Utah Self-Employed Supplier Services Contract

Description

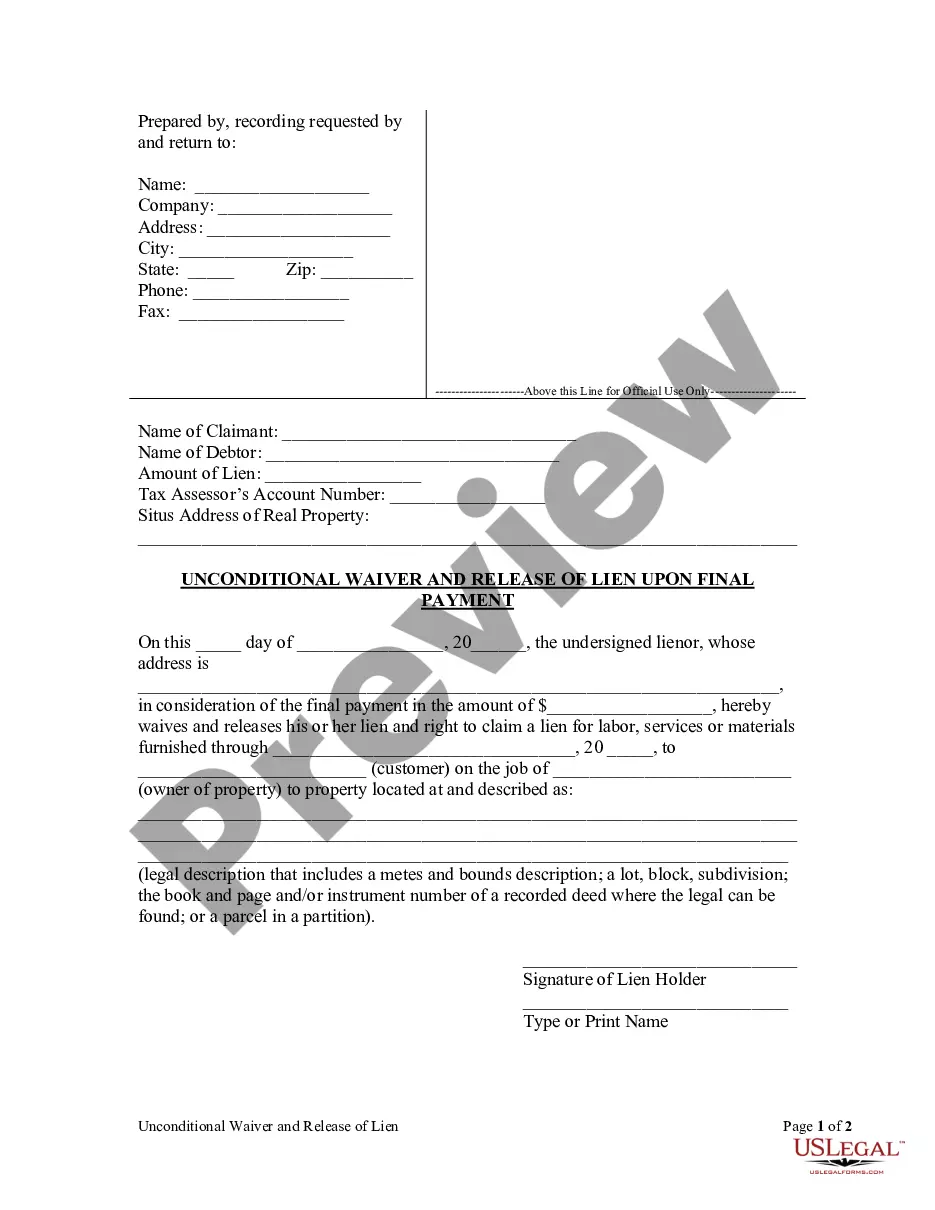

How to fill out Self-Employed Supplier Services Contract?

US Legal Forms - one of the most important collections of legal forms in the United States - offers a broad selection of legal document templates you can download or print.

