Utah Term Sheet - Convertible Debt Financing

Description

To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status."

How to fill out Term Sheet - Convertible Debt Financing?

You may commit several hours on the web trying to find the legitimate file format that fits the state and federal demands you need. US Legal Forms offers thousands of legitimate varieties that are evaluated by professionals. You can actually down load or print the Utah Term Sheet - Convertible Debt Financing from my services.

If you currently have a US Legal Forms bank account, you may log in and click the Obtain button. After that, you may complete, modify, print, or signal the Utah Term Sheet - Convertible Debt Financing. Every single legitimate file format you buy is the one you have permanently. To obtain another copy associated with a acquired develop, visit the My Forms tab and click the corresponding button.

If you use the US Legal Forms site for the first time, stick to the simple guidelines below:

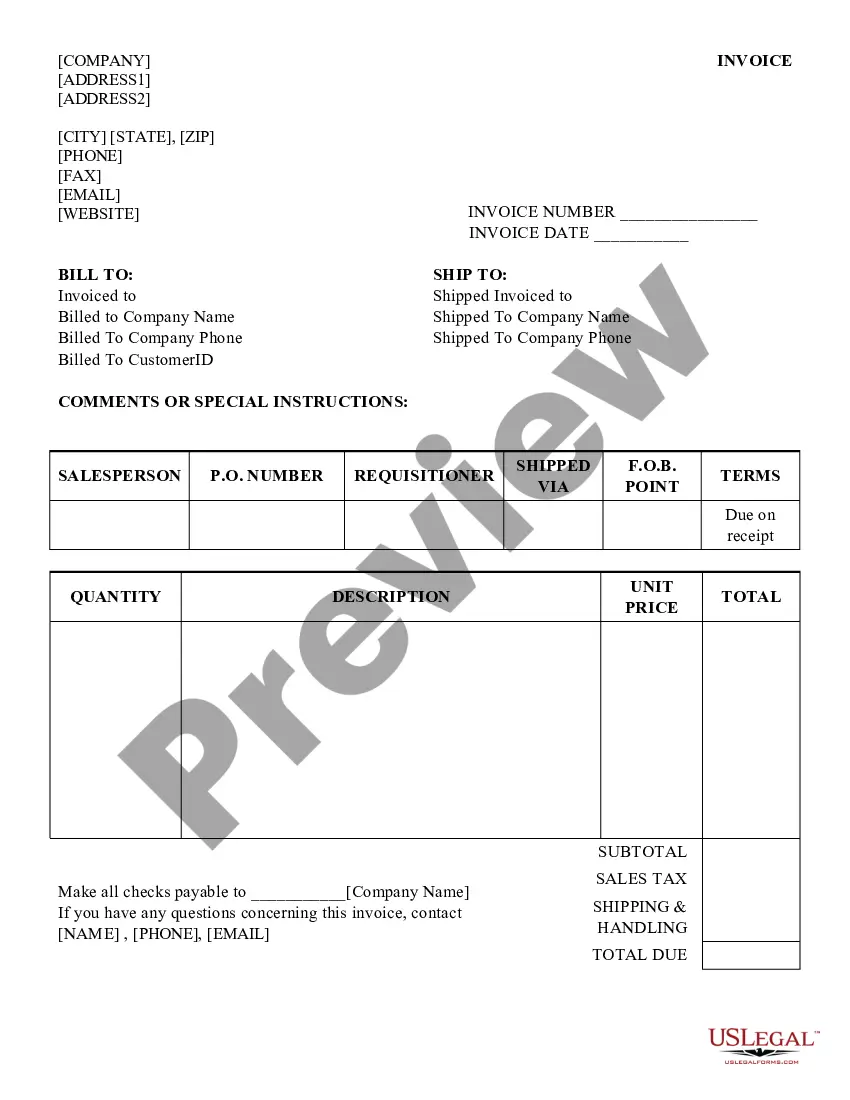

- Very first, ensure that you have chosen the proper file format for the county/metropolis of your liking. Look at the develop information to make sure you have chosen the appropriate develop. If accessible, take advantage of the Review button to check from the file format too.

- If you wish to find another version in the develop, take advantage of the Research field to find the format that meets your requirements and demands.

- After you have located the format you would like, just click Acquire now to continue.

- Find the costs strategy you would like, type your qualifications, and sign up for your account on US Legal Forms.

- Comprehensive the transaction. You can use your bank card or PayPal bank account to fund the legitimate develop.

- Find the structure in the file and down load it for your gadget.

- Make changes for your file if necessary. You may complete, modify and signal and print Utah Term Sheet - Convertible Debt Financing.

Obtain and print thousands of file themes while using US Legal Forms Internet site, that offers the largest selection of legitimate varieties. Use professional and condition-specific themes to tackle your company or person requirements.

Form popularity

FAQ

Convertible bonds are basically debt instruments but they also contain an option to convert into equity shares and this means that a convertible bond contains both debt and equity elements. The option to convert into equity is strictly a derivative that is embedded into the host contract. What is a financial instrument? ? part 2 - ACCA Global accaglobal.com ? student ? technical-articles accaglobal.com ? student ? technical-articles

A company lists its long-term debt on its balance sheet under liabilities, usually under a subheading for long-term liabilities. On Which Financial Statements Do Companies Report Long-Term Debt? investopedia.com ? ask ? answers ? which-fi... investopedia.com ? ask ? answers ? which-fi...

Convertible debt may become current Generally, if a liability has any conversion options that involve a transfer of the company's own equity instruments, these would affect its classification as current or non-current. Classifying liabilities as current or non-current kpmg.com ? dam ? kpmg ? pdf ? 2020/07 kpmg.com ? dam ? kpmg ? pdf ? 2020/07

Although it is customary to forego a term sheet, in some cases it may be required if the parties need to negotiate certain terms. It can be advantageous to use a term sheet for the company to easily summarize the terms of the notes for potential other investors purchasing a convertible note.

A convertible note should be classified as a Long Term Liability that then converts to Equity as stipulated from the contract (usually a new fundraising round).

Repayment Method With most convertible debt, you will repay the investment by converting the entire value to stock. Some investors, though, may also include language that obligates you to pay back a certain percentage of the original investment as cash and the remainder as stock. Convertible Debt For Startups: The Complete Guide - Bond Collective bondcollective.com ? blog ? convertible-debt bondcollective.com ? blog ? convertible-debt

6 Tips for Writing a Term Sheet List the terms. ... Summarize the terms. ... Explain the dividends. ... Include liquidation preference. ... Include voting agreement and closing items. ... Read, edit and prepare for signatures.

Convertible Notes are loans ? so they are recorded on the Balance Sheet of a company as a liability when they are made. Depending on the debt's maturity date, they can either be shown as a current liability (loans maturing within 12 months) or as a Long-term liability (loans maturing over 12 months).