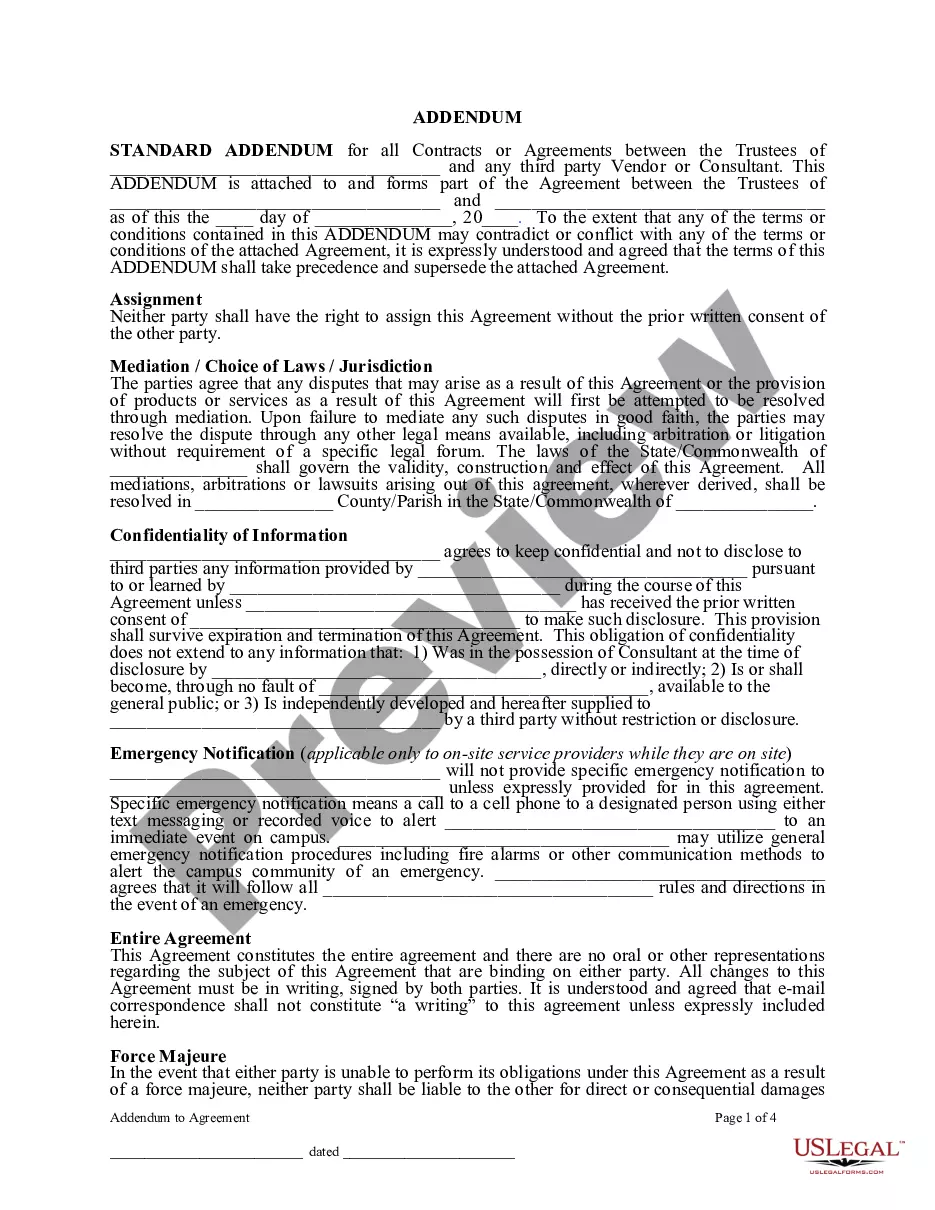

This form is used when the events giving rise to the termination of the Trust have occurred. Pursuant to the terms of a Will, Grantor executes this Deed and Assignment for the purposes of distributing to the beneficiaries of a Testamentary Trust, all rights, title, and interests in the Properties held in the name of that Trust, and all Properties owned by the Estate of the deceased, and the Testamentary Trust created under the Will of the deceased.

Utah Trustee's Deed and Assignment for Distribution by Testamentary Trustee to Trust Beneficiaries

Description

How to fill out Trustee's Deed And Assignment For Distribution By Testamentary Trustee To Trust Beneficiaries?

Finding the right legitimate papers format might be a have a problem. Of course, there are a lot of layouts available online, but how will you discover the legitimate kind you require? Make use of the US Legal Forms web site. The services delivers 1000s of layouts, such as the Utah Trustee's Deed and Assignment for Distribution by Testamentary Trustee to Trust Beneficiaries, that can be used for enterprise and private requires. All the forms are inspected by specialists and satisfy federal and state needs.

When you are already registered, log in in your bank account and click on the Download switch to obtain the Utah Trustee's Deed and Assignment for Distribution by Testamentary Trustee to Trust Beneficiaries. Make use of bank account to look from the legitimate forms you possess ordered formerly. Go to the My Forms tab of the bank account and have another backup from the papers you require.

When you are a brand new end user of US Legal Forms, listed here are easy recommendations that you can follow:

- First, make certain you have selected the appropriate kind for the city/area. It is possible to check out the form while using Preview switch and browse the form explanation to guarantee it is the right one for you.

- In case the kind does not satisfy your requirements, make use of the Seach industry to get the right kind.

- Once you are certain the form is suitable, go through the Get now switch to obtain the kind.

- Choose the rates strategy you need and enter in the required details. Design your bank account and buy your order using your PayPal bank account or credit card.

- Select the data file formatting and acquire the legitimate papers format in your device.

- Comprehensive, revise and produce and indication the attained Utah Trustee's Deed and Assignment for Distribution by Testamentary Trustee to Trust Beneficiaries.

US Legal Forms may be the most significant library of legitimate forms that you can find a variety of papers layouts. Make use of the company to acquire professionally-manufactured paperwork that follow state needs.

Form popularity

FAQ

To transfer real property into your Trust, a new deed reflecting the name of the Trust must be executed, notarized and recorded with the County Recorder in the County where the property is located. Care must be taken that the exact legal description in the existing deed appears on the new deed.

For instance: A trustee holds property for the beneficiary, and the profit earned from this property belongs to the beneficiary. If the customer deposits securities or valuables with the banker for safe custody, banker becomes a trustee of his customer.

This transfer doesn't usually lead to an immediate tax obligation, meaning no tax is levied for merely changing the ownership. However, the trust, which now owns the stock, may become liable for taxes on dividends and capital gains from the stock.

How much does a Trust cost in Utah? In Utah, the cost of setting up a basic Revocable Living Trust generally ranges from $1,000 to $3,000.

What is the Difference Between a Deed and a Deed of Trust? The primary difference between a deed and a deed of trust is the purpose of each document. A deed transfers ownership of a property from one party to another, while a deed of trust secures a loan on a property.

The key disadvantages of placing a house in a trust include the following: Extra paperwork: Moving property in a trust requires the house owner to transfer the asset's legal title. This involves preparing and signing an additional deed, and some people may consider this cumbersome.

Draft and sign a trust agreement. Sign a deed that transfers the home to the trust, making sure to include the name of the trustee, the trust name, and the trust date. Record the deed with the appropriate Utah county recorder's office and pay any associated fees.

A trustee has all the powers listed in the trust document, unless they conflict with California law or unless a court order says otherwise. The trustee must collect, preserve and protect the trust assets.