Utah Deed and Assignment from Trustee to Trust Beneficiaries

Description

How to fill out Deed And Assignment From Trustee To Trust Beneficiaries?

Are you presently in a place in which you require paperwork for sometimes enterprise or person purposes just about every working day? There are plenty of legitimate file templates accessible on the Internet, but finding kinds you can rely on isn`t straightforward. US Legal Forms gives 1000s of form templates, such as the Utah Deed and Assignment from Trustee to Trust Beneficiaries, that are published to meet federal and state specifications.

Should you be already informed about US Legal Forms web site and have a merchant account, simply log in. Following that, you can download the Utah Deed and Assignment from Trustee to Trust Beneficiaries format.

If you do not have an account and would like to begin to use US Legal Forms, follow these steps:

- Obtain the form you want and ensure it is for that right area/county.

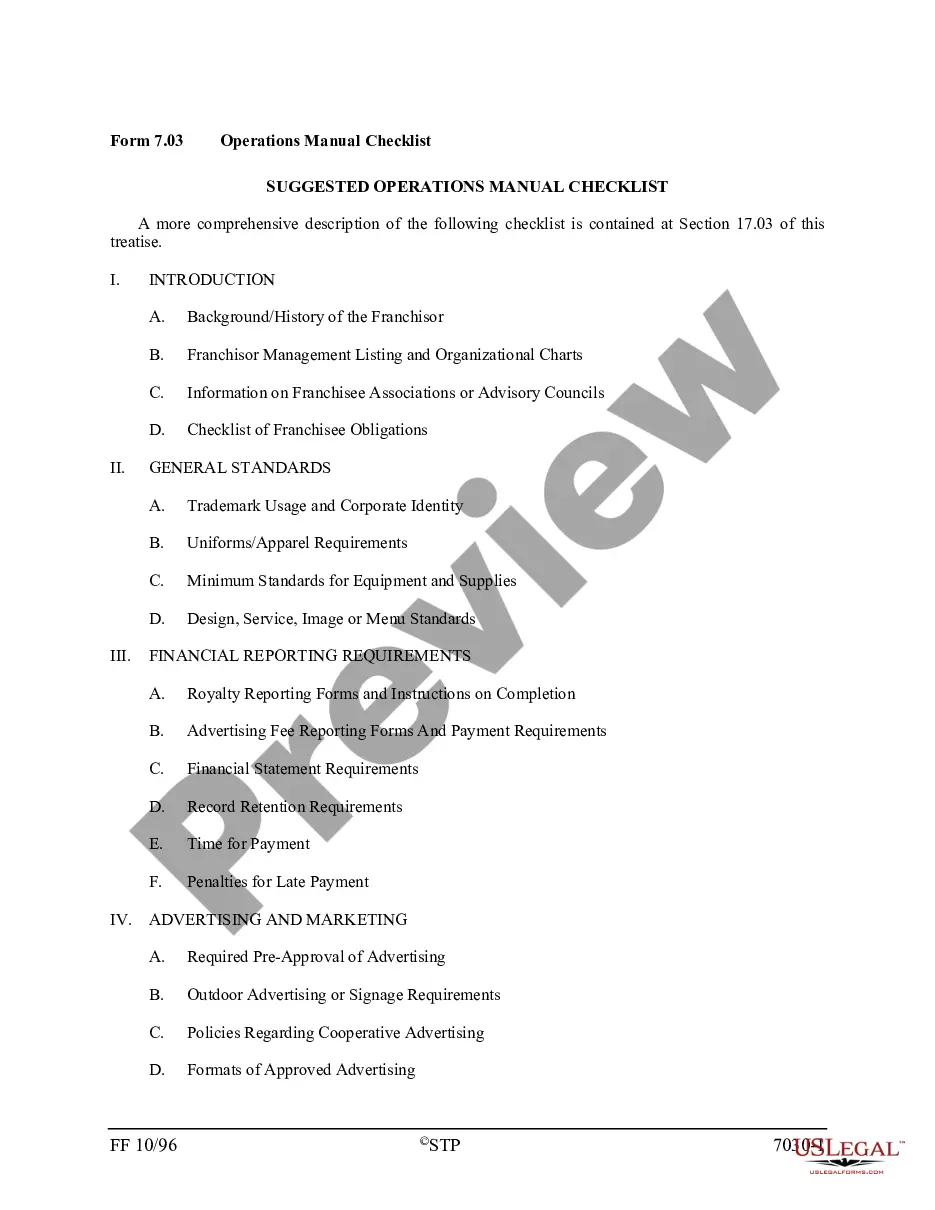

- Take advantage of the Preview switch to review the form.

- See the description to ensure that you have selected the proper form.

- In case the form isn`t what you`re searching for, make use of the Search area to obtain the form that meets your requirements and specifications.

- When you get the right form, click Purchase now.

- Select the costs program you want, submit the necessary information to generate your account, and buy the order using your PayPal or credit card.

- Choose a practical data file format and download your duplicate.

Find every one of the file templates you might have bought in the My Forms menu. You can aquire a further duplicate of Utah Deed and Assignment from Trustee to Trust Beneficiaries any time, if needed. Just click on the required form to download or print the file format.

Use US Legal Forms, the most considerable variety of legitimate kinds, to save lots of efforts and prevent faults. The assistance gives expertly created legitimate file templates that can be used for a selection of purposes. Create a merchant account on US Legal Forms and begin creating your daily life a little easier.

Form popularity

FAQ

The key disadvantages of placing a house in a trust include the following: Extra paperwork: Moving property in a trust requires the house owner to transfer the asset's legal title. This involves preparing and signing an additional deed, and some people may consider this cumbersome.

In real estate law, "assignment" is simply the transfer of a deed of trust from one party to another. This usually happens when the beneficiary of a trust deed sells their loan to another lender.

How much does a Trust cost in Utah? In Utah, the cost of setting up a basic Revocable Living Trust generally ranges from $1,000 to $3,000.

This transfer doesn't usually lead to an immediate tax obligation, meaning no tax is levied for merely changing the ownership. However, the trust, which now owns the stock, may become liable for taxes on dividends and capital gains from the stock.

To transfer real property into your Trust, a new deed reflecting the name of the Trust must be executed, notarized and recorded with the County Recorder in the County where the property is located. Care must be taken that the exact legal description in the existing deed appears on the new deed.

Draft and sign a trust agreement. Sign a deed that transfers the home to the trust, making sure to include the name of the trustee, the trust name, and the trust date. Record the deed with the appropriate Utah county recorder's office and pay any associated fees.

A trust agreement is a legal document containing, terms, conditions and provisions that allows the trustor to transfer the ownership of assets to the trustee to be held for the trustor's beneficiaries. The trustees will manage the property and assets on behalf of the beneficiary.

If you borrow from a commercial lender, it is most likely that the lender will determine the trustee, which is typically a title company, professional escrow company, or other company in the business of serving as a real estate trustee. Sometimes a real estate broker or an attorney serves in this role.