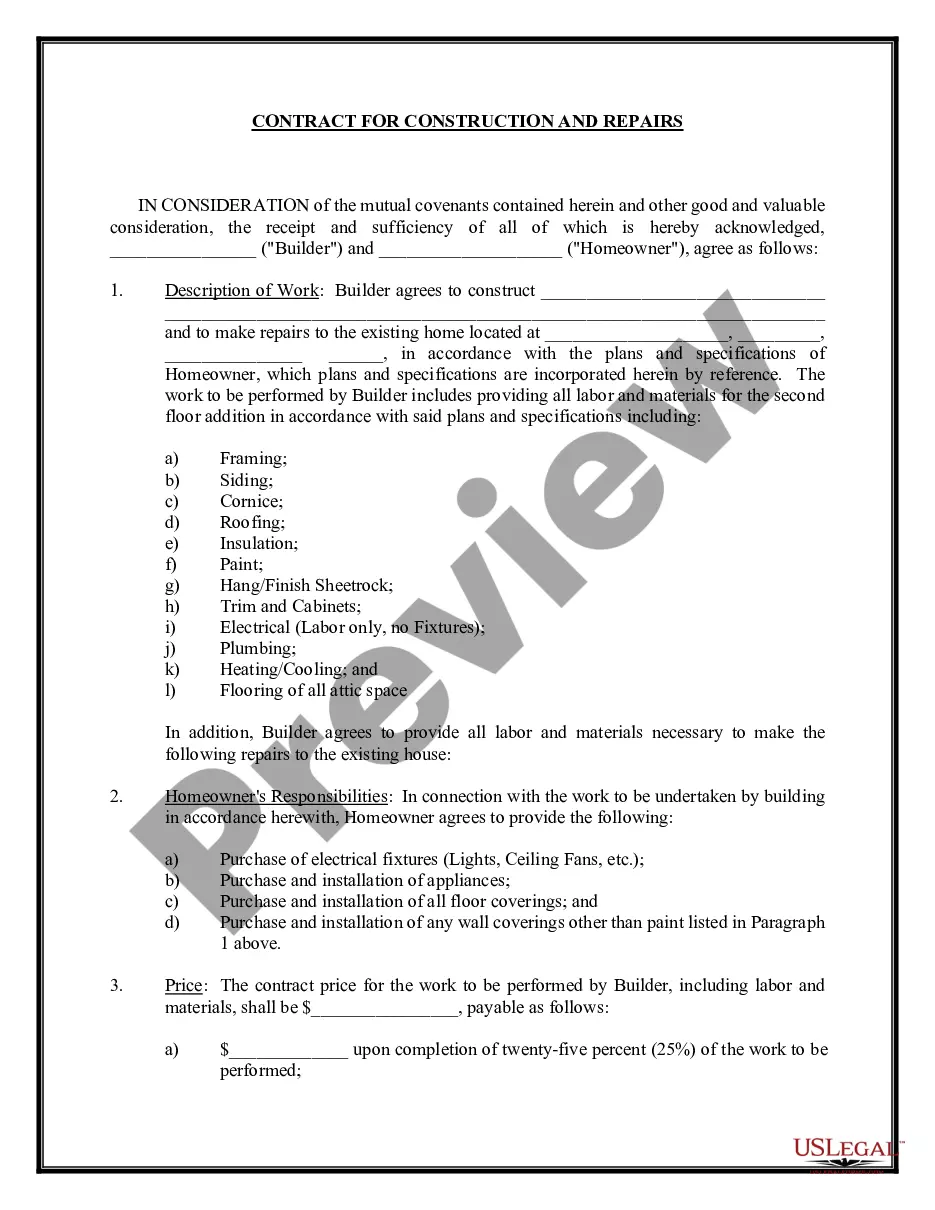

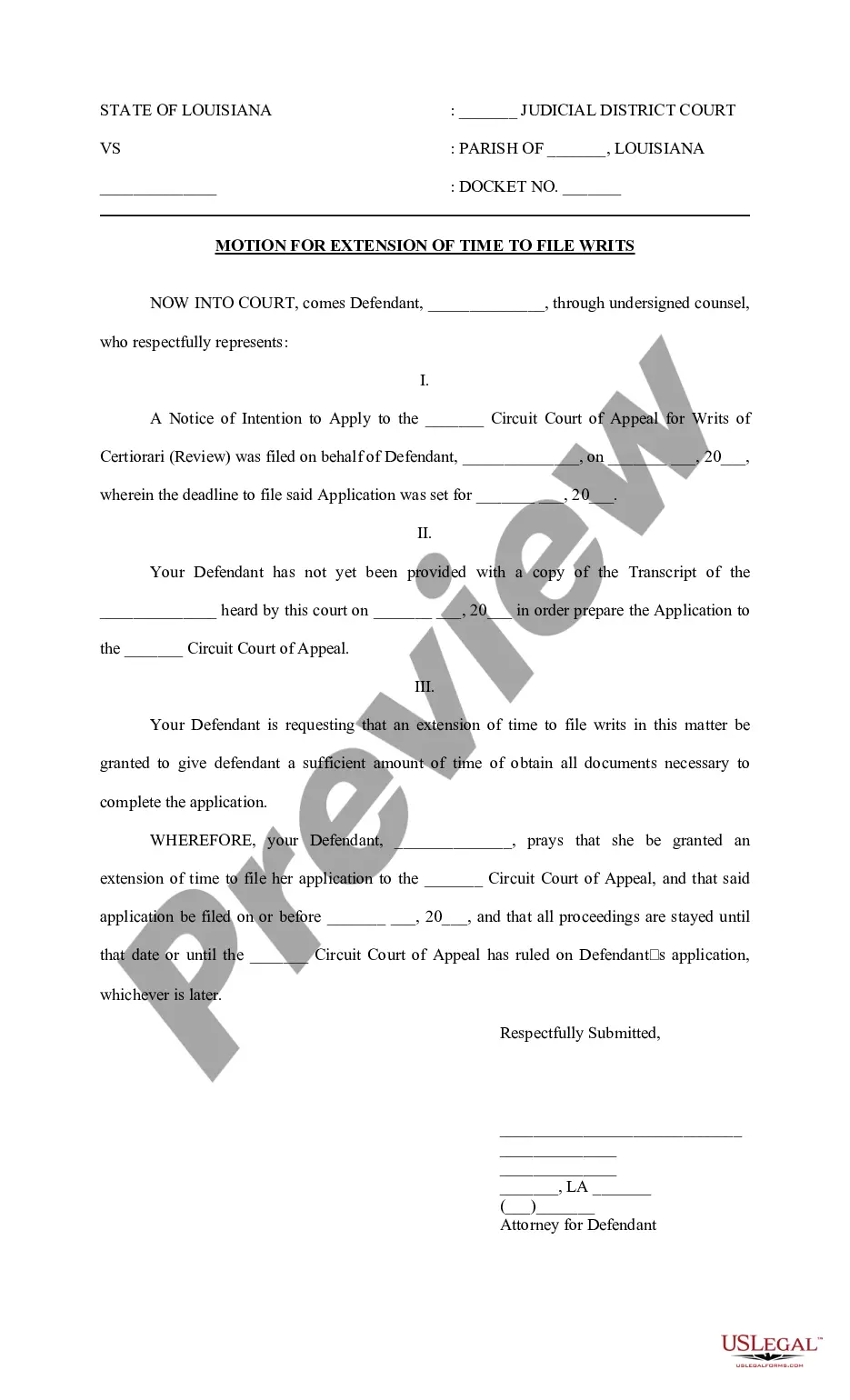

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Virginia Installment Promissory Note with Acceleration Clause and Collection Fees

Description

How to fill out Installment Promissory Note With Acceleration Clause And Collection Fees?

US Legal Forms - one of the largest collections of legal documents in the USA - offers a wide selection of legal form templates that you can download or print.

On the website, you can find numerous forms for both commercial and personal applications, categorized by types, claims, or keywords.

You can access the latest forms like the Virginia Installment Promissory Note with Acceleration Clause and Collection Fees within moments.

