Virginia Security Agreement involving Sale of Collateral by Debtor

Description

How to fill out Security Agreement Involving Sale Of Collateral By Debtor?

If you need to finish, obtain, or print sanctioned document templates, utilize US Legal Forms, the top collection of legal forms, which can be accessed online.

Employ the site's straightforward and user-friendly search to locate the documentation you need.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Step 3. If you are dissatisfied with the document, utilize the Search area at the top of the screen to find other types of the legal document template.

Step 4. When you have found the form you need, click the Download now button. Choose your preferred payment plan and enter your details to register for your account.

- Use US Legal Forms to locate the Virginia Security Agreement related to Sale of Collateral by Debtor with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the Virginia Security Agreement related to Sale of Collateral by Debtor.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, refer to the following instructions.

- Step 1. Ensure you have selected the form for the appropriate city/state.

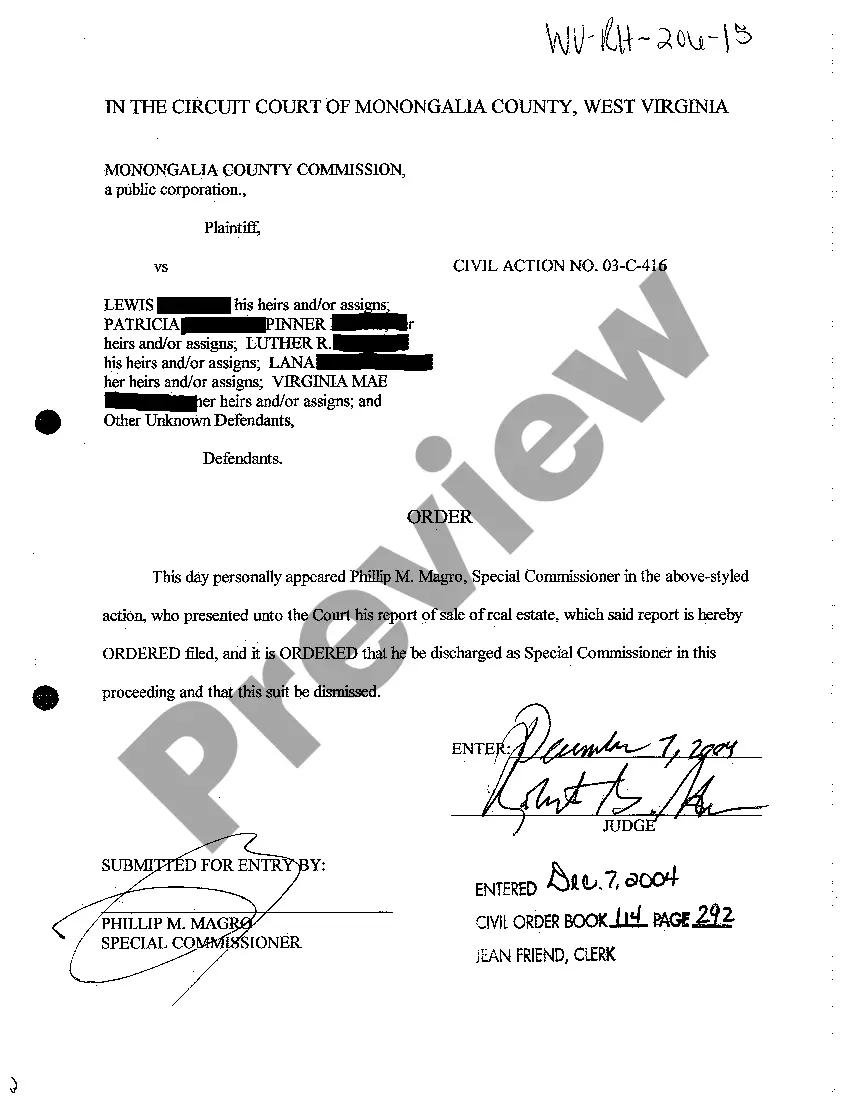

- Step 2. Use the Preview option to review the form's content. Don't forget to read the description.

Form popularity

FAQ

The purpose of a Virginia Security Agreement involving Sale of Collateral by Debtor is to establish a legal framework that protects the lender's interests. This agreement outlines the terms under which the debtor can sell specific collateral while ensuring that the lender retains a claim to that property. By implementing this agreement, both parties can navigate financial transactions with clarity and confidence. It helps to prevent disputes and ensures that all parties understand their rights and responsibilities.

Creating a security contract involves outlining the terms in a Virginia Security Agreement involving Sale of Collateral by Debtor, which describes the roles, responsibilities, and collateral involved. You can simplify this process by using templates from reputable platforms like US Legal Forms, ensuring you cover all necessary legal requirements and protect your interests effectively. Remember, clarity is key to minimizing misunderstandings later.

The description of collateral in a Virginia Security Agreement involving Sale of Collateral by Debtor should be clear and detailed. This may include specific assets, such as equipment, inventory, or receivables, that the debtor agrees to provide as security. Accurate descriptions help protect the lender’s interests and ensure that both parties understand what is at stake in the agreement.

In a Virginia Security Agreement involving Sale of Collateral by Debtor, the debtor is the party that borrows or receives funding, providing collateral to secure their obligations. This collateral acts as a form of insurance for the lender. Understanding the role of the debtor is crucial, as it determines both their responsibilities and rights within the agreement.

Generally, a Virginia Security Agreement involving Sale of Collateral by Debtor does not need to be notarized to be valid. However, having it notarized adds an extra layer of authenticity and can be helpful in case of disputes. It’s wise to consult state laws or legal experts to ensure compliance with local regulations.

To create a Virginia Security Agreement involving Sale of Collateral by Debtor, you should start by identifying all parties involved, including the debtor and the secured party. Clearly define the collateral to be secured, as this will be essential for the document. You can draft the agreement yourself or use templates available on platforms like US Legal Forms, which simplifies the process significantly.

To make a security interest enforceable under the Virginia Security Agreement involving Sale of Collateral by Debtor, several steps must occur. First, the debtor must grant a security interest to the lender, which needs to be properly documented in a written agreement. Next, the lender must ensure that they have possession of the collateral or file a financing statement with the appropriate authority. This process secures the lender's rights and makes the security interest legally recognized, thus providing clarity and protection for both parties involved.

To create a security agreement, you should start by identifying the collateral you wish to pledge and drafting the terms of the agreement. The document should outline the rights and responsibilities of each party involved, ensuring all relevant details are included. Using platforms like uslegalforms can simplify this process, providing templates that help craft a strong Virginia Security Agreement involving Sale of Collateral by Debtor.

A security agreement is a contract that defines the terms between a lender and a borrower regarding collateral. Meanwhile, a UCC filing is a public record that provides notice of the lender's interest in the collateral. By implementing a Virginia Security Agreement involving Sale of Collateral by Debtor and properly filing with the UCC, the lender secures their rights and protects against claims from other creditors.

No, a security agreement is not the same as a lien, although they are closely related concepts. A security agreement establishes a legal framework between the lender and the borrower, allowing the lender to claim specific collateral. A lien, on the other hand, is a legal right or interest that a lender has in the debtor's property until the debt obligation is satisfied.