Utah Trustee's Deed and Assignment for Distribution of Trust, Oil and Gas Properties

Description

How to fill out Trustee's Deed And Assignment For Distribution Of Trust, Oil And Gas Properties?

You can spend several hours on the Internet attempting to find the authorized file format which fits the state and federal requirements you need. US Legal Forms provides a huge number of authorized forms which can be reviewed by specialists. It is possible to acquire or produce the Utah Trustee's Deed and Assignment for Distribution of Trust, Oil and Gas Properties from our support.

If you already possess a US Legal Forms account, you can log in and click the Acquire button. Following that, you can total, revise, produce, or signal the Utah Trustee's Deed and Assignment for Distribution of Trust, Oil and Gas Properties. Every single authorized file format you purchase is yours forever. To acquire an additional copy of the obtained type, visit the My Forms tab and click the corresponding button.

If you work with the US Legal Forms web site initially, keep to the basic instructions listed below:

- Initially, make certain you have selected the best file format for that county/metropolis of your choosing. Read the type information to make sure you have chosen the appropriate type. If accessible, make use of the Review button to look from the file format at the same time.

- If you would like find an additional edition of your type, make use of the Research discipline to find the format that fits your needs and requirements.

- Upon having discovered the format you need, just click Buy now to carry on.

- Choose the prices program you need, type your credentials, and sign up for your account on US Legal Forms.

- Full the financial transaction. You may use your bank card or PayPal account to purchase the authorized type.

- Choose the file format of your file and acquire it for your product.

- Make alterations for your file if needed. You can total, revise and signal and produce Utah Trustee's Deed and Assignment for Distribution of Trust, Oil and Gas Properties.

Acquire and produce a huge number of file templates utilizing the US Legal Forms site, that provides the largest collection of authorized forms. Use specialist and express-certain templates to deal with your company or personal demands.

Form popularity

FAQ

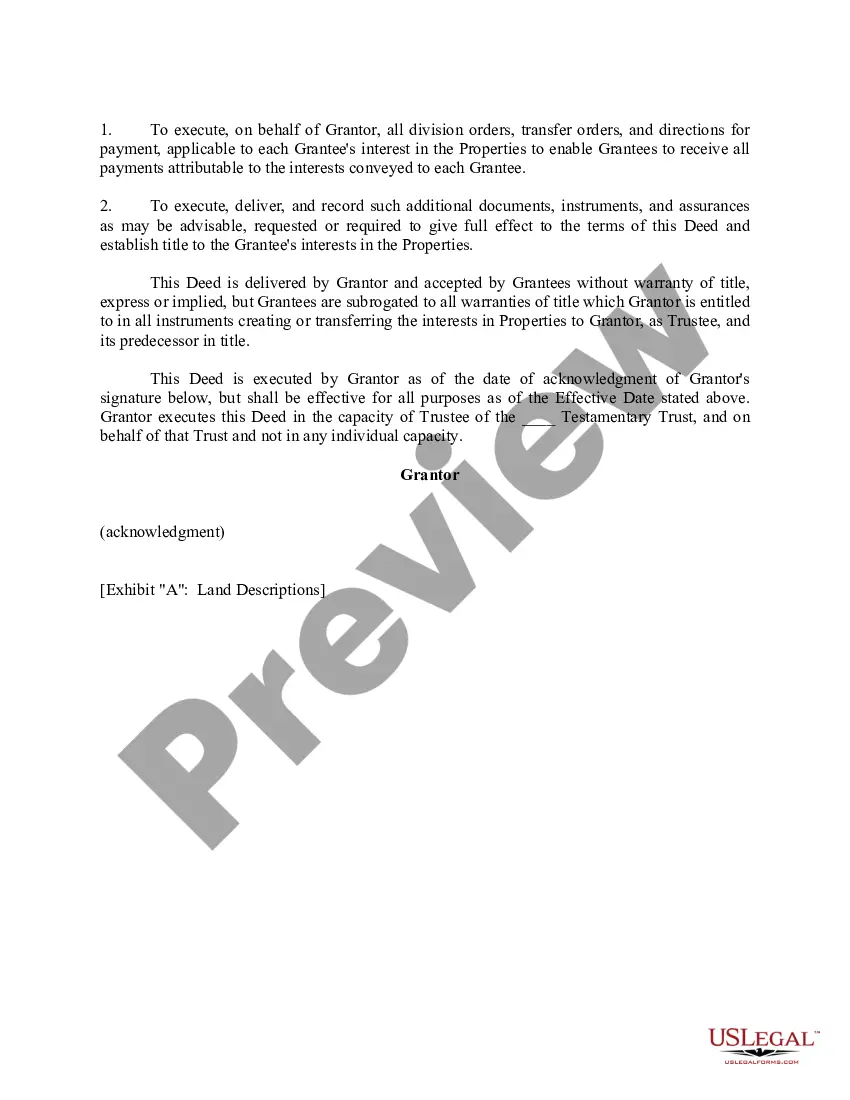

This Deed of Trust (the ?Trust Deed?) sets out the terms and conditions upon which: [Settlor Name] (the ?Settlor?), of [Settlor Address], settles that property set out in Schedule A (the ?Property?) upon [Trustee Name] (the ?Trustee?), being a Company duly registered under the laws of [state] with registered number [ ...