If the form does not fulfill your needs, use the Search field at the top of the screen to find one that does.

Once you are satisfied with the form, confirm your choice by clicking the Buy now button. Then, select the pricing plan you prefer and provide your details to register for the account.

- If you already possess a membership, Log In and retrieve the Virginia Installment Promissory Note with Acceleration Clause and Collection Fees from the US Legal Forms library.

- The Download button will be visible on every form you encounter.

- You can access all previously downloaded forms in the My documents section of your account.

- If you are using US Legal Forms for the first time, here are simple instructions to get started.

- Ensure you have selected the correct form for your local area/region.

- Review the form's information by clicking the Review button.

Form popularity

FAQ

To accurately fill out a promissory note, start with the title and provide the date you are signing the document. Next, include the names of both the borrower and lender, followed by the amount borrowed and the interest rate. Additionally, with a Virginia Installment Promissory Note with Acceleration Clause and Collection Fees, make sure to describe the repayment schedule and any associated fees for late payments. Using a platform like uslegalforms can simplify this process by offering templates tailored to your needs.

Yes, you can demand a promissory note if you are a lender and proper terms were outlined in the agreement. This is particularly relevant when utilizing a Virginia Installment Promissory Note with Acceleration Clause and Collection Fees, as it allows you to initiate collections when necessary. It is essential to follow the legal requirements to ensure a smooth collection process. If you're uncertain about how to proceed, consult US Legal Forms to access templates that simplify demands for payment.

To legally enforce a promissory note, the lender must present the note if the borrower defaults. This often involves initiating legal proceedings in court, where the lender can pursue repayment. A Virginia Installment Promissory Note with Acceleration Clause and Collection Fees gives the lender an added advantage, as it may simplify recovery efforts. For those who need help with enforcement procedures, US Legal Forms offers practical resources and templates to guide you through the legal steps.

Acceleration in a promissory note refers to the lender's right to demand the total remaining balance due if the borrower defaults on payments or breaches other terms. In a Virginia Installment Promissory Note with Acceleration Clause and Collection Fees, this clause protects the lender's interests by allowing them to collect the owed sum promptly. Understanding this clause can help both parties clarify the consequences of non-payment. Utilizing resources from US Legal Forms can provide you with templates that clearly specify these terms.

In Virginia, a valid promissory note must include specific elements such as a written document, clear terms of repayment, and a signature from the borrower. It should specify the amount borrowed, the interest rate, and the due date. Particularly for a Virginia Installment Promissory Note with Acceleration Clause and Collection Fees, it is crucial to outline any conditions that might trigger acceleration of payment. You can easily create a customized promissory note using US Legal Forms, which simplifies the process.

To accelerate a promissory note, you must invoke the acceleration clause as outlined in the agreement after identifying a triggering event, such as payment default. This process is crucial within a Virginia Installment Promissory Note with Acceleration Clause and Collection Fees. Both parties should discuss these scenarios upfront to establish clear expectations.

Yes, many mortgages include an acceleration clause, enabling lenders to demand full payment if the borrower defaults. This clause is essential in protecting the lender’s investment and is often found in a Virginia Installment Promissory Note with Acceleration Clause and Collection Fees. Borrowers should be aware of these terms to understand their responsibilities.

An acceleration clause functions by triggering an immediate payment requirement if certain conditions are met, such as the borrower defaulting. Upon activation, the lender can demand full payment of the outstanding balance stated in the Virginia Installment Promissory Note with Acceleration Clause and Collection Fees. Understanding this mechanism helps both parties manage their obligations effectively.

You can accelerate a promissory note by including an acceleration clause that allows the lender to demand full payment upon certain conditions, typically in the event of a default. When both parties agree, this clause should be explicitly stated in your Virginia Installment Promissory Note with Acceleration Clause and Collection Fees. Properly drafting the clause can help protect your interests.

To create a Virginia Installment Promissory Note with Acceleration Clause and Collection Fees, you need basic information such as the borrower's name, address, and the amount being borrowed. Additionally, include repayment terms, interest rates, and the signatures of both parties. Ensuring all details are clear helps avoid future misunderstandings.