Virginia Prepayment Agreement

Description

How to fill out Prepayment Agreement?

It is possible to commit time on the Internet attempting to find the lawful papers web template which fits the federal and state demands you will need. US Legal Forms gives a large number of lawful forms which can be reviewed by pros. You can actually obtain or print out the Virginia Prepayment Agreement from our service.

If you currently have a US Legal Forms accounts, you can log in and click the Acquire option. After that, you can total, edit, print out, or indicator the Virginia Prepayment Agreement. Every lawful papers web template you acquire is yours for a long time. To acquire another duplicate for any bought develop, go to the My Forms tab and click the related option.

If you are using the US Legal Forms site the first time, adhere to the simple directions below:

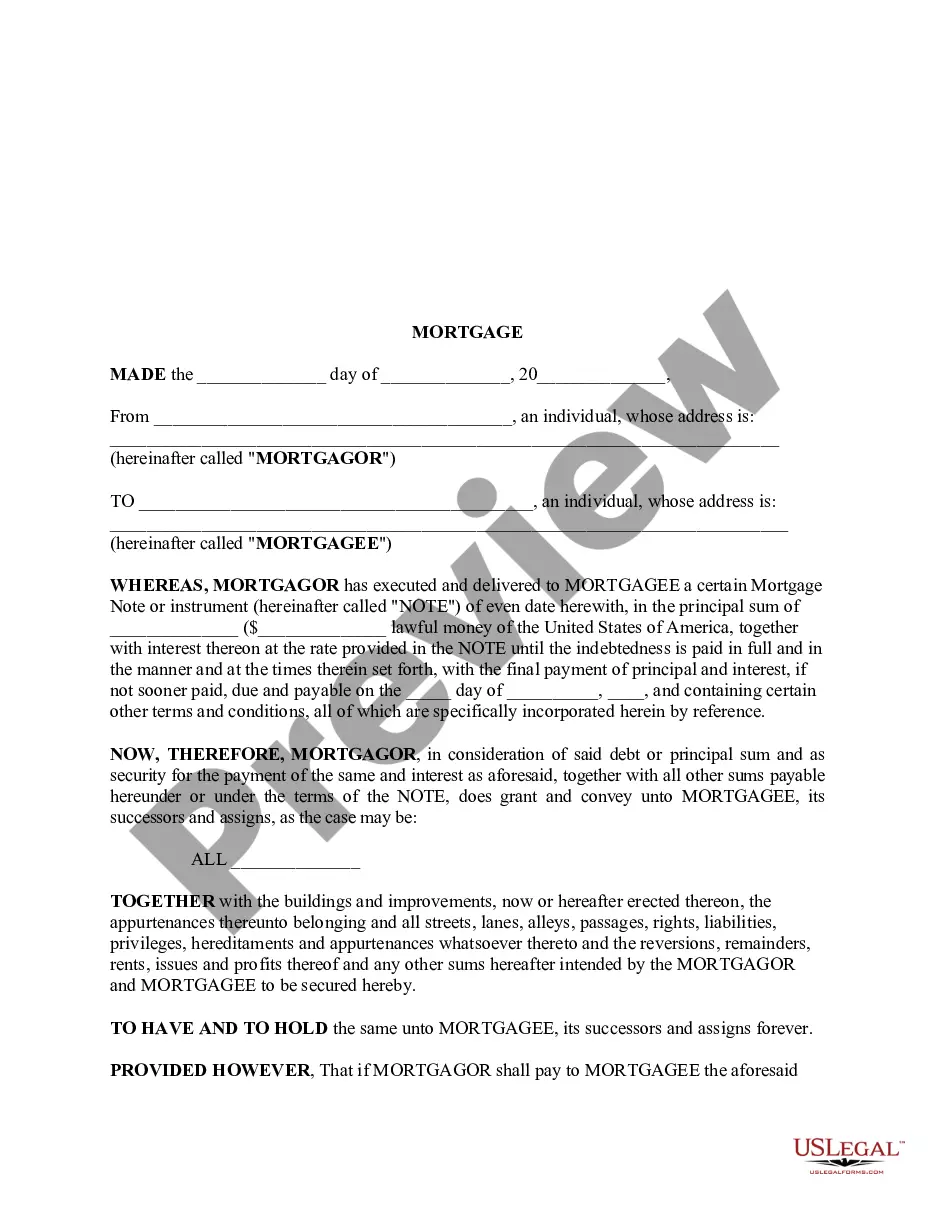

- Very first, ensure that you have chosen the best papers web template to the area/city that you pick. Browse the develop explanation to make sure you have picked out the appropriate develop. If available, use the Review option to search through the papers web template at the same time.

- If you want to get another edition of the develop, use the Search discipline to discover the web template that fits your needs and demands.

- After you have identified the web template you would like, just click Buy now to proceed.

- Select the rates prepare you would like, key in your credentials, and sign up for an account on US Legal Forms.

- Complete the purchase. You can utilize your Visa or Mastercard or PayPal accounts to purchase the lawful develop.

- Select the file format of the papers and obtain it for your system.

- Make adjustments for your papers if needed. It is possible to total, edit and indicator and print out Virginia Prepayment Agreement.

Acquire and print out a large number of papers layouts using the US Legal Forms Internet site, that offers the largest variety of lawful forms. Use expert and condition-specific layouts to deal with your business or person requires.

Form popularity

FAQ

VA loans have no prepayment penalties. You can pay off your mortgage early or make additional payments without fear of being penalized financially.

Eleven states generally prohibit prepayment penalties on residential first mortgages. These include Alabama, Alaska, Illinois (if the interest rate is over 8%), Iowa, New Jersey, New Mexico, North Carolina (under $100,000), Pennsylvania (under $50,000), South Carolina (under $100,000), Texas, and Vermont.

Fortunately, prepayment penalties are less common than they were years ago. The Dodd-Frank Act prohibits most prepayment penalties for current residential home loans, but they're still allowed for loans that were executed before Jan.

Yes, you can try negotiating it down, but the best way to avoid the fee altogether is to switch to a different loan or a different lender. Since not all lenders charge the same prepayment penalty, make sure to get quotes from different lenders to find the best loan for you.

Lenders charge these fees in order to dissuade borrowers from paying off or refinancing their mortgages, which would cause the lender to lose out on interest income. Federal law prohibits prepayment penalties for many types of home loans, including FHA and USDA loans, as well as student loans.

The prepayment penalty in the case of a loan secured by a mortgage or deed of trust on a home that is occupied or to be occupied in whole or in part by a borrower shall not exceed two percent of the amount of such prepayment.

For many kinds of new mortgages, the lender can't charge a prepayment penalty?a charge for paying off your mortgage early. If your lender can charge a prepayment penalty, it can only do so for the first three years of your loan and the amount of the penalty is capped.