Virginia Sample Letter for Binding First Security Interest

Description

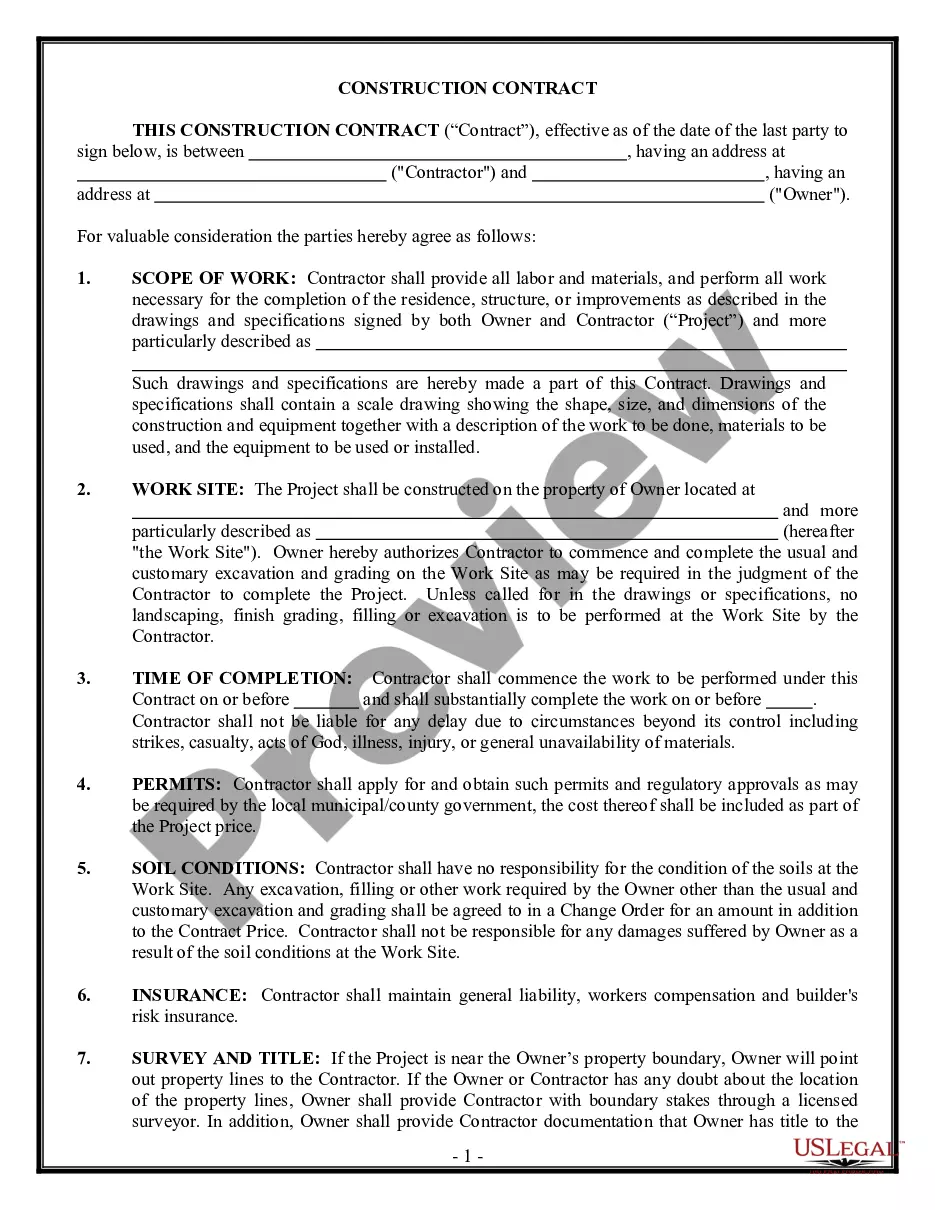

How to fill out Sample Letter For Binding First Security Interest?

It is feasible to spend numerous hours online attempting to discover the authentic document template that satisfies the state and federal requirements you require.

US Legal Forms offers a vast array of legal forms that are reviewed by professionals.

You can effortlessly download or print the Virginia Sample Letter for Binding First Security Interest from our platform.

If you wish to find another version of your form, utilize the Search field to locate the template that meets your needs and requirements. Once you have found the template you want, click on Get now to proceed. Select the pricing plan you prefer, enter your details, and register for a free account on US Legal Forms. Complete the transaction. You can use your Visa or Mastercard or PayPal account to purchase the legal form. Choose the format of your document and download it to your device. Make adjustments to your document if necessary. You can complete, modify, sign, and print the Virginia Sample Letter for Binding First Security Interest. Obtain and print a vast number of document templates using the US Legal Forms website, which provides the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you already possess a US Legal Forms account, you can Log In and click the Acquire button.

- After that, you can complete, modify, print, or sign the Virginia Sample Letter for Binding First Security Interest.

- Every legal document template you obtain is yours permanently.

- To obtain another copy of the downloaded form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions provided below.

- First, ensure that you have selected the appropriate document template for the region/town that you choose.

- Review the form description to confirm you have selected the correct form.

- If available, use the Review button to preview the document template as well.

Form popularity

FAQ

A perfected security interest is any secure interest in an asset that cannot be claimed by any other party. The interest is perfected by registering it with the appropriate statutory authority, so that it is made legally enforceable and any subsequent claim on that asset is given a junior status.

Perfection: The process by which secured parties protect their security interests in collateral against the claims of third parties who may look to the same collateral to satisfy the debtor's obligations to them.

In order to perfect an interest in a ?general intangible,? a creditor is required to file a UCC-1 financing statement in the state where the debtor is located. Notwithstanding the lack of a legal obligation to record a security interest at the USPTO, it remains good practice to do so.

A lender can perfect a lien on a borrower's deposit account only by obtaining "control" over the account, which requires one of the following arrangements: (1) the borrower maintains its deposit account directly with the lender; (2) the lender becomes the actual owner of the borrower's deposit accounts with the ...

A security interest in certificated securities, negotiable documents or instruments is perfected without filing or the taking of possession or control for a period of 20 days from the time it attaches to the extent that it arises for new value given under an authenticated security agreement.