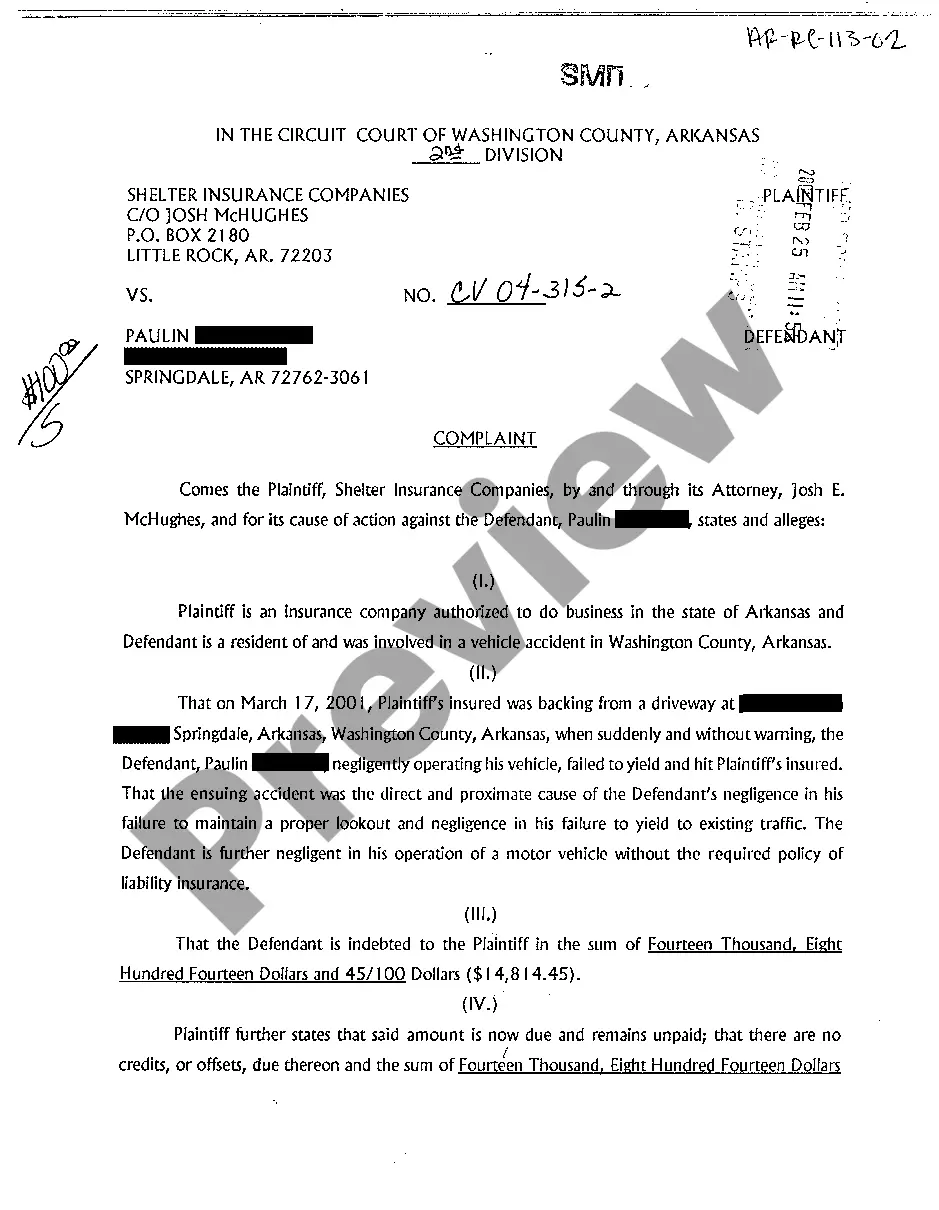

Virginia Letter to Foreclosure Attorney - After Foreclosure - Did not Receive Notice of

Description

How to fill out Letter To Foreclosure Attorney - After Foreclosure - Did Not Receive Notice Of?

