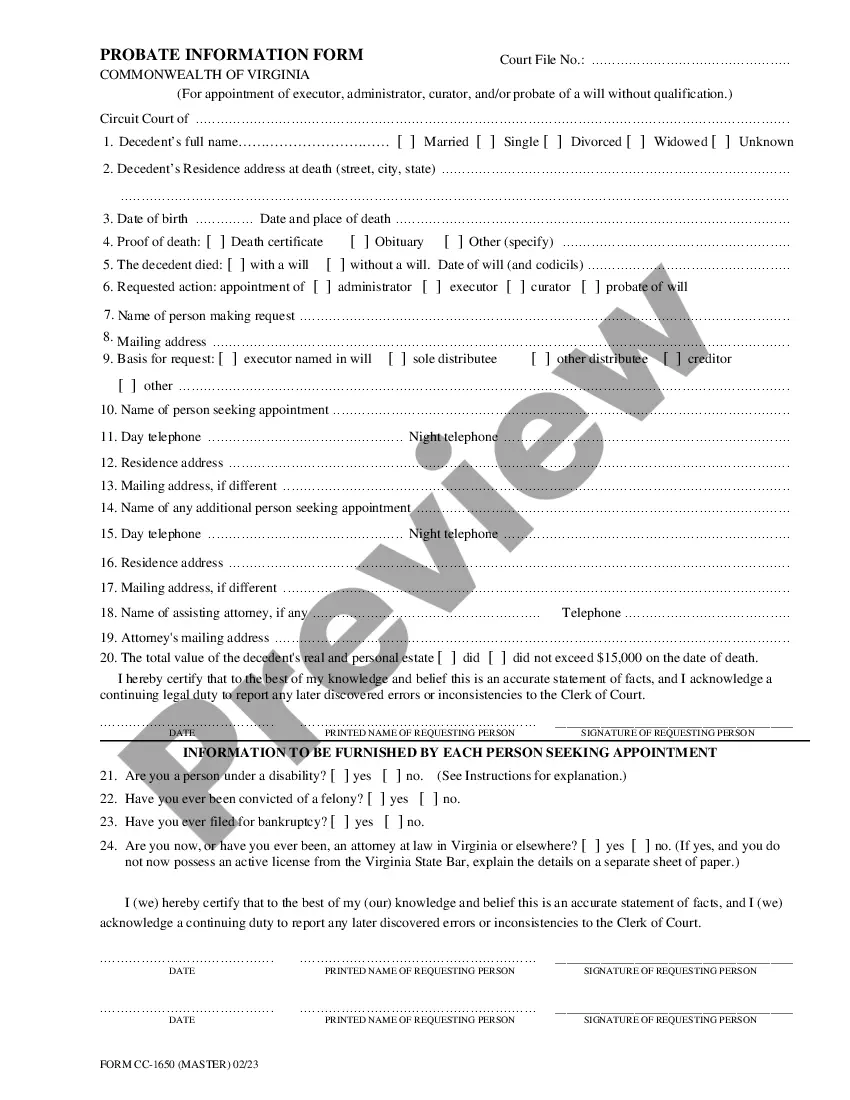

Virginia Probate Information Form (PIF) is a document that is used to provide information about the assets of a deceased person in the Commonwealth of Virginia. It is typically used to help the probate court or executor of the estate to understand the assets of the deceased person so that they can be distributed according to the law. The PIF consists of four forms: the Personal Property Form, the Real Property Form, the Small Estate Affidavit, and the Power of Attorney Form. The Personal Property Form is used to list all the personal belongings of the deceased, such as jewelry, furniture, and vehicles. The Real Property Form is used to list all the real estate owned by the deceased, such as land, houses, and other buildings. The Small Estate Affidavit is used to verify the total value of a deceased person’s estate and ensure that it is below a certain threshold before the estate is eligible for a simplified probate process. Lastly, the Power of Attorney Form is used to designate a person to act on behalf of the deceased in the probate process. All of these forms are required to be submitted to the probate court in order to begin the probate process.

Virginia Probate Information Form

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Virginia Probate Information Form?

Dealing with official paperwork requires attention, precision, and using well-drafted templates. US Legal Forms has been helping people across the country do just that for 25 years, so when you pick your Virginia Probate Information Form template from our service, you can be sure it complies with federal and state laws.

