Virginia Sample Letter to State Tax Commission concerning Decedent's Estate

Description

How to fill out Sample Letter To State Tax Commission Concerning Decedent's Estate?

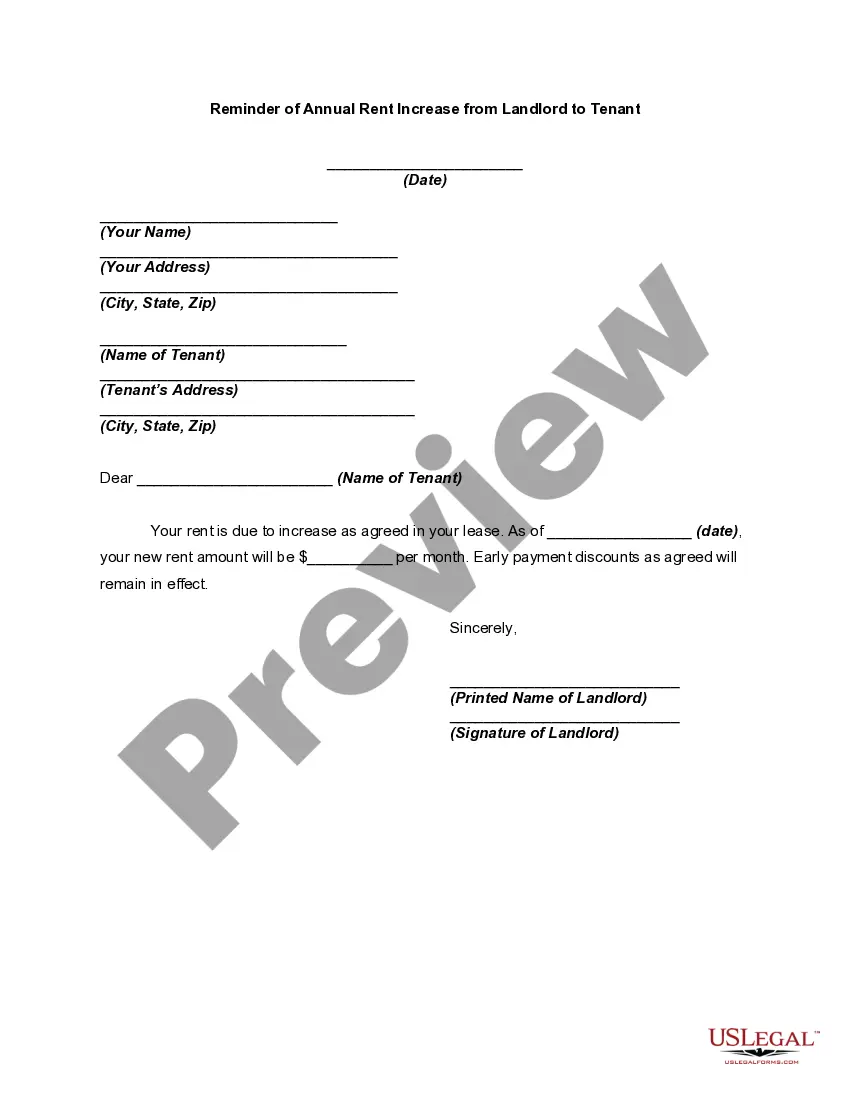

You can devote time on-line attempting to find the lawful file template that fits the federal and state specifications you require. US Legal Forms supplies 1000s of lawful types that are analyzed by specialists. It is simple to obtain or produce the Virginia Sample Letter to State Tax Commission concerning Decedent's Estate from your service.

If you already possess a US Legal Forms profile, you can log in and then click the Down load switch. Following that, you can full, edit, produce, or indication the Virginia Sample Letter to State Tax Commission concerning Decedent's Estate. Each lawful file template you buy is yours eternally. To acquire one more copy associated with a purchased form, go to the My Forms tab and then click the related switch.

If you work with the US Legal Forms internet site initially, follow the straightforward directions under:

- Initial, make certain you have selected the right file template for the region/area of your choosing. See the form explanation to ensure you have picked the proper form. If offered, use the Preview switch to appear from the file template as well.

- If you would like discover one more variation from the form, use the Look for field to discover the template that meets your requirements and specifications.

- Upon having located the template you need, simply click Purchase now to continue.

- Find the rates plan you need, type your accreditations, and register for a free account on US Legal Forms.

- Complete the deal. You can use your charge card or PayPal profile to purchase the lawful form.

