South Dakota Lease of Showroom

Description

How to fill out Lease Of Showroom?

You may spend several hours online attempting to discover the proper legal template that meets the federal and state requirements you desire.

US Legal Forms offers thousands of legal documents that are reviewed by experts.

You can conveniently obtain or print the South Dakota Lease of Showroom from this service.

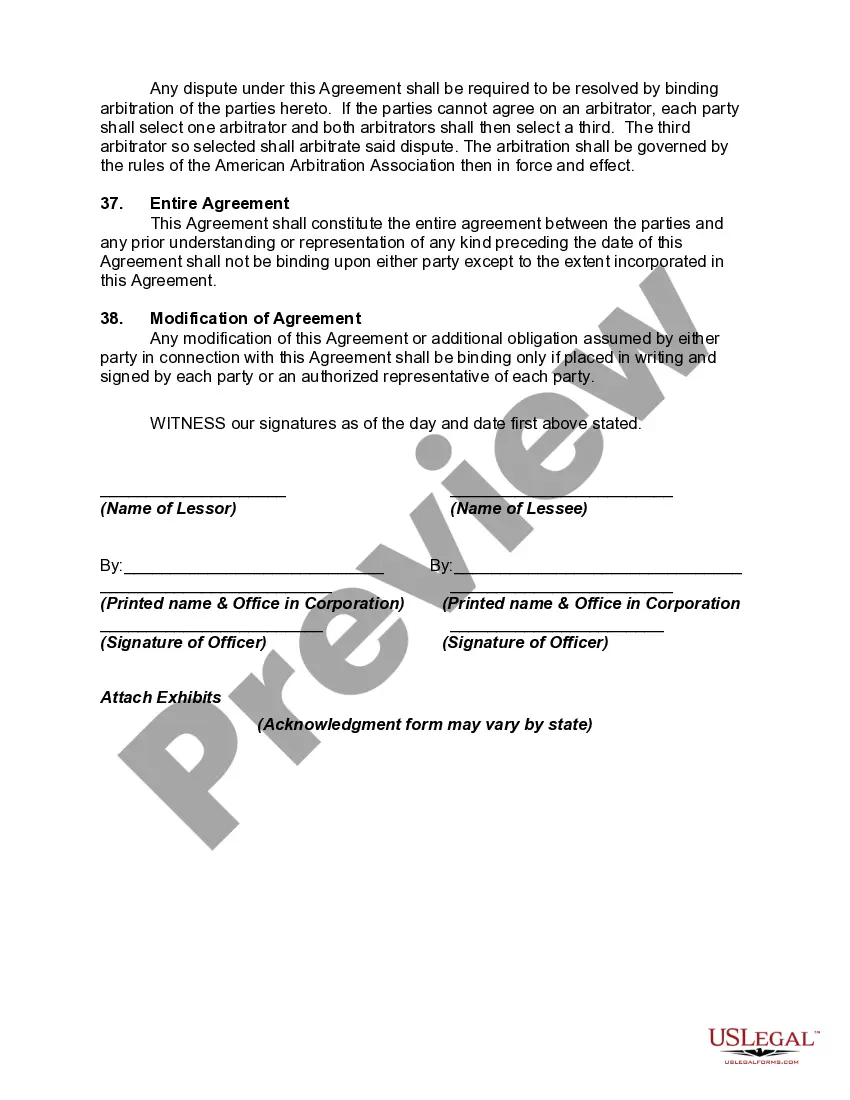

If available, utilize the Preview button to view the template simultaneously.

- If you already possess a US Legal Forms account, you can sign in and click the Download button.

- Afterward, you can complete, edit, print, or sign the South Dakota Lease of Showroom.

- Every legal document you download is yours permanently.

- To obtain another version of a previously acquired form, navigate to the My documents section and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure that you have selected the correct format for the county/city of your choice.

- Review the form details to confirm that you have chosen the appropriate document.

Form popularity

FAQ

To get out of a lease early in South Dakota, first, review your South Dakota Lease of Showroom for any early termination clauses. You may also consider discussing your circumstances with your landlord to negotiate an amicable solution. Subletting or finding a replacement tenant are common strategies that can help you exit your lease without penalties. If you need further assistance, platforms like USLegalForms provide valuable resources to navigate your lease agreements efficiently.

Breaking a lease can potentially affect your credit score, especially if your landlord takes legal action or sends your debt to collections. However, if you handle the situation appropriately, using the guidance of a South Dakota Lease of Showroom can minimize these effects. It is essential to review the lease terms and possibly negotiate your exit with your landlord. Taking proactive steps can help protect your credit while you transition out of your lease.

Exiting a lease in South Dakota requires careful adherence to the lease terms and state laws. Typically, you may need to provide written notice, and if applicable, fulfill any obligations to mitigate damages. If you find yourself negotiating a South Dakota Lease of Showroom, consulting legal resources such as US Legal Forms can help you navigate the process effectively.

In South Dakota, rent is generally not subject to sales tax unless it pertains to certain types of leases involving tangible personal property. This factor is essential to consider when entering into a South Dakota Lease of Showroom, as it can affect your budgeting and financial strategy. For accurate compliance with tax laws, resources like US Legal Forms can provide guidance and templates.

South Dakota has a uniquely simple tax structure that excludes several taxes many other states impose. Notably, there is no individual income tax, which can be advantageous for business owners and their employees. Understanding these tax benefits is essential when entering into a South Dakota Lease of Showroom, as it may impact your financial planning.

Operating a business in South Dakota offers various benefits, such as a favorable tax climate and lower overhead costs. Entrepreneurs often appreciate the absence of a corporate income tax, which can significantly enhance profitability. If you're considering a South Dakota Lease of Showroom, these advantages can contribute to the overall success of your business.

Yes, South Dakota does have a business personal property tax. However, this tax structure is quite favorable, as many types of personal property can be exempt or assessed at lower rates compared to other states. When dealing with a South Dakota Lease of Showroom, it's crucial to understand how this tax may impact your overall operating costs.

In South Dakota, certain individuals and organizations can be exempt from sales tax, including nonprofit entities, certain government purchases, and items used in manufacturing. For a thorough understanding, review the South Dakota Department of Revenue guidelines or seek advice regarding your situation. If you lease a South Dakota Lease of Showroom, ensure you are aware of these exemptions to maximize your business's financial efficiency.

Exemptions from all taxes generally apply to specific entities, such as government organizations, certain nonprofit institutions, and specific educational institutions in South Dakota. These entities must meet specific criteria outlined in South Dakota tax law. If you believe your business fits these criteria, seeking legal advice can help clarify your eligibility. Additionally, understanding your tax obligations is crucial if you are involved with a South Dakota Lease of Showroom.

Leasing commercial properties in South Dakota involves several key steps. First, identify the right location for your business needs, such as a South Dakota Lease of Showroom. Next, negotiate the terms of your lease with the property owner or manager. Don't forget to review the lease agreement thoroughly before signing, as this document outlines your rights and obligations.