This Warranty Deed from Husband and Wife to LLC form is a Warranty Deed where the grantors are husband and wife and the grantee is a limited liability company. Grantors convey and warrant the described property to grantee less oil, gas and minerals to which grantors reserve the right.

Virginia Warranty Deed from Husband and Wife to LLC

Description

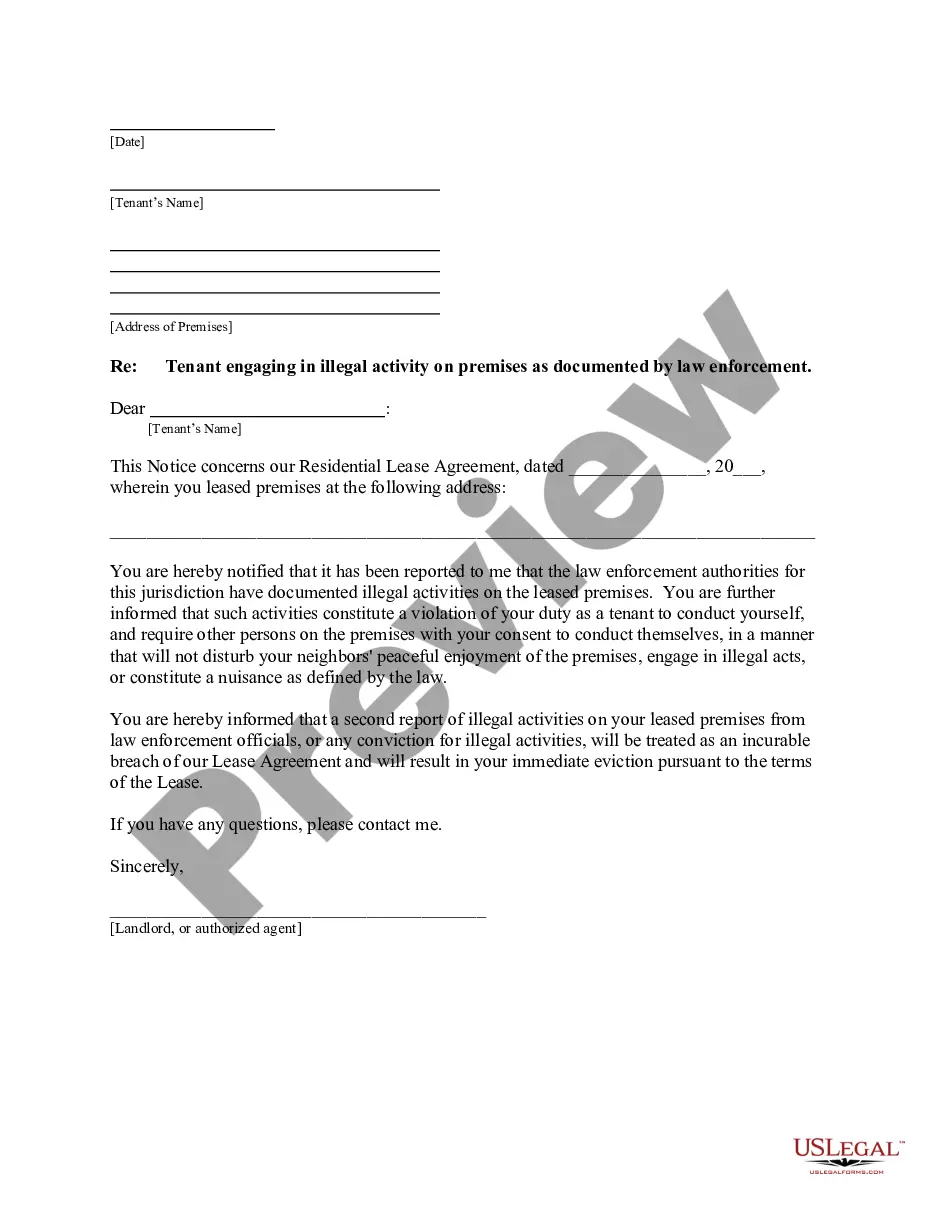

How to fill out Virginia Warranty Deed From Husband And Wife To LLC?

Searching for a Virginia Warranty Deed from Husband and Wife to LLC on the internet can be stressful. All too often, you see documents that you just think are alright to use, but discover later on they’re not. US Legal Forms offers more than 85,000 state-specific legal and tax forms drafted by professional attorneys according to state requirements. Get any document you are looking for quickly, hassle free.

If you already have the US Legal Forms subscription, merely log in and download the sample. It will immediately be added to your My Forms section. If you do not have an account, you need to sign up and select a subscription plan first.

Follow the step-by-step guidelines below to download Virginia Warranty Deed from Husband and Wife to LLC from our website:

- See the form description and press Preview (if available) to check if the template meets your expectations or not.

- In case the document is not what you need, get others with the help of Search engine or the provided recommendations.

- If it’s appropriate, click Buy Now.

- Choose a subscription plan and create an account.

- Pay with a card or PayPal and download the template in a preferable format.

- After downloading it, it is possible to fill it out, sign and print it.

Obtain access to 85,000 legal forms from our US Legal Forms library. In addition to professionally drafted templates, customers may also be supported with step-by-step guidelines concerning how to find, download, and complete templates.

Form popularity

FAQ

Creating an LLC for your rental property is a smart choice as a property owner. It reduces your liability risk, effectively separates your assets, and has the tax benefit of pass-through taxation.You can add unique bank accounts for each rental property.

No you can't. A single member LLC is just you as far as the IRS is concerned. You're just living in your own property. You can't rent your own house to yourself.

Does LLC ownership count as time used as a primary residence? For a single-member LLC, the answer is typically yes. For example, if the house is owned by an LLC. The Treasury Regulations allow for the capital gains exclusion when title is held by a single-member disregarded entity.

Locate the most recent deed to the property. Create the new deed. Sign and notarize the new deed. Record the deed in the land records of the clerk's office of the circuit court in the jurisdiction where the property is located.

However, there are substantial downsides associated with transferring your primary home into an LLC.If you are using your personal residence for estate planning purposes, a qualified personal residence trust (QPRT) may be more effective than transferring your property to a limited liability company.

Transferring property to an LLC is a simple way to reduce your personal liability for claims relating to the property. But a property title transfer should be only part of your strategy. It's also important to contact an insurance agent and obtain adequate liability insurance to cover any claims that might arise.

Locate the most recent deed to the property. Create the new deed. Sign and notarize the new deed. Record the deed in the land records of the clerk's office of the circuit court in the jurisdiction where the property is located.

No you can't. A single member LLC is just you as far as the IRS is concerned. You're just living in your own property. You can't rent your own house to yourself.

Creating an LLC for your rental property is a smart choice as a property owner. It reduces your liability risk, effectively separates your assets, and has the tax benefit of pass-through taxation.