Title: Virginia Sample Letter for Tax Exemption — Discussion of Office Equipment Qualifying for Tax Exemption Introduction: In Virginia, businesses and organizations have the opportunity to avail tax exemptions on certain office equipment purchases. This article will provide a detailed description of Virginia's tax exemption policy for office equipment and provide a sample letter to assist businesses in applying for this tax exemption. Keywords: Virginia, sample letter, tax exemption, office equipment, discussion, qualifying, tax exemption policy, businesses, organizations, purchasing, applying. Section 1: Understanding Virginia's Tax Exemption Policy for Office Equipment — Explanation of Virginia's tax exemption policy for office equipment purchases. — Overview of the types of office equipment that may qualify for tax exemption. — Mention of the eligibility criteria to avail this tax exemption. Section 2: Types of Office Equipment that can Qualify for Tax Exemption in Virginia — Computers and laptops, including peripheral devices such as monitors and printers. — Office furniture items like desks, chairs, and filing cabinets. — Telecommunication equipment such as phones, fax machines, and routers. — Networking equipment like switches, servers, and data storage devices. — Software applications and licenses required for business operations. — Business-related equipment like copiers, scanners, and projectors. — Presentation tools like interactive whiteboards and audio-visual systems. — Security systems including surveillance cameras and access control systems. — Office supplies like stationery, ink, and toner cartridges may also qualify for exemption. Section 3: Sample Letter for Tax Exemption — Office EquipmenPurchaseas— - Explanation of the importance of a well-drafted letter when applying for tax exemption. — Introduction to a sample letter template addressing office equipment tax exemption. — Detailed instructions on how to customize the template to fit individual business needs. — Tips for providing accurate information and supporting documents in the letter. Conclusion: The tax exemption policy in Virginia provides a valuable opportunity for businesses and organizations to save costs on office equipment purchases. By understanding the qualifying criteria and following the guidelines provided, businesses can effectively apply for and benefit from this tax exemption. The sample letter provided offers a helpful starting point for drafting a customized letter to request tax exemption for office equipment purchases. Keywords: tax exemption policy, Virginia, office equipment, sample letter, businesses, organizations, savings, drafting, customized, request, qualifying criteria, guidelines.

Virginia Sample Letter for Tax Exemption - Discussion of Office Equipment Qualifying for Tax Exemption

