Virginia Deed of Gift - Single - Out of State

What is this form?

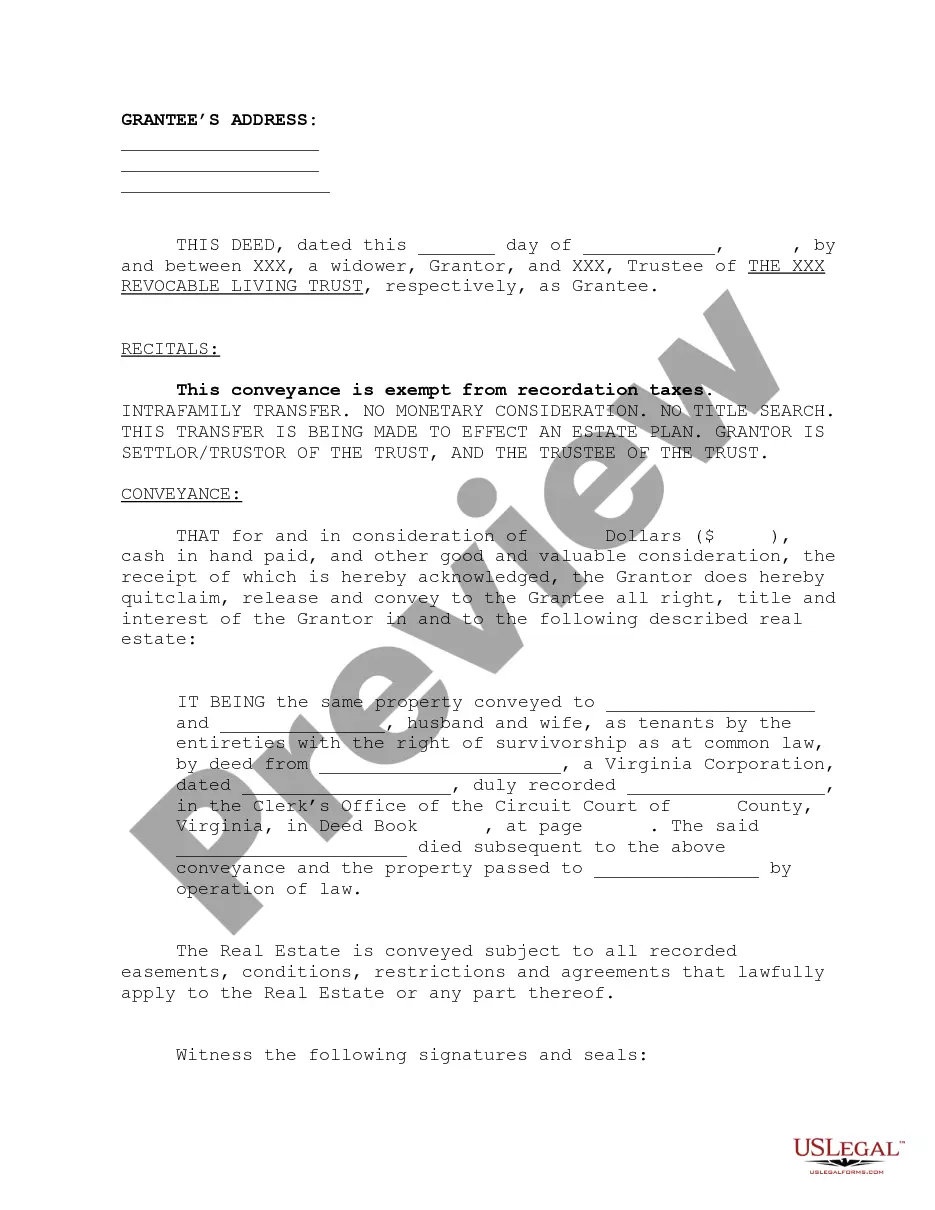

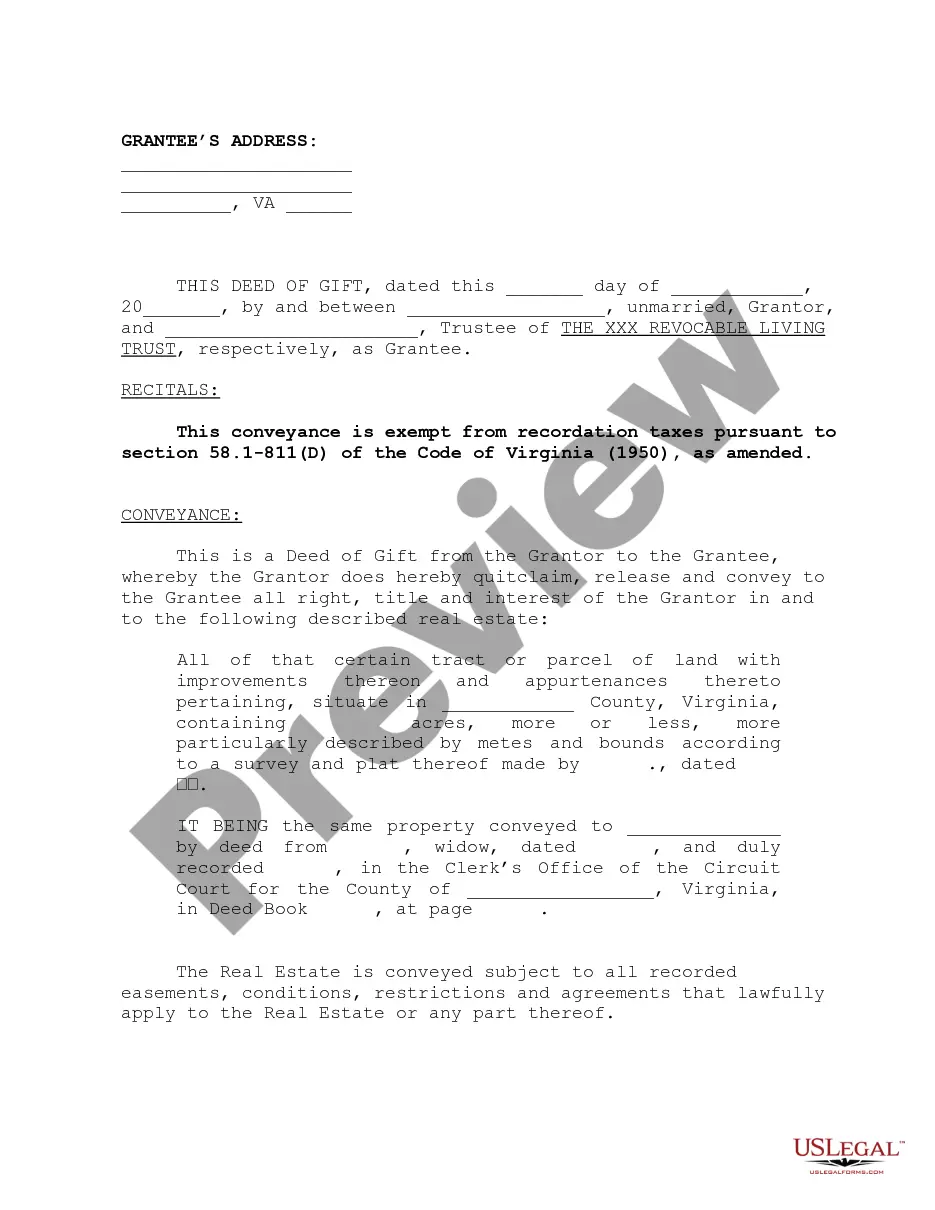

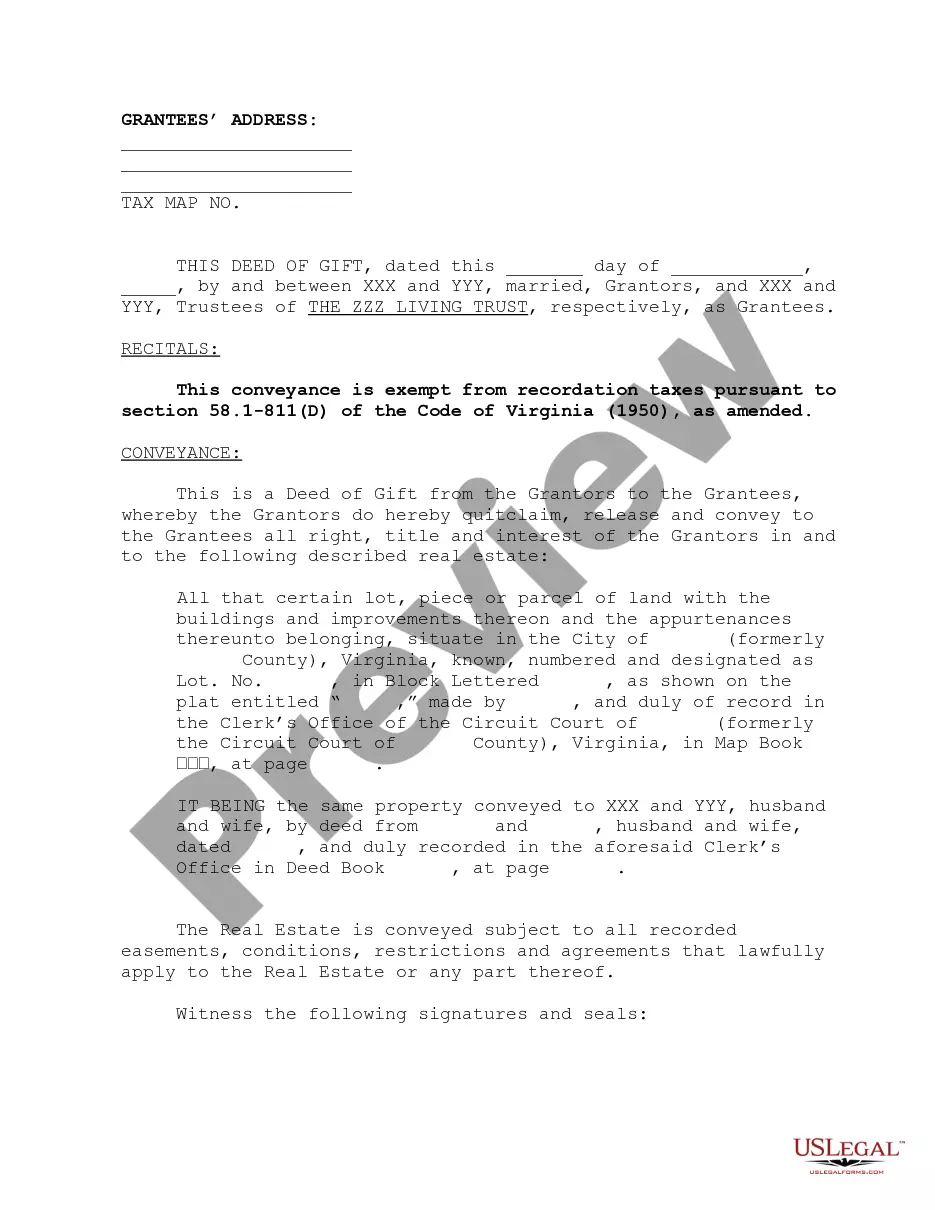

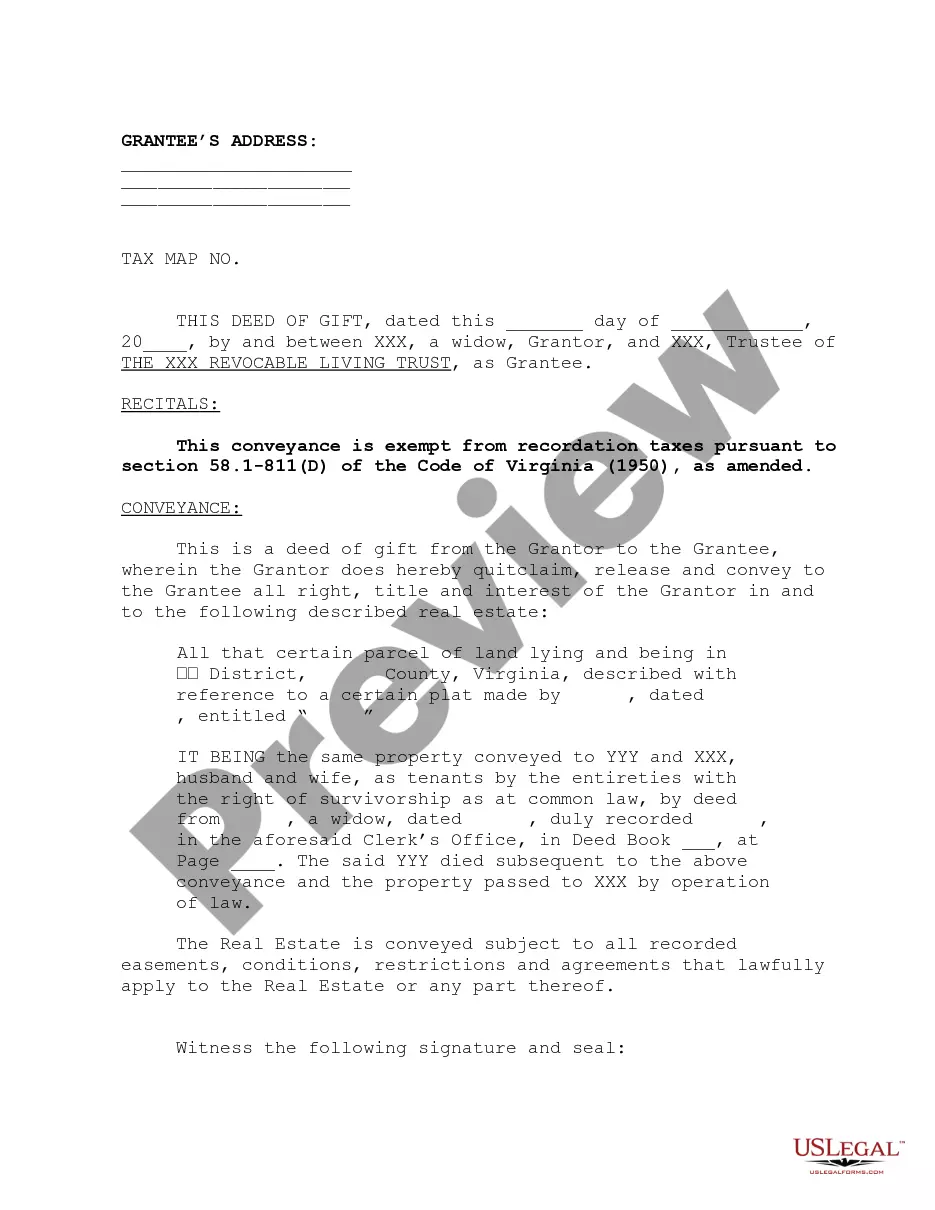

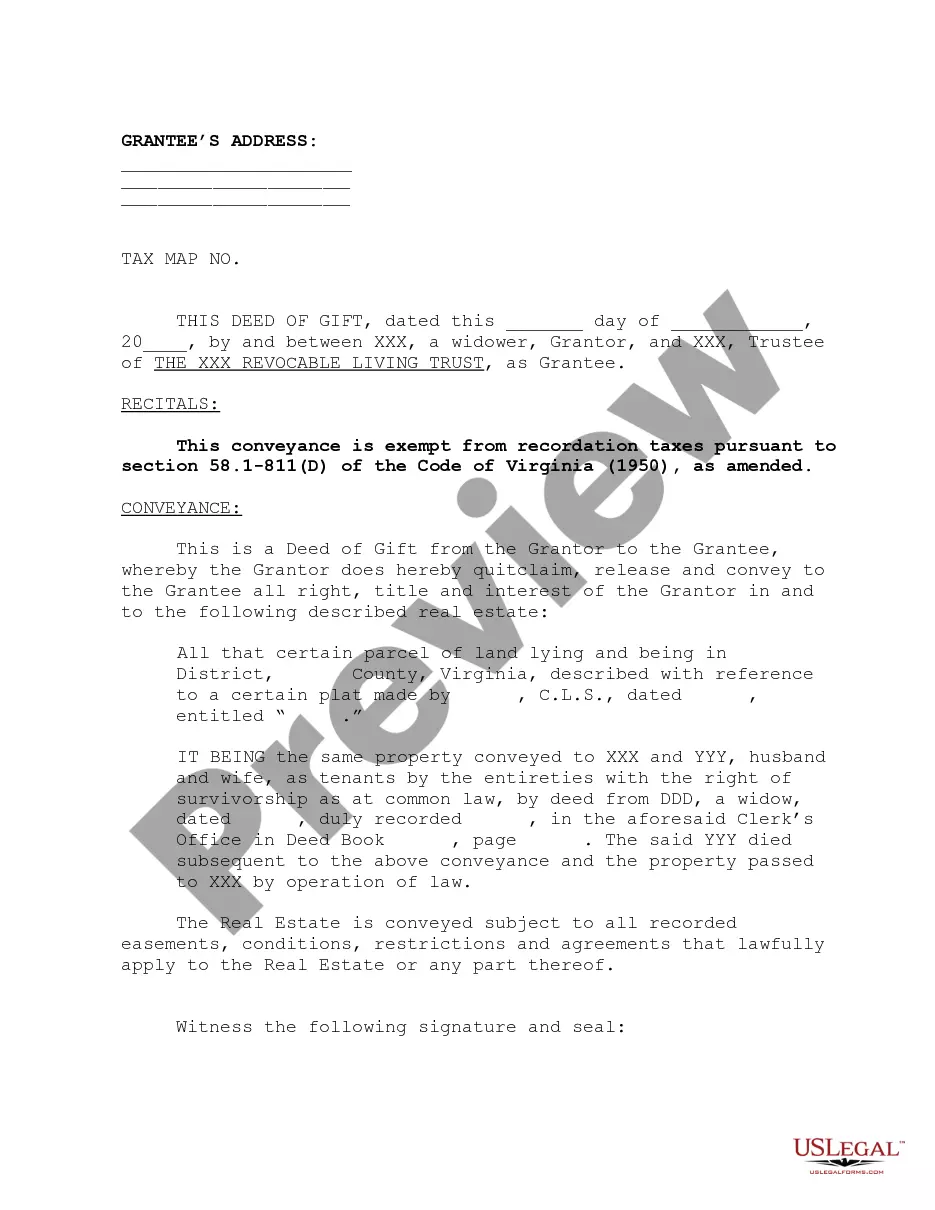

The Deed of Gift - Single - Out of State is a legal document used to transfer property ownership from an individual (such as a widower) to the trustee of a revocable living trust without a sale. This form is specifically designed for situations where no payment is required (beyond nominal consideration) for the property transfer, which distinguishes it from other real estate transactions. By using this form, individuals can ensure their property is transferred according to their wishes while potentially avoiding costly probate processes in the future.

Key parts of this document

- Names and contact information of the grantor (the individual giving the property) and the trustee.

- Detailed description of the property being transferred.

- Statement of consideration, which is typically a nominal amount.

- Signatures of both parties to finalize the transfer.

