Utah Reservations of Other Interests

Description

How to fill out Reservations Of Other Interests?

Have you been in the position the place you will need paperwork for possibly enterprise or personal reasons just about every working day? There are a variety of lawful document templates available online, but discovering versions you can rely on isn`t easy. US Legal Forms delivers thousands of type templates, like the Utah Reservations of Other Interests, that are published to satisfy state and federal needs.

Should you be presently familiar with US Legal Forms website and have a free account, merely log in. Next, you may acquire the Utah Reservations of Other Interests web template.

If you do not offer an bank account and need to begin using US Legal Forms, follow these steps:

- Discover the type you need and make sure it is for that appropriate city/region.

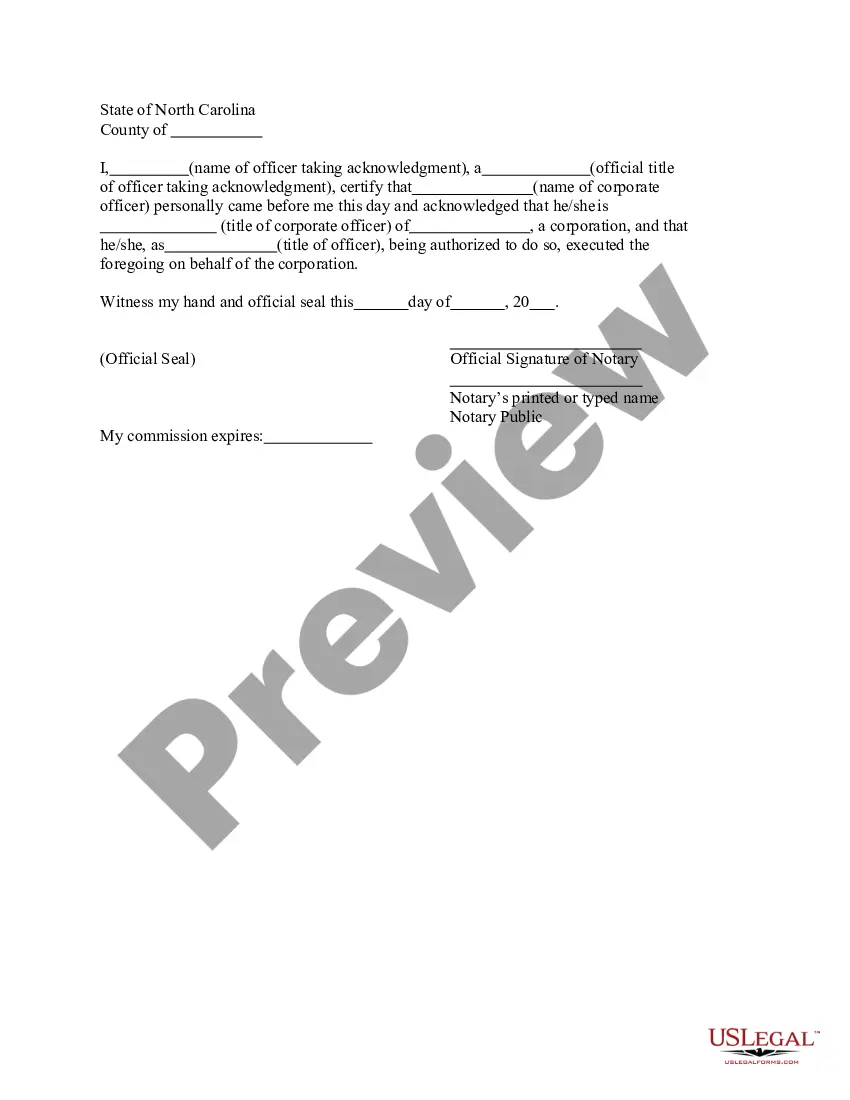

- Use the Preview button to examine the form.

- Browse the explanation to ensure that you have chosen the right type.

- If the type isn`t what you`re seeking, use the Lookup field to discover the type that suits you and needs.

- If you get the appropriate type, simply click Purchase now.

- Opt for the prices strategy you need, submit the specified info to produce your account, and pay for the transaction using your PayPal or Visa or Mastercard.

- Select a convenient data file formatting and acquire your backup.

Locate all the document templates you may have bought in the My Forms menu. You can obtain a additional backup of Utah Reservations of Other Interests anytime, if possible. Just click on the necessary type to acquire or produce the document web template.

Use US Legal Forms, one of the most extensive selection of lawful kinds, to save efforts and steer clear of mistakes. The service delivers appropriately produced lawful document templates that you can use for a range of reasons. Create a free account on US Legal Forms and start making your daily life a little easier.

Form popularity

FAQ

In Utah partnerships are generally taxed as pass-through entities, meaning the profit and losses from the businesses pass directly into the partners' personal incomes. Utah does require a yearly partnership return from each partnership within the state.

When and where the return must be filed. A return must be filed with the Utah State Tax Commission, 210 N 1950 W, SLC, UT 84134-0270 on or before the 15th day of the fourth month following the close of the fiscal year or by April 15th for a calendar year business.

File your Utah taxes at tap.utah.gov. If filing on paper, mail your return to the address on page 1. TC-40 page 3, TC-40A, TC-40B, TC-40S, and TC-40W (all that apply). An explanation for any equitable adjustment entered on TC-40A, Part 2, code 79.

If you need to change or amend an accepted Utah State Income Tax Return for the current or previous Tax Year you need to complete Form TC-40. Form TC-40 is a Form used for the Tax Return and Tax Amendment. You can prepare a current tax year Utah Tax Amendment on eFile.com, however you can not submit it electronically.

TAP ? Taxpayer Access Point at tap.utah.gov: The Utah State Tax Commission's free online filing and payment system.

Description:You can not eFile a UT Tax Amendment anywhere, except mail it in. However, you can prepare it here on eFile.com. Option 1: Sign in to your eFile.com account, modify your Return and download/print the UT Form TC-40 under My Account.

If you live in Utah... and you are filing a Form...and you are not enclosing a payment, then use this address...and you are enclosing a payment, then use this address...4868Department of the Treasury Internal Revenue Service Ogden, UT 84201-0045Internal Revenue Service P.O. Box 802503 Cincinnati, OH 45280-25035 more rows ?

Companies who pay employees in Utah must register at the OneStop Online Business Registration to receive both a Withholding Account ID and an Employer Registration Number (for unemployment taxes). Apply to receive a Withholding Account Number within 2 weeks.