Description

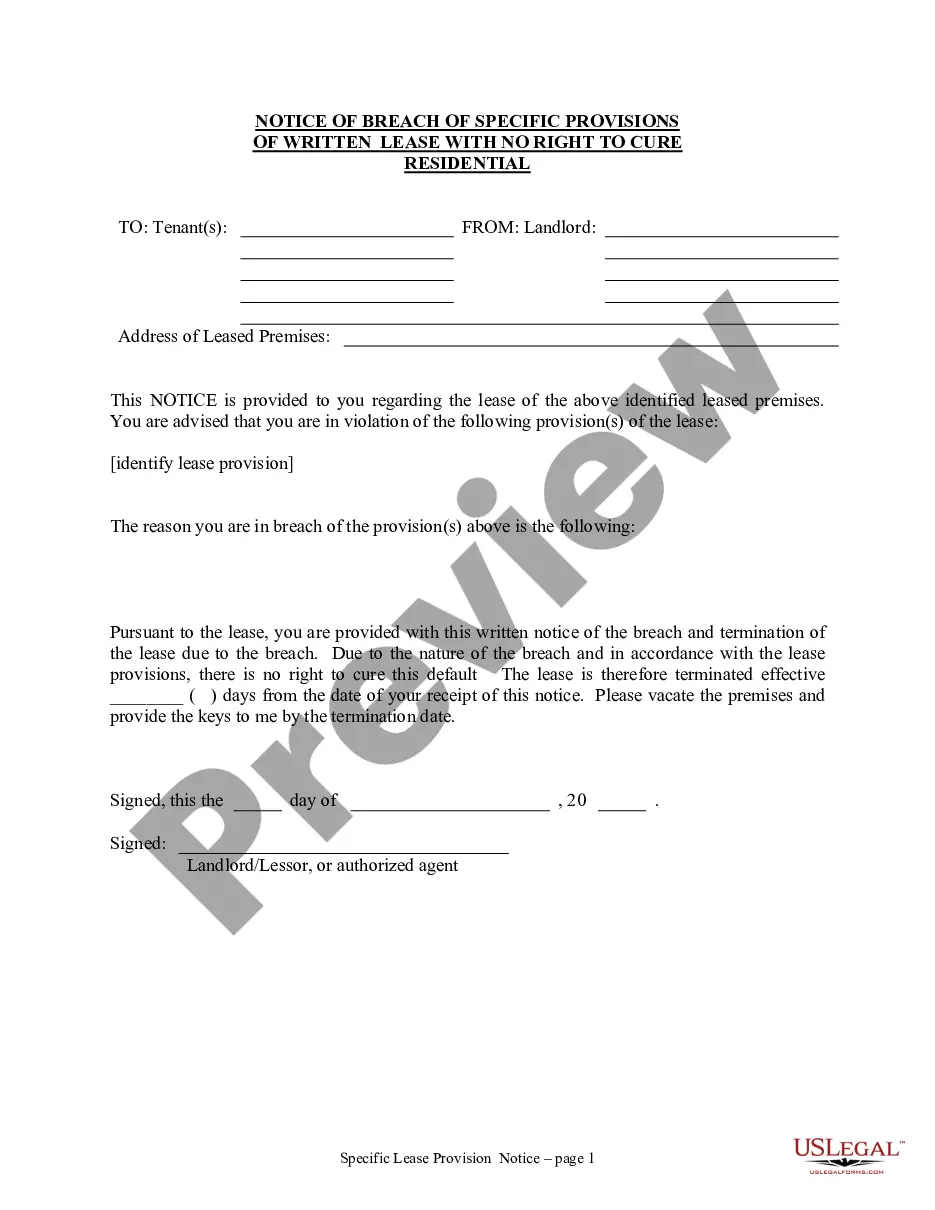

How to fill out Virginia Sample Letter For Tax Exemption - Discussion Of Office Equipment Qualifying For Tax Exemption?

Discovering the right lawful papers web template can be a struggle. Naturally, there are tons of layouts available on the net, but how do you discover the lawful develop you will need? Take advantage of the US Legal Forms web site. The services provides a large number of layouts, such as the Virginia Sample Letter for Tax Exemption - Discussion of Office Equipment Qualifying for Tax Exemption, which can be used for company and private requires. Every one of the types are checked by pros and meet up with state and federal needs.

If you are previously signed up, log in in your profile and then click the Obtain option to have the Virginia Sample Letter for Tax Exemption - Discussion of Office Equipment Qualifying for Tax Exemption. Make use of profile to look from the lawful types you might have bought earlier. Visit the My Forms tab of the profile and get an additional version of your papers you will need.

If you are a new user of US Legal Forms, allow me to share easy guidelines that you should comply with:

- First, make certain you have selected the correct develop for your area/county. You are able to look over the form making use of the Preview option and read the form description to make sure this is basically the right one for you.

- When the develop fails to meet up with your needs, make use of the Seach area to find the correct develop.

- When you are sure that the form is suitable, select the Acquire now option to have the develop.

- Pick the costs prepare you want and type in the needed details. Design your profile and purchase the order making use of your PayPal profile or Visa or Mastercard.

- Pick the submit formatting and down load the lawful papers web template in your product.

- Complete, change and produce and indicator the attained Virginia Sample Letter for Tax Exemption - Discussion of Office Equipment Qualifying for Tax Exemption.

US Legal Forms is the largest library of lawful types where you will find a variety of papers layouts. Take advantage of the service to down load skillfully-manufactured papers that comply with state needs.

Form popularity

FAQ

You could only claim an exemption for yourself if no one else could claim you as a dependent on their tax return. In addition to claiming a personal exemption, you could also take the standard deduction if you weren't itemizing your deductions.

Virginia Code § 58.1-609.3 2 iii provides an exemption from the retail sales and use tax for "machinery or tools or repair parts therefor or replacements thereof, fuel power, energy, or supplies, used directly in processing, manufacturing, refining, mining or converting products for sale or resale ...." [Emphasis added ...

How does an organization apply for a Virginia retail sales and use tax exemption? Go to Nonprofit Online, or complete Form NP-1 and submit it to Virginia Tax, Nonprofit Exemption Unit, P. O. Box 715, Richmond, Virginia 23218-0715.

Virginia allows an exemption of $930* for each of the following: Yourself (and Spouse): Each filer is allowed one personal exemption. For married couples, each spouse is entitled to an exemption. When using the Spouse Tax Adjustment, each spouse must claim his or her own personal exemption.

Things sold to federal or state governments, or their political subdivisions, are not subject to sales tax. The exemption doesn't apply to property purchased by the Commonwealth of Virginia, then transferred to a private business.

Industrial materials sold to make things, or parts of things, that will be sold to someone else are not subject to sales tax. Machinery, tools, fuel, and supplies used to make things out of these industrial materials are also exempt from sales tax.

Age 65 or over: Each filer who is age 65 or over by January 1 may claim an additional exemption. When a married couple uses the Spouse Tax Adjustment, each spouse must claim his or her own age exemption. Blindness: Each filer who is considered blind for federal income tax purposes may claim an additional exemption.

Owner/Applicant must be at least 65 or permanently disabled as of December 31 of the previous year. Sworn affidavits from two medical doctors licensed in Virginia or two military officers who practice medicine in the United States Armed Forces - use the Tax Relief Affidavit of Disability (PDF) for their completion.