- Date of execution to establish when the deed is effective.

State-specific compliance details

This form can be used across multiple states but may need to be tailored to comply with specific state laws regarding property transfers and trust management. Always check local requirements to ensure compliance.

Common use cases

This form is suitable in various situations, such as when an individual wishes to gift real estate to a trust for the benefit of family members or other beneficiaries while avoiding the complexities of probate. You might also use this deed when transferring property to support estate planning goals or charitable purposes, ensuring that the property is managed according to the grantor's wishes.

Who this form is for

- Individuals looking to donate property to a revocable living trust.

- Trustees managing the transfer of property into a trust.

- Individuals seeking to streamline their estate planning process.

- Anyone wishing to give property to a family member or organization without financial transaction.

How to complete this form

- Identify the parties involved: the grantor and the trustee.

- Describe the property being gifted in clear terms.

- Specify the nominal consideration amount for the conveyance.

- Gather signatures from both the grantor and the trustee to validate the document.

- Record the date of the transaction to document when the property transfer occurs.

Notarization requirements for this form

Notarization is required for this form to take effect. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available 24/7.

Common mistakes

- Failing to include a complete and accurate description of the property.

- Not obtaining signatures from all parties involved in the transaction.

- Missing the date of execution on the deed.

- Neglecting to check state-specific requirements for valid property transfers.

Advantages of online completion

- Convenient access allows for immediate download and completion.

- Editability to customize the form as per your specific needs.

- Drafted by licensed attorneys ensures legal reliability and accuracy.

- Reduces the need for legal consultations for straightforward property gifting.

Form popularity

FAQ

California doesn't enforce a gift tax, but you may owe a federal one. However, you can give up to $15,000 in cash or property during the 2019 and 2020 tax years without triggering a gift tax return.

