Utah Disclaimer of All Rights Under Operating Agreement by Party to Agreement

Description

How to fill out Disclaimer Of All Rights Under Operating Agreement By Party To Agreement?

US Legal Forms - among the most significant libraries of lawful types in the United States - offers an array of lawful papers templates you may obtain or print. While using website, you may get 1000s of types for business and specific purposes, sorted by categories, states, or search phrases.You will find the latest variations of types like the Utah Disclaimer of All Rights Under Operating Agreement by Party to Agreement in seconds.

If you currently have a monthly subscription, log in and obtain Utah Disclaimer of All Rights Under Operating Agreement by Party to Agreement from your US Legal Forms library. The Down load button will show up on each and every develop you look at. You have accessibility to all formerly delivered electronically types inside the My Forms tab of your respective bank account.

If you wish to use US Legal Forms for the first time, here are easy instructions to help you get started:

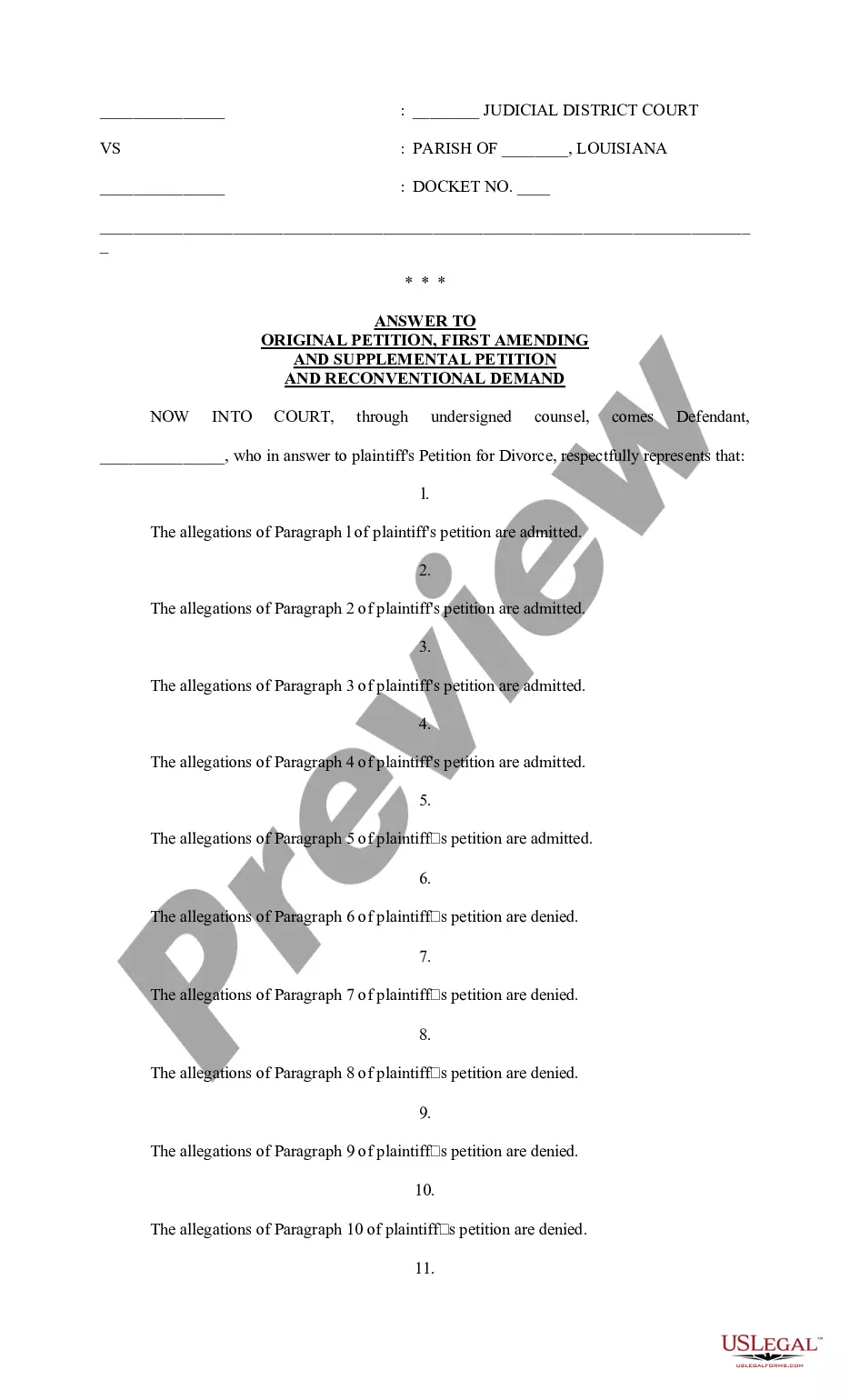

- Be sure you have chosen the proper develop to your city/region. Select the Review button to review the form`s content material. Browse the develop information to ensure that you have chosen the right develop.

- If the develop does not suit your requirements, utilize the Lookup field towards the top of the display to discover the the one that does.

- Should you be satisfied with the form, affirm your option by visiting the Buy now button. Then, choose the rates prepare you prefer and offer your references to register for an bank account.

- Approach the financial transaction. Utilize your charge card or PayPal bank account to accomplish the financial transaction.

- Choose the format and obtain the form in your gadget.

- Make adjustments. Fill out, revise and print and sign the delivered electronically Utah Disclaimer of All Rights Under Operating Agreement by Party to Agreement.

Each and every web template you added to your account does not have an expiry day and is your own for a long time. So, if you would like obtain or print one more duplicate, just visit the My Forms segment and then click on the develop you want.

Get access to the Utah Disclaimer of All Rights Under Operating Agreement by Party to Agreement with US Legal Forms, probably the most extensive library of lawful papers templates. Use 1000s of skilled and condition-certain templates that fulfill your small business or specific demands and requirements.

Form popularity

FAQ

Certain modifications under California law. Idaho, Iowa, Nebraska and Wyoming have already adopted RULLCA.

There is no set requirement for what an operating agreement must contain, but it generally governs, at the very least, relations among the members as members and between the members and the company; rights and duties of manager(s); activities and affairs of the company and how they are to be conducted; and how the ...

Single member LLCs are treated the same as sole proprietorships. Profits are reported on Schedule C as part of your individual 1040 tax return. Self-employment taxes on Utah LLC net income must be paid just as you would with any self-employment business.

In Utah, statutes of limitations allow four years for the filing of charges relating to breached oral contracts or six years for breached written contracts. Those involved in a civil litigation case are seeking money or another remedy rather than criminal punishment.

Pros and Cons of Forming an LLC in Utah. Step 1: Name Your LLC. ... Step 2: Nominate Your Registered Agent. ... Step 3: File Your Certificate of Organization. ... Step 4: Get Your Business Licensed. ... Step 5: Create Your Operating Agreement. ... Step 6: Get Your EIN. ... Step 7: Keep Your LLC Active.

"Governing person" means a person, alone or in concert with others, by or under whose authority the powers of the limited liability company are exercised and under whose direction the activities and affairs of the limited liability company are managed pursuant to this chapter and the limited liability company's ...

The document required to form an LLC in Utah is called the Articles of Organization. The information required in the formation document varies by state. Utah's requirements include: Registered agent.