Utah Coaching Services Contract - Self-Employed

Description

How to fill out Coaching Services Contract - Self-Employed?

Have you found yourself in a situation where you require documents for potential organizational or personal reasons nearly every day.

There are numerous legal document templates accessible online, but locating reliable ones can be challenging.

US Legal Forms offers thousands of form templates, including the Utah Coaching Services Contract - Self-Employed, which are designed to comply with federal and state regulations.

Once you obtain the correct form, click Buy now.

Select the pricing plan you prefer, provide the required information to create your account, and complete the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you will be able to download the Utah Coaching Services Contract - Self-Employed template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it corresponds to the correct city/county.

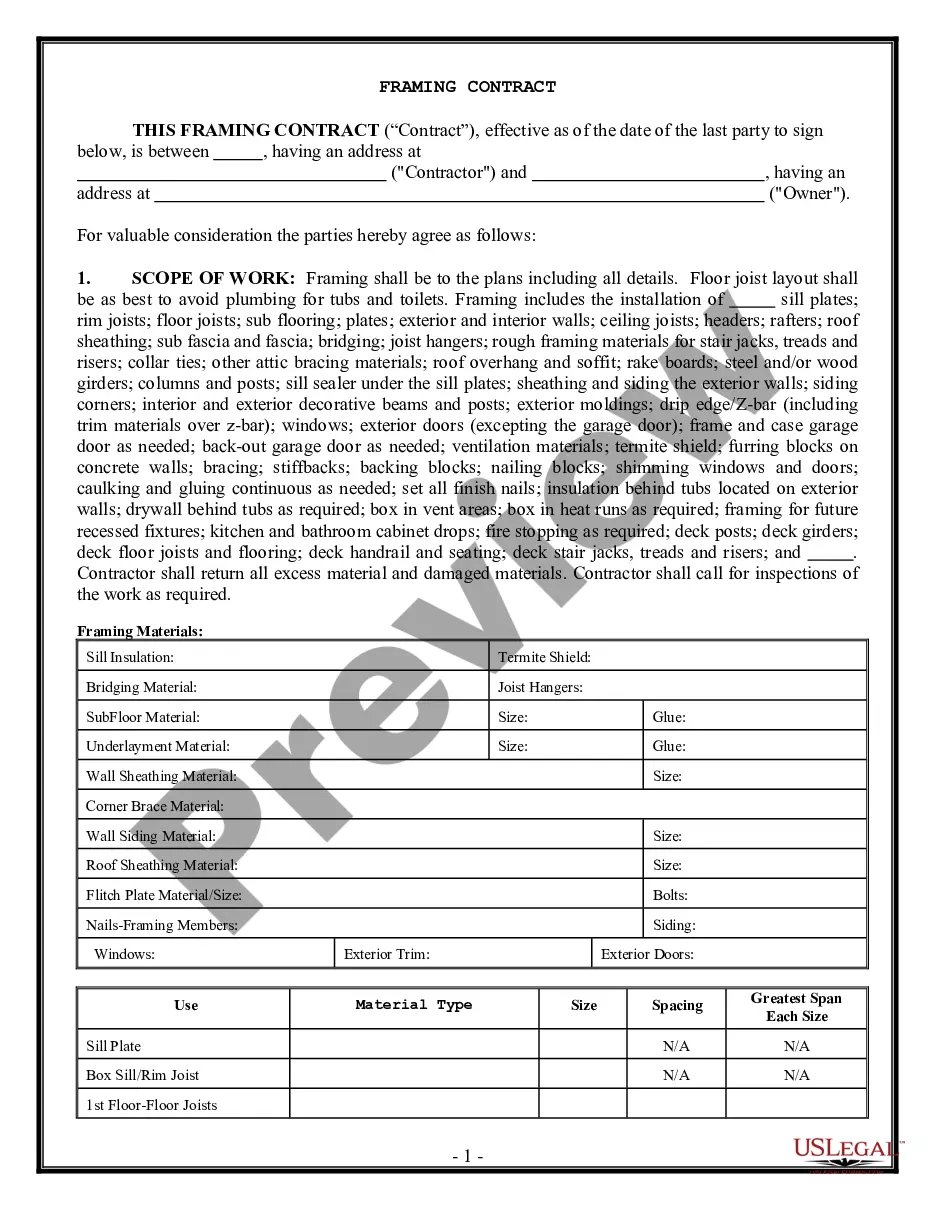

- Utilize the Review button to evaluate the form.

- Examine the summary to confirm you have selected the right form.

- If the form is not what you are looking for, use the Search field to find the form that fits your needs.

Form popularity

FAQ

An independent contractor might need a business license in Utah based on the services rendered and the local regulations. Always check with your local government for specific requirements. Utilizing a Utah Coaching Services Contract - Self-Employed can help clarify your business status and obligations while ensuring compliance with any licensing needs.

Generally, independent contractors in Utah do not need to register their business unless they plan to operate under a specific business name or entity structure. However, registration might be beneficial for branding and legal clarity. A comprehensive Utah Coaching Services Contract - Self-Employed can support your business operations and help you navigate these requirements.

As an independent contractor in Utah, whether you need a business license can depend on your specific business activities and location. If your work falls under certain local regulations, a license may be necessary. Ensure your Utah Coaching Services Contract - Self-Employed aligns with state laws, and consider seeking guidance from US Legal.

To determine if you need a business license in Utah, consider the nature of your services and where you operate. Typically, localized business activities in specific counties or cities may require a license. Consulting with local authorities or using resources from platforms like US Legal can provide clarity on whether your Utah Coaching Services Contract - Self-Employed necessitates a business license.

Yes, you can issue a Form 1099 to an independent contractor without a business license, as long as the contractor meets the IRS requirements for independent contractor status. However, always check local regulations in Utah to ensure compliance. Utilizing a Utah Coaching Services Contract - Self-Employed can help delineate your business relationship and simplify tax reporting.

Independent contractors must comply with both federal and state laws, including tax obligations. In Utah, ensure you understand your income tax responsibilities and any applicable business regulations. A well-crafted Utah Coaching Services Contract - Self-Employed can help clarify your role and protect your rights as a contractor.

To set up a coaching contract, begin by defining the services you will provide and the expectations of both parties. Include an outline of payment terms, confidentiality agreements, and the duration of the contract. You can utilize the US Legal platform to find templates specifically designed for a Utah Coaching Services Contract - Self-Employed, ensuring your contract meets all necessary legal guidelines.