Dealing with our service is easy and quick. To obtain the necessary paperwork, all you’ll need is an account with a valid subscription. Here’s a quick guideline for you to find your Virginia Probate Information Form within minutes:

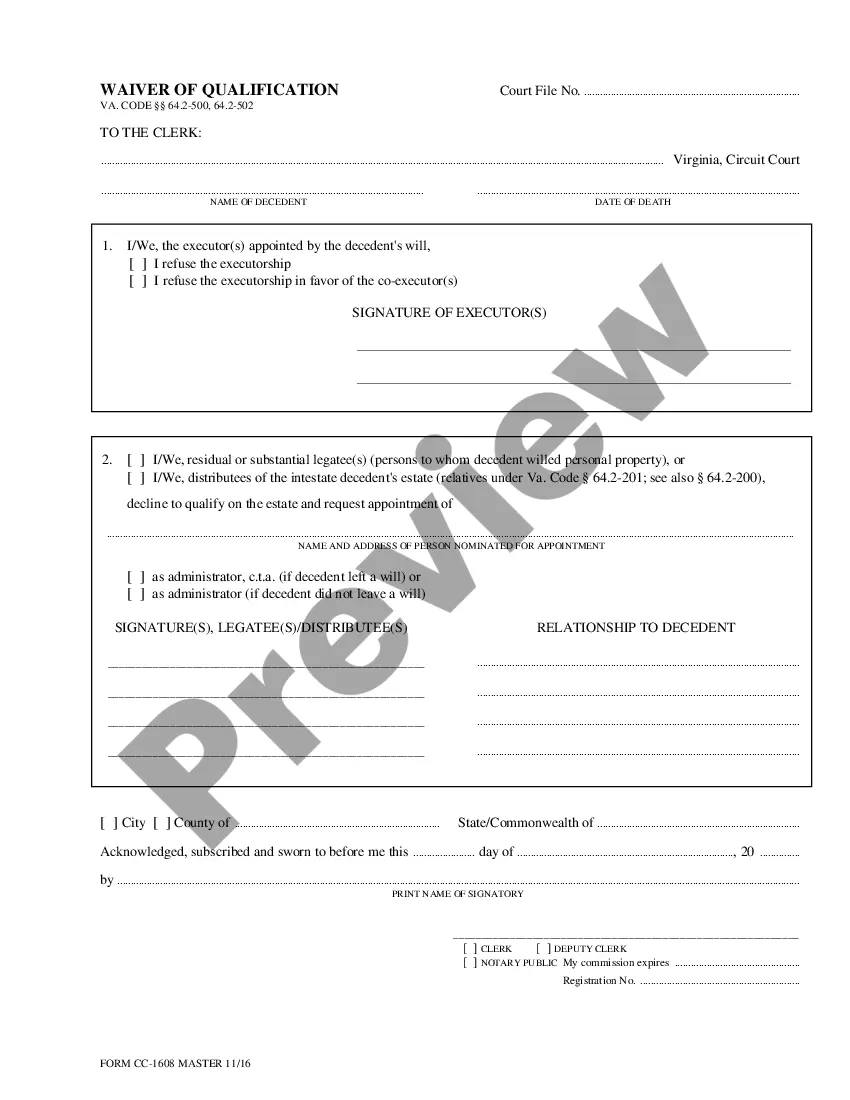

- Make sure to carefully look through the form content and its correspondence with general and legal requirements by previewing it or reading its description.

- Search for an alternative official template if the previously opened one doesn’t suit your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and save the Virginia Probate Information Form in the format you need. If it’s your first time with our service, click Buy now to continue.

- Register for an account, decide on your subscription plan, and pay with your credit card or PayPal account.

- Choose in what format you want to save your form and click Download. Print the blank or upload it to a professional PDF editor to submit it paper-free.

All documents are drafted for multi-usage, like the Virginia Probate Information Form you see on this page. If you need them in the future, you can fill them out without re-payment - just open the My Forms tab in your profile and complete your document whenever you need it. Try US Legal Forms and accomplish your business and personal paperwork rapidly and in total legal compliance!

Form popularity

FAQ

Most people who have not signed estate planning documents assume that they have no estate plan. However, if you die without a will, Virginia's laws will determine who receives your property after you die. Either way, if you die with or without a will in Virginia, your estate must go through a process called probate.

The probate tax is imposed on the probate of most wills and grants of administration, and applies to property in Virginia. No tax is imposed on estates valued at $15,000 or less. The tax does not apply to the following types of property within an estate: Property passing by the exercise of a power of appointment.

Common non-probate assets include: Life insurance proceeds or pension benefits payable to a named beneficiary. Assets such as a home owned with someone else in joint tenancy or tenancy by the entirety. Assets with a listed beneficiary outside of the deceased person's will such as an IRA or payable-on-death bank account.

Probate Taxes & Fees The state probate tax is 10 cents per $100 of the estate value at the time of death. The local probate tax is 3.33 cents (1/3 of 10 cents) per $100 of the estate value at the time of death.

The local probate tax is 3.33 cents (1/3 of 10 cents) per $100 of the estate value at the time of death. The recording fee is $16 for the first 10 pages of the Will, $16 for the List of Heirs, $67 for an Intestate List of Heirs, now known as a Real Estate Affidavit (if applicable) and $16 for the Affidavit of Notice.

In Virginia, any estate valued at greater than $50,000 at the time of the owner's passing must go through the probate procedure.

While there is no inheritance tax in Virginia, another state's inheritance tax may apply if the inheritance you receive is from someone in that state. The state of Pennsylvania, for example, has an inheritance tax that applies to heirs who live in other states.

In Virginia, you can make a living trust to avoid probate for virtually any asset you own?real estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).