By utilizing the website, you can access thousands of forms for business and personal purposes, sorted by categories, states, or keywords. You will find the latest versions of forms such as the Utah Self-Employed Supplier Services Contract within moments.

If you already have a subscription, Log In and download the Utah Self-Employed Supplier Services Contract from your US Legal Forms library. The Download button will appear on each form you view. You can access all previously downloaded forms in the My documents section of your account.

Process the transaction. Use your credit card or PayPal account to complete the transaction.

Select the format and download the form to your device. Make modifications. Fill out, edit, print, and sign the downloaded Utah Self-Employed Supplier Services Contract. Every template you added to your account does not have an expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you need. Access the Utah Self-Employed Supplier Services Contract with US Legal Forms, one of the most extensive collections of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- Ensure you have selected the correct form for your area/county.

- Click on the Review button to examine the form's content.

- Read the form details to confirm that you have chosen the appropriate form.

- If the form does not meet your requirements, use the Search field at the top of the screen to find the one that does.

- If you are satisfied with the form, confirm your selection by clicking on the Purchase now button.

- Then, choose the payment plan you prefer and provide your details to create an account.

Form popularity

FAQ

Yes, contract work generally counts as self-employment. When you take on contract work, you are essentially running your own business, even if you are working for a single client. This means you are responsible for your taxes and other business-related expenses. To formalize this relationship, consider using a Utah Self-Employed Supplier Services Contract to outline the terms and protect your rights.

Absolutely, a self-employed person can have a contract. In fact, having a contract is a smart business practice that helps outline the terms of the work being performed. A well-structured Utah Self-Employed Supplier Services Contract can safeguard your interests and ensure that both parties understand their obligations. This clarity fosters a more successful working relationship.

Yes, you can and should have a contract even if you are self-employed. A contract provides clarity and sets expectations for both parties involved in a business arrangement. It is particularly important to use a Utah Self-Employed Supplier Services Contract to define the scope of work, payment terms, and other responsibilities clearly. This protects your rights and ensures a professional relationship.

Yes, subcontractors in Utah typically need a license to operate legally, depending on the type of work they perform. Licensing ensures that subcontractors meet specific standards and regulations within their industry. If you are a self-employed supplier, having the right licensing is essential for credibility and compliance. You can outline these requirements in your Utah Self-Employed Supplier Services Contract.

In Utah, self-employed individuals must meet several legal requirements to operate their business legally. This includes obtaining any necessary licenses, registering for sales tax, and ensuring compliance with local regulations. Furthermore, it is essential to keep accurate financial records and file taxes appropriately. A well-crafted Utah Self-Employed Supplier Services Contract can help clarify obligations and protect your interests.

The main difference between being self-employed and contracted lies in the nature of the work agreement. A self-employed person operates their own business and is responsible for their own taxes and expenses. In contrast, a contracted worker typically provides services under a specific agreement for a company, often with different tax implications. Understanding this distinction is crucial when drafting a Utah Self-Employed Supplier Services Contract.

In Utah, contractors are generally liable for their work for a period of six years under the statute of limitations for written contracts. This means if any issues arise from your work, clients have up to six years to initiate legal action. A Utah Self-Employed Supplier Services Contract can help address liability terms clearly, providing peace of mind for both parties.

Contract law in Utah governs the agreements made between parties, ensuring they are legally enforceable. This includes elements like offer, acceptance, and consideration. Having a properly drafted Utah Self-Employed Supplier Services Contract ensures that your rights are protected and obligations are clear.

To determine if you need a business license in Utah, review the specific regulations of your city or county. Each location may have different requirements based on your business type. Consulting with legal resources, such as a Utah Self-Employed Supplier Services Contract, can help clarify your obligations.

Registering your business as an independent contractor in Utah is often beneficial. It helps establish your credibility and can protect your personal assets. A well-structured Utah Self-Employed Supplier Services Contract can complement your registration efforts by clearly defining your business relationship with clients.