Can Gift Deed property be sold? Yes, the property received under Gift Deed can be sold. Provided, that you have received the property under registered Gift Deed without any condition attached.However, in the case of the registered Gift Deed, donor and donee both need to acquiesce for revocation.

A Deed of Gift is a formal legal document used to give a gift of property or money to another person. It transfers the money or ownership of property (or share in a property) to another person without payment is demanded in return.Giving a gift to someone can have some Inheritance Tax implications.

It is however difficult to prove the same. You should have clinging evidence to show that it was against the wish of owner of through fraud, misrepresentation, coercion etc. As it is registered gift deed under sec 17 of Registration Act 1908 it becomes a valid and authentic document.

The gift deed can be questioned by filing a suit for declaration in the court of law. However, it will be challenged only if the person is able to establish that the execution of the deed was not as per the wish of the donor and was executed under fraud, coercion,misrepresentation etc.

Gift made by way of movable property is required to be made in stamp paper and stamped by the notary or court. Registration of gift deed is not required in case of transfer of moveable property.Gift of immovable property which is not registered is not a valid as per law and cannot pass any title to the donee.

Locate the most recent deed to the property. Create the new deed. Sign and notarize the new deed. Record the deed in the land records of the clerk's office of the circuit court in the jurisdiction where the property is located.

For the purpose of making a gift of immovable property, the transfer must be registered, signed by or on behalf of the donor, and attested by at least two witnesses. The stamp duty, calculated on the basis of the market value of the property (differing from state to state), must be paid at the time of registration.

Gifts of Real Estate in Virginia. A gift deed, or deed of gift, is a legal document voluntarily transferring title to real property from one party (the grantor or donor) to another (the grantee or donee). They typically transfer real property between family or close friends.