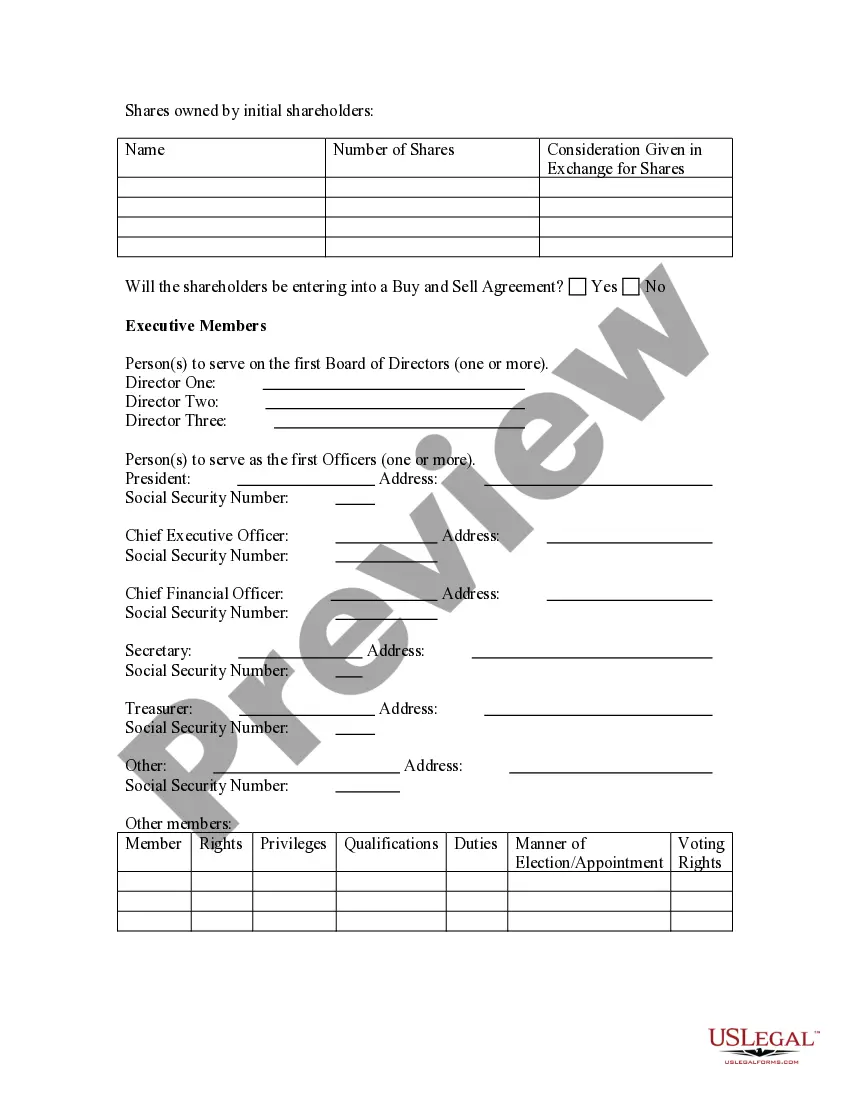

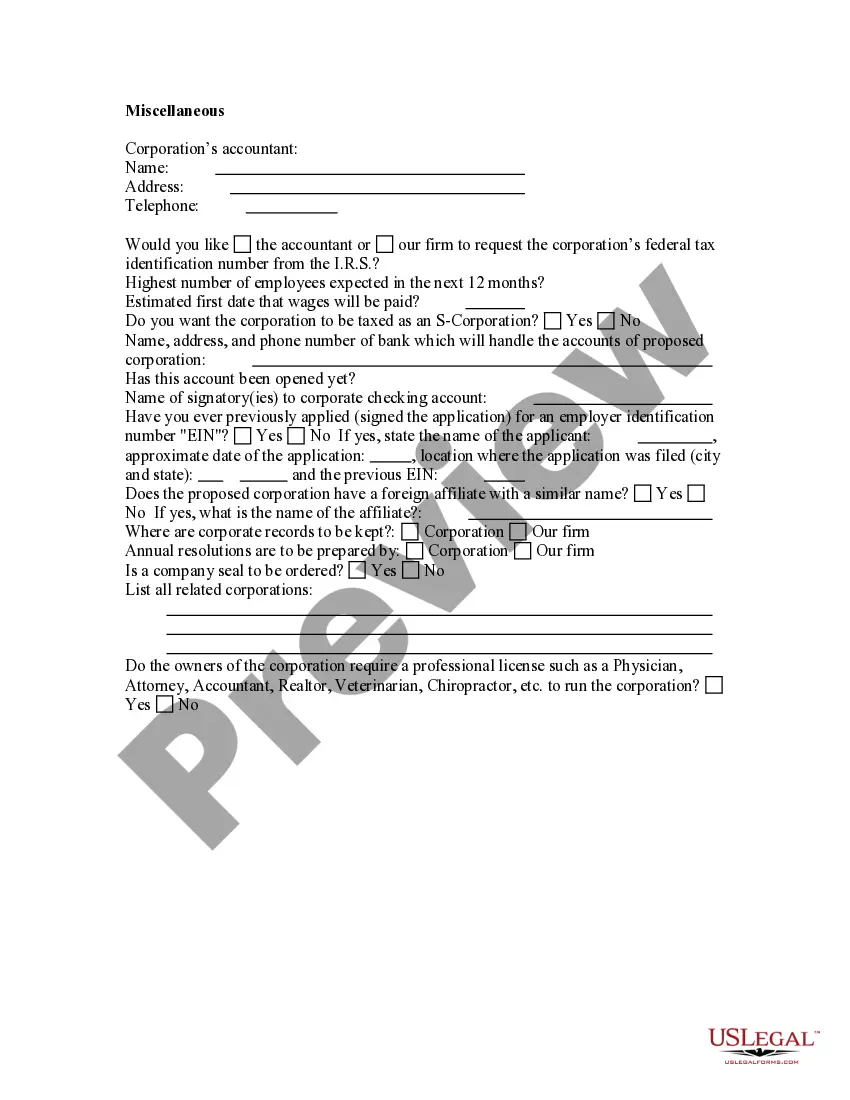

Are you within a place that you require files for possibly enterprise or person functions nearly every time? There are tons of legitimate papers layouts available on the Internet, but getting kinds you can depend on is not simple. US Legal Forms gives thousands of form layouts, such as the Utah Business Incorporation Questionnaire, which are published to fulfill federal and state specifications.

If you are currently acquainted with US Legal Forms internet site and have your account, basically log in. Afterward, you can acquire the Utah Business Incorporation Questionnaire template.

Should you not offer an account and want to begin to use US Legal Forms, adopt these measures:

- Find the form you need and ensure it is to the right metropolis/area.

- Use the Review key to check the shape.

- Read the outline to ensure that you have selected the right form.

- If the form is not what you are looking for, utilize the Lookup industry to find the form that meets your requirements and specifications.

- Once you get the right form, click on Buy now.

- Select the rates prepare you desire, submit the specified details to generate your money, and purchase your order using your PayPal or bank card.

- Pick a practical document file format and acquire your duplicate.

Locate each of the papers layouts you possess purchased in the My Forms menu. You may get a extra duplicate of Utah Business Incorporation Questionnaire whenever, if possible. Just select the needed form to acquire or produce the papers template.

Use US Legal Forms, by far the most extensive collection of legitimate forms, to save lots of time as well as steer clear of errors. The services gives expertly made legitimate papers layouts which can be used for a selection of functions. Produce your account on US Legal Forms and start generating your way of life easier.