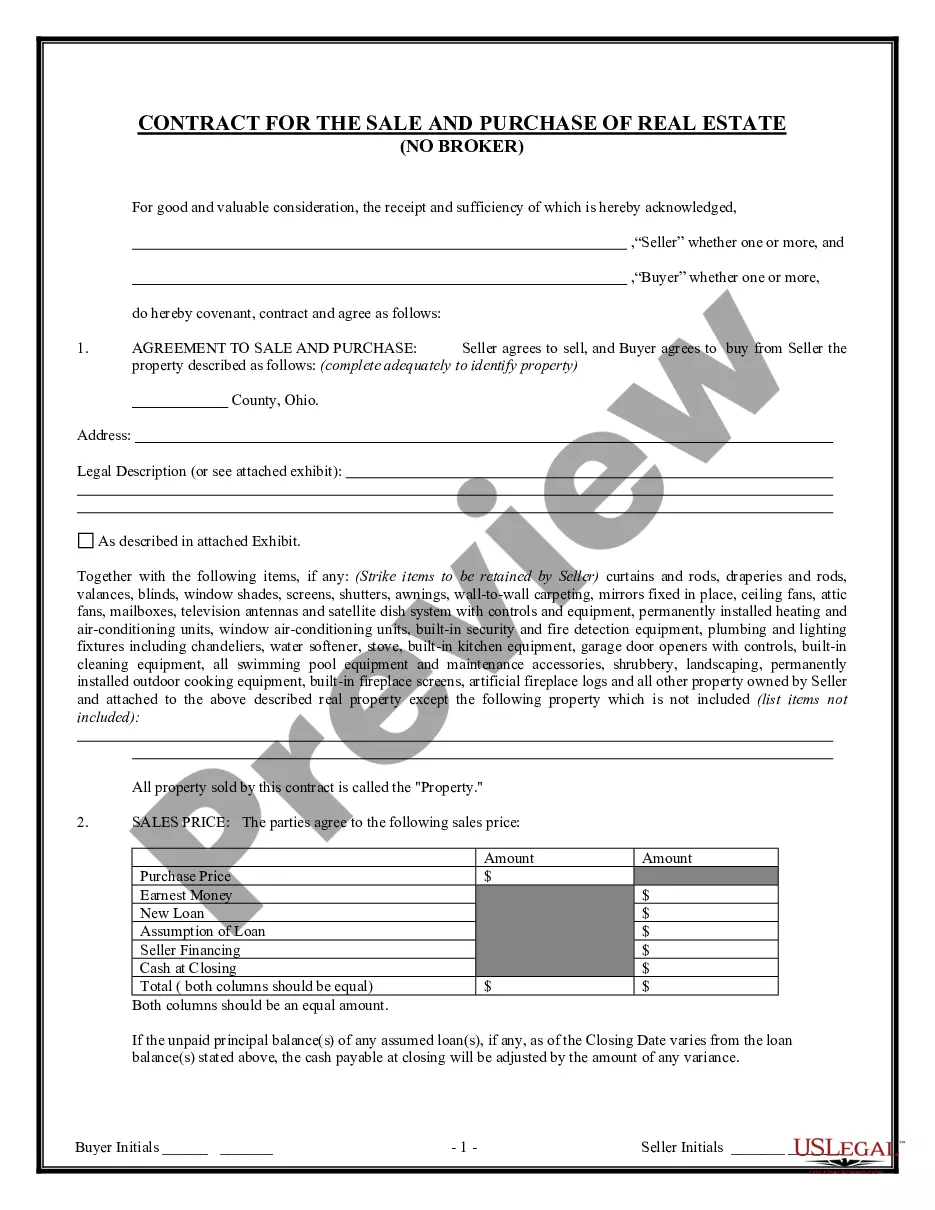

Virginia Inventory for Decedent's Estate is a document used to identify assets owned by a decedent at the time of their death. The inventory is filed with the estate and becomes part of the public record. It is important for the executor of the estate to accurately list all the decedent's assets, as this will determine how the assets are distributed and how applicable taxes are paid. There are two types of Virginia Inventory for Decedent's Estate. The first type is a Preliminary Inventory. This inventory is filed with the court within 90 days of the decedent's death and includes all assets owned by the decedent at the time of death, including real estate, tangible personal property, intangible assets, and life insurance policies. The second type is a Final Inventory. This inventory is filed with the court at the conclusion of the estate administration and includes all assets that were distributed to the heirs or beneficiaries of the estate. The Virginia Inventory for Decedent's Estate is an important document that must be accurately completed in order to properly settle the decedent's estate.

Virginia Inventory for Decedent's Estate

Description

How to fill out Virginia Inventory For Decedent's Estate?

How much time and resources do you typically spend on drafting official documentation? There’s a better way to get such forms than hiring legal specialists or wasting hours searching the web for a suitable blank. US Legal Forms is the leading online library that provides professionally drafted and verified state-specific legal documents for any purpose, like the Virginia Inventory for Decedent's Estate.

To get and complete an appropriate Virginia Inventory for Decedent's Estate blank, follow these simple instructions:

- Examine the form content to make sure it meets your state requirements. To do so, check the form description or utilize the Preview option.

- In case your legal template doesn’t satisfy your needs, find another one using the search tab at the top of the page.

- If you already have an account with us, log in and download the Virginia Inventory for Decedent's Estate. If not, proceed to the next steps.

- Click Buy now once you find the correct blank. Select the subscription plan that suits you best to access our library’s full opportunities.

- Create an account and pay for your subscription. You can make a payment with your credit card or via PayPal - our service is totally secure for that.

- Download your Virginia Inventory for Decedent's Estate on your device and fill it out on a printed-out hard copy or electronically.

Another benefit of our service is that you can access previously acquired documents that you securely keep in your profile in the My Forms tab. Pick them up at any moment and re-complete your paperwork as frequently as you need.

Save time and effort preparing official paperwork with US Legal Forms, one of the most trustworthy web solutions. Join us today!

Form popularity

FAQ

WHO INHERITS THE PROPERTY OF AN INTESTATE? someone other than the surviving spouse in which case, one-third goes to the surviving spouse and the remaining two-thirds is divided among all children. ? if no surviving spouse, all passes to the children and their descendants.

Common non-probate assets include: Life insurance proceeds or pension benefits payable to a named beneficiary. Assets such as a home owned with someone else in joint tenancy or tenancy by the entirety. Assets with a listed beneficiary outside of the deceased person's will such as an IRA or payable-on-death bank account.

Property owned or owned in substance by the decedent immediately before death that passed outside probate at the decedent's death. Property included under this category consists of: a. Property over which the decedent, alone, immediately before death, held a presently exercisable general power of appointment.

Probate is necessary when a person dies leaving property in his or her own name (such as a house titled only in the name of the decedent) or having rights to receive property. Motor Vehicles.

If the decedent had no known place of residence, the will should be probated where the decedent owned any real estate, or if none, where the decedent died or has any estate. Usually the Clerk of the Circuit Court or a deputy clerk handles the probate of wills and the circuit court judge is not involved.

Probate assets can include vehicles, real estate, bank and brokerage accounts, and personal belongings (for example, jewelry, home furnishings, artwork, and collections). Life insurance proceeds that are payable to the estate (not a named beneficiary) are also probate assets.

A person can expect for the probate process in Virginia to take anywhere from six months up to a year or more. Generally, there is a creditor period, so an estate cannot be completely distributed and closed prior to the expiration of the six-month period.

In simple terms, an estate inventory includes all of the assets of an estate belonging to someone who's passed away. This inventory can also include a listing of the person's liabilities or debts.