Utah Chef Services Contract - Self-Employed

Description

How to fill out Chef Services Contract - Self-Employed?

If you wish to accumulate, download, or create legal document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Employ the site’s straightforward and user-friendly search to locate the documents you require.

Various templates for commercial and personal purposes are categorized by types and states, or keywords.

Every legal document template you purchase is your property indefinitely. You have access to each form you saved in your account. Select the My documents section and choose a form to print or download again.

Complete, download, and print the Utah Chef Services Contract - Self-Employed with US Legal Forms. There are millions of professional and state-specific forms you can use for your business or personal needs.

- Use US Legal Forms to find the Utah Chef Services Contract - Self-Employed in just a few clicks.

- If you are already a US Legal Forms user, Log Into your account and click the Download button to obtain the Utah Chef Services Contract - Self-Employed.

- You can also access forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Ensure you have selected the form for the correct city/state.

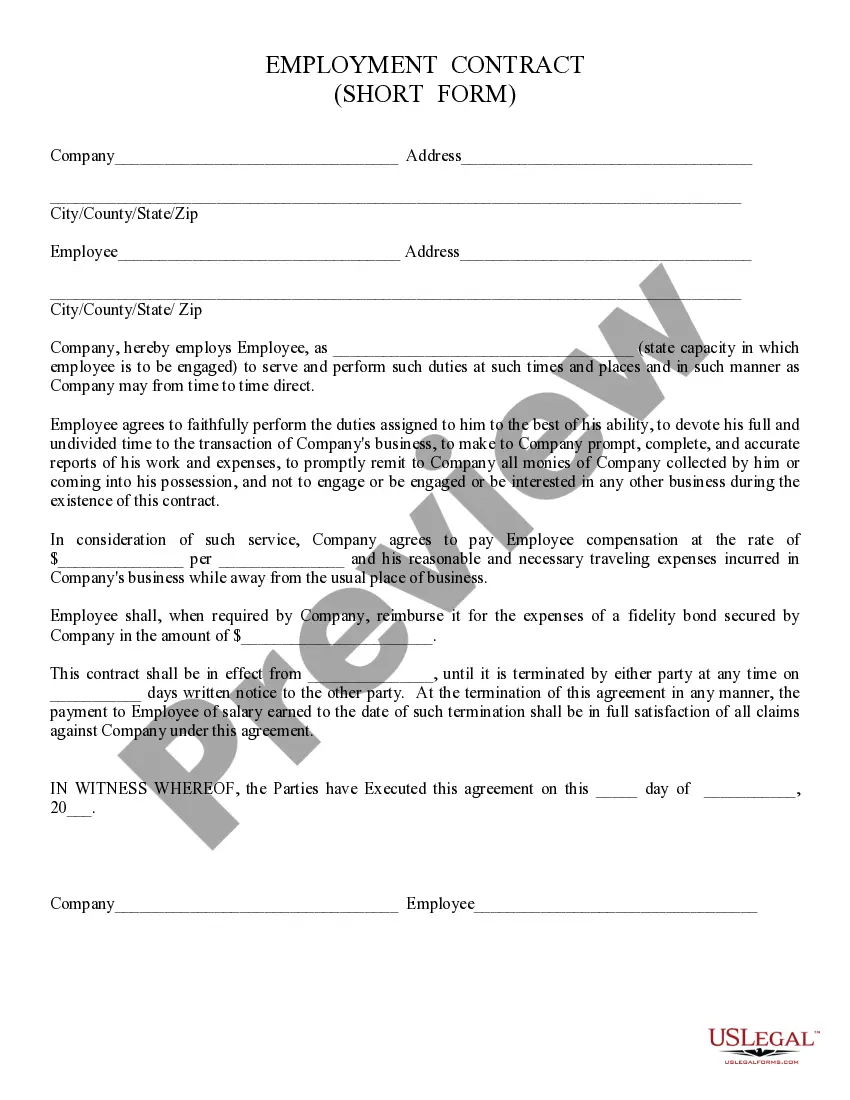

- Use the Review option to check the form’s details. Don’t forget to read the description.

- If you are dissatisfied with the form, use the Lookup section at the top of the screen to find other forms in the legal template.

- Once you have found the form you need, click the Buy now button. Choose the payment plan you prefer and enter your credentials to register for an account.

- Process the transaction. You can use your credit card or PayPal account to complete the purchase.

- Select the format of the legal form and download it to your device.

- Complete, edit, and print or sign the Utah Chef Services Contract - Self-Employed.