You can devote several hours on the web attempting to find the authorized papers web template which fits the federal and state demands you want. US Legal Forms offers a huge number of authorized varieties which can be analyzed by pros. You can easily obtain or produce the Virginia Letter to Foreclosure Attorney - After Foreclosure - Did not Receive Notice of from your support.

If you already possess a US Legal Forms bank account, you can log in and then click the Acquire option. Afterward, you can full, edit, produce, or indicator the Virginia Letter to Foreclosure Attorney - After Foreclosure - Did not Receive Notice of. Each authorized papers web template you buy is your own eternally. To acquire yet another duplicate associated with a acquired develop, proceed to the My Forms tab and then click the corresponding option.

If you are using the US Legal Forms web site initially, adhere to the easy instructions beneath:

- Very first, ensure that you have selected the correct papers web template for the state/city of your liking. Browse the develop explanation to make sure you have picked the appropriate develop. If readily available, utilize the Review option to look through the papers web template at the same time.

- If you wish to locate yet another model from the develop, utilize the Research area to discover the web template that meets your needs and demands.

- After you have located the web template you would like, just click Buy now to continue.

- Select the rates strategy you would like, type in your accreditations, and sign up for a free account on US Legal Forms.

- Comprehensive the transaction. You may use your bank card or PayPal bank account to purchase the authorized develop.

- Select the structure from the papers and obtain it to the device.

- Make adjustments to the papers if necessary. You can full, edit and indicator and produce Virginia Letter to Foreclosure Attorney - After Foreclosure - Did not Receive Notice of.

Acquire and produce a huge number of papers themes while using US Legal Forms website, that provides the largest variety of authorized varieties. Use skilled and status-particular themes to handle your company or individual needs.

Form popularity

FAQ

Some states have a law that gives a foreclosed homeowner time after the foreclosure sale to redeem the property. Virginia, however, doesn't have a law providing a post-sale redemption period. So, you won't be able to redeem the home following a foreclosure.

STRATEGIES FOR KEEPING YOUR PROPERTY AND STOPPING FORECLOSURE REINSTATE YOUR MORTGAGE ? ... REFINANCE ? ... REPAYMENT PLAN ? ... FORBEARANCE ? ... LOAN MODIFICATION ? ... BANKRUPTCY (Chapter 13) ? ... SELL THE PROPERTY ? ... SHORT SALE ?

Conventional loan (3?7 years) ? After a foreclosure, it can take you as long as seven years to get a conventional loan (one that mortgage market-makers like Fannie Mae or Freddie Mac will buy).

VA Loan Foreclosure Waiting Period Generally, Veterans must wait two years after a foreclosure event to reapply for a VA loan. This period is a mandatory cooling-off phase to ensure that the borrower has regained financial stability. While two years may sound like a long time, it's better than some alternatives.

Many Virginia deeds of trust have a provision that requires the lender to send a notice, commonly called a "breach letter," informing you that the loan is in default before the lender can accelerate the loan. The breach letter gives you a chance to cure the default and avoid foreclosure.

When You Have to Move Out After a Virginia Foreclosure. After a Virginia nonjudicial foreclosure, the purchaser that bought the home at the foreclosure sale may start a separate unlawful detainer (eviction) action. The foreclosed homeowner might get a five-day notice to quit (leave).

Under Virginia law, foreclosures are done outside of court. Virginia is a non-judicial state therefore the Trustee simply sells your property, usually at a public auction to the highest bidder. Before doing this, the Trustee must follow the rules set forth in your Deed of Trust.

Under Virginia law, foreclosures are done outside of court. Virginia is a non-judicial state therefore the Trustee simply sells your property, usually at a public auction to the highest bidder. Before doing this, the Trustee must follow the rules set forth in your Deed of Trust.

In Virginia, the applicable statute of limitations for credit card debts, mortgage debts, and medical debts is five years. After the statute of limitations has expired, a creditor or debt collector can no longer file a collection lawsuit related to that debt.