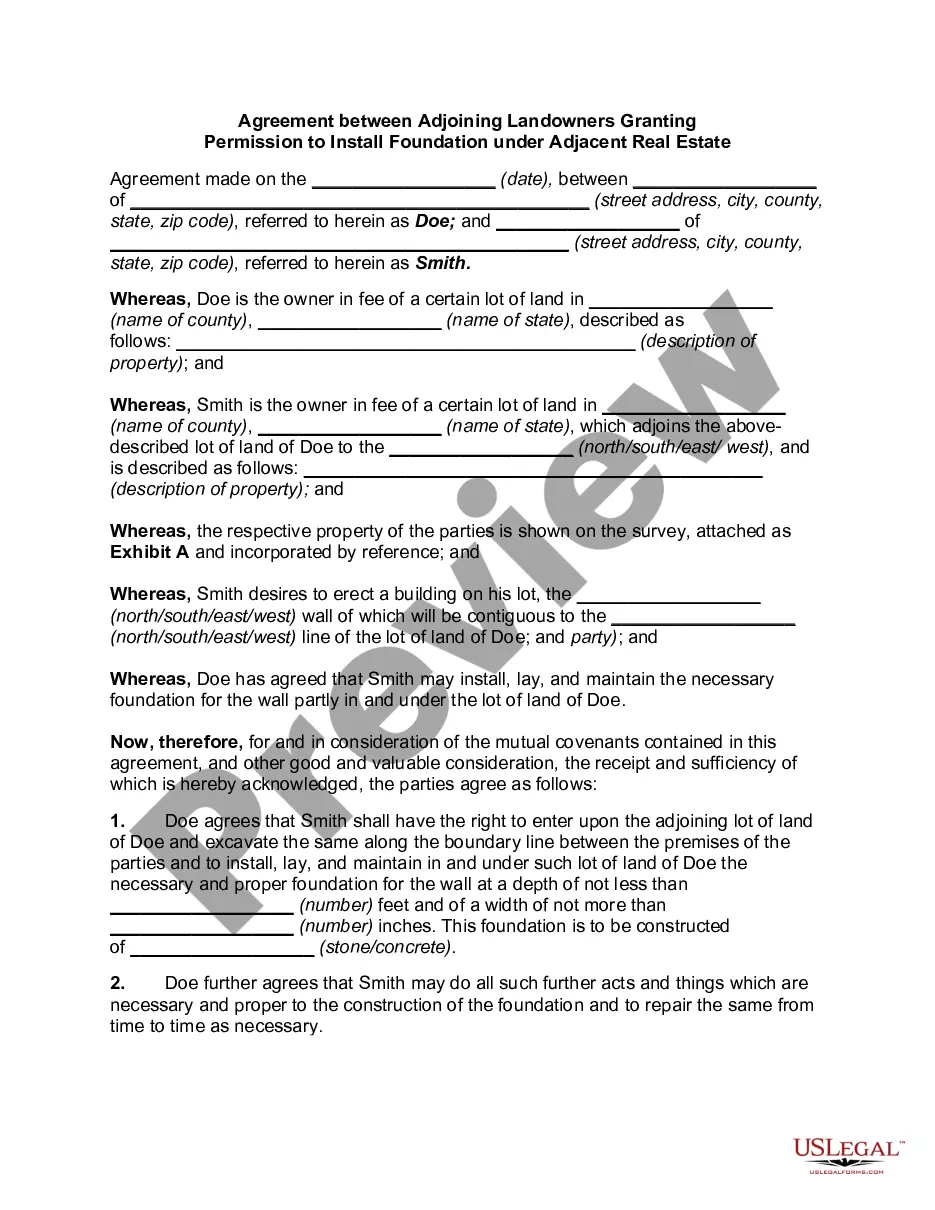

Draft and sign a trust agreement. Sign a deed that transfers the home to the trust, making sure to include the name of the trustee, the trust name, and the trust date. Record the deed with the appropriate Utah county recorder's office and pay any associated fees.

This transfer doesn't usually lead to an immediate tax obligation, meaning no tax is levied for merely changing the ownership. However, the trust, which now owns the stock, may become liable for taxes on dividends and capital gains from the stock.

How much does a Trust cost in Utah? In Utah, the cost of setting up a basic Revocable Living Trust generally ranges from $1,000 to $3,000.

A trust deed is a legal document that sets out the rules for establishing and operating your fund. It includes such things as the fund's objectives, who can be a member and whether benefits can be paid as a lump sum or income stream. The trust deed and super laws together form the fund's governing rules.

The key disadvantages of placing a house in a trust include the following: Extra paperwork: Moving property in a trust requires the house owner to transfer the asset's legal title. This involves preparing and signing an additional deed, and some people may consider this cumbersome.

A deed of trust has a borrower, lender and a ?trustee.? The trustee is a neutral third party that holds the title to a property until the loan is completely paid off by the borrower.

To transfer real property into your Trust, a new deed reflecting the name of the Trust must be executed, notarized and recorded with the County Recorder in the County where the property is located. Care must be taken that the exact legal description in the existing deed appears on the new deed.