Form popularity

FAQ

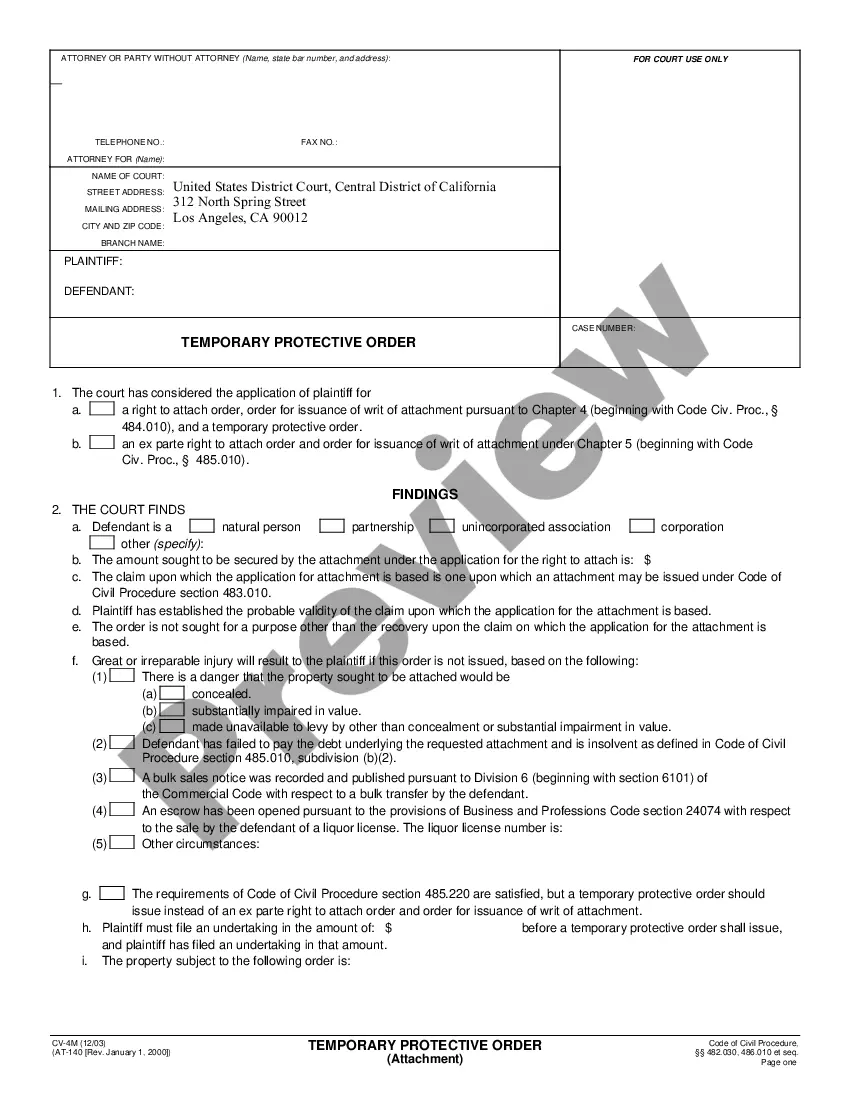

As an independent contractor in Utah, you typically need a business license depending on your location and the nature of your services. Verify local requirements as they can vary by city or county. Having the appropriate licenses not only fulfills legal obligations but also enhances your credibility in the culinary industry. The Utah Chef Services Contract - Self-Employed aligns well with these regulatory needs, making compliance easier.

To write a self-employed contract, start with a strong title that reflects the content, such as 'Utah Chef Services Contract - Self-Employed.' Clearly outline your roles and responsibilities, payment details, and contract duration. Don't forget to include any clauses that address dispute resolution. Using USLegalForms can save you time and provide valuable insights into creating effective contracts.

Yes, you can write your own legally binding contract for chef services, provided it includes all the essential components like services offered, compensation, and confidentiality terms. Make sure to have both parties sign and date the contract to give it legal weight. Exploring the Utah Chef Services Contract - Self-Employed on USLegalForms can provide you a solid template to ensure compliance and thoroughness.

To show proof of self-employment, you can use your signed contract, business cards, and invoices detailing your chef services. Additionally, bank statements reflecting payments for services rendered can also serve as evidence. This documentation is vital for tax purposes and helps in establishing your status as a self-employed professional under the Utah Chef Services Contract - Self-Employed. Consider organizing these documents carefully to make your case clear.

To write a contract for a 1099 employee, specifically for your services as a self-employed chef, include your business details, payment terms, and the service specifics. Clearly outline the start date and any deadlines. You might want to note that this agreement serves as the Utah Chef Services Contract - Self-Employed. USLegalForms offers helpful resources to guide you through this process.

Filling out an independent contractor agreement involves providing your name, contact information, and the scope of your chef services. Specify payment terms, including rates and invoicing details. Adding a section for termination or modifications will make your agreement robust. For a smooth experience, consider using the Utah Chef Services Contract - Self-Employed template available on USLegalForms.

To write a self-employment contract, start by clearly defining the services you will provide as a chef. Include the terms of payment, deadlines, and any obligations for both parties. Make sure to detail how disputes will be resolved and mention that this is a part of the Utah Chef Services Contract - Self-Employed. You can use platforms like USLegalForms for templates and legal guidance.

Certainly, a chef can be self-employed and enjoy many benefits of running a personal business. This arrangement allows flexibility, creativity, and control over your work life. To formalize your business relationship with clients, consider drafting a Utah Chef Services Contract - Self-Employed.

Yes, private chefs are generally self-employed. They provide personalized cooking services directly to clients, often creating customized dining experiences. A Utah Chef Services Contract - Self-Employed is advantageous for setting clear terms and defining the services offered.

Yes, you can cook meals to sell from home, provided you comply with local health regulations. Many self-employed chefs operate home-based businesses, but it is crucial to ensure your kitchen meets safety standards. A Utah Chef Services Contract - Self-Employed can help outline your services and protect your business interests.