- Find the structure from the file and obtain it for your gadget.

- Make changes for your file if required. You can full, edit and indication and produce Virginia Sample Letter to State Tax Commission concerning Decedent's Estate.

Down load and produce 1000s of file themes utilizing the US Legal Forms web site, that provides the largest collection of lawful types. Use professional and state-particular themes to take on your organization or person requires.

Form popularity

FAQ

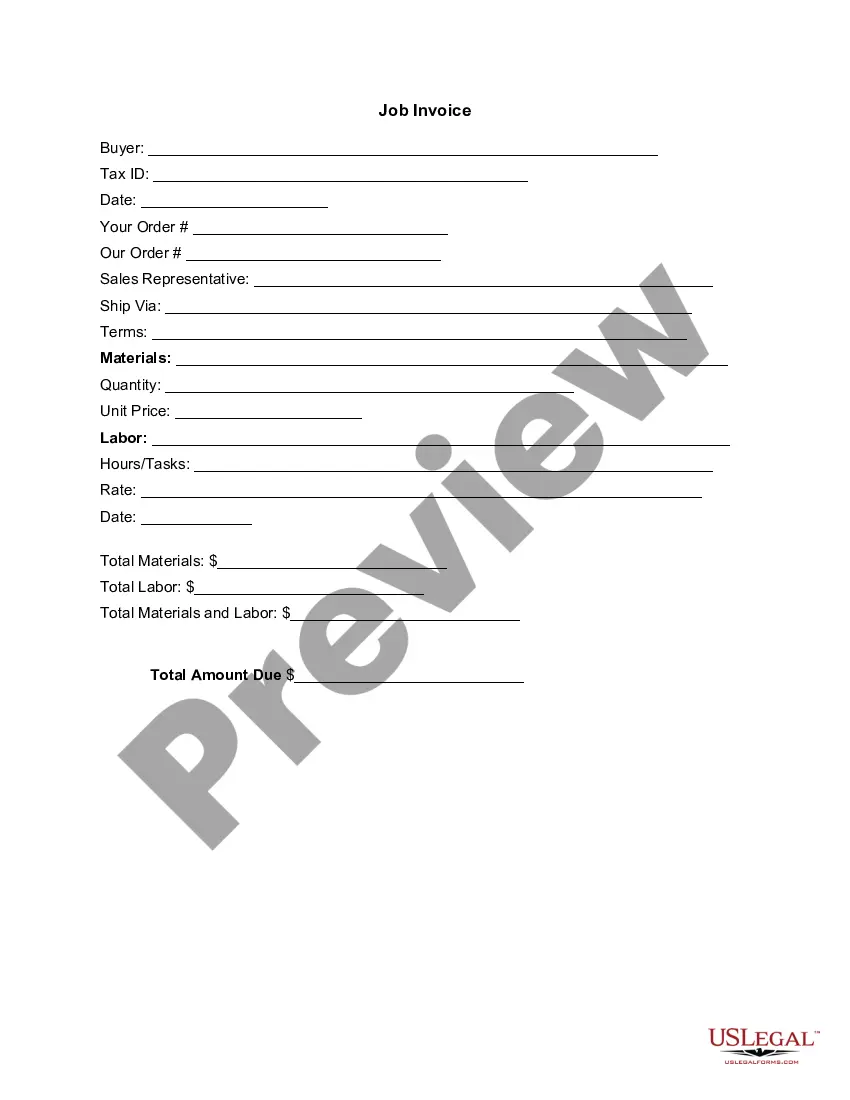

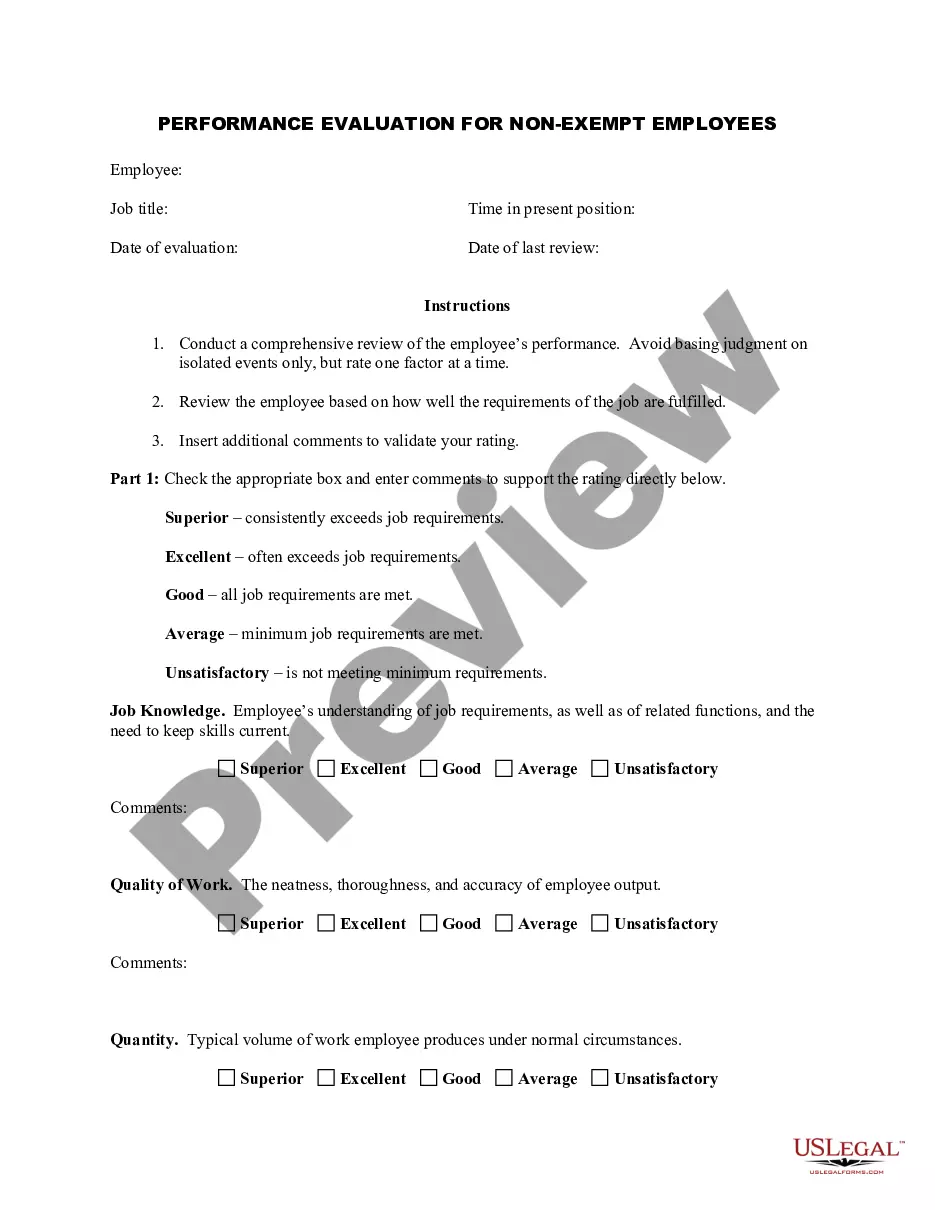

The personal representative of an estate is an executor, administrator, or anyone else in charge of the decedent's property. The personal representative is responsible for filing any final individual income tax return(s) and the estate tax return of the decedent when due.

A person can expect for the probate process in Virginia to take anywhere from six months up to a year or more.

Unless a contrary intent is clearly set out in the will, if no executor qualifies, or those qualifying die, resign, or are removed, an administrator with the will annexed has the power to sell or convey the real estate devised by the will to be sold and to receive the proceeds of sale or the rents and profits of any ...

Also, unlike most states, in Virginia there is no deadline for creditors to make claims against an estate other than the normal statute of limitations for a given debt.

Closing an Estate in Virginia In order for the Commissioner of Accounts to allow an estate to be closed, the personal representative must produce a Final Account of the estate. The Final Account must show: All assets have been distributed to the beneficiaries and the balance of the account is zero.

With a small estate affidavit, an heir can usually claim bank accounts and other estate assets much faster and at far less cost than via probate. In Virginia, this process can only be used if the estate is not worth more than $50,000 and at least 60 days have passed since the death.

This form is sent to each person named in another form the Executor or Administrator of an Estate is required to file -- the "List of Heirs." It is a form that the executor or administrator of an estate must send to everyone who would stand to receive a share of an estate under Virginia law if there had been no will.

Virginia Code § 64.2-508 (A-D) requires that a fiduciary give written notice of probate to certain individuals within 30 days of qualification. Within 4 months of qualification, a fiduciary must file an affidavit with the Probate Department confirming that said notice(s) were sent.