This Formula System for Distribution of Earnings to Partners provides a list of provisions to conside when making partner distribution recommendations. Some of the factors to consider are: Collections on each partner's matters, acquisition and development of new clients, profitablity of matters worked on, training of associates and paralegals, contributions to the firm's marketing practices, and others.

Vermont Formula System for Distribution of Earnings to Partners

Description

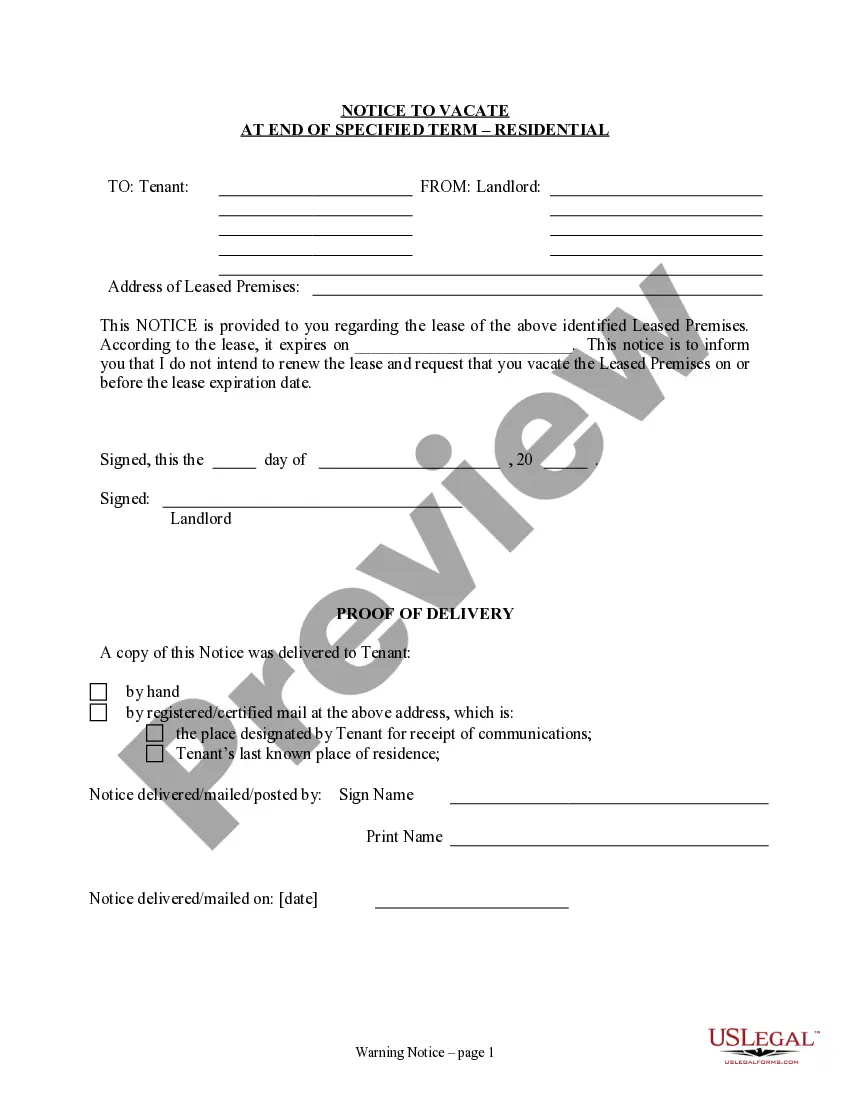

How to fill out Formula System For Distribution Of Earnings To Partners?

Choosing the right legitimate record template might be a struggle. Naturally, there are tons of themes accessible on the Internet, but how would you discover the legitimate type you need? Take advantage of the US Legal Forms internet site. The assistance delivers a large number of themes, like the Vermont Formula System for Distribution of Earnings to Partners, which you can use for organization and private demands. All of the types are checked by experts and satisfy federal and state requirements.

When you are presently authorized, log in to the bank account and click on the Obtain button to obtain the Vermont Formula System for Distribution of Earnings to Partners. Make use of your bank account to look throughout the legitimate types you may have acquired earlier. Proceed to the My Forms tab of your respective bank account and acquire an additional duplicate in the record you need.

When you are a fresh consumer of US Legal Forms, listed here are straightforward guidelines so that you can stick to:

- First, ensure you have chosen the proper type to your area/region. It is possible to look over the shape making use of the Review button and read the shape outline to make certain this is the best for you.

- In case the type will not satisfy your needs, use the Seach area to get the right type.

- Once you are positive that the shape is acceptable, select the Buy now button to obtain the type.

- Opt for the pricing prepare you desire and enter in the needed information and facts. Build your bank account and pay money for an order making use of your PayPal bank account or Visa or Mastercard.

- Select the document formatting and obtain the legitimate record template to the system.

- Complete, change and print out and indicator the attained Vermont Formula System for Distribution of Earnings to Partners.

US Legal Forms may be the most significant collection of legitimate types where you will find various record themes. Take advantage of the service to obtain professionally-created files that stick to express requirements.

Form popularity

FAQ

The Vermont apportionment percentage is the numerical average of the sales factor (double- weighted), the salaries and wages factor, and the property factor. If the sales factor does not exist, i.e. Line 12a is zero, the remaining two factors are totaled and divided by two.

If the partnership had income, debit the income section for its balance and credit each partner's capital account based on his or her share of the income. If the partnership realized a loss, credit the income section and debit each partner's capital account based on his or her share of the loss.

Business income from a partnership is generally computed in the same manner as income for an individual. That is, taxable income is determined by subtracting allowable deductions from gross income. This net income is passed through as ordinary income to the partner on Schedule K-1.

Partnerships file an information return to report their income, gains, losses, deductions, credits, etc. A partnership does not pay tax on its income but "passes through" any profits or losses to its partners. Partners must include partnership items on their tax or information returns.

This means that the partnership itself is not subject to tax: any profits are instead taxable on the partners. Generally, for tax purposes each partner is treated as receiving their share of the income and expenses of the partnership as they arise.

Partnerships Investments by each partner are credited to the partners' capital accounts. Withdrawals from the partnership by a partner are debited to the respective drawing account. The net income for a partnership is divided between the partners as called for in the partnership agreement.

Form BI-471, Vermont Business Income Tax Return. For use by those entities not filing federally as a C Corporation to calculate Vermont business income tax liability.