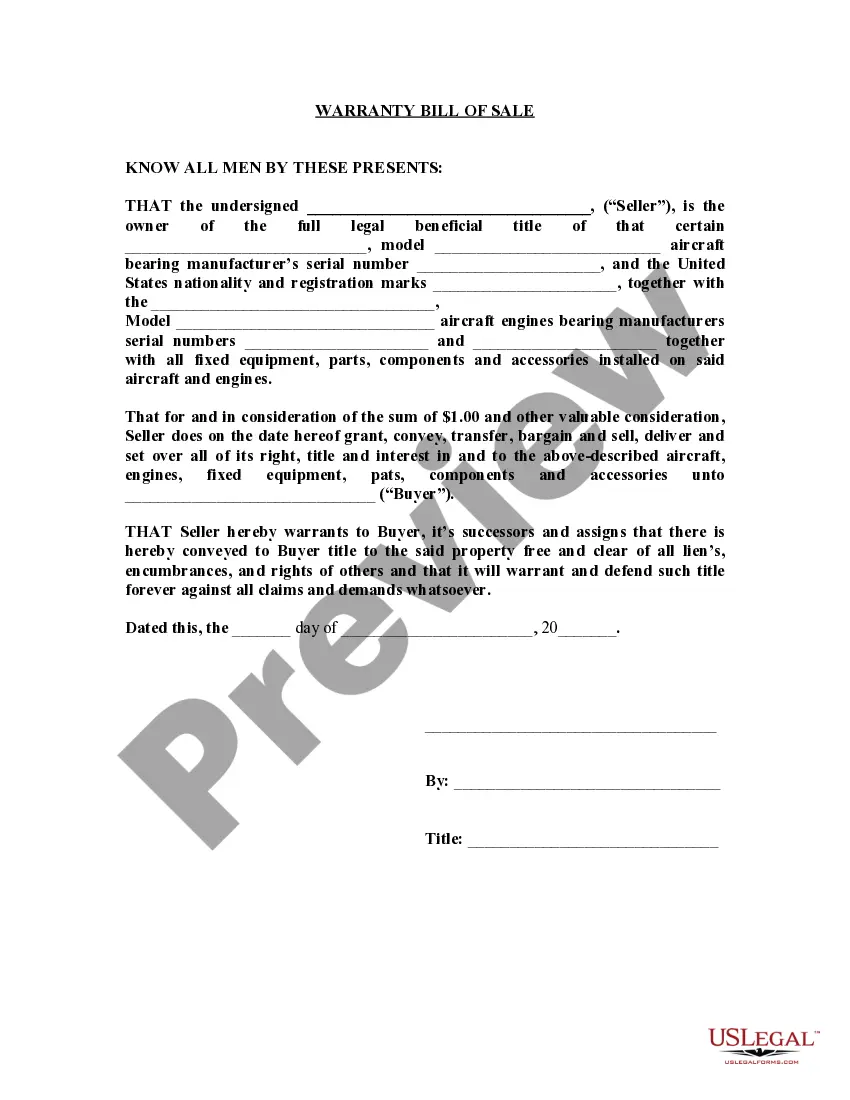

- Use the Review button to examine the document.

- Read the description to confirm you’ve selected the right template.

- If the document is not what you’re looking for, utilize the Search area to find a template that fulfills your requirements.

Form popularity

FAQ

Yes, a retiring partner is typically entitled to receive their share of the partnership. This share may include the value of their interest in partnership assets and any profits accrued until their retirement date. Ensuring a clear agreement, like a Virginia Agreement Acquiring Share of Retiring Law Partner, helps outline the specifics.

Businesses earn profits based on the size of the company. Partners divide their profits equally. By contributing 50% of the startup money each will gain the right to 50% of the profits, Weltman wrote.

Absent an agreement, the partners will share profits and losses equally. If an agreement exists, partners divide profits based on the terms specified. Any reason can be used as the basis for establishing a profit-sharing ratio, but the two main factors are responsibility and capital contributions.

This means that in a partnership there is more than one owner, and the profit is shared between the owners. In a partnership, it is the residual profit which is divided between the partners in the profit and loss sharing ratio.

Suppose A and B invest Rs. x and Rs. y respectively for a year in a business, then at the end of the year: (A's share of profit) : (B's share of profit) = x : y.

All partners will share profits and losses equally, unless otherwise agreed. one partner cannot be expelled by the other partners unless otherwise agreed. a partner is only responsible for partnership debts and liabilities that arise after the person becomes a partner.

In a General Partnership, all partners are financially obligated to any debts incurred by the partnership. When a partner leaves, the partnership dissolves and the partners equally split debts and assets.

Partnership Agreements and the Exit of One Partner A partnership does not necessarily end when a partner exits. The remaining partners may continue with the partnership. Therefore, your partnership agreement covers what happens when a partner wants to leave, becomes incapacitated, or dies.

When a partner leaves a partnership, the present partnership ends, but the business can still continue to operate. Assets invested by a partner into a partnership remain the property of the individual partner.

19. (1) A person who is admitted as a partner into an existing firm does not thereby become liable to the creditors of the firm for anything done before he became a partner. (2) A partner who retires from a firm does not thereby cease to be liable for partnership debts or obligations incurred before his retirement.